Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global petroleum coke market size reached a value of around USD 26.75 Billion in 2025. The market is assessed to grow at a CAGR of 7.00% in the forecast period of 2026-2035 to reach a value of nearly USD 52.62 Billion by 2035.

Base Year

Historical Period

Forecast Period

The United States' net production of petroleum coke in December 2023 reached a total of 25,443 barrels.

In 2022, the leading importers of calcined petroleum coke were India, Australia, and the United Arab Emirates.

Among various countries, the United States and China stand as the leading producers of pet coke on a global scale.

Compound Annual Growth Rate

7%

Value in USD Billion

2026-2035

*this image is indicative*

Petroleum coke, also known as pet coke, is a solid rock material and a byproduct of crude oil refining and other cracking processes. It can be produced in different grades by varying the coking temperature, coking time, and the quality of the raw material used. Petroleum coke has various industrial applications due to its ability to provide a concentrated source of energy. However, its use as a fuel in power generation and other industries can raise environmental concerns, as it tends to emit a higher amount of carbon dioxide and sulphur compounds compared to other fossil fuels.

The growing global energy demand is driving the petroleum coke market growth. Petroleum coke is widely used as an energy source in power plants and various industries like cement, steel, and others due to its high calorific value. The rising construction activities and growing urbanisation trends are expected to enhance the demand for steel and cement, further contributing to the market growth. The rapid technological advancements and the growth in oil production capacity are also driving the market growth globally. However, fluctuations in fuel prices are a major challenge, which may restrain the market in the forecast period.

Increasing demand for cost-effective fuel, advancements in low-sulphur refining, a focus on sustainability, and shifts in international trade policies are positively impacting the petroleum coke market expansion

There is an increasing demand for petroleum coke as a cost-effective fuel alternative, especially in the power generation and industrial sectors of emerging economies. This is driven by the growing need for energy resources and the competitive pricing of petroleum coke compared to other fossil fuels.

The market is experiencing a shift towards higher-quality petroleum coke with lower sulphur content. This trend is spurred by stringent environmental regulations globally, leading to technological advancements in refining processes to produce cleaner petroleum coke.

There is a growing emphasis on the development of sustainable and environmentally friendly alternatives to traditional petroleum coke usage. This fosters innovation in recycling and repurposing petroleum coke for various industrial applications.

The market is influenced by international trade dynamics, with significant export activities from major producers to countries with high demand. This aligns with shifts in global energy policies and economic factors.

The demand for petroleum coke is increasing as it serves as an affordable alternative to traditional fossil fuels. This trend is particularly notable in emerging economies, where the need for energy resources is growing rapidly. The competitive pricing of petroleum coke makes it an attractive option for power generation and industrial applications.

There is a market shift towards producing higher-quality petroleum coke with lower sulphur content. This is driven by stringent global environmental regulations that necessitate cleaner fuel sources. Technological advancements in refining processes are enabling the production of low-sulfur petroleum coke, which is more environmentally friendly.

Overall, these trends indicate a growing emphasis on sustainability, environmental responsibility, and the evolution of the petroleum coke market to meet the changing needs of the global energy landscape.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Petroleum Coke Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

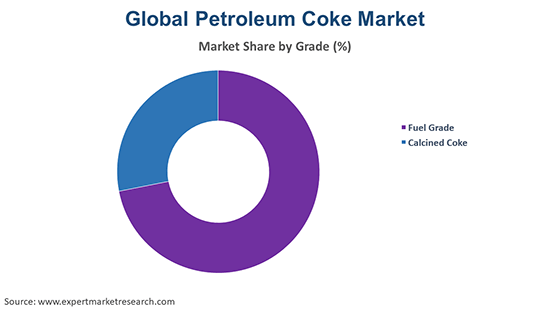

Market Breakup by Grade

Market Breakup by Physical Form

Market Breakup by End Use

Market Breakup by Region

The pivotal role of petroleum coke in power plants, cement kilns, and metal production is expected to aid the market in the forecast period

Power plants and cement kilns are dominating the petroleum coke market share. Petroleum coke serves as a cost-effective alternative to coal, and fuel-grade petroleum coke is often utilised as a source of energy in various industries. Further, petroleum coke is also utilised in the production of metals, particularly steel. The rising demand for cement and the growth of the construction sector is expected to significantly boost the demand for petroleum coke in the forecast period.

