Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America home security system market was valued at USD 10.79 Billion in 2025. The industry is expected to grow at a CAGR of 20.00% during the forecast period of 2026-2035 to reach a value of USD 66.81 Billion by 2035. The market growth is attributed to the widespread consumer awareness about the superior technological infrastructure amid the rising concerns over residential safety across the region.

Government policies and investments are fundamental in accelerating this market adoption by making advanced security solutions more accessible and affordable for consumers. Public funding and fiscal incentives, particularly in disaster-prone and high-risk areas, reduce financial barriers and encourage the integration of smart home security systems in North America.

These efforts align with the broader regional trend of adopting smart home technologies integrated with AI and IoT for enhanced safety and convenience. For example, the United States Fiscal Year 2025 budget allocated USD 3.2 billion in FEMA grants aimed at resilience upgrades, including smart home security.

Additionally, the Department of Homeland Security’s Nonprofit Security Grant Program dispersed USD 274.5 million in 2025 to support physical and cybersecurity enhancements in vulnerable organizations. The State and Local Cybersecurity Grant Program also provided USD 91.7 million to strengthen local cybersecurity infrastructure. These combined government initiatives not only improve overall security standards but also bolster consumer confidence and market growth.

Thus, policy and investment represent critical enablers, unlocking new opportunities for sustainable expansion within the North America home security systems market opportunities.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

20%

Value in USD Billion

2026-2035

*this image is indicative*

The North America home security system market is majorly driven by growing safety concerns amid persistent property crimes, with a violent crime reported every 25.9 seconds in the United States in 2024, according to the FBI. This sustained threat fuels demand for advanced, integrated security solutions offering real-time monitoring and AI-enabled detection. Consumer preferences for convenient, smart technology further boost adoption, with major players like ADT and Ring advancing innovative products to meet rising security needs.

The push for smarter, efficient, and affordable home security solutions is steadily driving consumers toward advanced system adoption. Features such as AI-powered threat detection, extended battery life, and integrated mobile controls make modern systems appealing for both urban and suburban households. For instance, in March 2024, Arlo Technologies launched cameras equipped with new AI-powered object identification and improved energy efficiency, highlighting how continuous innovation is crucial for reinforcing the value proposition in the North America home security system market value.

Growing collaboration between property developers and security technology firms is fueling baseline adoption of integrated security systems in homes and apartments. As both residential and commercial projects become increasingly security-focused, prefabricated or pre-installed solutions gain traction. A notable example occurred in 2024 when Lennar, a major Texas developer, partnered with Honeywell to offer built-in security panels in its new constructions, illustrating the surging trajectory reflected in North America.

Sophistication in AI-powered analytics is sharply elevating demand for home security systems that differentiate between regular activity and real security threats. Personalization and intelligent alerts are central to meeting homeowners’ evolving expectations. An example occurred in June 2024, when Google Nest released its new AI doorbell camera, offering facial recognition and package detection, underscoring how AI breakthroughs, further expanding the North America home security system market scope.

Consumer preference is shifting toward security systems that seamlessly interconnect with other smart home devices, creating unified control experiences. Providers actively partner with tech giants to develop integrated home automation and monitoring platforms. In 2025, ADT enhanced its ADT+ platform through integration with Google Nest, forming a consolidated ecosystem and setting a market benchmark for interoperability, a key aspect shaping the market dynamics.

Read more about this report - REQUEST FREE SAMPLE COPY

The EMR’s report titled “North America Home Security System Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Integration

Key Insight: Self-contained systems are preferred for basic security needs due to simplicity and cost-effectiveness, while integrated systems are the fastest-growing segment, offering centralized control, smart home compatibility, and real-time monitoring. Homeowners increasingly invest in integrated solutions for urban residences where automation and convenience are high priorities. The combination of rising smart home adoption, property safety awareness, and demand for flexible solutions is fueling home security system demand growth in North America.

Market Breakup by Type of Installation

Key Insight: DIY type installations are gaining popularity because they are cost-effective, easy to install, and compatible with smart devices. Professionally installed systems remain the largest segment, offering reliability, comprehensive monitoring, and advanced service features. Homeowners appreciate solutions that balance convenience with security. Increasing wireless system adoption and mobile monitoring apps are also contributing to market expansion. This trend is boosting demand in the North America home security system market as consumers seek scalable and flexible security solutions.

