Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico flat steel market reached a volume of around 18904.55 KMT in 2025. The market is projected to grow at a CAGR of 5.50% between 2026 and 2035, reaching a volume of nearly 32291.70 KMT by 2035.

Base Year

Historical Period

Forecast Period

As of May 2024, the average monthly crude steel production in Mexico stood at 1.34 MMT.

Galvasid S.A. de C.V., T A 2000, S.A. de C.V. (TYASA), and Outokumpu Oyj are a few of the major companies in the Mexico flat steel market.

Flat steel is 100% recyclable, which expands its applications in the production of consumer and industrial goods. In 2022, Mexico’s industrial production growth stood at 5.3%.

Compound Annual Growth Rate

5.5%

Value in KMT

2026-2035

*this image is indicative*

| Mexico Flat Steel Market Report Summary | Description | Value |

| Base Year | KMT | 2025 |

| Historical Period | KMT | 2019-2025 |

| Forecast Period | KMT | 2026-2035 |

| Market Size 2025 | KMT | 18904.55 |

| Market Size 2035 | KMT | 32291.70 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.50% |

| CAGR 2026-2035 - Market by Region | Yucatan Peninsula | 5.0% |

| CAGR 2026-2035 - Market by Region | Central Mexico | 4.4% |

| CAGR 2026-2035 - Market by Material Type | Stainless Steel | 6.2% |

| CAGR 2026-2035 - Market by Application | Automotive | 5.8% |

| 2025 Market Share by Region | Central Mexico | 35.0% |

Mexico has 14 free trade agreements (FTAs) with different nations, including the United States, Canada, Japan, and Australia, as well as the EU. The reduced tariffs and taxes on the transport of goods further create opportunities to position Mexico as a manufacturing and nearshoring hub. In 2022, the United States and Mexico traded goods worth USD 855.1 billion.

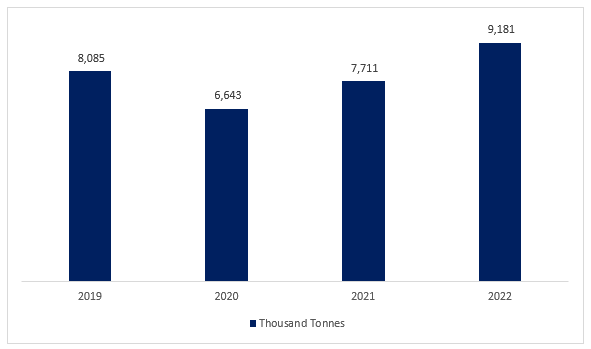

Figure: Flat Steel Production in Mexico (Thousand Tonnes), 2018-2022

One of the major factors driving the Mexico flat steel market growth is the expanding automotive sector. The country’s proximity to the United States, low labour and facility costs, and rising demand for cross-border logistics and automotive supply chain services are contributing to the expansion of automotive manufacturing in Mexico, aiding the demand for flat steel. Mexico is a significant producer of trucks, light vehicles, passenger cars, and auto parts. In 2023, Mexico produced 3.1 million commercial vehicles and 0.9 million passenger cars, a 14% increase compared to 2022.

Increasing flat steel demand in the automotive sector; thriving Mexico manufacturing sector; rising demand for low carbon steel; and the flourishing Mexico construction sector are favouring the Mexico flat steel market expansion

Flat steel is used in body panels and structural elements of automobiles owing to its durability and strength. In 2023, Mexico produced around 4 million vehicles, a 14% increase compared to 2022.

Mexico’s manufacturing sector is expanding due to the availability of low-cost skilled labour and its advantageous location for companies looking to outsource their manufacturing operations, driving the Mexico flat steel market.

Mexico has embraced modern steelmaking technologies, including the electric arc furnace (EAF) technology, which is well-known for its efficiency and recycling capacity, and the basic oxygen steelmaking (BOS) process, which involves injecting oxygen into molten iron to reduce carbon content.

Flat steel bars are essential in structural framing, offering strength and durability for long-lasting construction. Between 2023-2032, the Mexico construction sector is projected to witness an average annual growth of 2.8%, aiding the demand for flat steel.

Iron ore is an essential component of steel production. As of 2024, Mexico has 10 operational iron ore mines. Some of these mines are owned by key flat steel manufacturers, such as Ternium (Pena Colorada and Las Encinas), and ArcelorMittal (Las Truchas and San Jose Iron Ore).

Mexico is a major manufacturer of passenger vehicles, light vehicles, trucks, and auto parts. Flat steel is a crucial component in the production of auto parts, including doors, bonnet lids, bumpers, and other systems. By the end of 2024, automotive production in Mexico is expected to grow around 8% compared to 2023, totalling 4.1 million units. During 2020-2023, Mexico’s electronics manufacturing sector experienced 30% growth, contributing to flat steel demand due to its exceptional electrical resistivity. In August 2024, Bosch's BSH Division inaugurated its first appliance manufacturing plant in Nuevo Leon, Mexico. Construction of the plant began in July 2022 on a 430,000-square-meter site designed to meet the needs of the North American market. The factory has an annual production capacity of over 300,000 refrigerator units.

In the construction sector, flat steel is widely used for supporting and joining structural elements. It finds application in roofing, staircases, sheds, and welded structures. In H1 2023, Mexico’s construction sector grew by 29% year-on-year, supporting the Mexico flat steel market expansion. Flat steel bars are used in white goods to make the products safe, corrosion-resistant and long-lasting. Nuevo Leon is the hub of home appliances due to the presence of leading manufacturers, including Whirlpool Corporation, LG Corporation, Bosch GmbH, and Conair LLC.

