Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global sodium methoxide market attained a volume of 1532.79 KMT in 2025. The market grew at an estimated CAGR of 4.50% during the forecast period of 2026-2035. By 2035, the market is expected to reach 2380.38 KMT. The market is driven by capacity expansions and growing demand for sodium methoxide in end use markets, such as agrochemicals, biodiesel production, and pharmaceuticals.

Base Year

Historical Period

Forecast Period

The growing demand for biofuels is a key driver for sodium methoxide production. In July 2024, Evonik announced the expansion of its sodium methoxide production capacity in Argentina in response to the growing demand for biofuels in the region. The company will increase its annual production capacity by 50%, from 60,000 to 90,000 tons.

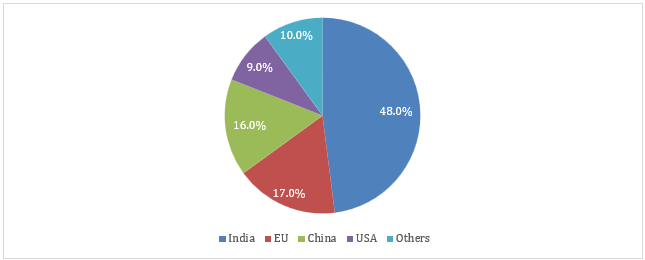

The pharmaceutical sector increasingly uses sodium methoxide as a catalyst in the production of active pharmaceutical ingredients (APIs) and other critical intermediates. In 2023, India and the EU dominated the global total active API drug master files (DMFs) by country, accounting for 48% and 17%, respectively.

In the agrochemical sector, sodium methoxide acts as a catalyst in the production of various crop protection agents and fertilisers. In 2023, the members of the International Fertiliser Association produced and distributed over 180 million tonnes of plant nutrients and raw materials.

Sodium methoxide is deployed in the production of methacrylic acid, a starting material for polymethyl methacrylate (PMMA) production. PMMA is widely used in optical lenses, cell phone screens, and safety glasses. Worldwide smartphone shipments expanded by 6.4% in 2024 amounting to 1.24 billion units.

Compound Annual Growth Rate

4.5%

Value in KMT

2026-2035

*this image is indicative*

| Global Sodium Methoxide Market Report Summary |

Description |

Value |

|

Base Year |

KMT |

2025 |

|

Historical Period |

KMT |

2019-2025 |

|

Forecast Period |

KMT |

2026-2035 |

|

Market Size 2025 |

KMT |

1532.79 |

|

Market Size 2035 |

KMT |

2380.38 |

|

CAGR 2019-2025 |

Percentage |

XX% |

|

CAGR 2026-2035 |

Percentage |

4.50% |

|

CAGR 2026-2035- Market by Region |

Asia Pacific |

6.1% |

|

CAGR 2026-2035 - Market by Country |

India |

6.3% |

|

CAGR 2026-2035 - Market by Country |

China |

6.0% |

|

CAGR 2026-2035 - Market by Form |

Liquid |

4.8% |

|

CAGR 2026-2035 - Market by Application |

Biodiesel |

5.8% |

|

Market Share by Country 2025 |

China |

2.0% |

Sodium methoxide finds application as a catalyst for commercial-scale production of biodiesel. To produce biodiesel, vegetable oils or animal fats, are transesterified with methanol to give fatty acid methyl esters (FAMEs). As per sodium methoxide market report, in 2023, global FAME biodiesel production was around 44.0 billion tonnes (~50 billion litres). Indonesia led with 12.32 billion tonnes (~14 billion litres), followed by the EU with 11.44 billion tonnes (~13 billion litres) and Brazil with 7.04 billion tonnes (~8 billion litres).

Sodium methoxide is used in the processing of various chemicals. In 2023, the global chemical industry experienced a growth of 1.7%, driven mainly by a significant expansion in chemical production in China, which saw a robust growth rate of 7.5%.

Figure: Biodiesel Production by Leading Countries, Million Tonnes

| Country | Production (Million Tonnes) |

| EU-27 | 13.73 |

| USA | 10.23 |

| Indonesia | 9.70 |

| Brazil | 5.49 |

| China | 2.20 |

| Argentina | 1.91 |

| Singapore | 1.75 |

| Thailand | 1.40 |

| Malaysia | 0.87 |

| Colombia | 0.71 |

Sodium methoxide is an effective and reliable catalyst that offers a sustainable solution for biodiesel production, helping meet the high-quality fuel standards set by engine manufacturers while reducing emissions. It promotes higher yields and lower preparation costs for biodiesel production

In 2022, global biodiesel production was nearly 52.0 million tonnes, with the European Union (excluding the United Kingdom) accounting for the largest share, approximately 25% of the total global output.

