Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The United Kingdom air conditioner market was valued at USD 1.33 Billion in 2025. The industry is expected to grow at a CAGR of 6.30% during the forecast period of 2026-2035 to attain a valuation of USD 2.45 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.3%

Value in USD Billion

2026-2035

*this image is indicative*

In the United Kingdom, air conditioners offer several advantages: they ensure precise climate control, providing comfort during hot weather and heatwaves. They enhance indoor air quality by filtering pollutants and allergens.

In the United Kingdom air conditioner market dynamics and trends are driven by productivity in offices and schools by creating a comfortable environment. They also promote better sleep with controlled temperatures and are energy-efficient, helping to manage energy use and cut costs. Moreover, they regulate indoor humidity, which reduces mould growth and boosts overall comfort.

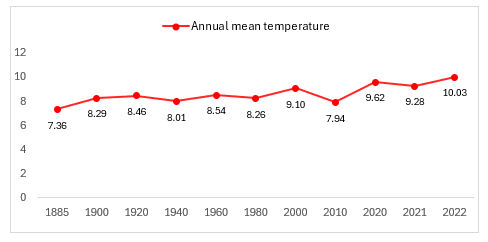

ANNUAL MEAN TEMPERATURE UK (DEGREE CELSIUS)

The United Kingdom air conditioner market demand is driven by rising temperature levels in the country. Moreover MCE trade show, a leading global event for the HVACR sector, provides a platform for companies to display their latest technologies. Major players like Haier and LG showcased their innovations, with LG presenting the DUALCOOL residential air conditioner indoor unit.

In tandem with these technological advancements are environmental considerations. According to the UK Government, the country's annual mean temperature reached a record high of 10.03 degrees Celsius, potentially influencing the growth of the United Kingdom air conditioner industry.

As per United Kingdom Government, in the financial year ending March 2022, the United Kingdom completed 204,530 dwellings, with the largest number in England at 171,190, followed by Scotland with 20,770, Northern Ireland at 7,300, and Wales with 5,270. The quarterly figures for Q1 2024 show that new build dwelling starts in England reached 22,310, reflecting an 11% increase compared to Q4 2023. This indicates a rebound from the previous quarter, though the starts are still 67% below the Q2 2023 peak and 34% above the Q2 2020 trough. The number of new build dwelling completions in England for Q1 2024 was 34,630, seasonally adjusted, marking a 12% decrease from both Q4 2023 and Q1 2023. Despite these decreases, completions were 115% above the 2020 Q2 trough and 29% below the Q1 2021 peak.

These trends demonstrate a fluctuating but generally positive momentum in the UK's housing market, driven by ongoing construction efforts and economic conditions. The significant number of completions in 2022 and the seasonal adjustments in 2024 highlight the market's resilience and the influence of regulatory and economic factors on housing activity. The steady rise in new housing starts from Q4 2023 to Q1 2024 underscores the sector's growth and recovery potential, boosting the United Kingdom air conditioner market revenue, as modern homes increasingly feature advanced HVAC systems to improve comfort and energy efficiency, this trend addresses rising temperatures and evolving climate conditions.

Furthermore, rising urbanisation in the UK is boosting the United Kingdom air conditioner industry revenue as, urban areas experienced slightly higher growth, reaching an index of around 106.5, reflecting consistent urbanization trends. Rural areas, while growing at a slower rate, still saw a notable increase, with the index rising to about 103.5 by 2019. The overall population growth in England highlights the ongoing demographic shifts, with urban areas leading the growth trajectory. This trend highlights the increasing concentration of populations in urban centres, driven by factors such as better economic opportunities and enhanced living standards.

AB Electrolux

Daikin Industries, Ltd.

Haier Group Corp.

LG Corporation

“United Kingdom Air Conditioner Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Size

Market Breakup by End Use

Market Breakup by Distribution Channel

Market Breakup by Region

In the United Kingdom air conditioner market, central air conditioners are popular for cooling entire buildings and are commonly used in large commercial structures. They ensure consistent temperatures across multiple rooms or floors. Conversely, window air conditioners are used for cooling individual rooms and are installed in windows or through-wall openings, with the compressor and condenser placed outdoors.

The United Kingdom air conditioner industry revenue is driven by both commercial and residential needs. Commercial air conditioning supports offices, retail stores, and hotels by maintaining comfortable environments for employees and guests, while residential systems offer relief from extreme temperatures and enhance indoor comfort.

The companies specialise in innovative HVAC solutions, providing advanced heating, ventilation, and air conditioning systems.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The United Kingdom air conditioner market value is projected to grow at a CAGR of 6.30% between 2026 and 2035.

Factors driving the market are rising temperatures in the domestic regions and technological advancements in the industry to combat the concerns that are raised about the sustainability and environmentally friendly nature of the technology.

The market is broken down into window air conditioners, central air conditioners, and mini split air conditioners among others.

The competitive landscape consists of Carrier Global Corporation, Hughes Group, LG Corporation, AB Electrolux, Daikin Industries, Ltd., Haier Group Corp., Samsung Electronics Co. Ltd., Panasonic Holdings Corporation, Johnson Controls International Plc and Mitsubishi Electric Corp. among others.

Based on the distribution channel it is divided into hypermarkets/supermarkets, specialty stores, and online channels among other channels of distribution.

The market is broken down into England, Wales, Scotland, and Northern Ireland.

Based on the end use, the market is divided into commercial and residential markets.

In 2025, the market attained a value of nearly USD 1.33 Billion.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 2.45 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Size |

|

| Breakup by End Use |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share