Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global nylon market attained a value of USD 37.15 Billion in 2025 and is projected to expand at a CAGR of 5.70% through 2035. The market is further expected to achieve USD 64.67 Billion by 2035. Rising demand from electric-vehicle and high-performance electronics makers is driving the adoption of reinforced nylon-66 resins for lightweight, heat-resistant structural components.

The market experiences a renewed momentum as several leading producers began rolling out next-generation nylon grades tailored for high-performance uses. For instance, players like Invista and Toray Industries ramped up development of reinforced nylon-6 and nylon-66 variants designed for engineering plastics and automotive components. In August 2025, Invista announced that the company is increasing its investments in nylon textiles, mainly for fiber and fabric solutions under the Cordura brand. In order to establish traction in end-use garment industries, such as outdoor, workwear, military, and lifestyle sectors, this initiative focuses on next-generation performance fabrics, thereby accelerating the nylon market growth.

Moreover, the expanding demand comes from sectors such as automotive, electronics, and industrial machinery. As a response, in April 2024, Avient introduced durable orange nylon colorants for high voltage electrical vehicle (EV) connectors, combining high heat and long-term color stability. Meanwhile, major producers are investing in supply-chain resilience and product innovation, reshaping the nylon market trends. Companies such as BASF SE, DuPont, and LANXESS AG are expanding their production capacities and exploring bio-based or recycled nylon resin alternatives anticipating tighter regulatory constraints and rising environmental demand.

Base Year

Historical Period

Forecast Period

Nearly 4 million tonnes of nylon 6,6 is manufactured per year and it is one of the most extensively used fibres in the fashion and performance apparel sectors. With customers increasingly shifting towards durable, high-performance, and versatile materials in clothing, the use of nylon 6,6 is surging due to its abrasion resistance, strength, elasticity, and moisture-wicking properties.

In 2022, 85.4 million motor vehicles were produced globally, a surge of 5.7% as compared to 2021. As vehicle production surges and the focus on improving the fuel efficiency of vehicles grows, the demand for nylon-based components in the automotive sector for producing durable and lightweight parts that can withstand mechanical stress and high temperatures is increasing.

There is a growing demand for nylon films in flexible packaging in sectors such as medical, pharmaceutical, and food and beverages due to their puncture resistance, barrier properties, moisture control, and high strength. Moreover, the growing focus on sustainability is surging the demand for recycled nylon and bio-based nylons, propelling the nylon market expansion.

Compound Annual Growth Rate

5.7%

Value in USD Billion

2026-2035

*this image is indicative*

Bio-based nylon is becoming a strategic requirement as producers compete to decarbonize their portfolios and secure long term feedstock flexibility. Toray’s memorandum with PTT Global Chemical on biomass derived adipic acid, announced in November 2024, points toward scaled nylon 6,6 made from non-edible raw materials instead of oil-based inputs. In October 2025, Genomatica announced that it has entered into a new partnership with Sojitz Corporation to significantly accelerate the commercialization of plant-based nylon-6 based on Geno’s underlying proprietary technology, impacting the overall nylon market value. Strong policy tailwinds from the EU Green Deal which aims for fully reusable or recyclable packaging by 2030, are pushing converters to test bio-based engineering resins.

Circularity is starting to redefine nylon sourcing strategies as newer recycling technologies move from lab to pilot scale. Honda and Toray’s project to build a closed loop for engineering plastics, launched in September 2023, shows how post-consumer parts can reenter mobility supply chains as high-grade nylon pellets. In March 2025, Aquafil unveiled the world's first demonstration plant capable of chemically separating elastic fibers from nylon, creating new nylon market opportunities. Climate tech firms such as Samsara Eco are proving enzymatic paths that break down mixed nylon waste, while rapid depolymerization work at the Indian Institute of Science demonstrates real time recycling routes as well.

Electrification is another strong structural driving factor because EV and power electronics designers need lighter components that survive higher heat loads and demanding duty cycles. Material suppliers are expanding reinforced nylon 6,6 portfolios that handle temperatures close to 250°C with stable mechanical strength, targeting battery frames, bus bars and under hood structures, redefining the nylon market dynamics. In March 2025, TR, part of the Trifast plc Group, introduced a breakthrough in sustainable materials with the development of a range of plastic fasteners and components produced using 100% recycled nylon.

