Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The solar PV inverter market attained a value of USD 8.87 Billion in 2025. The industry is expected to grow at a CAGR of 5.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 14.45 Billion.

The rapid global shift towards renewable energy sources is one of the key solar PV inverter market trends. According to SolarPower Europe, the global solar installations recorded nearly 600 GW in 2024, exhibiting a 33% rise from 2023. Governments and corporations are committing to reduce carbon emissions, leading to increased solar installations. As solar panels become more affordable and efficient, the demand for reliable inverters to convert DC power to AC power is rising. This growth is prominent in emerging markets and developing countries where energy infrastructure is expanding, fuelling the need for cost-effective solar solutions.

Large-scale solar farms are growing rapidly worldwide to meet energy demand and sustainability goals. These projects require high-capacity, reliable inverters capable of handling significant power outputs and integrating with grid infrastructure. Utility-scale inverters focus on durability, scalability, and advanced grid support features to cater to the sustainability demands. In September 2024, GE Vernova launched a 6 MVA, 2000V DC utility-scale inverter, piloted in North America, to cut solar energy costs and speed up renewable energy adoption and decarbonization. The rise in government-backed renewable energy auctions and private investments in utility solar farms is also fuelling the solar PV inverter industry growth.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Solar PV Inverter Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 8.87 |

| Market Size 2035 | USD Billion | 14.45 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.8% |

| CAGR 2026-2035 - Market by Country | India | 6.6% |

| CAGR 2026-2035 - Market by Country | China | 5.5% |

| CAGR 2026-2035 - Market by Technology | String Inverters | 5.7% |

| CAGR 2026-2035 - Market by Application | Utility Scale | 5.9% |

| Market Share by Country 2025 | Germany | 4.5% |

Innovation in inverter technology is shaping the solar PV inverter market growth. Modern solar PV inverters are becoming more efficient, compact, and intelligent by integrating maximum power point tracking, grid support functions, and enhanced monitoring. In January 2025, Solis introduced its Solarator hybrid inverter series with MPPT capability, UPS-level switching, generator-grid compatibility, and advanced fault diagnostics for residential and commercial applications in India. These advancements improve system performance, reduce downtime, and allow better integration with smart grids and energy management systems, thus appealing to both residential and commercial users.

Corporate and governmental carbon neutrality targets drive demand for clean energy solutions. Solar PV systems, supported by efficient inverters, are key to achieving these goals. Companies increasingly invest in renewable energy to meet sustainability commitments. Inverters that support higher energy yields and seamless grid integration contribute to reducing carbon footprints. In September 2024, Midea launched a 0.5 PK inverter air conditioner that optimizes energy consumption, delivering efficient cooling with reduced electricity usage and lower monthly utility bills. Such instances are further positioning solar PV as a core technology in decarbonization efforts.

Supportive regulatory frameworks and incentives, such as tax credits, subsidies, and feed-in tariffs, are accelerating the solar PV inverter deployment. Many countries have implemented policies to promote clean energy, including mandates for renewable energy targets. These policies also include favourable conditions for solar inverter installation, such as streamlined permitting and net metering. In February 2024, India introduced its ambitious ₹75,000 cr rooftop solar subsidy scheme to offer central financial assistance covering up to 60% for systems ≤ 2 kW and 40% for 2–3 kW. Government backing lowers financial barriers and encourages developers and homeowners to invest in solar infrastructure, boosting the market.

Residential solar markets are expanding due to increased consumer awareness, falling costs, and energy independence desires. Homeowners prefer inverters that offer easy installation, high efficiency, and compatibility with energy storage systems. In May 2025, POM Systems & Services launched hybrid inverters for residential solar use, available in 5 kW, 3 kW, and 10 kW power ratings. The rising trend of rooftop solar, combined with government incentives and net metering policies, also boosts inverter demand. Moreover, residential users opt for smart inverters to provide real-time energy monitoring and integrate with home automation systems.