Figure: Total Active Drug Master Files (DMFs) by Country, 2023

Sodium methoxide is widely used in the production of active pharmaceutical ingredients (APIs). Its ability as a catalyst to enhance reaction efficiency and selectivity is highly valued in the pharma sector.

API Drug Master Files (DMF) are documents containing information on APIs that are submitted to the U.S. Food and Drug Administration (FDA) by API manufacturers to provide confidential and detailed information about their facilities and the processes used in the manufacturing, processing, packaging, and storing of human drug products. In 2023, India accounted for 48.0% of the global actives API DMFs followed by the EU with 17.0%.

Sodium methoxide is widely used in pharmaceutical production, such as the manufacture of Vitamin A1, BI and APIs. India and China possess the largest API manufacturing capacities, making them key players in the global pharmaceutical industry. Some of the leading API producers are Glenmark Pharmaceuticals, Teva Pharmaceutical Industries, Cipla Limited, and Pfizer Inc., among others. According to 2024 data, global pharmaceuticals output is forecasted to increase by 4% in 2025 and 3.6% in 2026.

The growing demand for fertilisers to ensure food security is driving the demand of sodium methoxide market in fertilizer production. In 2023, the global fertiliser market was valued at USD 145 billion and is projected to experience an annual production capacity growth of approximately 2.5% through 2027.

Rising biodiesel production, expansion in pharmaceutical production, and the production of agrochemicals and specialty chemicals aid the sodium methoxide market growth.

As the demand for sustainable transportation solutions grows, biodiesel has emerged as a viable alternative to fossil fuels. Sodium methoxide, in 25% or 30% concentration, is produced through a water-free process, preventing soap formation during biodiesel production. Its methanol content reduces the amount of methanol needed in the reaction, increasing its use. In 2023, U.S. biofuel production capacity increased by 7%, reaching 0.08 billion tonnes (24 billion gallons) per year by early 2024, led by a 44 rise in renewable diesel and other biofuels.

In the pharmaceutical industry, sodium methoxide finds application as a catalyst in the production of active pharmaceutical ingredients (APIs) and other critical intermediates. It is also used in manufacturing of Vitamin A1, Vitamin BI, Sulfamethoxypyridazine, Sulfadiazine, and trimethoprim, thus supporting the sodium methoxide market development. In 2023, India accounted for the largest share of 48% in the total active Drug Master Files (DMFs) by country, followed by the EU with 17% and China with 16%.

As per the sodium methoxide market analysis, sodium methoxide is deployed in the agrochemical sector as a catalyst to produce crop protection agents and fertilisers. Its versatile properties facilitate the efficient synthesis of these crucial agricultural products, supporting the growth of sustainable farming practices. In 2024, research and development (R&D) spending in the agrochemical sector represented 7% to 10% of revenue globally.

Sodium methoxide is primarily used as a strong base and a versatile reagent in chemical reactions and also employed as a catalyst in organic synthesis processes. In 2023, the global chemical industry saw a growth of 1.7%, primarily driven by a substantial increase in chemical production in China, which experienced a strong growth rate of 7.5%.

While sodium methoxide solutions are more expensive than sodium or potassium hydroxide, they offer higher efficiency in certain applications. This efficiency is crucial for maintaining profitability in competitive markets, making sodium methoxide a valuable option for businesses seeking optimised production processes.

Rising biodiesel production drives the demand for sodium methoxide as a catalyst. To produce biodiesel, vegetable oils or animal fats undergo transesterification with methanol, resulting in fatty acid methyl esters (FAMEs). Sodium methoxide serves as a vital base catalyst, offering efficient biodiesel production by preventing the formation of water and ensuring a high yield. In 2022, Europe led the global biodiesel production, with 13.7 million tonnes followed by the USA with 10.2 million tonnes and Indonesia with 9.7 million tonnes.

In the pharmaceutical industry, sodium methoxide is utilised as a catalyst in the synthesis of active pharmaceutical ingredients (APIs) and other essential intermediates. Its ability to improve reaction efficiency and selectivity is highly valued in advancing pharmaceutical innovations, which is supporting the sodium methoxide market expansion. API Drug Master File (DMF) indicate the geographic locations where APIs are being manufactured. In 2023, the Asia Pacific region held a dominant share of the total active drug master files (DMFs) by country, with India representing 48% and China representing 16% of the global total. The European Union accounted for 17%, and the United States for 9%.