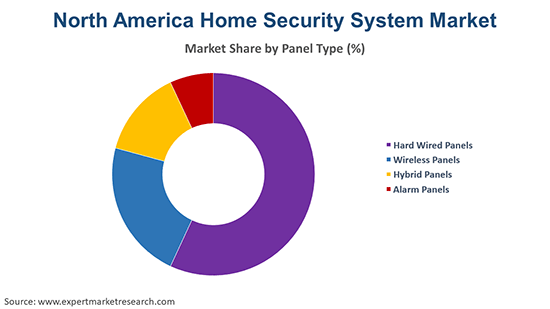

Market Breakup by Panel Type

Key Insight: Hard-wired panels remain significant for reliability in large homes and commercial properties. Wireless panels, however, are the largest and fastest-growing segment due to easy installation, remote access, and integration with smart devices. Hybrid panels combine advantages of wired and wireless setups, and alarm panels provide essential alerts and deterrence. Growing adoption of connected technologies and AI-enabled monitoring supports market expansion, driving North America home security system industry revenue as homeowners increasingly demand convenience alongside security.

Market Breakup by Sensor Type

Key Insight: Wireless sensors are leading the market due to flexibility, ease of retrofitting, and compatibility with smart home networks. Wired sensors maintain a stable presence for high-security setups. The popularity of AI-based threat detection, home automation, and remote monitoring solutions is driving adoption. Homeowners value solutions that combine safety and convenience across all property types. These factors are significantly increasing the market revenue.

Market Breakup by Communication Modules

Key Insight: Professional-monitored systems dominate due to real-time alerts, emergency response, and high reliability. Self-monitored systems are the fastest-growing segment as cost-conscious and tech-savvy homeowners seek app-controlled solutions. The rise of smartphones, IoT integration, and smart home connectivity supports flexible, convenient security options. Together, these trends are fueling the growth of the North America home security system industry, as both monitoring models meet different consumer needs.

Market Breakup by Equipment Type

Key Insight: Video surveillance systems are the largest and fastest-growing segment due to rising awareness and smart monitoring adoption. Intruder alarms and electronic locks are also expanding, driven by smart home integration and access control needs. Fire sprinklers and other safety equipment complement these systems, supporting comprehensive security solutions. Rising residential and commercial demand for automated monitoring and safety features is boosting North America home security system market growth, contributing to the overall expansion of the market.

Market Breakup by Residence Type

Key Insight: Independent homes dominate market share because of higher investment capacity and demand for full-featured security solutions. Condominiums and apartments are the steadily growing segments, driven by urbanization, smart home integration, and community-level monitoring. Homeowners increasingly seek automated and reliable systems that fit their residence type. These dynamics are supporting the rising demand in the North America home security system market, as all residential segments adopt technology-enabled home security solutions.

Market Breakup by Region

Key Insight: The United States leads in terms of market revenue, fueled by high disposable incomes, advanced technology adoption, and supportive government policies. Canada is the fastest-growing region, with urbanization and smart home integration driving adoption. Rising awareness of residential security and the adoption of connected and automated systems across both countries are contributing to growth of the home security systems market, ensuring a robust market trajectory in North America.

By integration, self-contained home security systems continue to gain notable traction

Self-contained home security systems continue to appeal to homeowners seeking simple, cost-effective protection solutions. These systems are particularly favored for basic security needs, offering straightforward alarm and sensor setups without complex integrations. Their ease of use and affordability make them ideal for budget-conscious consumers looking for reliable, standalone protection in suburban and rural areas of North America.

Integrated security systems represent the fastest growth in the North America home security system market, driven by increasing adoption of smart home technologies and demand for centralized control. These systems combine alarms, cameras, locks, and sensors into a unified platform accessible via smartphones or home automation hubs. Preferred in urban residences, integrated solutions offer enhanced convenience, real-time monitoring, and flexible customization, aligning with rising safety awareness and tech-savvy consumers’ expectations, fueling robust demand growth in the market.

By installation type, DIY type represents biggest portion

The DIY home security wave in North America is fueled by homeowners’ desire for affordable, hassle-free, and intelligent protection. People increasingly favor systems they can install themselves while enjoying smart, remote monitoring. Alarm.com’s September 2025 launch of the ADC-V516 Indoor Wi-Fi Camera showcases this shift—bringing AI-powered detection, two-way audio, and cloud recording into compact, budget-friendly devices. By making professional-grade security simple and accessible, innovations like this are redefining DIY adoption and empowering homeowners and small businesses to take control of safety on their own terms.