The EMR’s report titled “Mexico Flat Steel Industry Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Material Type

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Region |

| Yucatan Peninsula | 5.0% |

| Central Mexico | 4.4% |

| Baja California | 4.2% |

| Northern Mexico | XX% |

| The Bajío | XX% |

| Pacific Coast | XX% |

By material type, carbon steel is expected to hold a significant market share due to its hardness and improved wear resistance.

Carbon steel is composed of carbon between 0.05 and 2.10% by weight and boasts corrosion-resistant and environmentally friendly properties. It is widely adopted in applications requiring strength and hardness, such as construction, engineering, agriculture, automotive manufacturing, and shipbuilding. Some of the major companies providing carbon steel in Mexico are ArcelorMittal México and Klöckner & Co SE.

Stainless steel is growing in demand in Mexico, particularly due to the growth of consumer goods, electronics and automotive sectors. Major industrial and commercial cities, such as Monterrey, CDMX and Guadalajara, are important demand centres for stainless steel. In July 2024, Stainless-steel supplier Prominox acquired the Mexican distribution business of Outokumpu, a Finnish steelmaker. The acquisition includes the large centres in Mexico City, Guadalajara and Monterrey.

Major players in the Mexico flat steel market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

Headquartered in Mexico and founded in 2005, Galvasid S.A. de C.V. serves the appliances, refrigeration, processors, automotive, construction, and general industries. Its product portfolio includes galvanised flat steels, including rolls such as Covering G30, G40, G60 and G90, tapes, and plain sheets.

Headquartered in Mexico and founded in 1985, T A 2000, S.A. de C.V. (TYASA) produces and markets four major product lines: Construction steel, Coated steel, Flat steel, and Special steel. The company offers various types of steel products under various categories such as black sheet, including non-slip sheet, hot foil, and cold sheet; and galvanised sheet and colo steel painted sheet.

Headquartered in Finland and founded in 1970, Outokumpu Oyj is the global leader in sustainable stainless steel, and bases its business on a circular economy, with over 90% of its production using recycled steel. Under its flat steel product portfolio, it offers cold rolled coil, strip and sheet, hot rolled coil, strip and plate, quarto plate, and precision strip.

Headquartered in Japan and founded in 1974, Nippon Steel Corporation is dedicated to advancing technologies and manufacturing excellence, contributing to society by delivering top-quality products and services. The company offers various ranges of flat steels including steel plate, stainless steel and steel sheets.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Mexico flat steel market include Acerinox, S.A., Grupo Simec SAB de CV, ArcelorMittal S.A., POSCO Co. Ltd., Hyundai Steel Co., Ltd, and Nucor-JFE Steel Mexico, S. de R.L. de C.V, among others.

Central Mexico is a prominent region due to the expanding automotive production in the region

In June 2024, Audi, the German carmaker announced its decision to invest USD 1.08 billion in electric vehicle projects in the Mexican state of Puebla. The government and Audi aim to make the region a hub for electric vehicles, significantly providing lucrative Mexico flat steel market opportunities.

In Northern Mexico, automotive manufacturing in Mexico is primarily located in the regions of Baja California, Sonora, Chihuahua, Coahuila, and Nuevo León. Some of the automotive companies with a presence in northern Mexico include Toyota, Stellantis, Daimler Freightliner and General Motors. In July 2024, Toyota witnessed a light vehicle production increase of 1.7% to 20,191 units compared to July 2022.

The rapid industrial development in the Bajio region aids the Mexico flat steel market growth. In May 2024, EMAG Group opened its new manufacturing unit in San Isidro Business Park in Querétaro, Mexico, showcasing the company’s commitment to the region. The new production facility covers an area of 2,880 m², including 1,800 m² of production space with 30 machine assembly stations.

In the Pacific Coast, the presence of the Chip Act and nearshoring are key factors driving the industrial development in Jalisco. A significant number of investments are carried out in the region, primarily in electronic component manufacturing (17% of total foreign direct investment) and the automotive sector (14%). Some companies chosen to locate in Jalisco are Flextronics (electronics manufacturer) and Jabil (electronics).

Weathering Steel Market

Stainless Steel Market

Structural Steel Market

Electrical Steel Market

South Korea Steel Market

Saudi Arabia Structural Steel Market

North America Stainless Steel Market

Europe Stainless Steel Market

Asia Pacific Stainless Steel Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market volume was nearly 18904.55 KMT.

The market is assessed to grow at a CAGR of 5.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach 32291.70 KMT by 2035.

The major drivers include the growth of the manufacturing and construction sectors and the presence of prominent iron ore mines in the country.

The key trends aiding the market development include the growing demand for low carbon steels and surging automotive manufacturing activities.

The different types of flat steel include carbon steel and stainless steel.

The major applications of flat steel include automotive, white goods and consumer durables, electrical equipment, and machinery, among others.

The major players in the market include Galvasid S.A. de C.V., T A 2000, S.A. de C.V. (TYASA), Outokumpu Oyj, Nippon Steel Corporation, Acerinox, S.A., Grupo Simec SAB de CV, ArcelorMittal S.A., POSCO Co. Ltd., Hyundai Steel Co., Ltd, and Nucor-JFE Steel Mexico, S. de R.L. de C.V, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Material Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share