Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global underwater drone market size was valued at USD 4.72 Billion in 2025. The industry is expected to grow at a CAGR of 12.00% during the forecast period of 2026-2035 to reach a value of USD 14.66 Billion by 2035. The growth is attributed to the rapid advancements in onboard autonomy and network-level connectivity brought about in the modern underwater drones.

Ongoing advancements are enabling underwater drones to perform complex missions with minimal human intervention and near-real-time situational awareness. The transition from single-vehicle operations to coordinated multi-vehicle systems is driven by enhanced sensor suites, AI-powered data processing, and high-bandwidth underwater communication links, which is transforming the underwater drone market landscape.

For example, in November 2025, Kyocera Corporation announced a breakthrough underwater wireless optical communication (UWOC) technology achieving 5.2 Gbps data speeds, allowing high-definition video and sensor data streaming from unmanned vehicles. This illustrates how autonomy and connectivity work together, in a way that smart vehicles generate large volumes of data, but without reliable communication and networked control, their operational value is limited.

As commercial and defense sectors seek solutions for extended and complex underwater missions, the continuous improvements in AI-enabled, interconnected drone systems offers scalable and cost-effective capabilities for seabed mapping, infrastructure inspection, maritime security, and environmental monitoring, driving underwater drone market development.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

12%

Value in USD Billion

2026-2035

*this image is indicative*

Manufacturers are pushing small, powerful underwater drones into both the recreational and industrial segments, thus increasing the demand that can be targeted beyond the defence and energy sectors. To give an instance, in April 2023, QYSEA Technology introduced the FIFISH V EVO with a 4K 60 fps camera and 360° omnidirectional movement, thus enabling filmmakers and marine inspectors to capture ultra-high-definition footage underwater. This launch is indicative of how suppliers are addressing the needs of new leisure and inspection usage scenarios, thus facilitating the growth of the commercial ecosystem of the underwater drone market.

Development is supported when firms obtain new capital to broaden R&D, increase production and open new regions in the underwater drone sector. For instance, in August 2024, a marine robotics startup EyeROV based in India, raised INR 10 crore (USD1.2 million) in a Pre-Series A round led by Unicorn India Ventures to facilitate the development and exports of underwater drones. Such a capital infusion is a loudspeaker signaling that smaller players are on the verge of scaling up, which, in turn, expands the supply chain capacity and assists in fulfilling the growing global demand.

Most of the growth is driven by the ability to launch fleets of underwater drones rather than just single units. So, companies are spending money on support vessels, remote operations, and service contracts. A very clear example is when EyeROV announces its growth plan to provide oil & gas, maritime infrastructure, and defense markets' services; together with the recent funding round, it is backing up the statement. In fleet-based business models, operators lower their costs per mission and therefore can apply for large framework contracts, thus facilitating the conversion of growth potential into repeatable revenue streams fueling the growth of the underwater drone market.

One more factor in the growth of underwater drones is the establishment of strategic alliances, which combine platform makers, system integrators, and sensor companies to provide turnkey solutions. Back in April 2024, the two French companies, SIREHNA and Couach, decided to join forces and develop small, unmanned surface and underwater systems for global markets. Such partnerships that bring together expertise in naval platforms and autonomous systems not only help companies to speed up their go-to-market process but also allow them to better meet customer needs who prefer full-stack capability over point solutions.

Consolidation is becoming a key driver as the subsea drone sector matures. Larger firms are acquiring niche specialists to expand their offerings and strengthen their presence in the underwater drone market. As a result, in March/April 2025, Kraken Robotics acquired 3D at Depth, a United States-based subsea LiDAR imaging and metrology company, to extend Kraken's service capabilities and presence in the U.S. The consolidation moves faster to productization, deepens the services, and makes it more difficult for new companies to enter the market, thus having an impact on the market structure and growth rates.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Underwater Drone Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insights: ROVs remain essential for real-time inspection and maintenance in oil & gas and infrastructure, while AUVs are gaining traction due to autonomous navigation and deep-water endurance. Hybrid vehicles, capable of both tethered and untethered operations, offer versatile multi-mission capabilities. For instance, in March 2024, Ocean Infinity secured a framework agreement with Shell for subsea AUV operations, reflecting growing adoption of autonomous platforms. Market players continue enhancing endurance, payload options, and modularity across all segments.

