Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico third-party logistics (3PL) market was valued at USD 20.44 Billion in 2025. The industry is expected to grow at a CAGR of 5.90% during the forecast period of 2026-2035. The region's growing auto and service industries are fueling demand for 3PL, as they need ways to derive efficiency from the supply chain through complex logistics and global distribution networks in multiple sectors. In turn, all these factors have resulted in the market attaining a valuation of USD 36.26 Billion by 2035.

Base Year

Historical Period

Forecast Period

Mexico has a developing e-commerce sector. A recent article by Centre For Strategic & International Studies stated that e-commerce in Mexico represents 15 percent of overall retail sales, a substantial increase from 10 years earlier, when that figure stood at only 1 percent. Online sales in Mexico were $74 billion in 2023 and are predicted to have reached about $100 billion in 2024 and $176.8 billion by 2026. This is building demand for third-party logistics (3PL) providers with the objective of quicker delivery to satisfy customer convenience and efficient supply chains at a lower cost.

With manufacturers relocating operations near the United States, Mexico's geographical location has placed its 3PL industry as a significant contributor, offering integrated solutions that satisfy the needs of a global supply chain. This has further boosted the Mexico third-party logistics market growth.

Mexican 3PLs are integrating AI and automation into their processes to improve operational efficiency, providing B2B clients with real-time tracking, predictive analytics, and smoother inventory management to help logistics operations run smoothly.

Compound Annual Growth Rate

5.9%

Value in USD Billion

2026-2035

*this image is indicative*

With the growing cross-border trade and the industrial expansion, the Mexico 3PL market is seeing significant growth. Key trends that are observed in the market include the growth of omnichannel logistics as 3PLs partner with both bricks-and-mortar and digital retail, and the implementation of green logistics practices to minimize environmental impact. Mexico’s robust transportation infrastructure, including its ports and highways, also works in the market’s favor. Industry giants including DHL, FedEx and XPO Logistics are increasingly offering warehousing, distribution, and supply chain management. With growing demand for customized solutions, these players are broadening their service portfolio to cater to various industry sectors.

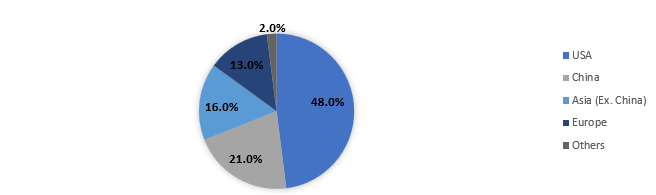

Figure: Nearshoring Demand by Area of Origin; 2023

The automotive and textile industries are two of the key niches driving high demand in the Mexico 3PL market. Building cars requires efficient supply chain management to track the movement of parts and components between production facilities. As a result, the demand for specialized logistics services, such as just-in-time delivery and cross-border transportation, has also increased. Mexico’s proximity to the United States and low labor costs, meanwhile, redound to the textile industry’s advantage. Moreover, as demand for fast fashion and apparel increases, 3PL providers are becoming increasingly willing to guide the textile supply chain with flexible warehousing, distribution and fulfillment services.

E-commerce boom, nearshoring, technological advancement, and sustainable practices fuel the Mexico third-party logistics industry, with firms shifting towards omnichannel logistics, automation, and greener solutions for greater efficiencies.

The demand for third-party logistics in Mexico with capacity for omnichannel logistics has been on the rise with e-commerce growth. Retailers now need an integrated experience between stores and online. 3PLs like DHL and FedEx offer complete solutions, from warehousing to last-mile delivery, bringing timely and cost-effective fulfillment. In addition, local 3PLs help retail giants like Amazon manage their network of fulfillment centers, they have specific responsibilities in this process which help optimize delivery times between the fulfillment center and the customer, to deliver the best consumer experience.

As nearshoring takes hold, increasing numbers of companies are moving their manufacturing operations to Mexico in a bid to mitigate supply chain risk. This opens up huge potential for 3PL's in the cross-border trade segment, boosting the Mexico third-party logistics market revenues. XPO Logistics is one of many companies pursuing this deployment of seamless logistics from Mexico to the United States. The growth in transportation and warehousing demands has led 3PLs to offer customized offerings to simplify customs and border clearance, enhancing cross-border trade efficiency.