Regulation on plastic waste is rewriting nylon demand patterns, especially in Europe where the Green Deal sets aggressive targets for reusable or recyclable packaging by 2030. In response, UNIFI with CiCLO technology, launched REPREVE, which is a recycled polyester and nylon embedded with a biodegradable technology that enables synthetics to break down naturally, in April 2025. Moreover, EU guidance on plastic waste shipments and national action plans in Asia are pushing municipalities to capture more industrial plastics, including nylon from fishing gear and automotive shredding, shaping the overall nylon market trends and dynamics. This creates a feedstock base that supports investment in recycled nylon plants and long-term offtake agreements with brands globally.

Specialty nylon grades in textiles and technical fabrics are also shaping market momentum as brands look for fibers that feel familiar yet carry better sustainability credentials. Fulgar’s bio based nylon yarn, launched in June 2024, gives hosiery and sportswear makers an opportunity reduce fossil dependency without redesigning entire collections. At the same time, performance focused yarns for airbags, industrial belts and filtration media rely on tighter control of strength and thermal behavior, areas where nylon 6 and 6,6 already excel, broadening the nylon market penetration. Suppliers now differentiate through customized additive packages, color stability and traceability ready data for brand reporting across sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Nylon Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: According to the nylon market report, Nylon 6 keeps its lead where processors prioritize process stability and cost control for large volume parts. Nylon 6,6 are typically required when engineering teams need higher temperature capability, longer fatigue life, or tighter tolerances in safety relevant components. The others category covers specialty nylons, blends and high-performance co-polymers that serve more focused niche segments such as barrier structures, friction control surfaces or chemical contact environments.

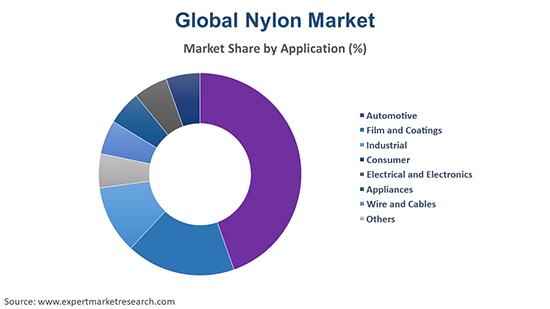

Market Breakup by Applications

Key Insight: Automotive programs anchor majority of the nylon demand because platform engineers constantly trade metals for lighter engineered plastics in structurally demanding parts. Film and coatings users rely on nylon where toughness, barrier behavior and puncture resistance matter in multilayer constructions. Industrial equipment builders turn to nylon for gears, housing, and fluid handling components during maintenance. Consumer brands use nylon in luggage, sporting goods, and high-wear accessories that need durability. Electrical and electronics, appliances, wire and cables and other categories prioritize flame performance, electrical insulation, dimensional stability, and manageable processing windows in production.

Market Breakup by Region

Key Insight: Regionally, Asia Pacific dominates nylon consumption as it houses global manufacturing hubs and integrated chemical chains that support high volume processors. North America combines complex automotive, electrical and industrial bases with strong design centers that drive higher value engineered nylon uses. Europe puts more emphasis on sustainability profiles, recycling options and regulatory compliance, which steers demand toward advanced grades and circular solutions. The nylon markets in Latin America and the Middle East and Africa participate mainly through automotive assembly, infrastructure build out and consumer goods.

Nylon 6 currently secures the dominant market position due to balanced performance, cost, and processability

Nylon 6 continues to be the dominant grade because it gives processors a reliable balance of stiffness, impact strength and chemical resistance while still running smoothly on existing molding and extrusion lines. Automotive, film and industrial machinery suppliers favor the familiarity and predictable behavior of established Nylon 6 compounds in complex tools and multi cavity molds, stimulating the nylon market growth.

Nylon 6,6 is emerging as the fastest growing type because design teams in automotive, electrical and industrial equipment want higher heat resistance and creep performance for more demanding duty cycles. New EV platforms, compact e-motors and high-density connector systems are pushing components closer to their thermal limits, and Nylon 6,6 stands out by maintaining stiffness and dimensional stability for much longer under elevated heat. In December 2025, SENSIL by NILIT and ROICA by Asahi Kasei collaborated to introduce the concept of a new fabric with less environmental impact, combining SENSIL ByNature, a NILIT biomass balanced Nylon 6,6 yarn, and biomass balanced ROICA premium stretch fiber, both designed for high-performance apparel.

By application, the automotive secure leads nylon demand growth

The automotive sector remains the dominant application for nylon because every major vehicle platform contains dozens of molded and extruded parts that must handle heat, vibration and fluids for many years. Under the hood, nylon replaces metal in intake manifolds, air ducts, cooling components and structural brackets where weight savings translate straight into efficiency and emissions gains.