Market Breakup by Product Type

Key Insights: Micro drones are gaining significant traction in the underwater drone market value for confined space inspections and marine research tasks, while small & medium types serve commercial survey and environmental monitoring. Light work-class drones dominate inspection and intervention, and heavy work-class machines support deep-sea construction and defence operations. For example, in February 2025, BAE Systems demonstrated its “Herne” XLAUV (extra-large autonomous underwater vehicle) in United Kingdom waters, reflecting how heavy-class platforms are expanding into endurance-led missions. Market players are accordingly enhancing endurance, modularity and payload flexibility across each class to match mission-specific demands.

Market Breakup by Propulsion System

Key Insights: The underwater drone market is segmented by propulsion system into Electric, Mechanical, and Hybrid systems. Electric systems dominate due to low noise, reduced maintenance, and suitability for research, inspection, and defense applications. Mechanical systems are preferred for heavy work-class vehicles requiring high thrust and deep-water operations. Hybrid systems combine the advantages of both, offering flexibility for long-endurance missions. Market players are focusing on enhancing battery life, motor efficiency, and modular propulsion units to meet diverse operational needs across commercial, defense, and offshore sectors.

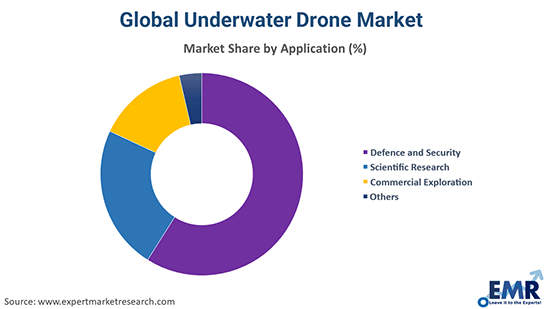

Market Breakup by Application

Key Insights: For defence & Security applications, the underwater drone market trend is shifting toward long-endurance autonomous UUVs for mine countermeasures, infrastructure protection and maritime domain awareness. Scientific research is driven by modular sensors, AI-enabled mapping, and multivehicle networks for marine biodiversity, climate, and ocean floor studies. Commercial exploration sees expanding use of inspection drones for offshore wind, oil & gas, subsea mining, and cable routing operations. Finally, the 'others' category is evolving via consumer-grade drones, aquaculture inspection and environmental monitoring.

Market Breakup by Region

Key Insights: North America leads growth in the global underwater drone market due to strong defense spending and offshore energy projects, while Europe benefits from offshore wind and environmental initiatives. Asia Pacific is rapidly expanding with commercial exploration and naval modernization. For example, in September 2025, RWE deployed an AUV for underwater ecosystem monitoring at its Kaskasi offshore wind farm in Europe. Latin America and MEA are emerging markets, driven by oil & gas inspections and port security, with companies expanding regionally to meet diverse operational requirements.

By type, ROV witness high demand

The demand for the ROV market is mainly influenced by the requirement of very detailed precision inspections that can be seen in the areas of offshore wind, oil & gas, and subsea infrastructure. Fleet operators are renting vessels and ROVs equipped with advanced sensors and real-time data links in order to be able to carry out more frequent inspection rounds and meet regulatory requirements. As an illustration, in March 2024, Rovco acquired new vessels through a charter of MV Patriot to carry out the inspection of the offshore wind farm. The manufacturers are responding by providing modular tool skids, digital monitoring, and service contracts instead of only selling hardware.

Expansion of the AUV segment substantially fuels underwater drone market value, mainly attributable to the longer endurance of missions, deeper operations, and untethered platforms entering the fields of defence, resource exploration and environmental monitoring. The providers are developing vehicles that are capable of extended deployments with very little support vessel time. As an example, in July 2023, the autonomous underwater vehicle "Neerakshi" was unveiled by Garden Reach Shipbuilders & Engineers Ltd. in India, aimed at mine detection and survey activities at 300 m depth. The vendors have now turned their attention to improvements in battery life, adaptive autonomy, and payload flexibility to meet these additional requirements.