The integration of digital technologies and Internet of Things (IoT) to enhance performance monitoring and predictive maintenance is boosting the solar PV inverter industry value. In April 2025, India’s Maxvolt launched a Smart Lithium Inverter series, supporting both lithium and lead-acid batteries, to deliver pure sine wave output and include smart charge/discharge functions, Wi Fi/Bluetooth connectivity, and app-based remote monitoring. This connectivity improves operational efficiency and system optimization, attracting commercial and utility customers who require detailed analytics and control, making digitalization a crucial trend shaping the future of the inverter market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Solar PV Inverter Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Technology

Key Insight: Central inverters are dominating the solar PV inverter market as they are primarily used in large-scale solar power plants and commercial installations. These inverters boast high capacity, often ranging from hundreds of kilowatts to several megawatts, making them ideal for utility-scale projects. In October 2023, Fuji Electric India launched the PVI1500 series central solar inverter, featuring advanced hybrid cooling, three-level IGBT technology to minimize cosmic ray failures, and a modular design for enhanced reliability. Large solar farms also use central inverters for their efficiency, reliability, and cost-effectiveness per watt at scale. Despite their bulkiness, they remain preferred where space and maintenance teams are available.

Market Breakup by Voltage

Key Insight: The < 1,000 V segment is a significant voltage category in the solar PV inverter market, widely used for residential and small commercial installations. Inverters operating under 1,000 V are favoured as they offer safety, ease of installation, and compatibility with typical rooftop solar panel configurations. In April 2025, Sunora introduced the SUN-10HL-G4, its 15 kW three-phase grid-connected inverter with a maximum DC input voltage of 1,000 V for commercial solar applications. Additionally, regulatory standards and safety concerns often limit residential systems to this voltage range, solidifying its dominance in the market.

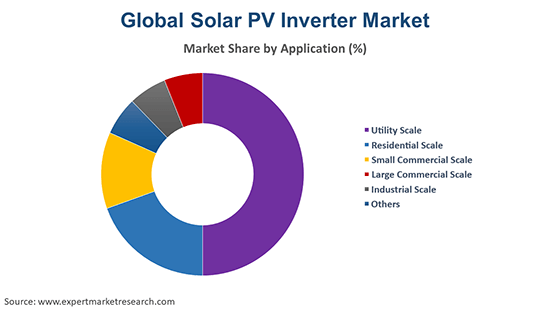

Market Breakup by Application

Key Insight: The utility-scale segment is influencing the solar PV inverter market value, driven by the global push for large renewable energy deployments. Utility-scale solar farms require high-efficiency inverters, such as central or high-voltage string inverters. In June 2025, Luminous Power Technologies launched its NXIA Utility String Inverter Series to deliver over 99% efficiency, offering scalable, intelligent solutions to enhance grid stability across India’s evolving utility-scale solar sector. These systems supply power directly to the grid and are key to achieving national renewable energy targets. Their ability to handle large capacities and reduce cost-per-watt drives their market dominance.

Market Breakup by Region

Key Insight: The Asia Pacific region is contributing to the solar PV inverter market revenue, driven by massive solar capacity additions. China, as the world's largest solar energy producer, is home to major inverter manufacturers. As per China's National Energy Administration, the country’s utility-scale solar power capacity exceeded 880 gigawatts in 2024. India is rapidly scaling its solar ambitions with large-scale installations. Australia’s strong residential solar uptake fuels demand for microinverters and hybrid systems. Government subsidies, cost-effective labour, and supportive policies also make the Asia Pacific a hub for both manufacturing and deployment of solar PV inverters.

String Inverters & Microinverters to Gain Traction

String inverters represent a significant segment of the solar PV inverter market, widely adopted for residential and small commercial solar installations. Their modular design offers flexibility, easier installation, and maintenance benefits. In May 2025, GoodWe launched its GT Series string inverter, offering models ranging from 100kW to 125kW, tailored for commercial and industrial applications. Residential solar setups by leading companies paired with string inverters also offers homeowners scalable and efficient energy conversion. String inverters further balance cost and performance well, gaining popularity in markets emphasizing distributed energy resources.

