Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

The global media planning and buying market size was valued at USD 478.07 Billion in 2024. The market is further expected to grow at a CAGR of 4.00% in the forecast period of 2025-2034, to reach USD 707.66 Billion by 2034.

Base Year

Historical Year

Forecast Year

Value in USD Billion

2025-2034

Media Planning and Buying Market Outlook

*this image is indicative*

Media planning is the mechanism by which advertisers decide where, when, and how often an advertisement is screened to optimise engagements and return on investments (ROI). The media strategy may divide advertisement spending and resources among different online and offline platforms, such as broadcast, print, paid ads, video ads, or native content. Media buying refers to the purchase of advertising from a media company such as a television station, a newspaper, a magazine, a blog, or a website. It also involves negotiating the price and placement of advertisements and researching the best locations for ad placement.

The global media planning and buying market is expected to grow at a significant rate in the coming years, due to several factors. One of the key drivers of media planning and buying market growth is the increasing demand for personalised and relevant content across different media platforms and devices. The rising adoption of digital and social media, especially among the younger generation, is also favourably shaping the media planning and buying market outlook.

Increased digitalisation and data-driven marketing, emergence of new technologies, and expansion of influencer marketing are boosting the media planning and buying market growth

| Date | Company | Event |

| February 2024 | Introduced a Media Planning API, allowing agency partners to access data directly from the platform to enhance ROI. | |

| October 2022 | WPP | Acquired remaining 26% stake in MediaCom Communications Private Limited in India, marking the completion of an initial agreement dating back to 2008. |

| April 2022 | Horizon Media | Introduced eMbrace, a customised software and data solution powered by Nielsen that improves cultural equity in media planning and communications. |

| August 2021 | The Stagwell Group | Announced the successful combination of Stagwell Marketing Group Holdings LLC and MDC Partners Inc., forming Stagwell Inc, a publicly traded media company. |

| October 2020 | Publicis Groupe | Appointed by E.ON as its media and performance partner across 8 major European markets, covering full media duties and additional performance marketing responsibilities in Germany and Sweden. |

| Trends | Impact |

| Increased digitalisation and data-driven marketing | Media planners and buyers need to leverage data and analytics to optimise campaigns across multiple channels and measure their effectiveness and ROI. |

| Growing demand for personalised and engaging content | Media planners and buyers now create and deliver relevant and tailored messages to target audiences and use interactive formats to enhance user experience and loyalty. |

| Rising importance of social media and influencer marketing | Media planners and buyers are collaborating with influential social media personalities and celebrities and leveraging their reach and credibility to amplify brand awareness and advocacy. |

| Emergence of new technologies and innovations | Introduction of artificial intelligence, machine learning, blockchain, and augmented reality has enhanced the media planning and buying process and capabilities and can lead to media planning and buying market development. |

The expansion of media planning and buying market size depends on the growth of advertising market, which is being supported by the digital channels due to the increasing presence of social media. The growing penetration of mobile phones also contributes to the expansion of overall digital advertisement spending. In the forecast period, many key players are likely to allocate higher shares of their advertising media budgets for mobile advertising because of its appeal, especially to the younger generation. Additionally, the intensifying competition in the market leads to the emergence of new brands, which raises the total advertising spending across industries.

Furthermore, the migration of consumers from television to online videos creates the demand for media planning and buying. The shift in the advertising budget from traditional to non-traditional media channels, growing focus on emerging markets, and cross-screen planning are some of the main media planning and buying trends in the market.

Other drivers include the use of artificial intelligence (AI) for media planning and buying and the rising location-based and technology-based media planning and buying, among others. Additionally, top players like WPP and Publicis are enhancing their digital capabilities by acquiring niche players in the market, which can result in higher media planning and buying market value.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global Media Planning and Buying market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:

Market Breakup Type

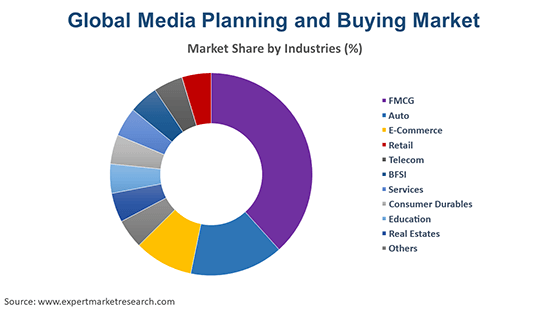

Market Breakup by Industries

Market Breakup by Region

Digital media are expected to hold significant market share as more consumers and businesses now adopt digital technologies and platform

