Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America feed testing market was valued at USD 746.70 Million in 2025. The industry is expected to grow at a CAGR of 7.50% during the forecast period of 2026-2035 to attain a valuation of USD 1538.97 Million by 2035.

Base Year

Historical Period

Forecast Period

As per the USDA, total poultry sector sales in 2022 were $76.9 billion, an increase of 67 per cent from 2021.

As of March 2024, an estimated 2,110 million pounds of beef was produced in the United States, as per the USDA.

As of March 2023, the cost of soybean meal for poultry was 484.4 dollars per tonne, reported the USDA.

Compound Annual Growth Rate

7.5%

Value in USD Million

2026-2035

*this image is indicative*

A safe animal feed supply helps ensure healthy animals and thus individuals. The North America feed testing industry plays a crucial role in the quality and safety of animal feed which has a direct impact on the health and productivity of livestock and other animals. Feed testing involves analysing feed ingredients for their nutritional contents, contaminants & pathogens among other things.

The animal feed industry manufactures dietary elements and mixtures vital for farm animals, poultry, fish farming, and pet nourishment. It involves diverse products such as cereals, protein meals, vitamins, minerals, and additives that are aimed at tailoring specified eating requirements to ensure the optimum health and performance of the animals.

The animal feed testing industry conducts analysis and assessments on various aspects of animal feed, including nutritional composition, contaminants, and toxins among others. The industry is poised to see growth due to consumer demand for safe and high-quality animal products. Furthermore, advancements in testing technologies are improving efficiency and testing accuracy.

The North American feed testing market is growing owing to numerous technological advancements in testing methodologies which may be correlated to a spike in pathogens and mycotoxins in feed for poultry, swine, and bovine animals.

The United States FDA is responsible as the regulatory authority for testing methodologies on animal feed for private companies and is constantly innovating novel testing methods.

Adoption of advanced analytical techniques such as chromatography, and mass spectrometry for accurate detection of contaminants and toxins will help the animal feed testing industry grow.

North American feed testing market growth is based on burgeoning Investments in animal nutrition research among agribusiness companies such as Cargill.

In a bid to meet the dietary requirements of different animal species, there is a growing emphasis on nutritional analysis of feed formulations.

innovation is driving growth in animal feed testing through advanced technologies like chromatography and mass spectrometry. Rising investment in animal nutrition research, led by companies like Cargill and an emphasis on nutritional analysis to meet diverse dietary needs, foster the industry's growth.

Coupled with this, the threats to animal feed in the form of mycotoxins, pesticide residues and pathogens along with a stable growth in the domestic meat market are also some key trends impacting the North America feed testing market.

North America Feed Testing Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Feed Stock

Market Breakup by Country

Mycotoxin testing leads the North America feed testing market since mycotoxin contamination is a serious safety concern when it comes to animal feed.

Pathogen testing for harmful microorganisms like bacteria, viruses and parasites in animal feed is important in assuring the safety of feeds, especially where livestock production and pet food manufacturing are involved.

Mycotoxin analysis helps in finding poisonous secondary metabolites produced by moulds in animal feeds. They put animals’ health at risk as well as that of humans. Mycotoxin testing helps in identifying their presence and reducing them during feed processing.

Based on feedstock, North America feed testing market share is led by poultry feed since they are reasonably priced and are a feasible choice for many people and a primary source of protein in their diet.

Poultry feed for broilers, turkeys, ducks, and quails contains grains, proteins, vitamins, minerals, and additives. It is designed to meet various growth phases for maximum meat production and egg production.

Cattle feed is made up of forages, grains, proteins, minerals, vitamins, and additives that help fulfil the nutritional requirements of dairy cows and beef cattle. It helps maintain them healthy thus sustaining their milk yield and meat quality, depending on age breed and production goals.

The North America feed testing market has seen major developments owing to recent acquisitions and the development of new scientific testing methods in animal feed for pathogens, mycotoxins, pesticide residues and nutritional label analyses among others.