Despite the surge in DIY solutions, professionally installed systems are gaining notable traction in the North America home security system market, prized for their reliability, comprehensive monitoring, and expert setup. Professional services provide thorough security assessments, optimal device placement, and ongoing maintenance, ensuring maximum protection. Homeowners favor these systems for peace of mind, especially in complex setups requiring integration and durable performance. The balance of convenience and security offered by professional installation continues to drive strong demand growth across diverse residential and commercial markets.

By panel type, hard-wired panels hold significant market share

Hard-wired panels continue to be significant for their high reliability, making them a preferred choice in the North America home security market. They are preferred in large residential properties and commercial buildings where consistent, interference-free connections are critical. Their stable performance supports complex security setups, ensuring uninterrupted protection and appealing to customers valuing durability and proven technology.

Wireless panels are the fastest-growing segment due to their ease of installation, scalability, and compatibility with smart home ecosystems. These panels offer remote access and real-time control via mobile apps, catering to tech-savvy homeowners prioritizing convenience and flexibility. The rising adoption of IoT devices and AI-enabled monitoring further fuels this segment’s growth, positioning wireless systems as the future backbone of connected home security in North America.

By sensor type, hard-wired sensors continue witnessing steady demand

Hard-wired sensors maintain a steady presence in the North America home security system market due to their reliability and consistent performance. They are preferred in high-security setups where uninterrupted connectivity is crucial. These sensors offer stable and tamper-resistant monitoring for large properties and commercial applications, catering to customers prioritizing durability and robust protection, making them an essential segment in the market.

The wireless sensors segment is propelled by the rising demand for flexible and smart home-compatible security solutions. Consumers increasingly prefer devices that enable seamless integration with mobile apps and AI-powered monitoring. In November 2024, Acre Security launched its 2-Way Wireless PIRCAM motion detectors, featuring bidirectional communication, cloud management, and long battery life. Such product developments highlight how advanced wireless sensors are enhancing convenience, scalability, and real-time threat detection in residential and light commercial settings, further contributing to the North America home security system market revenue.

By communication module, professional-monitored home security remains a preferred consumer choice

The professional-monitored home security systems increasingly benefiting from advanced AI technologies that enhance monitoring efficiency and accuracy. Amazon’s Ring, launched in October 2024, exemplifies this with its Ring Home Premium subscription, which offers 24/7 recording and AI-powered Smart Video Search. This innovative feature enables monitoring teams to quickly locate and review critical footage through natural language queries, improving response times and minimizing false alarms, thus strengthening consumer trust and fueling the overall North America home security system market growth.

Self-monitored systems are the fastest-growing segment, driven by cost-conscious and tech-savvy consumers who prefer app-controlled, flexible security options. The rise of smartphones, IoT integration, and smart home connectivity enables homeowners to manage their security systems independently, customizing alerts and control for convenience and scalability. This growth reflects changing consumer preferences for affordable, personalized security solutions in the evolving home security industry of the region.

By equipment type, video surveillance holds the largest share of the market

Video surveillance systems is experiencing robust growth driven by increasing demand for AI-powered, real-time monitoring solutions that enhance security precision and efficiency. Consumers across residential, commercial, and critical infrastructure sectors prioritize scalable and intelligent surveillance technologies to proactively detect and deter threats. Supporting this trend, GardaWorld’s ECAM launch in 2025 combines advanced AI-driven live video surveillance with expert human monitoring, exemplifying the market’s shift toward integrated, high-performance security systems that boost North America home security system market expansion.

Meanwhile, the fire sprinklers and extinguishers equipment category is witnessing an increasing demand for technologically advanced, easy-to-install, and cost-effective fire detection and alarm solutions. Mircom Group’s introduction of the next-generation Secutron product range into the United States market in February 2024, exemplifies this trend. Their comprehensive lineup, meeting stringent UL 864 10th edition standards, offers conventional and addressable fire alarm control panels, detectors, and notification devices designed for small to medium-sized applications, enhancing safety and operational efficiency.

By residence type, independent homes amass substantial revenue

Independent homes category generate the most revenue in the North America home security system market, principally by the increasing demand for comprehensive security solutions tailored to larger properties. Homeowners prioritize robust, integrated systems that ensure complete perimeter protection and remote monitoring capabilities. This focus is intensified by rising suburban housing developments and new construction projects where security is often built-in from the outset, fostering consistent demand for advanced, scalable home security solutions.

Besides this, the apartments across North America rely on smart communication and reliable monitoring tailored to multi-unit dwellings. Ajax Systems' 2025 launch of Ajax SIM, a pre-installed, IoT-optimized SIM card, ensures uninterrupted alarm transmission by automatically connecting to the strongest cellular network. This innovation improves installation ease and system reliability, making it ideal for apartments where secure and continuous monitoring is critical, supporting the increasing adoption of smart security solutions in urban residential complexes.

