Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The North America car rental market reached USD 51.75 Billion in 2025. The market is expected to grow at a CAGR of 6.60% between 2026 and 2035, reaching almost USD 98.06 Billion by 2035.

Base Year

Historical Period

Forecast Period

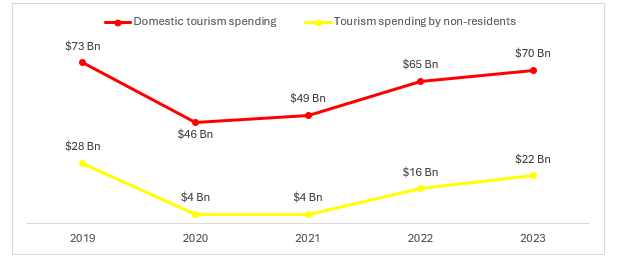

As per Statistics Canada, tourism spending was recorded in 2023 to be $70 billion domestically and $22 billion spent by non-residents.

In Canada total number of road motor vehicles registered in 2022 was 26.3 million, as per Statistics Canada.

In the US, as per the United States Census Bureau, $121 billion worth of sales were recorded in Auto and Other Motor Vehicles in March 2024.

Compound Annual Growth Rate

6.6%

Value in USD Billion

2026-2035

*this image is indicative*

In the North America car rental market, significant trends are shaping the industry. Digitalisation is driving rental companies to invest in friendly user interface platforms and mobile apps, enhancing booking procedures and offering contactless services. Moreover, there is a growing preference for sustainable options, with companies expanding fleets to include electric vehicles in response to consumer demand.

ANNUAL TOURISM SPENDING IN CANADA, 2019-2023

Growing tourism spending in the domestic region is driving demand for rental vehicles, the solution to which is the significant number of registered vehicles in both Canada and the United States. The car rental market plays a vital role in assisting travel and mobility. Moreover, strong sales in the auto industry underline the importance of car rental services in meeting diverse transportation needs across the region.

The North America car rental market growth is driven by increasing environmentally friendly options, rising tourism, digitalisation for ease of access, partnerships, collaborations, and increased funding.

Growing environmental awareness underscored the rise in demand for eco-friendly rental options such as electric and hybrid cars causing companies to expand their fleets.

The tourism industry in the domestic region has been witnessing a sharp recovery as numbers continue to rise to pre-COVID levels.

In a bid to enhance customer experience car rental companies have been increasingly investing in digital platforms and mobile apps.

In anticipation of growth in the North America car rental market partnerships among market leaders and outside investment helps with scaling.

As per the North America car rental market report, increased demand, fuelled by recovering tourism post-COVID, is a primary driver of growth. The rise in tourism numbers signals a resurgence in travel, boosting demand for rental vehicles and driving market growth. Companies are digitalizing to meet this demand, investing more in user-friendly platforms for better access and enhancing the overall user experience.

Partnerships and increased funding facilitate market expansion, enabling companies to scale operations and better cater to evolving market demands. Additionally, strategic partnerships and increased investment bolster market competitiveness, fostering innovation within the North America car rental industry.

North America Car Rental Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Booking Type

Market Breakup by Rental Length Type

Market Breakup by Application Type

Market Breakup by Vehicle Type

Market Breakup by Region

The North America car rental market is dominated by offline modes of booking which involve the more traditional method of reserving car rentals through rental offices, travel agencies, or call centres.

Making car rental reservations through physical locations or over the phone, such as rental counters at airports or standalone offices is referred to as offline booking.

Online booking involves making car rental reservations through digital platforms like the rental company's website or mobile apps and is a relatively novel way of offering more convenience.

North America car rental market growth comes from short-term car rentals that last from a few hours to a few days, catering to travellers and individuals needing temporary transportation solutions

Short-term rentals are where rented cars are used from a few hours to a few days for vacations, business trips, and short-term needs, often at airports and for city travel.

However, extended rentals that range from weeks to years are often favoured by businesses and individuals that have prolonged need for rented transportation also referred to as long-term rental arrangements.

North America car rental market growth based on vehicle types that are available for consumers to choose from in the domestic market is led by luxury/premium cars, economy/budget cars, SUVs, and MUVs

Used for urban travel, short trips, and by budget-conscious travellers in North America, economy/budget cars are popular choices for city exploration, commuting, and quick getaways.

Sport Utility Vehicles (SUVs) are popular for family trips, road adventures, and outdoor excursions, catering to the demand for spacious and capable vehicles among travellers.

Key players in the North America car rental market help propel the market forward by investing more in eco-friendly options like electric and hybrid vehicles coupled with an increased emphasis on digitalisation for ease of access.

Enterprise Holdings, Inc. was founded by Jack Taylor in the year 1957 and operates out of Missouri, US. It is a parent company of several car rental agencies and operates several other transportation services.

Avis Budget Group, Inc. which is headquartered in New Jersey, US is a car rental company. It was founded in the year 1946 in Michigan by Warren Avis.

Hertz Global Holdings Inc. was founded in the year 1918 by Walter Jacobs who then sold it to John D. Hertz in 1923, it operates out of Florida in the US. The company is a leader in the car rental industry.

SIXT SE is a German company that was founded in the year 1912 by Martin Sixt. It operates in 105+ countries and is a pioneer in the car rental business.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other North America car rental market key players are Fox Rent A Car, Ecos (I) Mobility & Hospitality Pvt. Ltd., Getaround Inc., ACE Rent A Car, Inc., Booking Holdings Inc. (Momondo), and Advantage Rent A Car company among others.

The car rental industry in both the United States and Canada has been experiencing growth, driven not only by an increase in domestic tourism but also by the efforts made by companies to enhance user experience and improve user-friendliness.

The number of miles travelled by vehicles in the United States and Canada has been on the rise, as per the United States Department of Energy , 3.19 trillion miles were travelled in the US (expressed as a moving 12-month count) in the year 2023.

South Korea Car Rental Market

Philippines Car Rental Market

Brazil Car Rental Market

Germany Car Rental Market

Europe Car Rental Market

United States Car Rental Market

Car Rental Market

Vietnam Car Rental Market

United Kingdom Car Rental Market

India Car Rental Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is estimated to be valued at USD 51.75 Billion in 2025.

The market is projected to grow at a CAGR of 6.60% between 2026 and 2035.

The market is expected to reach USD 98.06 Billion in 2035.

Key factors driving growth in the domestic market are the rise in the tourism industry, innovation in the rental cars industry to improve customer experience and steady growth in road transportation.

Based on booking type the market is divided into offline modes and online modes.

The market key players are Enterprise Holdings, Inc., Avis Budget Group, Inc., Hertz Global Holdings Inc., SIXT SE, Fox Rent A Car, Ecos (I) Mobility & Hospitality Pvt. Ltd., Getaround Inc., ACE Rent A Car, Inc., Booking Holdings Inc. (Momondo), and Advantage Rent A Car company among others.

Based on the rental length type the market is led by short-term and long-term duration of bookings.

The major market areas include the United States and Canada.

Based on vehicle type, growth in the North America car rental market is led by luxury/premium cars, economy/budget cars, SUVs, and MUVs.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Booking Type |

|

| Breakup by Rental Length Type |

|

| Breakup by Application Type |

|

| Breakup by Vehicle Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share