SGS S.A. is a Swiss multinational company founded in the year 1878, headquartered in Geneva, Switzerland it provides inspection, verification, testing and certification services.

Eurofins Scientific SE is a world leader in food, environment, pharmaceutical and cosmetic product testing, forensics, advanced material sciences, and in agroscience contract research services.

Bruker Corporation, established in 1960 and headquartered in Massachusetts, USA, develops, manufactures, and distributes high-performance scientific instruments and analytical and diagnostics solutions.

Tentamus Group GmbH is an international group of laboratories headquartered in Berlin and Munich. They provide testing for products in food & feed, nutraceutical & supplement, agriculture & environment, and agrosciences.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other North America feed testing industry key players are Lifeasible, ServiTech Inc, Dairyland Laboratories Inc, Ward Laboratories Inc, Neogen Corp, Intertek Group Plc, and among others.

North America feed testing market inferences based on poultry and livestock outlook.

As of 2023, as per the United States Department of Agriculture (USDA) 2023 U.S. livestock and poultry outlook, a slow but steady growth was to be expected.

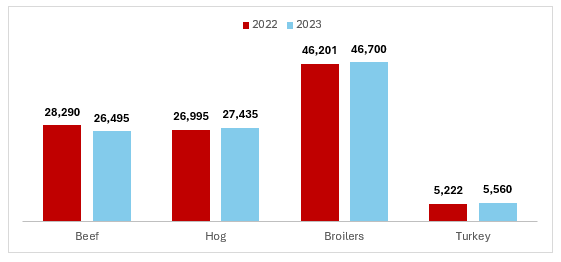

LIVESTOCK AND POULTRY OUTLOOK (IN MILLION LBS)

As in the 2023 U.S. Livestock and Poultry Outlook, beef production was expected to fall to 26 billion lbs, a drop of 6% from 2022. Broilers in the poultry industry were to show a steady slow growth rate of 1%, Turkeys at 6% and Hogs at 2%.

As per the data provided by the official website of the Government of Canada, for the years 2021 – 2022 negative growth was the trend in the production of cattle and hogs at -1.92% and -1.72% respectively while the production of sheep and lambs saw a rise of 2.45% at 3 million heads when compared to 2021.

(Thousands of heads)

|

2021 |

2022 |

% Change |

|

|

Cattle |

30,564.70 |

29,977.10 |

-1.92% |

|

Hogs |

60,638.50 |

59,594.80 |

-1.72% |

|

Sheep and lambs |

2,932.30 |

3,004.20 |

2.45% |

However recent data in the poultry segment by the Government of Canada suggests a slow steady growth in 2024 when compared to previous years' numbers for January, 67 million heads were counted in 2024, a rise of 2.6% when compared to 2023.

(Thousands of heads)

|

Jan-23 |

Jan-24 |

% Change |

|

|

Chicken |

65,556 |

67,282 |

2.63% |

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 7.50% between 2026 and 2035.

Technological and scientific advancements in testing methodologies coupled with a steady slow growth in meat consumption and a rise in pathogens and mycotoxins are some of the key drivers.

Key players in the industry are SGS S.A., Eurofins Scientific SE, Dairyland Laboratories Inc., Tentamus Group GmbH, Lifeasible, ServiTech Inc, Dairyland Laboratories Inc, Ward Laboratories Inc, Neogen Corp, Intertek Group Plc, and Bruker Corporation among others.

Based on feedstock the market can be broken down into poultry feed, swine feed, pet feed, aquafeed, cattle feed, and others.

Based on testing types, the feed testing market is divided into pathogen testing, mycotoxin testing, pesticide residue analysis, fats and oil analysis, and nutritional labeling analysis.

The market is bifurcated between The United States and Canada.

In 2025, the market attained a value of nearly USD 746.70 Million.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 1538.97 Million by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Feed Stock |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share