Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global stock video market was valued at USD 5.43 Billion in 2025. The market is expected to grow at a CAGR of 5.94% during the forecast period of 2026-2035 to reach a value of USD 9.67 Billion by 2035. Remote content production in post-COVID workflows has largely boosted the need for scalable, pre-shot video content solutions.

The market has witnessed a profound shift driven by the explosive demand for short-form and immersive video content, especially in business communication, online advertising, and corporate training. A notable market trend is the surging reliance on hyper-realistic stock footage created using AI and virtual production. For instance, Adobe’s Firefly AI platform offers generative video, reshaping how marketers and brands source clips. According to the stock video market analysis, 91% of marketers now use video as a core content asset, with a sharp tilt towards curated, licensable content to scale campaigns. This underlines a commercial demand for flexible, on-brand footage that eliminates traditional production hassles.

The market’s expansion is also boosted by global digitalisation initiatives and e-learning penetration. In the United Kingdom, the Department for Business and Trade reported a significant rise in SME video usage for customer engagement. Meanwhile, the European Commission’s Digital Decade targets have prioritised digital media access for small businesses by 2030, further boosting the stock video market opportunities.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.94%

Value in USD Billion

2026-2035

*this image is indicative*

The emergence of AI-based video generation tools, like Runway and Pika, has enabled platforms to offer customisable stock video built from text prompts. For instance, Shutterstock’s launch of a generative video suite, in partnership with NVIDIA in March 2023, saw a considerable growth in enterprise subscriptions, stimulating the stock video market growth. With brands demanding contextual content tailored to niche demographics, generative AI is being embedded into licensing models, allowing businesses to localise or customise stock content in minutes.

Several nations are establishing digital creator funds and production grants to foster high-quality video content creation, feeding stock libraries. For instance, the United Kingdom’s EUR 77 million Creative Industries Sector Vision aims to boost creative exports, particularly stock content from independent creators. Similarly, Canada’s Creative Export Strategy funds content digitisation and licensing for global platforms, accelerating the stock video demand growth. These initiatives not only support creators but also help stock marketplaces diversify their collections with authentic, region-specific clips.

Enterprise users are increasingly shifting from one-off purchases to volume-based subscriptions, driven by the need for continuous content streams. This is observed in Artgrid’s enterprise rollout and Envato’s tailored corporate packages. Subscription models ensure predictability in pricing and availability, an appealing proposition for agencies, educational institutions, and media houses running multichannel campaigns. This stock video market trend has compelled platforms to expand licensing rights, increase clip turnaround, and offer integrations with video editing suites like Premiere Pro and Final Cut.

Stock video is finding applications beyond marketing, particularly in corporate learning and development. Virtual training modules now rely heavily on stock clips to simulate workplace scenarios. Tech firms like SAP and PwC have expanded their use of stock footage in upskilling platforms. For businesses aiming to scale L&D efficiently across regions and languages, such ready-to-use footage is vital in ensuring relatability and compliance across geographies.

Stock video is being deeply integrated into marketing automation and content management ecosystems. Platforms like HubSpot, Canva, and Storyblok now offer in-app access to stock video libraries, allowing users to insert footage into workflows without external downloads. This streamlining appeals to B2B marketers working on tight schedules, boosting further demand in the stock video market. In addition, programmatic video ad platforms are tapping automated stock insertion to dynamically generate creatives at scale.

Read more about this report - REQUEST FREE SAMPLE

The EMR’s report titled “Global Stock Video Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Image Source

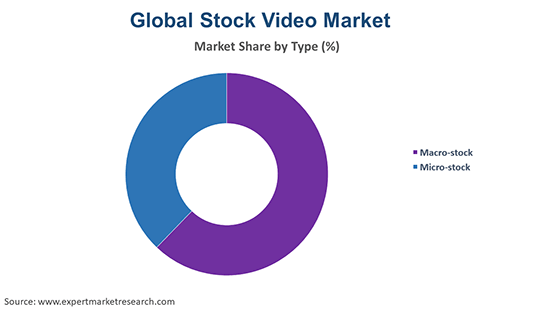

Key Insight: While macro-stock dominates large-scale commercial projects due to quality and brand consistency needs, micro-stock continues to disrupt the space with scalable access and integration ease. Businesses now strategically blend both, using macro for flagship campaigns and micro for agile, everyday content requirements. This hybrid sourcing strategy allows brands to balance visual impact with cost-efficiency, particularly as content demands rise across social platforms, internal communications, and training modules.