Technologies such as AI, IoT and automation are increasingly being used by 3PL providers to improve efficiency and optimize supply chains, thereby shaping the Mexico third-party logistics market dynamics. Real-time tracking, vast inventory management, and predictive analytics to boost decision-making capabilities offered by automated warehousing systems are being adopted by companies such as Kuehne + Nagel. AI-based systems assist in optimizing routes and minimizing delivery durations, whereas IoT facilitates enhanced monitoring of goods at every stage of supply chain ensuring transparency and improving real time operational efficiency.

The need to go green in logistics drives the adoption of green solutions in the third-party logistics market in Mexico. Electric vehicles, sustainable packaging and route optimization companies are making efforts to reduce their carbon footprint organizations such as Grupo TMM are making investments in energy-efficient fleets, and in product offerings and services that are friendly to the environment. The companies that make this transition are not only satisfying regulatory demands but are aligning with global environmental mandates and are giving themselves a competitive edge in an increasingly eco-conscious marketplace.

Expansion of cold chain logistics and increased demand for last-mile delivery solutions are two key growth opportunities in the Mexico third-party logistics market for companies. With Mexico’s food and pharmaceutical sectors expanding, there’s a greater demand for specialized cold chain services that ensure product integrity in transit. Moreover, the expansive transition towards urbanization and e-commerce has resulted in a high demand for last mile services, especially in urban areas. Temperature-controlled infrastructure investment and innovative delivery models can take advantage of these trends to provide more efficient and reliable logistics solutions in partnership with these companies to meet specific regional market needs.

Growth in the Mexico third-party logistics market is expected to be driven by the automotive sector and increasing consumer demand for faster delivery services. Mexico's automotive sector is expanding quickly, demanding advanced logistics services for parts distribution and just-in-time delivery, presenting opportunities for 3PL providers. Moreover, the growth of e-commerce with evolving consumer expectations for quick and reliable deliveries is putting pressure on 3PL companies to improve their last-mile delivery and distribution networks. This transformation is fueling new innovations across warehousing, transportation, and order fulfillment services that will allow businesses to efficiently meet demand throughout the region.

“Mexico Third-Party Logistics (3PL) Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Service

Market Breakup by End Use

Market Breakup by Region

Market Insights by Services

Key e-commerce platforms in Mexico, including Mercado Libre, Amazon, and Walmart use 3PL services. The expansion of e-commerce in Mexico provides a boost to value-added warehousing services including packaging, kitting, returns, and warranty management. Domestic and international transportation management uses sophisticated technology, including predictive data to effectively manage thousands of shipments across different carriers and transportation modes. This has majorly boosted the Mexico third-party logistics market growth. The use of geolocation technologies allows customers to track merchandise in real-time. In July 2023, GEODIS unveiled a new multi-user warehouse and distribution center in Mexico City to support omnichannel operations, including e-commerce, retail, and wholesale. Pallet racking for simple inventory movement, a mezzanine for enhanced capacity and operational flexibility are some of the features of this new omnichannel warehouse.

Analysis by End Use

Mexico has emerged as a preferred location for global companies looking to establish manufacturing facilities outside Asia, thereby accelerating the Mexico third-party logistics market value. Proximity to markets is a key advantage for the food and beverage industry, allowing businesses to efficiently reach new markets without significant transportation costs. Nearshoring to Mexico can benefit businesses dealing with perishable goods, ensuring quality and freshness. Mexico's automotive manufacturing sector, hosting major players like Fiat Chrysler, Ford, GM, and Toyota, has been pivotal in its economy. As South America's leading automotive manufacturer, it produces nearly 4 million units annually of which, over 80% is exported. Companies are capitalizing on shelter corporations and the IMMEX Program, allowing duty-free importation of raw materials. The growth in electronic manufacturing is attributed to the rising number of available engineers and design specialists.

Central Mexico Third-Party Logistics (3PL) Market Trends

The region boasting of Mexico City and Querétaro as industrial focal points, the demand for third-party logistics services in Central Mexico has grown to be substantial. As the region is connected to major highways and key markets, it enhances logistics capabilities and drives the demand for warehousing and transportation solutions.

Northern Mexico Third-Party Logistics (3PL) Market Insights

The Northern Mexico third-party logistics market covers cities like Monterrey and Tijuana, which are in close proximity to the United States border and is crucial for cross-border trade. The increase in nearshoring as businesses shift manufacturing operations to reduce supply chain risk has driven strong demand for 3PL services, from customs handling to transportation management.