By product type, light work class record strong market interest

The underwater drone market witnesses notable demand for light work class, mainly driven by the need for multifunctional vehicles that can perform inspection, maintenance, and shallow water construction tasks. To enable their release from smaller boats, producers are fitting modular manipulators, sonar systems, and lightweight tethers. As a case in point, Forum Energy Technologies announced a contract in April 2023 to supply an Asian navy with two light work class ROVs, thus highlighting the dual-use potential of such vehicles. Vendors are continually emphasizing modularity and mission adaptability to access both commercial and defense sectors.

The heavy work class category contributes significantly to the underwater drone market revenue as offshore energy, subsea mining, and large construction projects need high-endurance vehicles with heavy payload and advanced tether-management capabilities. Some companies are placing a bet on deep-rated ROVs and fleet support infrastructure to be able to carry out operations at extreme depths. For example, in July 2024, Next Geosolutions Europe S.p.A. put more than 8 million USD into buying a 4000-meter rated heavy-duty ROV for seabed survey and subsea intervention. The participants in the industry are becoming increasingly willing to provide complete solutions that cover inspection, maintenance, and intervention services.

By propulsion system, electric propulsion systems gain preference

The electric propulsion continues to witness sustained demand in the underwater drone market as operators are highly inclined to choose silent, low-maintenance underwater vehicles that can be used for inspection, research, and defense. In general, high-density batteries, more efficient motors, and power management systems have made it possible to have longer untethered missions. Take for instance the case of May 2024, when China introduced the UUV300CB, an unmanned electric propelled underwater vehicle able to make a 450 nautical mile journey and also equipped with torpedo-launching capability. Battery swapping through modular units, acoustic stealth and endurance are just a few of the features that vendors are improving to meet the demand for multi-mission electric UUVs.

Hybrid propulsion which combines electric and mechanical drives, is the main reason behind the increase of platforms that require not only long-range endurance but also high-power subsea capabilities. These are the best systems for tasks such as deep-water inspection, trenching, and lifting where being flexible is very important. An example would be Nezha SeaDart, a hybrid aerial underwater vehicle capable of transition between air and water demonstrated by China in August 2024 with both thrusters and propellers. Innovative firms are now gearing towards the development of the automatic mode switching, adaptable powertrains, and multi-environment versatility.

By application, defence & security leads the market share

The defence and security segment is rising with the use of autonomous and remote-operated underwater systems by navies for mine countermeasures, port security, and maritime surveillance, among other applications. In a case in point, Saab in December 2023 got a USD 16 million order to supply its Double Eagle semi-autonomous ROV to the Kuwaiti Navy for mine disposal and underwater threat detection. Manufacturers are promoting modular payloads, stealth operations, and scalable export-ready solutions, which, in turn, boosts the underwater drone market growth.

The commercial exploration applications are growing with the help of underwater drones, in their turn, are being more widely used for offshore wind inspections, subsea cable surveys, and oil & gas infrastructure monitoring. As an example, Blueye Robotics in March 2024 unveiled a miniaturized underwater drone specifically designed for the remote inspections of the offshore windfarm, thus making the surveys regular and cheap. Market players are concentrating on the provision of lightweight and easily deployable vehicles, subscription-based services, and advanced analytics for the best use of operational efficiency.

By region, North America registers robust growth

The North American underwater drone market is benefitted by the large defense expenditures and the growing demand for offshore energy. To address the rising demand, OEMs are innovating new models of both UUVs and ROVs with surveillance, infrastructure inspection, and autonomous operations capabilities. As an illustration, Northrop Grumman was awarded a USD 24.9 million contract by the United States Navy in March 2025 to build next-generation undersea vehicles. In line with this, producers are enhancing local manufacturing, deepening partnership relations, and customizing products for naval and commercial usages.