Market Breakup by License Model

Key Insight: While royalty-free licensing continues to drive the stock video market value with its affordability, ease of use, and wide accessibility, rights managed content is becoming essential for enterprises requiring exclusivity, compliance, and brand safety. Each caters to distinct business needs, RF suits high-volume, fast-turnaround content, while RM fits regulated sectors and premium campaigns. As enterprises increasingly operate across diverse platforms and regions, this dual-model ecosystem offers flexibility and control, allowing companies to scale content creation while maintaining legal clarity, contextual relevance, and strategic alignment with brand identity.

Market Breakup by End Use

Key Insight: Editorial stock remains vital for ensuring media accuracy, legal clarity, and contextual integrity, making it a go-to for news, documentaries, and educational content. On the other hand, commercial end use is gaining rapid traction in the stock video industry in branding, digital marketing, and corporate training, thanks to its flexibility and wide application.

Market Breakup by Region

Key Insight: The North America stock video market’s continued dominance is powered by its advanced content ecosystem and licensing frameworks. Asia Pacific is growing rapidly, powered by digital expansion and regional content creation. Europe maintains steady demand, especially in public and educational sectors. The market in Latin America is experiencing growth through creative industries and ecommerce, while the Middle East and Africa are leveraging stock content in tourism, government outreach, and online education.

By image source, macro-stock footage led the market owing to high quality and editorial licensing demands

Macro-stock, traditionally the premium category, dominates the global market due to its unmatched quality and licensing exclusivity. These clips often include cinematic productions, editorial footage, and drone shots that meet broadcast and enterprise-grade requirements. Platforms like Getty Images and BBC Motion Gallery continue to attract high-budget buyers in sectors like finance, tourism, and pharmaceuticals.

Micro-stock observes the fastest growth in the stock video market, driven by cost-efficiency and wide availability. With platforms like iStock, Envato, and Storyblocks enabling access to millions of royalty-free videos, SMEs and digital startups have become increasingly drawn to this category. The ease of licensing and integration with popular design tools such as Canva and Figma also adds appeal.

By license model, royalty-free stock footage accounts for the largest market share due to cost efficiency and flexible usage rights

As per the stock video market report, royalty-free licensing remains the preferred model, particularly in marketing, education, and internal business communication. Its one-time payment structure and flexible usage make it ideal for ongoing campaigns and content repurposing. Platforms like Artgrid, Motion Array, and Shutterstock have expanded their RF libraries, offering 4K and vertical formats. B2B players favour RF for its budget predictability, especially for high-frequency content output in social, webinars, and training.

Rights managed stock video is finding relevance in highly regulated industries and bespoke brand storytelling. RM licenses ensure exclusivity, controlled usage, and accurate tracking, critical for industries like pharma, legal, and broadcast media, thereby boosting the stock video industry opportunities. Getty Images and Filmsupply continue to lead in this space, often offering RM bundles with location-specific restrictions.

Editorial end use dominates the market due to growing demand in news & documentaries

The editorial end use category continues to hold the dominant share in the stock video market revenue, driven by demand from media houses, news portals, and educational content producers. Editorial footage is highly sought after for its real-world relevance, covering protests, climate change, elections, and cultural events. Platforms like Reuters Connect and Getty Images have significantly expanded their editorial video libraries, targeting B2B buyers needing timely, authentic, and legally cleared content.

