Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The wood pulp market attained a value of USD 171.15 Billion in 2025. The industry is expected to grow at a CAGR of 2.70% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 223.40 Billion.

The accelerating expansion of the e-commerce sector is driving substantial demand for packaging materials, which is contributing to the growth of the wood pulp market. Industry data indicates that global retail e-commerce sales are projected to reach USD 6.42 trillion by 2025. In this context, wood pulp-derived products such as corrugated boxes and paper bags are witnessing increased adoption, owing to their durability and environmentally sustainable profile.

The wood pulp market value is growing with consumers and businesses increasingly prioritizing eco-friendly packaging options. Wood pulp-based materials, being biodegradable and recyclable, are gaining popularity over plastic alternatives. In December 2024, Procter & Gamble invested USD 20 million in developing wood-pulp alternatives. This move committed to protecting primary forests by 2030 while meeting the sustainability goals.

Conversely, the pulp and paper industry is facing labour shortages, compounded by an ageing workforce. Industry data indicates a nearly 17% rise in employees aged 55 and above between 2021 and 2023. In response, companies in the wood pulp market are actively investing in workforce development strategies, including the introduction of apprenticeship programs, enhanced training initiatives, and targeted recruitment efforts aimed at attracting younger talent. These measures are intended to preserve institutional knowledge and facilitate a smooth generational transition.

Base Year

Historical Period

Forecast Period

The demand for personal hygiene products like tissues, toilet paper, and diapers is contributing to growth of the wood pulp market.

Technological advancements in pulping processes and waste management are enabling producers to increase efficiency and reduce costs.

Economic growth and industrialisation in emerging markets, especially in Asia and Africa, are driving demand for paper products.

Compound Annual Growth Rate

2.7%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Wood Pulp Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 171.15 |

| Market Size 2035 | USD Billion | 223.40 |

| CAGR 2019-2025 | USD Billion | XX% |

| CAGR 2026-2035 | USD Billion | 2.70% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 3.5% |

| CAGR 2026-2035 - Market by Country | India | 4.0% |

| CAGR 2026-2035 - Market by Country | Canada | 3.3% |

| CAGR 2026-2035 - Market by Grade | Chemical | 3.0% |

| CAGR 2026-2035 - Market by End Use | Packaging | 3.1% |

| Market Share by Country 2025 | China | 16.9% |

Innovations in pulping technologies, such as enzyme-assisted pulping and nanocellulose applications for enhancing functionality and strength products is adding to the wood pulp market revenue. In March 2025, Valmet introduced an advanced process control system to enhance pulping yield by optimizing various stages of the pulp production process. These advancements are contributing to improved product quality and reduced environmental impact while aligning with the strong focus on sustainability.

The global health crisis is heightening the demand for hygiene products along with the consumption of tissue papers and wipes, further driving the wood pulp industry. Supporting with an instance, in October 2024, Robert Scott launched Ecofibre Compostable Wipe, made from 100% PEFC-certified wood pulp for offering eco-friendly and high-performance cleaning. Wood pulp, especially from softwood sources, is also essential for producing these products given its absorbency and softness.

The rising emphasis on recycling and circular economy practices is boosting the wood pulp market share. Several firms are expanding their recycled pulp facilities to match the thriving demand for sustainable materials. Driven by this factor, in April 2025, Yibin Grace launched China’s first recycled textile dissolving pulp facility, marking a major step towards circular fashion and sustainable material innovation. Investments in recycling technology are further assisting in improving the quality as well as efficiency of recycled pulp production.

The surging demand for specialty cellulose is encouraging the wood pulp market development. Specialty cellulose, sourced from high-purity wood pulp, is used in pharmaceuticals, textiles, and food. Higher adoption in textiles for producing sustainable and comfortable fibres is also adding to the market growth. To cater to this trend, in October 2023, Birla Cellulose launched a circular fibre blend with 50% mechanically recycled content to deliver high-strength yarn for sustainable fabric as well as garment production.

The integration of digital technologies is transforming the wood pulp industry for enhancing efficiency, product quality, and reducing operational costs. In March 2024, ANDRITZ launched its Metris Digital Twin Platform to enhance operational visibility and control in wood pulp mills. These technologies are allowing real-time data tracking, predictive analytics, and improved decision-making to facilitate responsive and resilient manufacturing operations.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Wood Pulp Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: The soft wood segment leads the wood pulp market due to its extensive usage in producing high-quality printing paper, packaging materials, and tissue products. Several companies are relying on softwood pulp for their premium-grade paper production. The long fibre enhances tear resistance and tensile strength, making softwood pulp essential in products requiring durability. For instance, in April 2024, Georgia-Pacific Cellulose expanded its softwood pulp line with unbleached southern pine pulp for enhancing fibre cement applications. Rising dominance stemming from the global availability of softwood forests and critical role in producing stronger, higher-quality paper also adds to the segment growth.