By region, United States lead the market growth

Customers across United States are highly inclined towards advanced, AI-powered systems that offer comprehensive threat detection and proactive response capabilities. There is a rising preference for integrated solutions combining cutting-edge sensor fusion and real-time monitoring to enhance safety and convenience. Supporting this trend, Sauron’s December 2024 launch of a perceptual platform with multi-modal sensors and 3D home views exemplifies how innovation is redefining security standards, thereby solidifying United States’ position as a lucrative destination in the North America home security systems market.

Meanwhile, in Canada, the home security market is rapidly evolving, driven by rising safety concerns, technological advancements, and consumer demand for smart, integrated solutions. Increasing adoption of cloud-based systems, AI-powered analytics, and IoT-enabled devices is reshaping the landscape, offering enhanced scalability and convenience. To address this demand, in September 2025, Protech Systems’ launch in Vancouver highlights the growing emphasis on localized, customized security services, reflecting the broader push towards modern, comprehensive protection solutions, further boosting the home security industry expansion.

Top North America home security system market players are focusing on innovation and partnerships to maintain competitive advantage. Leading companies such as ADT, Vivint, and Honeywell are investing heavily in AI and IoT technologies to offer smart, integrated home security solutions. Strategies include launching customizable wireless panels and remote monitoring systems that appeal to both DIY enthusiasts and professionally installed customer segments.

Additionally, major home security system companies emphasize collaborations with tech firms to enhance interoperability across smart home devices. They also leverage strategic alliances, like SimpliSafe’s partnership with insurance providers, to bundle security products with value-added services. Continuous R&D efforts further drive product innovation, such as AI-enhanced threat detection and energy-efficient devices, strengthening market presence and meeting evolving consumer demands in the evolving North America home security system market.

ADT Inc., established in 1874 and headquartered in Florida, the United States, is a pioneer in the home security industry. With a long legacy, ADT focuses on advanced security and smart home integration, continually innovating through partnerships and AI-enabled solutions to serve millions of customers across North America.

Vivint Smart Home Inc., founded in 2011 and based in Provo, the United States,, specializes in smart home security systems emphasizing AI-powered automation and wireless technologies. The company’s consumer-centric approach drives innovation in customizable, easy-to-install security products, supporting the growing consumer need in the North America home security system market.

Frontpoint Security Solutions, LLC, headquartered in Vienna, the United States,, and founded in 2007, offers user-friendly and scalable DIY home security systems. Their strategy focuses on customer service and flexible monitoring plans, appealing to tech-savvy consumers seeking hassle-free installation.

Bosch Security Systems, LLC, a division of German conglomerate Bosch founded over a century ago, operates in the United States, with a focus on high-quality, technologically advanced security and surveillance solutions. Their strategy combines global expertise with innovation to offer integrated smart home security products.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Protect America, Inc., and several others.

Explore the latest trends shaping the North America Home Security System Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Get a free sample report or contact our team for customized consultation on North America home security system market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the North America home security system market reached an approximate value of USD 10.79 Billion.

The market is projected to grow at a CAGR of 20.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 66.81 Billion by 2035.

Key strategies driving the market include AI integration, smart home compatibility, and strategic partnerships.

The key trends guiding the market include the development of advanced home security systems, technological advancements and innovations, and improving network infrastructure.

The major countries of home security system in North America include the United States and Canada.

Self-contained systems and integrated systems are the various integration systems considered in the market report.

The significant types of installation of home security system are DIY type and professional installed.

The several panel types considered in the market report include hard wired panels, wireless panels, hybrid panels, and alarm panels.

The major sensor types in the market are wireless sensor and wired sensor.

The different communication modules of home security system considered in the market report are professional monitored and self-monitored.

The various equipment types in the market include video surveillance, intruder alarms, electronic locks, and fire sprinklers and extinguishers, among others.

The significant resident types considered in the market report include independent homes, condominiums, and apartments, among others.

The key players in the market include ADT Inc. (NYSE: ADT), Vivint Smart Home Inc. (NYSE: VVNT), Frontpoint Security Solutions, LLC., Bosch Security Systems, LLC, and Protect America, Inc, among others.

The United States holds the largest share due to high adoption of smart security solutions.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Integration |

|

| Breakup by Type of Installation |

|

| Breakup by Panel Type |

|

| Breakup by Sensor Type |

|

| Breakup by Communication Module |

|

| Breakup by Equipment Type |

|

| Breakup by Residence Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share