Commercial usage is rising sharply as brands embrace stock video to fuel high-frequency, cost-efficient marketing. This category includes usage in digital ads, social media, explainer videos, and corporate films. With consumer attention spans shortening, businesses now prefer quick-to-license, high-quality footage for visual storytelling. Platforms such as Storyblocks and Artgrid offer tailor-made B2B packages with built-in editing tools, making them ideal for fast-paced campaign cycles.

North America leads the market due to high content consumption and corporate demand

North America remains the dominant region in the global stock video industry, driven by high content consumption across sectors such as media, advertising, and e-learning. The presence of major platforms, strong demand from film studios, and the rise of content-driven B2B enterprises support the region’s sustained growth. United States-based companies increasingly use stock video in corporate training, product launches, and explainer campaigns. Canada’s creative economy further fuels regional supply, supported by content export incentives.

The stock video market in Asia Pacific experiences continuous growth, with surging demand from digital-first businesses, edtech firms, and mobile-centric marketing ecosystems. Countries like India, China, and Indonesia are witnessing increased content creation, driven by localised branding needs and regional storytelling. The expanding gig economy and regional creator platforms have contributed to the volume of culturally relevant stock footage, particularly in micro-stock libraries.

The global industry is becoming intensely competitive, with companies focusing on localisation, AI integration, and B2B licensing tools. Key stock video market players are investing in partnerships with media houses, building creator networks, and launching intuitive editing platforms to enhance customer retention. The surge in demand from regional businesses and startups has prompted platforms to curate vernacular and culturally nuanced content, opening monetisation channels for local creators.

Automation and metadata tagging, powered by AI, is another area of focus, aiming to reduce content discovery time for B2B buyers. Mobile-first tools and drag-and-drop editors are also being embedded into licensing platforms to serve non-design professionals. The biggest opportunity lies in bundling video with templates, music, and analytics to create complete brand solutions. As businesses seek agility and scale in content creation, stock video companies must continuously innovate and offer value beyond footage, through licensing models, API integrations, and industry-specific libraries.

Established in 1982 and headquartered in San Jose, California, Adobe Inc. caters to the stock video market through its Adobe Stock platform, seamlessly integrated within the Creative Cloud suite. The company enables B2B users to access, license, and directly use stock video within tools like Premiere Pro and After Effects. Its subscription-based model and enterprise solutions are tailored for agencies, content teams, and marketing departments.

Founded in 1995 and based in Seattle, Washington, Getty Images is a leading global provider of high-quality editorial and commercial stock footage. The platform caters to media houses, government institutions, and corporate clients with exclusive rights-managed content and extensive archival footage. Getty’s editorial strength makes it a trusted source for news coverage, documentaries, and legal-safe storytelling.

Pond5 Inc., established in 2006 and headquartered in New York City, operates as a dynamic marketplace for royalty-free stock videos, particularly focusing on creative and independent contributors.

Established in 2002 and based in New York City, Shutterstock, Inc. is a key player in the global stock video market, offering a vast library of royalty-free video content through flexible subscription models. The platform serves businesses across sectors, from retail to education, providing ready-to-use, high-resolution clips suitable for ads, presentations, and internal communication.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Explore the latest trends shaping the global stock video market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customised consultation on stock video market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.94% between 2026 and 2035.

Creating regional content, automating metadata tagging, partnering with SaaS platforms, bundling services, and simplifying licensing terms are helping stakeholders stay competitive while addressing the diverse needs of enterprise clients.

The key trends guiding the market include the rising use of stock video in filmmaking applications and the growing availability of vendors offering stock video.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading image sources of stock video in the market are macro-stock and micro-stock.

The significant license models of stock video in the market are rights managed (RM) and royalty-free (RF).

The major end uses of stock video in the market are editorial and commercial.

The major players in the market are Adobe Inc., Getty Images, Pond5 Inc., and Shutterstock, Inc., among others.

In 2025, the stock video market reached an approximate value of USD 5.43 Billion.

Content oversaturation, licensing complexity, and platform discoverability limit creator visibility and confuse buyers, making it harder for businesses to find footage that is brand-safe, unique, and legally viable.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Image Source |

|

| Breakup by License Model |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share