Technological integration and the adoption of sustainable production processes provide an opportunity for the growth of the sodium methoxide market. Emerging trends such as digitalisation, sustainability, and circular economy are reshaping traditional sodium methoxide industry operations and creating new value propositions. Industry 4.0 technologies, including the Internet of Things (IoT), Artificial Intelligence (AI), and blockchain, are transforming the sodium methoxide market.

AI-driven predictive maintenance optimises equipment performance and lifespan, while blockchain enhances supply chain transparency and traceability. Sustainability and green chemistry are becoming key competitive advantages Companies that prioritise environmentally friendly production processes, contributing to global sustainability goals resonate better with the increasing base of eco-conscious consumers.

Exposure to sodium methoxide is hazardous to human health. Sodium methoxide is regulated under strict guidelines for its production, handling, and transportation due to its hazardous properties. Classified as a hazardous substance by regulatory agencies, sodium methoxide (UN 1431, Hazardous 4.2/PG 2) is a highly corrosive chemical that can cause severe burns upon contact with skin or eyes. Inhalation of its dust or vapors may also irritate the respiratory system. To minimize risks, it must be handled in a fume hood or adequately ventilated area to prevent exposure to its dust or vapors.

Producing sodium methoxide in its desired purity and concentration can be technically challenging, requiring advanced manufacturing processes and expertise. This could lead to higher operational costs and potential quality inconsistencies.

“Sodium Methoxide Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of form, the market can be divided into the following:

On the basis of application, the market can be divided into the following:

Based on region, the market can be segregated into:

Market Analysis by Form

Increasing production of biodiesel and rising demand of pesticides in the agrochemical sector drive the demand for sodium methoxide in liquid form. Sodium methoxide promotes higher yields and reduces preparation costs in biodiesel production. Some of the leading biodiesel producers are Renewable Energy Group, Pacific Biodiesel, Wilmar International Limited, and COFCO International.

As per sodium methoxide market analysis, liquid sodium methoxide, used as a raw material in pesticides, dyes, and chemical fibers, also catalyses fatty ester exchange reactions. In 2022, pesticide use in agriculture reached 3.70 million tonnes of active ingredients, up 4% from 2021 and 13% over the past decade.

Market Analysis by Application

Sodium methoxide catalyst enhances biodiesel yield and minimises gum formation during the conversion process. Eco-friendly sodium methoxide ensures strong compatibility with the biodiesel process while offering improved cost benefits. In 2022, global biodiesel production reached nearly 52.0 million tonnes, with the European Union (excluding the United Kingdom) holding the largest share at approximately 25% of the global production, or about 13.7 million tonnes.

Sodium methoxide is primarily used in the pharmaceutical industry for producing Vitamin A1, Vitamin B1, Sulfamethoxypyridazine, Sulfadiazine, and Trimethoprim among other antibiotics and Active Pharmaceutical Ingredients (APIs). In 2023, India and China were the largest API manufacturers globally. In 2023, companies in China filed 219 API Drug Master Files (DMFs), a 63% increase from the 134 filed in 2021. This growth underscores China’s expanding role in global API production, there by supporting the sodium methoxide market growth.

In agrochemicals, sodium methoxide acts as a catalyst in producing crop protection agents and fertilisers, enhancing synthesis efficiency and contributing to sustainable farming.

In 2023, the total pesticide sales of the global top 20 agrochemical players reached USD 73.847 billion. The sales of the leading agrochemical giants, namely, Syngenta, Bayer CropScience, BASF, and Corteva, accounted for 59.50% of the total sales of the top 20 companies, marking an increase of 4.5% compared to the fiscal year 2022.

North America Sodium Methoxide Market Opportunities

As per sodium methoxide market report, between January 2023 and January 2024, biodiesel capacity expanded by 12.66 thousand tonnes (~3.8 million gallons) in the USA, driven by the addition of new facilities in Florida and Kentucky. According to 2023 report, Iowa leads biofuels production in the country with over 17.99 million tonnes (5.4 billion gallons) per year, while 14 states, mainly in the Midwest, Gulf Coast, and West Coast, account for 90% of the country’s biofuel production capacity. In 2022, biodiesel accounted for around 9% share in the total biofuel consumption in the USA.