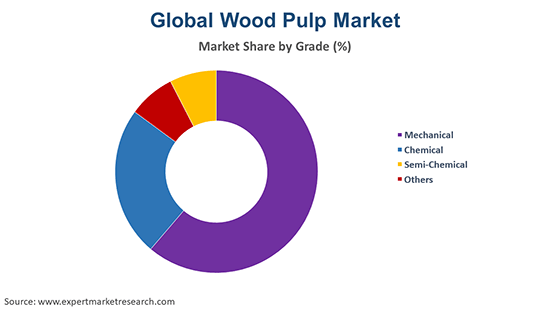

Market Breakup by Grade

Key Insight: The mechanical segment of the wood pulp industry is gaining traction as it is widely used in newsprint, catalogues, and paperboard due to its high yield and lower cost. Leading companies are utilizing mechanical pulp extensively for producing packaging and printing paper. In February 2024, ANDRITZ launched the world’s largest single mechanical pulping line at Wuzhou Special Paper for enhancing production capacity and efficiency. This segment further remains significant, especially in regions with abundant softwood resources.

Market Breakup by End Use

Key Insight: The packaging segment is a major driver in the wood pulp market as it serves diverse industries. Wood pulp-based packaging offers biodegradability, sustainability, and strength, making it ideal for eco-conscious brands. For instance, in January 2025, Conserving Beauty deployed Futamura’s compostable NatureFlex films from renewable wood pulp for dissolvable wipe sachets for meeting global composting standards. The pharmaceutical sector relies heavily on pulp-based cartons to ensure secure and compliant product delivery. At the same time, the automotive industry is incorporating pulp-derived materials into lightweight and durable components to meet sustainability and performance goals. This expanding cross-industry adoption is significantly accelerating the growth of the packaging segment, positioning it as a key driver in the overall pulp market.

Market Breakup by Region

Key Insight: Asia Pacific dominates the wood pulp market, driven by rapid industrialization, population growth, and the stronger demand for paper-based packaging and hygiene products. China’s growing focus on self-sufficiency in pulp production and investments in high-capacity mills is strengthening its position. Japan and Indonesia are also contributing significantly, with major companies investing in sustainable production. The strong manufacturing base as well as expanding e-commerce sector are also fuelling the product demand, especially for packaging and tissues. As per industry reports, China accounted for 83.0% of retail ecommerce sales in Asia-Pacific in 2025, adding to segment growth.

Hardwood Pulp to Garner Huge Preference

The hardwood segment of the wood pulp market is growing for contributing to smoother paper surfaces and better printability. Hardwood pulp is widely used in producing fine printing paper, coated papers, and tissue products. This segment supports the market growth with its ability to produce lighter, smoother paper products ideal for magazines and books. Moreover, hardwood pulp is vital for specialty paper applications where surface quality is key. Driven by these trends, in May 2025, TNPL partnered with ANDRITZ to launch a ₹300 crore tissue project in Tamil Nadu, India by installing a PrimeLineTM S 2000 machine producing 34,000 t/a from hardwood pulp.

Surging Popularity of Chemical & Semi-Chemical Wood Pulp

Chemical pulp is largely contributing to the wood pulp market owing to its superior fibre quality, strength, and brightness. Major producers are focusing heavily on chemical pulp, especially kraft and sulfite processes. This segment supports most premium paper applications for ensuring durability and printability. The market leadership further stems from the growing demand for quality paper and sustainable forestry practices that align with chemical pulping methods, making it the most dominant segment in the market.

Semi-chemical wood pulp market share is expanding with higher usage in corrugated packaging and fibreboard to offer balanced strength and production efficiency. This segment fills a niche between cost-effectiveness and performance. This has compelled leading companies to deploy semi-chemical pulp to manufacture packaging materials. According to industry reports, Switzerland imported USD 772k of semi-chemical wood pulp in 2023. This rising rate of imports is characterising the segment growth for expanding presence in global markets.

Rising Wood Pulp Demand in Print Media & Tissues

The print media segment is gaining momentum in the wood pulp market due to the rising adoption of newspapers, magazines, and books. The segment remains significant, especially in regions with lower internet penetration and for specialty paper products. Wood pulp for print media offers high brightness and strength, crucial for quality publications. Leading pulp producers are continuing to supply print-grade pulp. Print media further supports the demand for coated and uncoated papers, maintaining a steady growth largely driven by educational materials and premium publishing.

The tissue segment is growing steadily in the wood pulp industry with rising hygiene awareness and population growth, especially in emerging markets. Wood pulp has grown essential for producing facial tissues, toilet paper, and paper towels. Companies are heavily relying on quality pulp for their tissue products. For instance, in January 2025, Jani Sales inaugurated a 60-ton-per-day tissue paper line at its facility in Gujarat, India to produces 100% virgin pulp-based products. The consistent growth of the segment is also fuelled by urbanization and increasing disposable incomes, making it an important contributor to overall wood pulp consumption.

