Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

The global microinsurance market size was around USD 82.87 Billion in 2024. The industry is further expected to grow at a CAGR of 6.50% over the forecast period of 2025-2034 to attain a value of around USD 155.56 Billion by 2034.

Base Year

Historical Year

Forecast Year

Value in USD Billion

2025-2034

Microinsurance Market Outlook

*this image is indicative*

Favourable policies, rising awareness, and customizable plans are driving global microinsurance market growth.

The expansion of favourable government initiatives, growth in the insurance industry, and growing awareness regarding insurance schemes amongst consumers are propelling the growth of the global microinsurance market. Incessantly sedentary and busy lifestyle habits result in an increase in obesity and diabetes cases around the globe. This therefore increases demand for microinsurance which could cover increased medical expenses. The introduction of low-cost insurance policies, which can be further tailored to meet the needs of the customers, is boosting the growth of the industry. The introduction of innovative programs by the key players operating in the market, for offering protection from very high medical bills to the customers is likely to support the microinsurance market growth in the forecast years.

Some of the major trends in the global microinsurance market include digital platform infiltration with regard to policy management and claim processes. Companies such as BIMA offer micro-insurance products through a mobile application that enables customers in the emerging markets to have fairly cheap coverage and manage their policies at ease. This, in turn, develops better accessibility and more convenience for the insured population, especially in regions where the traditional infrastructure related to insurance is at a minimal stage, thus fuelling broader adoption and wider market expansion.

March 2022

KVGB has commenced a micro policy at affordable rate for providing insurance cover for vector-borne disease in association with Liberty General Insurance Co. Ltd.

February 2023

Arsht-Rock introduces Extreme Heat Income Insurance on the occasion of 50 years of SEWA. This is a new climate resilience tool, which compensates women in the informal sector for loss of income attributed to climate-driven extreme heat.

Over the last five years, there has been an increasing demand for microinsurance, especially in emerging markets, hence the growth of the microinsurance market across the globe. Initially, several issues faced the industry, including lack of access, low awareness of products, and high operational costs. Key players like BIMA and MicroEnsure rose to the occasion by adopting mobile technology and digital platforms to increase access and cut down operations costs, hence obtaining better access to the underserved.

Further, these companies innovated new models-like peer-to-peer insurance and plans that could be tailored according to the needs of people-further making it more affordable and transparent. Strong data analytics and automated systems also ensured better risk management and operational efficiency, which boosted demand of microinsurance market.

With the improvement in technology and the regulatory framework, the microinsurance market will definitely grow very strongly in the future. Looking ahead, the drivers going forward will be digital solutions and bespoke products; there is a need to further develop them to meet the emerging risks and extend coverage even further in underserved areas.

Affordability, digital platforms, and innovative models like peer-to-peer are boosting microinsurance market growth.

Microinsurance is increasingly being preferred, as it is reasonably priced and its dynamics are transparent, thus assisting the consumers. Also, several organisations are employing multichannel platforms and virtual networks to provide incentives and build a value chain in the microinsurance business. Further, the advent of consumer-friendly insurance models, such as the peer-to-peer model, is also providing a thrust to microinsurance market opportunities. Automated portfolio monitoring, therefore, is an increasing trend in several companies, and this keeps them updated about the credit flow of their client segment. They can keep track and take appropriate steps with immediate effect.

Expanding climate-risk coverage with technology and local partnerships offers a major microinsurance opportunity.

A significant opportunity for microinsurance lies in the inclusion of climatic risks and, even more so, in the extension of coverage to vulnerable regions. The tendency for extreme events, induced by climate change, is on the rise, and this is driving the emergent demand for the most accessible insurance products that protect poor people from such risks. Companies are seemingly capitalising on this by developing specialised microinsurance products that protect vulnerable populations against climate-induced events like floods, droughts, or even periods of extreme heat, shaping the microinsurance market dynamics and trends.

This could be even further made more accessible and efficient by the use of mobile platforms and blockchain for transparency in claim processing. From this view, collaboration with regional organisations will create solution adaptations for regional-specific needs that assure further market penetration and, ultimately, address emerging demands for climate resilience among underserved populations.

Increasing focus on financial inclusion is driving sustained growth in the global microinsurance market.