Canada's Clean Fuel Regulation (CFR) which became law in July 2022, aims to reduce the carbon intensity of transportation fuels. This is expected to significantly increase the consumption of ethanol, biobased diesel, and other renewable fuels. In 2022, Canada consumed approximately 668.80 million tonnes (around 760 million liters) of biobased diesel. In 2022, the country had 11 operational biodiesel plants.

Europe Sodium Methoxide Market Dynamics

The Europe sodium methoxide market is expanding due to rising environmental concerns. Biodiesel supports EU energy goals under the Renewable Energy Directive. In 2022, the European Union (excluding the United Kingdom) produced around 13.7 million tonnes of biodiesel. Germany is the largest biodiesel producer in Europe. In 2022, the country produced 3.4 million tonnes of biodiesel.

Sodium methoxide is primarily used in the pharmaceutical industry as a catalyst or reagent in the synthesis of active pharmaceutical ingredients (APIs). In 2022, Germany’s pharmaceutical sector, produced products worth around USD 39,417 million.

France is the second-largest biodiesel producing country in Europe. In 2022, France manufactured 2.1 million tonnes of biodiesel. In 2022, the country produced USD 34,536 million worth of pharmaceutical products. The rising output in both industries is fueling demand for sodium methoxide, a key input in biodiesel refining and pharmaceutical production.

Asia Pacific Sodium Methoxide Market Trends

Biodiesel is gaining popularity due to the government's goal of carbon emission reduction. In 2022, in APAC, Indonesia produced around 9.7 million tonnes of biodiesel, followed by China with 2.2 million tonnes. In 2022-23, India exported USD 5.5 billion of agrochemicals, driving the demand of sodium methoxide market.

In the pharmaceutical industry, sodium methoxide is used as a catalyst in the production of active pharmaceutical ingredients (API). China has a significant production for API, contributing to sodium methoxide demand. In 2023, API exports were worth USD 40.909 billion. Sodium methoxide is widely deployed in the production of specialty chemicals. China is the world’s largest chemical producer and experienced a production expansion of 7.5% in 2023 compared to 6.6% in 2022.

Indian agrochemical industry is marking steady growth driven by factors such as government support for the industry, and expansion of production capacities by companies. During FY 2025-2028, the industry is projected to grow strongly at CAGR of 9%. India aims to expand the use of biodiesel to reduce the emissions of the transportation sector. Under the 2018 National Policy on Biofuels, the government set a 5% biodiesel blending target by 2030, requiring about 3.96 billion tonnes (~4.5 billion litres) annually, which will significantly impact the sodium methoxide market.

Indonesia, the world's leading producer of palm oil and a key supplier of vegetable oil, implemented a 40% (B40) mandatory palm oil blend in biodiesel in 2024. The country also aims to introduce a 50% palm oil-based biodiesel mandate by 2026, which could significantly increase the demand for sodium methoxide as a catalyst. Evonik produces alkoxides for biodiesel production including sodium methoxide. In May 2023, it commenced the construction of a new production plant for alkoxides in Singapore to strengthen its global alkoxides business.

Latin America Sodium Methoxide Market Insights

The government of Brazil raised the biodiesel blend mandate from 12% to 14%, effective March 1, 2024. Additionally, B15 blending is scheduled to begin in 2025. In 2024, Brazil had 62 biodiesel plants, up from 61 in 2023 and 57 in 2022. Key players are strengthening their position in Brazil sodium methoxide market through capacity expansions. In July 2024, BASF’s Monomers division announced that it has increased the production capacity for sodium methoxide in Guaratinguetá, Brazil to 90,000 metric tons/ year. In 2022, biodiesel production reached a volume of 5.4 million tonnes.

Key developments in Argentina support the demand for sodium methoxide. In July 2024, Evonik announced the expansion of sodium methoxide production capacity at its Rosario site in Argentina to meet the growing demand for biofuels. This expansion aims to increase annual production capacity by 50%, from 60,000 to 90,000 tons and is expected to support its innovation and sustainability efforts in South America.

The growth in biofuel demand drives the sodium methoxide market as a catalyst. In 2022, Colombia was one of the leading countries producing biodiesel globally, with an output of around 0.71 million tonnes. Colombia is a production and distribution hub for pharmaceutical products with capacity to serve the regional market. In 2023, Colombia exported pharmaceutical products worth of USD 547 million.

Middle East and Africa Sodium Methoxide Market Drivers

Rising health care demand and government reforms, improved supply chain management, and regulatory environment aid the Middle East pharmaceutical market. In 2023, the pharmaceutical industry in this region surpassed a value of USD 25 billion.