The electrical and electronics category is emerging as the fastest growing application boosting overall demand in the nylon market because devices and infrastructure hardware keep shrinking while power densities rise. Component makers need housings, connectors and insulation structures that maintain dimensional stability under heat and frequent load cycles. In January 2025, Toray Industries, Inc., announced that it has developed a damping nylon resin that maintains the high-temperature rigidity and moldability of standard nylon while delivering four times the damping performance of butyl rubber and other conventional materials.

Asia Pacific clocks in the largest share of the market revenue driven by manufacturing, automotive clusters

Asia Pacific holds the dominant share in the nylon market revenue because it houses much of the world’s automotive, electronics and industrial goods production capacity, mainly in China, Japan, South Korea and the ASEAN belt. Regional processors run high volumes of injection molding, fiber spinning and film extrusion, which fits naturally with Nylon 6 and Nylon 6,6 value chains. Large integrated chemical complexes give resin producers secured accessibility to intermediates and logistics links into export markets.

North America is emerging as one of the fastest growing nylon industries because reshoring and capacity expansion in automotive, electrical and industrial sectors are raising local consumption. United States and Canadian OEMs are redesigning platforms around lightweighting, modular subassemblies and higher efficiency electrical systems, all areas where engineered nylons compete strongly with metals and commodity plastics. Specialist compounders in the region are also offering custom glass reinforced or flame retarded formulations that respond to program specific requirements.

Competition in the industry is intensifying as nylon companies shift from bulk resin sales toward high-value engineered grades designed for EVs, smart electronics, and circular supply chains. Leading suppliers are prioritizing nylon formulations that replace metal in safety-critical automotive parts, withstand high thermal loads in power electronics, and meet stringent tracking index requirements for compact connector systems.

Another focus area is recycling and bio-based feedstocks since OEMs in automotive and electronics now assess nylon suppliers on lifecycle credentials. This opens opportunities for producers that scale chemical recycling and offer traceability data. Collaborative development programs with automotive and electronics design centers are also becoming important to secure downstream program wins. Nylon market players that combine reliable global supply, custom compounding services, and sustainability-aligned portfolios appear better positioned over the forecast period.

BASF SE, established in 1865 and headquartered in Ludwigshafen, Germany, supports the nylon market through high-performance polyamide portfolios focused on metal replacement and electrification hardware. The company offers specialty grades tuned for EV thermal management parts, autonomous drive sensor housings and lightweight structural assemblies.

E. I. du Pont de Nemours and Company, founded in 1802 and headquartered in Wilmington, United States, caters to nylon buyers through solutions designed for durability, fatigue resistance and precision molding. Its Zytel brand portfolio targets demanding environments in mobility, 5G hardware and industrial automation.

Ascend Performance Materials LLC, formed in 2009 and headquartered in Houston, United States, specializes in fully integrated nylon 6,6 production with strong backward linkages into adiponitrile. Its product lineup supports EV battery modules, high-voltage connectors and power electronics housing where heat, electrical tracking and long-term structural reliability matter.

LANXESS Corporation, established in 2004 and headquartered in Cologne, Germany, focuses on engineering plastics under its Durethan polyamide family. The company supports advanced nylon applications such as automotive crash-relevant parts, fluid handling components and flame-retardant electrical housings. LANXESS helps OEMs accelerate metal-to-plastic conversion through simulation software, mechanical testing and fast-turn prototype support.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Koninklijke DSM N.V., Solvay SA, Invista, Libolon Enterprise Co. Ltd, and Honeywell International Inc., among others.

Unlock the latest insights with our nylon market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 37.15 Billion.

The market is projected to grow at a CAGR of 5.70% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach nearly USD 64.67 Billion by 2035.

Key strategies driving the market include expanding recycling capacities, forming OEM co-development programs, scaling regional compounding hubs, and advancing high-performance nylon portfolios.

Technological advancements and the rising investments in the electronic and electrical industry are expected to augment the growth of the industry.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Nylon 6, and nylon 6,6, among others, are the major types of nylon in the market.

The different applications of nylon are automotive, film and coatings, industrial, consumer, electrical and electronics, appliances, and wire and cables, among others.

The key players in the market include BASF SE, E. I. du Pont de Nemours and Company, Ascend Performance Materials LLC, LANXESS Corporation, Koninklijke DSM N.V., Solvay SA, Invista, Libolon Enterprise Co. Ltd, and Honeywell International Inc., among others.

Supply instability of intermediates, long validation cycles, and tight durability requirements for EV and electronics make nylon programs costly and risk-sensitive.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share