Microinverters are growing rapidly in the solar PV inverter industry, especially in residential and small commercial installations that prioritize panel-level optimization and monitoring. Unlike central or string inverters, microinverters are installed on each individual solar panel, converting DC to AC right at the source. This reduces the impact of shading, panel mismatch, or dirt on the overall system’s performance. Brands have popularized microinverters due to their enhanced safety, improved energy harvest, and easier system expansion. Microinverters further appeal to customers seeking maximum efficiency and detailed panel-level analytics.

1,000 – 1,499 V & > 1,500 V Solar PV Inverters to Record Popularity

The 1,000 – 1,499 V segment holds a substantial share of the solar PV inverter market. This voltage range is primarily used in medium to large commercial and industrial solar projects where higher voltage allows for reduced current, lowering losses and cabling costs. Many central and string inverters for commercial-scale plants, such as those deployed in warehouses or factories, operate in this range. Projects developed by major companies use inverters in this voltage range to optimize performance and cost-efficiency without the complexity of ultra-high voltage systems.

The > 1,500 V segment is a swiftly growing category of the solar PV inverter industry, mainly in utility-scale solar power plants. Higher voltage systems offer improved efficiency by minimizing losses and reducing conductor size and cost for large solar arrays. In July 2024, TBEA launched its new 1,500 V TS360KTL‑HV‑C1 string inverter to deliver 99.02% efficiency, six MPPT channels, up to 65 A input, 115 A short-circuit current, optimizing utility-scale PV performance. Advanced central inverters and next-generation utility-scale projects further leverage this segment to maximize output and reduce overall system costs.

Large Commercial Scale & Industrial Scale Solar PV Inverters to Witness Demand

Large commercial solar systems serve office buildings, shopping centres, and large institutions with rooftop or ground-mounted installations, adding to the solar PV inverter market share. Inverters used here offer multiple MPPTs, high efficiency, and remote monitoring. With financial incentives and ESG compliance pressure, many corporations are investing heavily in large commercial solar. In October 2024, Solplanet’s ASW350K HT 350 kW inverter was launched in India to deliver 99.01 % efficiency, six MPPTs, 75 A input for empowering large-scale PV projects, further keeping this segment significant.

The industrial-scale segment is growing rapidly as factories and manufacturing units turn to solar for stable, low-cost energy. These systems typically demand rugged inverters that support high loads and resist dust and temperature fluctuations. Inverters, such as Growatt’s MAX series or SMA’s Sunny Tripower are commonly used. These setups can be rooftop or ground-mounted and range from 100 kW to several megawatts, especially when paired with battery storage. In high-energy-use industries, such as textiles and food processing, solar plus inverter systems further drastically cut peak demand charges and reduce dependency on the grid.

Europe & North America to Record Solar PV Inverter Deployment

Europe holds a large share of the solar PV inverter market, underpinned by strong environmental regulations, aggressive carbon-neutral targets, and a mature solar infrastructure. Germany, Spain, and Italy lead adoption, with a focus on high-efficiency residential and commercial installations. The region favours string inverters and smart inverters with grid support features due to evolving energy standards. Additionally, energy storage integration and retrofitting of older systems have created new demand in the continent. Europe’s emphasis on distributed generation continues to drive growth in medium and small-scale solar deployments.

| CAGR 2026-2035 - Market by | Country |

| India | 6.6% |

| China | 5.5% |

| USA | 4.4% |

| Germany | 4.1% |

| France | 3.9% |

| Canada | XX% |

| UK | XX% |

| Italy | XX% |

| Japan | 3.4% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

North America, while technologically advanced, is accelerating the solar PV inverter market development. Several companies are driving innovations and partnerships in the microinverter and smart inverter space, especially for residential rooftop solar. In February 2024, Canada-based SPARQ Systems partnered with JioThings, a subsidiary of Reliance Industries, to manufacture and distribute PV microinverters in India. Utility-scale projects in Texas and California also rely on high-voltage central and string inverters from global players, further boosting the regional product uptake.