Saudi Arabia boasts the largest pharmaceutical market in the Middle East and North America (MENA) and the Gulf. In 2024, the Saudi Arabian pharmaceutical market was valued at USD 8.6 billion and constituted over 30% of the Middle East market. Players in the sodium methoxide market are investing in expanding their production capacities. In September 2023, Desatec GmbH announced a 70,000 metric ton increase in sodium methoxide production at its existing facility in Dammam, Saudi Arabia. With this expansion, the plant now holds the title of the world’s largest sodium methoxide production facility, with an annual output of 150,000 metric tons.

The UAE's efforts to diversify its economy beyond oil, coupled with its commitment to the 2050 net-zero emissions target, are driving the demand for sustainable alternatives like biodiesel. During 2020-2026, the UAE’s biodiesel market is projected to register a compound annual growth rate (CAGR) of 28.4%. Advancements in raw material production for sodium methoxide support its manufacturing. In February 2025, TA’ZIZ announced a USD 1.7 billion investment to build one of the world’s largest methanol plants in Al Ruwais Industrial City, Abu Dhabi.

|

CAGR 2026-2035 - Market by |

Country |

|

India |

6.3% |

|

China |

6.0% |

| Japan |

5.5% |

| Brazil |

4.8% |

| Germany |

3.5% |

| USA |

XX% |

| Canada |

3.4% |

| UK |

XX% |

| Italy |

XX% |

| Australia |

XX% |

| Saudi Arabia |

2.3% |

| Mexico |

XX% |

| France |

3.2% |

The sodium methoxide market is highly competitive, with key players striving to increase their market share through the expansion of production facilities, competitive pricing strategies, and investments in technologies that enhance productivity. Additionally, companies focus on sourcing high-quality raw materials at competitive prices to maintain a competitive edge.

Founded in 1865, BASF is one of the largest chemical businesses in the world. Chemicals, materials, industrial solutions, surface technologies, nutrition and care, and agricultural solutions make up the company's portfolio, which serves practically every industry. The company's market domination is astounding, with top-three market positions in over 70% of its business categories, and a vast product portfolio serving around 100,000 clients globally, ranging from basic chemicals to high-value-added products and system solutions.

Founded in 2007, Evonik is one of the leading producers of specialised chemicals in the world. The company's strengths include a diverse range of commercial operations, end markets, and geographic areas. The company concentrates its businesses in three divisions including specialty additives, nutrition and care; and smart materials. These three divisions provide consumers with innovative and personalized solutions. The products are made with extremely advanced technologies that the company is constantly improving.

Founded in 1969 and headquartered in Germany, Desatec, an associate member of the TESUCO Group of Companies, focuses primarily on Southern Africa. The export of industrial goods to Africa remains a key pillar of its trading business. As a dominant supplier in the Sodium Methylate solution and powder markets, Desatec plays a crucial role in the biodiesel industry, serving as a significant supplier and sales partner to the sector.

Anhui Jinbang Medicine Chemical Co., Ltd., a privately-owned enterprise, was formerly state-owned and is recognised as a provincial contract trustworthiness enterprise with an AAA bank reference. With its own import and export permit, the company focuses on the development and production of fine chemicals, pharmaceutical intermediates, chemical reagents, and food additives. Jinbang prioritises product quality and customer service, striving to integrate technology and resources to enhance processes and meet diverse customer requirements.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the sodium methoxide market include, Allegro Specialty Chemicals Pvt Ltd., and Kimia Pars Co. among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the sodium methoxide market reached an approximate volume of 1532.79 KMT.

The market is projected to grow at a CAGR of 4.50% between 2026 and 2035.

The major drivers of the industry, such as rising disposable incomes, increasing population, growing demand from the pharmaceuticals and agrochemicals sectors, rising demand for end-use products, growing prevalence of various lifestyle-related disorders, increasing R&D activities, rising demand for plastics and polymers, improving standards of living, and rising demand for personal care products, are expected to aid the market growth.

The key trends guiding the growth of the market include the rising production of biodiesel, growing environmental concern, and increasing implementation of favourable government initiatives.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific, with the Asia Pacific accounting for the largest market share.

The leading forms of sodium methoxide in the market are solid and liquid.

The major application segments in the industry are biodiesel, pharmaceuticals, and agrochemicals, among others.

The major players in the industry are BASF SE, Evonik Industries AG, Anhui Jinbang Medicine Chemical Co., Ltd, Allegro Specialty Chemicals Pvt Ltd, Desatec GmbH, and Kimia Pars Co., among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a volume of around 2380.38 KMT by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Form |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share