North America & Europe to Emerge as Significant Consumers

North America wood pulp market growth is supported by advanced technologies, sustainable forestry practices, and the presence of established players. The United States and Canada are major producers and exporters, supplying pulp globally for packaging, printing, and hygiene applications. As per industry reports, the United States produced nearly 43 million metric tons of chemical pulp in 2023. The regional demand is largely driven by sustainable packaging initiatives and hygiene product consumption. Investments in unbleached and recycled pulp solutions, are further reflecting a shift towards eco-friendly alternatives.

Europe is playing a crucial role in driving sustainability and innovation in the wood pulp industry. Sweden and Finland, with abundant forests and advanced processing technologies, are leading producers. Companies, such as Södra and UPM are focusing on high-quality softwood pulp and bio-based alternatives. The region's strict environmental regulations as well as circular economy initiatives are promoting the usage of FSC-certified wood pulp and biodegradable packaging. Europe’s demand is further primarily focused on eco-friendly packaging, tissues, and specialty paper products.

| CAGR 2026-2035 - Market by | Country |

| India | 4.0% |

| China | 3.3% |

| Canada | 3.3% |

| USA | 2.9% |

| Australia | 2.4% |

| Japan | 2.1% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Key players in the wood pulp market are employing strategies that revolve around sustainability, capacity expansion, technological innovation, and diversification. With increasing demand for eco-friendly and biodegradable products, companies are investing heavily in sustainable forestry practices and certification systems to ensure responsible sourcing. Many players are also pursuing vertical integration to control supply chains, reduce costs, and enhance operational efficiency. Capacity expansion in emerging markets is a major strategy to meet growing global demand for paper, packaging, and hygiene products.

Technological advancements, including improvements in pulping processes and the use of automation and AI, are enhancing productivity and reducing environmental impact. Market players are further exploring diversification into higher-margin specialty pulp products. Strategic mergers, acquisitions, and partnerships are helping companies to expand their geographic presence and product portfolios. As a response to environmental regulations as well as shifting consumer preferences, companies are increasingly focusing on reducing carbon footprints, improving water management, and developing gen-next wood-based products.

Founded in 1979 and headquartered in Santiago, Chile, Celulosa Arauco y Constitución S.A. specializes in the production of wood pulp, forestry products, and wood panels. The firm serves global markets with sustainable solutions primarily in pulp, wood, and tissue paper products.

Founded in 1938 and headquartered in Sweden, Södra is a cooperative owned by forest owners and focuses on producing pulp, paper, and wood products. The firm emphasizes sustainability and innovation in its offerings, including softwood and hardwood pulp and bioenergy solutions.

Founded in 1924, Suzano S.A. operates from São Paulo, Brazil, as one of the world’s largest pulp and paper producers. The company’s product range includes eucalyptus pulp, paper, and cellulose-based specialty products, with a strong commitment to sustainable forestry and circular economy principles.

Headquartered in Santiago, Chile, and founded in 1920, Empresas CMPC is a leading name in the pulp, paper, and forestry sectors. The company offers pulp, tissue, paper products, and packaging solutions while prioritizing environmental responsibility and sustainable resource management.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the wood pulp market are Asia Pacific Resources International Limited (APRIL), Metsä Group, UPM-Kymmene Corporation, and Georgia-Pacific LLC, among others.

Unlock the latest insights into the wood pulp market trends 2026 with our free sample report. Get detailed forecasts, key player strategies, and regional breakdowns to stay ahead in this evolving industry. Download your sample now and make data-driven decisions with confidence. Stay competitive with Expert Market Research’s trusted intelligence.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 171.15 Billion.

The market is projected to grow at a CAGR of 2.70% between 2026 and 2035.

The market is projected to witness a healthy growth in the forecast period of 2026-2035 to attain around a value of USD 223.40 Billion by 2035.

Key strategies driving the market include sustainable sourcing, investment in advanced processing technologies, expansion into emerging markets, and product innovation, such as recycled and specialty pulps. Companies are also focusing on strategic partnerships, digital integration for operational efficiency, and aligning with circular economy goals to meet rising global demand and environmental standards.

The key trend guiding the market development includes rising consumption of tissue papers in households and various end-use sectors.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading types of wood pulp in the market are soft wood and hard wood.

The major grades of wood pulp in the industry are mechanical, chemical, and semi-chemical, among others.

The various end uses of wood pulp include packaging, print media, and tissues, among others.

The key players in the market report include Celulosa Arauco y Constitucion S.A., Södra, Suzano S.A., Empresas CMPC SA, Asia Pacific Resources International Limited (APRIL), Metsä Group, UPM-Kymmene Corporation, and Georgia-Pacific LLC, among others.

Asia Pacific is the fastest growing region in the wood pulp market.

North America holds the biggest share in the market.

The packaging segment dominates the market as it serves diverse industries.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Grade |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share