Key players in the solar PV inverter market are employing strategic approaches to strengthen their market position and drive growth. With technological innovation, firms are focusing on the development of smart and hybrid inverters that enable grid stability, remote monitoring, and better energy management. Companies are also integrating advanced software solutions and artificial intelligence to enhance inverter efficiency and performance. Expansion into emerging markets is another common strategy, driven by the rising demand for clean energy and supportive government policies.

Strategic partnerships, mergers, and acquisitions help companies broaden their product portfolios, enter new regions, and gain access to advanced technologies. Cost optimization through improved manufacturing processes and economies of scale allows firms to remain competitive while meeting the growing demand for affordable renewable energy solutions. Furthermore, a strong focus on R&D ensures ongoing product development aligned with evolving grid standards and energy storage integration. Customer-centric approaches are also key to building long-term relationships and brand loyalty in a rapidly evolving energy landscape.

Founded in 1836, Schneider Electric SE is headquartered in Rueil-Malmaison, France. The company is known for pioneering energy management and automation solutions with innovations including EcoStruxure™, a platform enhancing efficiency and sustainability. Schneider is recognized globally for advancing digital transformation across industries via smart grid and renewable energy technologies.

Siemens AG, established in 1847 and headquartered in Munich, Germany is renowned for industrial automation and as well as infrastructure, and leads in grid solutions and renewable integration. Siemens' SINAMICS and SICAM platforms have modernized power systems, while its investment in AI and IoT technologies supports energy efficiency and digitalized infrastructure development.

Mitsubishi Electric US, Inc., founded in 1973, operates from Cypress, and specializes in advanced electronics and energy systems. Notable achievements include high-efficiency photovoltaic inverters and smart grid technologies. This American company’s innovations focus on sustainable energy, smart building solutions, and environmentally responsible products aligned with global carbon reduction goals.

General Electric Company (GE), established in 1892 and headquartered in Boston, the United States. GE has been instrumental in power generation and grid modernization via its breakthroughs in digital energy platforms, such as GE Digital and Predix. The company continues driving innovation in renewables, including wind, solar, and hybrid energy solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the solar PV inverter market are Huawei Technologies Co., Ltd, FIMER Group, SolarEdge Technologies Inc, and Toshiba International Corporation, among others.

Stay ahead with the latest solar PV inverter market trends 2026 and beyond. Download your free sample report today to explore in-depth insights, data-driven forecasts, and expert analysis. Discover opportunities, benchmark competitors, and plan your strategy with trusted market intelligence tailored for industry leaders.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 8.87 Billion.

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

By 2035, the market is estimated to reach a value of about USD 14.45 Billion.

Key strategies driving the market include technological advancements, increasing solar installations, supportive government policies, grid modernization, focus on energy storage integration, and rising demand for clean energy. Strategic partnerships, cost reduction efforts, and expansion into emerging markets also contribute to sustained market growth.

Key trends aiding market expansion include the shift from fossil fuel-based energy, the growing cost-effectiveness of solar inverters, and the introduction of favourable government initiatives aimed at boosting the installation of solar electric systems.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Based on technology, the market is divided into central inverters, string inverters, and microinverters, among others.

The major voltage segments considered in the market report include < 1,000 V, 1,000 – 1,499 V, and > 1,500 V, among others.

The significant applications of solar PV inverters are utility scale, residential scale, small commercial scale, large commercial scale, and industrial scale, among others.

The key players in the market report include Schneider Electric SE, Siemens AG, Mitsubishi Electric US, Inc., General Electric Company, Huawei Technologies Co., Ltd, FIMER Group, SolarEdge Technologies Inc, and Toshiba International Corporation, among others.

Central inverters are dominating the market as they are primarily used in large-scale solar power plants and commercial installations.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Voltage |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share