One of the key factors expected to drive growth in the global microinsurance market during the next ten years is the increasing focus on financial inclusion. Greater inclusion of low-income and underserved populations within the reach of the financial system is building access to microinsurance products. The insurer and financial institution partnerships, such as banks and microfinance organisations, facilitate the delivery of affordable insurance solutions to more people.

Initiatives such as the World Bank's Financial Inclusion Initiative, hence, have integrated insurance in various ways into broader financial services to reach low-income communities, paving new microinsurance market trends and dynamics. In this way, access and affordability will improve to fuel market growth further. Until active financial inclusions keep taking place across the world, an increasing proportion of the population is covered by micro-insurance, which in turn supports continued market growth and coverage.

Regulatory uncertainty and evolving compliance requirements pose a significant threat to the microinsurance market.

Regulatory uncertainty and changing regulatory compliance needs do indeed pose one of the most significant threats to the microinsurance market. Indeed, evolving regulations on behalf of governments and regulatory bodies for consumer protection and emerging risks complicate the process for microinsurance providers, since it implies having to continuously address these changes in order to maintain compliance. This increases operational costs and sometimes enhances complexity for companies operating in more than one country, where regulations may also vary, leading to microinsurance market challenges.

Increased data protection and anti-money laundering legislation, for example, could be fraught with heavy technology and legal investment. For companies failing to adapt to these new regulatory regimes, fines, reputational damage, and loss of market access may be imposed. This also serves as a further threat that microinsurance companies have to be dynamic, proactive in terms of their regulatory approaches if their growth is to continue in their efforts to manage the risks.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Microinsurance market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:

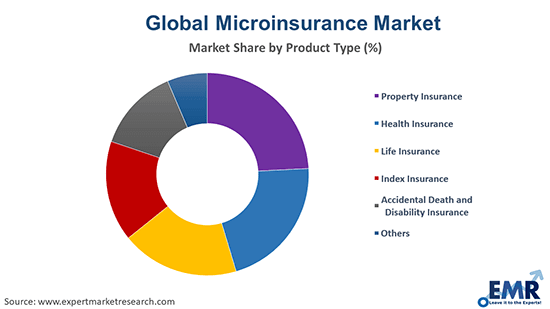

The microinsurance market segmentation, based on product type, is as follows:

On the basis of provider, the microinsurance market has been categorised into:

On the basis of model type, the microinsurance market has been categorised into:

Based on region, the market can be segregated into:

Microinsurance demand grows through property, health, life, index, accidental, and niche insurance products.

In the global microinsurance market, the different types of products have a different impact on demand. Property insurance, where financial loss is covered in case of damage or loss of property, enters this industry, placing an emphasis on the need for financial protection among low-income households. Health insurance contributes to covering high treatment costs, thus promoting access to basic health services and increasing demand within the market, garnering a 7.2% CAGR through 2032.

As per the microinsurance market analysis, life insurance, on the other hand, will provide a sort of comfort to the survivors in case of an eventuality and hence confidence to the family and shall increase adoption. Index insurance demands that this form of insurance, with its payout triggers based on weather conditions or other indices, be an innovative solution for crop failure and other risks among agricultural communities. Accidental death and disability insurance provides protection against sudden events at affordable costs, boosting market growth due to protection against accidents that disrupt livelihoods. Others include a suite of specialized niche products catering to highly specialized needs, thus expanding this market into servicing a wide gamut of risk profiles and preferences.

Commercially viable models ensure affordability and efficiency, while aid supports accessibility and market expansion.

Commercially viable microinsurance develops demand through multiple sustainable product offerings provided via innovative business models, acquiring a 7.4% CAGR through 2032. Aided by technology and effective distribution, these players offer insurance services to the low-income groups to make the product more accessible and attractive. They address the local need and maintain profitability through adaptive product offering, enabling market growth and extension of coverage.

On the other hand, microinsurance through aid/ government support increases demand by removing affordability and accessibility barriers, and government and aid-funded programs offer subsidies and financial assistance to bear the cost burden away from poor people. As per microinsurance industry analysis, most programs involve educational work to build awareness and trust among recipients, and uptake is even higher on that count. Because this completes the gaps a commercial model would miss, the inclusion of aid and government support spreads the reach of the market, ensuring cover for the most vulnerable population. These strategies incorporate affordability, accessibility, and focused outreach, all put together raising the total demand for microinsurance.