High-quality needle coke powerhouse driving the global market

Needle coke is a high-quality, premium-grade petroleum coke known for its crystalline structure and low sulphur content, which is expected to account for a significant portion of the petroleum coke market. It is primarily used to manufacture graphite electrodes, which are essential components in electric arc furnaces used in steel production. Needle coke's low thermal expansion and high electrical conductivity make it ideal for this application.

Sponge coke is another widely used form of petroleum coke. It has a sponge-like texture and is used primarily as a fuel in various industrial applications, such as in cement kilns and power plants. Sponge coke is also used in the production of anodes for aluminium smelting.

Major players in the petroleum coke market are increasingly investing in the expansion of production facilities

BP Plc, commonly known as British Petroleum, is one of the world's leading oil and gas companies. Headquartered in London, England, BP operates in all areas of the oil and gas market, including exploration, production, refining, distribution, and marketing. The company has a strong presence in the global energy market and is committed to transitioning towards more sustainable energy solutions.

Phillips 66 is an American multinational energy company headquartered in Houston, Texas. It operates in three segments: refining, midstream, and chemicals. Phillips 66 is known for its extensive network of refineries and pipelines, as well as its involvement in the production of petrochemicals and speciality chemicals.

PJSC Lukoil is a Russian multinational energy corporation headquartered in Moscow. It is one of the largest publicly traded oil and gas companies in the world, with operations in the exploration, production, refining, marketing, and distribution of oil and gas products. Lukoil has a significant presence in Russia and operates in over 30 countries worldwide.

Royal Dutch Shell Plc, commonly known as Shell, is a global group of energy and petrochemical companies headquartered in the Netherlands and incorporated in the United Kingdom. Shell is one of the oil "supermajors" and is involved in various aspects of the energy sector, including exploration, production, refining, and renewable energy. The company is focused on meeting the world's growing energy needs while reducing its carbon footprint.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global petroleum coke market are Indian Oil Corporation Ltd., Valero Marketing and Supply Company, and Essar, among others.

Many companies are investing in expanding their production facilities to increase their output of petroleum coke. This allows them to meet the growing demand in both domestic and international markets. Companies are also adopting advanced technologies to improve the quality of petroleum coke and reduce its environmental impact. This includes the development of processes to produce lower sulphur content pet coke and more efficient refining techniques.

Regionally, North America plays a pivotal role in the growth of the market, primarily due to the surging demand for energy within the region. This demand is driven by various factors, including the rapid pace of urbanisation, which leads to increased energy consumption in cities and urban areas. As urban centres expand, so do their energy needs, further fueling the demand for energy sources such as petroleum coke.

Furthermore, the region is witnessing a significant increase in operations and activities across various sectors, including industrial, commercial, and residential. This uptick in operations contributes to the overall energy demand, necessitating a reliable supply of energy sources like petroleum coke.

United States Petroleum Coke Market

Calcined Petroleum Coke Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market size attained a value of approximately USD 26.75 Billion.

The market is projected to grow at a CAGR of 7.00% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach about USD 52.62 Billion by 2035.

The major drivers of the market include the growing requirement for energy, rapid industrialisation and urbanisation, and growing construction activities.

The key trends guiding the growth of the market include the growing technological advancements and increasing E&P activities in the oil sector.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading various of petroleum coke in the market are fuel grade and calcined coke.

The major physical forms of petroleum coke in the market are needle coke, sponge coke, catalyst coke, shot coke, and purge coke.

The significant end uses of petroleum coke are power plants, cement industry, steel industry, and aluminium industry, among others.

The key players in the market are BP Plc, Phillips 66 Company, PJSC Lukoil, Royal Dutch Shell Plc, Indian Oil Corporation Ltd., Valero Marketing and Supply Company, and Essar, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Grade |

|

| Breakup by Physical Form |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share