Pacific Coast Third-Party Logistics (3PL) Market Drivers

The Pacific Coast third-party logistics market with ports like Manzanillo operate, has become a vital part of Mexico’s import/export process. With globalization, the 3PL market controls international shipments, cargo handling, and warehousing, as well as operations in busy coastal hubs to improve sea freight efficiency.

The Bajío Third-Party Logistics (3PL) Market Outlook

The Bajío region is a hot spot for growing demand for third-party logistics services given its automotive and manufacturing industries. As numerous international automakers establish operations in cities like León and Silao, there is an increasing demand for fast and efficient logistical solutions such as parts shipping, distribution, and inventory management in this industrial hub.

Yucatan Peninsula Third-Party Logistics (3PL) Market Dynamics

With the rise of tourism, agriculture and infrastructure development, the Yucatán Peninsula third-party logistics market is gaining huge momentum. As more attention is being given to distribution networks, 3PL providers are leveraging the region’s strategic position to provide logistics solutions to the supply of goods into Mexico and Central America.

Baja California Third-Party Logistics (3PL) Market Drivers

Due to its proximity to California, Baja California boasts an increasing third-party logistics demand that is mainly driven by cross-border trade. With strongly developed electronics, automotive and manufacturing sectors, the region has a demand for logistics providers providing transportation, warehousing and just-in-time inventory management, making it a key market for 3PL growth.

Mexico third-party logistics (3PL) market players are increasingly aiming to boost their operational efficiency, expanding technological capabilities, and offering customized solutions to meet diverse industry needs. Most of the Mexico third-party logistics companies are focusing on optimizing cross-border logistics, providing end-to-end supply chain management, and improving last-mile delivery.

Deutsche Post AG, established in 1969, with its head office located in Germany, provides logistics and related services under its divisions, namely Express; Global Forwarding, Freight; eCommerce; Post & Parcel Germany; and Supply Chain.

Founded in 2011, Groupo Traxión, SAB de CV, is based in Mexico City. The company provides logistics services under 8 business areas which are fright, integrated logistics, warehousing, logistics systems, passenger transportation, special services, moving (national and international services), and advertising (encompassing custom transportation services for promotional and marketing campaigns).

Established in 1935 and based in Wisconsin, United States, Schneider National, Inc. provides logistics solutions, dedicated, bulk, transportation management, long-haul trucking, warehousing, and more.

Founded in 2007 and headquartered in France, CEVA Logistics is a leading global supply chain management company, providing end-to-end design, implementation, and operational services in freight forwarding, contract logistics, and transportation management.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the Mexico third-party logistics (3PL) market include WH Forwarding SA de CV, Kuehne + Nagel International AG, Ryder System, Inc, Penske Truck Leasing Co., L.P, GXO Logistics, Inc, among others.

Third-Party Logistics (3PL) Market

Germany Third-Party Logistics (3PL) Market

Chile Third-Party Logistics (3PL) Market

India Third-Party Logistics (3PL) Market

Singapore Third-Party Logistics (3PL) Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The Mexico 3PL market attained a value of USD 20.44 Billion in 2025.

The market is estimated to grow at a CAGR of 5.90% during 2026-2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of USD 36.26 Billion by 2035.

The market is being driven by the increase in demand by companies to outsource logistics services related to inventory management and product distribution and increasing trade activities between Mexico and the United States.

The key trends aiding the market expansion include the rise in demand for third-party logistics due to an increase in national and international trade and the surging awareness regarding the cost-saving and flexibility benefits of 3PL.

The key Mexican markets for 3PL are the Central Mexico, Northern Mexico, The Bajío, Pacific Coast, Yucatan Peninsula, and Baja California.

The various end uses considered in the market report are food and beverage, automotive, consumer and retail, IT and telecom, healthcare, energy, and others.

The major players in the market are Deutsche Post AG, Grupo Traxión, SAB de CV, CEVA Logistics SA, Schneider National, Inc., WH Forwarding SA de CV, Kuehne + Nagel International AG, Ryder System, Inc, Penske Truck Leasing Co., L.P, GXO Logistics, Inc, among others.

The various services considered in the market report are Domestic Transportation Management, International Transportation Management, and Value Added Warehousing and Distribution.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Service |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share