Different microinsurance models drive growth: partner agents, full-service, provider-driven, community-based, and niche.

The partner agent model drives demand effectively in collaboartion with the local agents or organisations as that increases its reach and involvement with the underserved areas; for example, the partnerships with NGOs help to reach very remote areas. The full-service model bases its popularity on its comprehensive approach to managing everything right from the issuance of policies to claims. It appeals to customers who want service that is streamlined and assured. The provider-driven model relies on established insurance providers to manage products directly, using their infrastructure and expertise in scaling operations efficiently. It allows large insurers to take advantage of this when they enter the micro-insurance market. Community-based/mutual-the model leverages local networks and mutual support systems best by building trust and increasing uptake through community ownership and shared risk, boosting the microinsurance demand growth. Finally, there are niche approaches, including many recent innovative solutions, which also help extend the market reach. Currently, the community-based/mutual model is dominant in the effective combination of local trust and affordability.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

North America Microinsurance Market Opportunities

Increased awareness and demand for affordability in insurance schemes create major opportunities in the microinsurance industry in North America. Growth in the United States and Canada has been facilitated by increased awareness of financial inclusion, protection for the under-insured, and vulnerable classes. For instance, MicroInsurance Canada deals in low-cost insurance solutions meant for low-income classes. Other drivers will be better distribution and accessibility through local NGOs and technology firms. It also benefits from a growing emphasis on inclusive financial services and government support for insurance programs that help low-income people. It is, therefore, an enabling environment that makes expanding microinsurance solutions throughout North America an enticing opportunity.

Europe Microinsurance Market Dynamics

Some of the influencing factors in the development of the microinsurance market in Europe is the diverse regulatory environment across the continent. For instance, there are EU-wide regulations like the Solvency II that are accommodative of cross-border operations while the national regulations lead to variability. Other drivers include an increasing financial inclusion since efforts from the public and private sectors have increased in attempts to offer insurance at an affordable price to the unserved segments that include immigrants and low-income earning families. With the spreading of digital platforms and mobile technologies, technology-related factors will continue to play a vital role in increasing the reach and efficiency of microinsurance. Partnerships between insurers and NGOs extend coverage and improve distribution-as seen with partnerships involving social enterprises in Eastern Europe. Increased market awareness and education regarding the benefits accruing from microinsurance further facilitate greater acceptance and demand on the continent.

Asia Pacific Microinsurance Market Trends

Regional dynamics vary sharply and act as drivers for the growth of microinsurance in the Asia Pacific region, advancing at a CAGR of 7.5% through 2032. The high mobile penetration rates across big countries, such as India and Indonesia, lead to wider microinsurance reach on mobile platforms because such coverage would be much more affordable and thus more easily accessible. New and innovative products cater to very specific risks for the low-income populations in emerging markets. Agricultural insurance provided to farmers is a very good example of this. Other government initiatives include providing regulatory support, especially in countries like the Philippines and Thailand, also contribute to market growth by financial inclusion. Furthermore, growth in digital ecosystems and partnerships of insurers with fintech companies accelerate market growth.

Latin America Microinsurance Market Insights

The microinsurance market is, therefore, one of the fastest-growing in Latin America, with a couple of key factors acting as drivers. First, informal employment and income inequalities are extremely high, hence raising demand for low-cost cover suited to the low-income stratum. Other regional drivers include the regulator's support for microinsurance in Brazil and innovative insurance products against drought for small-scale farmers in Argentina. Increased smartphone penetration further enables the buying of microinsurance products through digital channels, hence improving both access and affordability. Improvement in distribution and uptake also emanates from a collaborative partnership between insurers, NGOs, and local communities. This is gradual recognition of the need for inclusive financial solutions in Latin America and hence pushes the microinsurance market share in Latin America.

Middle East and Africa Microinsurance Market Drivers

The microinsurance industry in the Middle East and Africa is getting influenced by the increased awareness about financial security in the low-income population and an increased reach of digital platforms, which allow easy access to microinsurance products. Other factors include governmental programs for financial inclusion and poverty alleviation, much-needed improvement in distribution systems, and affordability through alliance between insurers and mobile network operators. With rising economic development and increasing middle-class segments, this market is bound to grow further. Collectively, these drivers promote the growth of microinsurance, covering financial protection for underserved communities throughout the region.

