Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global vinyl acetate market value reached is expected to grow at a CAGR of 4.00% in the forecast period of 2026-2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4%

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

| Global Vinyl Acetate Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | XX |

| Market Size 2035 | USD Million | XX |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 4.5% |

| CAGR 2026-2035 - Market by Country | India | 4.5% |

| CAGR 2026-2035 - Market by Country | China | 4.1% |

| CAGR 2026-2035 - Market by End Use | Solar | 4.6% |

| CAGR 2026-2035 - Market by Application | Ethylene Vinyl Acetate (EVA) | 4.5% |

| Market Share by Country 2025 | France | 3.7% |

Vinyl acetate (VAM), an organic compound, is represented by the formula C4H6O2. It is a precursor to polyvinyl acetate, which serves as a significant industrial polymer. It is used as a major ingredient in furniture glue. Commercially, it is prepared via the reaction of ethylene, acetic acid, and oxygen in the presence of a palladium catalyst.

The growth of the significant downstream applications including polyvinyl acetate, polyvinyl alcohol, and ethylene vinyl acetate is driving the vinyl acetate market demand. Ethylene vinyl alcohol is the fastest growing end-use sector for the product.

Further, ethylene vinyl acetate (EVA) resins are used in the production of packaging film, foam, wires and cables, hot melt adhesives, and encapsulation of photovoltaic (PV) modules in solar cells. The growing demand for photovoltaic panels, which are used in solar energy generation is expected to drive the demand of the vinyl acetate market over the forecast period.

The vinyl acetate demand growth is dominated by the Asia Pacific region. The demand is growing in the region due to the rapid urbanisation and industrialisation as well as the growing construction activities in the region. With the growing construction activities, the production capacity of paints and coatings, and adhesives are also growing, wherein vinyl acetate is mainly utilised, thus, aiding the industry growth.

The developed regions like North America and Europe will significantly contribute to the vinyl acetate industry growth over the forecast period owing to the growing adoption of renewable energy sources like solar panels.

The vinyl acetate market revenue has experienced significant growth in recent years. According to Trade Map, the total global import value was USD 2.05 billion in 2019, which increased to USD 3.65 billion in 2021 and to USD 4.14 billion in 2022. Belgium, a major importer, saw its import value rise from USD 540.1 million in 2019 to USD 881.2 million in 2020, peaking at USD 1.03 billion in 2021. China's import value also showed resilience, growing from USD 440.6 million in 2020 to USD 521.6 million in 2022. India maintained steady growth, with imports increasing from USD 193.9 million in 2019 to USD 450.1 million in 2021.

Germany's imports exhibited robust growth, from USD 172.7 million in 2019 to USD 384.6 million in 2022. Turkey also saw substantial increases, recovering from USD 111.5 million in 2020 to USD 384.6 million in 2022. Italy's imports rose from USD 57.9 million in 2020 to USD 368.2 million in 2022. The Republic of Korea's imports increased from USD 64.6 million in 2019 to USD 86.8 million in 2022. Spain's imports grew from USD 59.7 million in 2019 to USD 112.4 million in 2022. Canada and the United Kingdom exhibited similar growth patterns, with Canada's imports rising from USD 45.3 million in 2019 to USD 71.2 million in 2022, and the United Kingdom's imports growing from USD 46.4 million in 2019 to USD 101.1 million in 2022. France's import value rose significantly from USD 40.8 million in 2019 to USD 101.1 million in 2022. Trade Map data underscores the rising demand and strategic significance of vinyl acetate across industries worldwide, indicating robust market performance and favorable future growth for the vinyl acetate industry revenue.

In 2023, Asian Paints announced plans to establish a new manufacturing facility in India dedicated to producing Vinyl Acetate Monomer (VAM) and Vinyl Acetate Ethylene Emulsion (VAE). This project, valued at USD 255 million (INR 21 billion), is expected to have an annual production capacity of 100,000 tonnes of VAM and 150,000 tonnes of VAE.

Celanese Corporation

Clariant Ltd.

Exxon Mobil Corporation

China Petrochemical Corporation

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Vinyl Acetate Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Manufacturing Process

Market Breakup by Application

Market Breakup by End Use

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| India | 4.5% |

| China | 4.1% |

| Canada | 4.0% |

| Mexico | 4.0% |

| UK | 3.8% |

| USA | XX% |

| Germany | XX% |

| France | 3.4% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Italy | 3.0% |

The increase in demand for adhesives in food packaging applications and the growing adoption of solar power generation are driving the demand for the vinyl acetate market. The solar power industry is witnessing a rapid growth across the world owing to the growing environmental concern and rising demand for renewable energy sources.

Further, the thriving construction sector, growing demand for automotive and furniture as well as paints and coatings are the major drivers of vinyl acetate industry growth. In emerging economies such as India and China, there has been a rise in consumer disposable incomes that is further aiding the demand for automobiles. This, in turn, is augmenting the demand for ethylene vinyl acetate (EVA) resins, which are widely used in the production of automobile bumpers and moulded parts.

The rapid technological advancements and increasing R&D activities are expected to have a positive effect on the expansion of the global vinyl acetate industry. For instance, the introduction of bio-based ethylene vinyl acetate materials will provide lucrative opportunities for the growth of the vinyl acetate industry in the coming years.

The companies specialise in the production of petrochemicals, refining, and exploration of oil and gas, offering a wide range of products and services in the energy and chemical sectors.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global vinyl acetate market value is projected to grow at a CAGR of 4.00% between 2026 and 2035.

The major drivers of the industry, such as rising disposable incomes, increasing population, growing downstream applications, rising demand for photovoltaic panels, rapid urbanisation and industrialisation, increasing construction activities, growing demand for adhesives in food packaging applications, rising technological advancements, and growing R&D activities are expected to aid the market growth.

The key trends guiding the growth of the market include the rising adoption of renewable energy and the introduction of bio-based ethylene vinyl acetate materials.

Based on the region, the market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The market is broken down into ethylene process and acetylene process, among others.

The market is broken down into polyvinyl acetate, polyvinyl alcohol, ethylene vinyl acetate (EVA), and ethylene-vinyl alcohol (EVOH), among others.

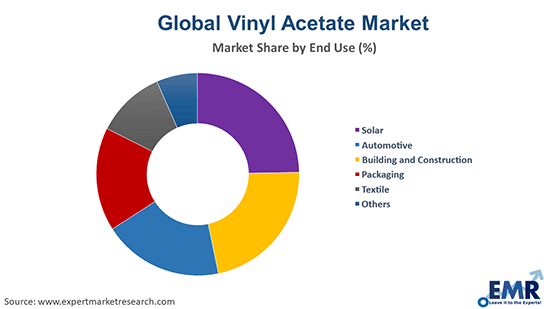

The significant end-use sectors in the industry are solar, automotive, building and construction, packaging, and textile among others.

The competitive landscape consists of Celanese Corporation, Clariant Ltd., Exxon Mobil Corporation, China Petrochemical Corporation, and Dairen Chemical Corporation among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Manufacturing Process |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share