The Asia Pacific underwater drone market has been witnessing a rapid growth over the past few years, mostly due to increased budgets for maritime security, offshore energy, and port infrastructure inspections. The governments in the region are speeding up the use of autonomous underwater vehicles for defense and commercial sectors. A good example would be when the Indian Navy in July 2025, awarded a Coratia Technologies a contract worth INR 66 crores for the supply of underwater robotic systems. To get ready for a vast deployment in different countries, companies are building local stations, working on their logistics chains, and upgrading the skills of their staff.

Major underwater drone market players are gradually directing more money to research and development in order to keep the life of the vehicle longer, increase its modularity, and make it possible for it to autonomously make decisions. To provide different kinds of applications for defense, offshore energy, and marine research, companies are using AI-based navigation, real-time imaging, and cloud-based mission control together. By strategically collaborating with naval forces and tech firms, manufacturers are thus shortening their prototype-to-production cycle and consolidating the presence of their military and commercial segments.

The industry is making tactical growth moves through partnership, funding, and merger strategies that are aimed at increasing the volume of operations and widening the portfolio. The prominent underwater drone companies are focusing on dual-use platforms that combine military-grade performance with commercial adaptability and thus, a larger customer base is ensured. Besides, the enterprises are establishing local assembly stations and investing in the data-driven software ecosystem, which is a full-service underwater solution of design, deployment, monitoring, and post-mission analytics, to move their business forward in the underwater drone market.

ECA Group is an independent company founded in 1936, and its head office is in Toulon, France. Three main areas of the company's activities are to supply defense industries and navies with robotics, automated systems, and simulation technology and the manufacture of advanced intruder-tracing equipment. ECA Group is identified with the goal of creating AUVs and ROVs of high technology levels and, in general, of supporting mine countermeasures, hydrography, and subsea inspection.

Located in Bremen and established in 1902, Atlas Elektronik GmbH is a leading German defense electronics company with a primary focus on marine systems and sonar technologies. The company offers solutions in the underwater drone market and grants minimal system goals while delivering advanced mine countermeasures.

Saab Seaeye Ltd. is a subsidiary of Saab AB that was established in 1986 and is in Fareham, the United Kingdom. The company provides electric and hybrid underwater robotics solutions to the sectors of oil and gas, defence, and ocean research. The unit is notable for the design of heavy inline devices, hybrid remote vehicles, electric propulsion systems, etc.

Deep Trekker Inc., was established in 2010 and has its head office in Kitchener, Canada. The company is the designer of small, simple to carry ROVs and underwater drone for the inspection, aquaculture, and environmental monitoring sector. It is a firm whose battery-powered equipment are recognized for their robustness, ease of implementation, and low-rate usage across commercial and research application sectors.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market Includes Kongsberg Gruppen ASA, and Oceaneering International, Inc., among others.

Explore the latest trends shaping the Global Underwater Drone Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global underwater drone market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global underwater drone market reached an approximate value of USD 4.72 Billion.

The market is projected to grow at a CAGR of 12.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 14.66 Billion by 2035.

Key strategies driving the market include fleet-based operations, strategic alliances and integrated solutions, mergers and acquisitions, investment in R&D for advanced autonomy and connectivity, and dual-use product development for commercial and defense applications.

The market is expected to be defined by the research and development (R&D) activities in the industry.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different types of underwater drones are remotely operated vehicle (ROV), autonomous underwater vehicles (AUV), and hybrid vehicles.

The major product types of underwater drones are micro, small and medium, light work-class, and heavy work-class.

The major propulsion systems of underwater drones include electric system, mechanical system, and hybrid system.

The significant applications of underwater drones are defence and security, scientific research, and commercial exploration, among others.

The key players in the market include ECA Group, Saab Seaeye Ltd., Atlas Elektronik GmbH, Deep Trekker Inc., Kongsberg Gruppen ASA, and Oceaneering International, Inc., among others.

Major challenges include high costs of advanced drones, technological complexity in deep-water and long-endurance operations, regulatory and export restrictions, a limited skilled workforce for maintenance and operations, and intense competition among established and emerging players.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Product Type |

|

| Breakup by Propulsion System |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share