The global microinsurance market startups offer this insurance as an affordable, accessible insurance product to economically disadvantaged people. Startups are focusing on leveraging technology through mobile platforms and digital tools to enhance processes and reduce costs. In turn, they will bridge the protection gap by finding suitable solutions to provide the exact needs of the low-income and rural communities to obtain a greater number of beneficiaries and more sustainable impact.

BIMA, founded in 2010, uses mobile technology to provide microinsurance and health services across emerging markets in partnership with telecom companies, offering reasonable insurance products with access to healthcare, hence improving financial protection and health outcomes for underserved communities.

MicroEnsure, founded in 2002, specialises in microinsurance. It offers affordable insurance products in developing countries through strategic partnerships with leading mobile operators and local insurers, along with its product offering of health, life, and property cover to improve the financial security of poor families and small businesses.

Microinsurance key players in the microinsurance market are scaling up business through strategic partnerships with mobile network operators and local businesses to scale distribution channels. Players invest aggressively in technology for operational efficiency and cost reduction that creates affordability at scale. Microinsurance companies are opting for data analytics help in offering refinement and increased targeting of underserved populations, further refining market reach and operational efficiency.

Etiqa Life and General Assurance Philippines, Inc., established in 1962 with headquarters in Manila, offers various microinsurance products that can provide affordable protection to low-income Filipinos. Its microinsurance products include life, health, and accident insurances, which are designed specifically to improve the financial securities of the underprivileged communities.

SBI Life Insurance Company Limited, set up in 2000 and headquartered in Mumbai (Maharashtra), India, has developed micro-insurance products to cater to rural and low-income segments across the country. The product bouquet encompasses term life insurance and savings plans on the principle of maximum and affordable accessibility to increase the level of financial protection and inclusion.

AFP General Insurance Corporation, with its head office located in Quezon City, was established in 1959. Microinsurance products involve life and accident insurance for military personnel and their families. Their goal is to ensure that the specific needs of that particular segment of the population are met by providing affordable and easily accessible insurance services.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players profiled in the microinsurance market report are MIC Global and CLIMBS Life and General Insurance Cooperative, others.

August 2023

Igloo is an insurtech from Singapore that has made it its business to try and fix the generally low insurance penetration across Southeast Asia with its fresh approach. Coupled with proprietary technology, Igloo develops microinsurance products through strategic partnerships for underserved markets. These address emerging risks that traditional insurers have often fallen short on, positioning Igloo in very good stead for evolving regional needs.

January 2024

The Insurance Commission will give incentives to new players of microinsurance in Philippines to further develop the sector and ensure financial inclusion. It said it intends to further facilitate the creation of a more enabling environment through a reduction in regulatory obstacles and the facilitation of easier compliance as a means of encouraging greater market participation and penetration of affordable insurance products throughout the country.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2024, the global microinsurance market attained a value of nearly USD 82.87 Billion.

The market is projected to grow at a CAGR of 6.50% between 2025 and 2034.

The market is estimated to grow in the forecast period of 2025-2034 to reach about USD 155.56 Billion by 2034.

The major drivers of the market are the growing demand for affordable and customisable insurance schemes, rising disposable incomes, increasing population, growing prevalence of various lifestyle-related diseases, and the rising shift towards digitalisation with a focus on providing improved transparency to consumers.

The key trends guiding the growth of the market include the launch of peer-to-peer insurance models and the growing adoption of automated portfolio monitoring by companies engaged in microinsurance business.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Property insurance, health insurance, life insurance, index insurance, and accidental death and disability insurance are the major product types considered in the market report.

The different microinsurance providers in the market are microinsurance (commercially viable) and microinsurance through aid/government support.

Partner agent model, full-service model, provider driven model, and community-based/mutual model, among others, are the major model types of microinsurance.

The key players in the market are Etiqa Life and General Assurance Philippines, Inc., SBI Life Insurance Company Limited, AFP General Insurance Corporation, MIC Global, and CLIMBS Life and General Insurance Cooperative, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Provider |

|

| Breakup by Model Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Company Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share