Digital media refers to the online and interactive forms of advertising and marketing, such as websites, social media, mobile apps, email, video, etc. Digital media offers many advantages over traditional media, such as lower costs, greater reach, more personalisation, and better analytics. Digital media is growing rapidly in terms of media planning and buying market share and revenue, as more consumers and businesses now adopt digital technologies and platforms.

Traditional media refers to the conventional forms of advertising and marketing, such as television, radio, newspapers, magazines, billboards, etc. However, as per media planning and buying market analysis, traditional media is still widely used by many businesses and organisations to reach their target audiences, especially in regions where internet penetration and digital literacy are low. However, traditional media also faces challenges such as high costs, limited measurement, and declining effectiveness.

Increased expenditure on media planning by FMCG industries to create brand awareness is bolstering the media planning and buying market growth

The fast-moving consumer goods (FMCG) industry is one of the largest spenders on media planning and buying, as it relies heavily on advertising to create brand awareness and loyalty among consumers. The e-commerce industry is a fast-growing and dynamic sector that relies on media planning and buying to attract and retain customers. According to media planning and buying market report, the growth drivers for this industry include internet penetration, smartphone adoption, online payment systems, and rise of social media.

The telecom industry is expected to hold a substantial media planning and buying market share in the forecast period as the telecommunications industry uses media planning and buying to communicate its offerings and enhance its brand image. The industry is further growing due to 5G network deployment, use of internet of things (IoT), and emergence of cloud computing and artificial intelligence. The key media channels for telecom are digital, TV, print, radio, and outdoor.

The banking, financial services, and insurance (BFSI) industry is a complex and regulated sector that uses media planning and buying to build trust and loyalty among its customers. The education segment in media planning and buying market is a sector that provides learning and training services to various segments of society such as students, professionals, and organisations. The education industry is utilising media and planning to share announcements, hold live lectures, create connections with students, and engage parents in school activities.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market participants are focused on expanding their international presence by engaging in mergers and acquisitions to provide new media and advertising solutions

| Company Name | Year Founded | Headquarters | Products/Services |

| Starcom Worldwide, Inc. | 1998 | Chicago, United States | Media planning and buying, digital marketing, data analytics, content creation, etc. |

| MediaCom | 1986 | London, United Kingdom | Media strategy, planning and buying, content marketing, digital media, etc. |

| Carat | 1968 | Paris, France | Integrated media planning and buying, digital media, performance marketing, etc. |

| Vizeum | 2003 | London, United Kingdom | Media planning and buying, digital media, innovation, consumer insights, etc. |

| Horizon Media | 1989 | New York, United States | Media planning and buying, brand strategy, social media, experiential marketing, etc. |

Other key players in the global media planning and buying market include WPP plc, Omnicom Group Inc., Publicis Groupe, Interpublic Group (IPG), Havas Group, Dentsu Inc., Hakohodo DY Holding Inc., Mindshare Worldwide, MDC Partners Inc., and Acxiom LLC, among others.

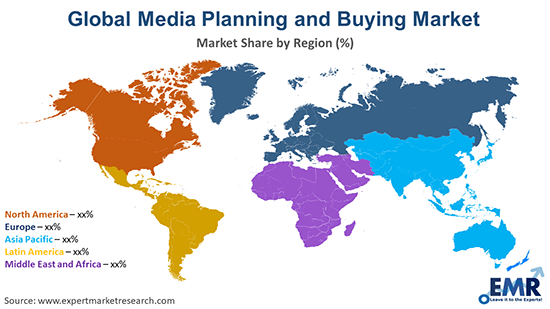

North America is one of the significant regional markets for media planning and buying due to robust advertising expenditures and presence of leading media agencies

According to media planning and buying market report, North America has the largest market for media planning and buying due to the high penetration of digital media, the advanced technology and infrastructure, the large and diverse population, and the presence of leading media agencies and advertisers in the region. Some of the key trends in the North American media planning and buying market are the shift from traditional to digital media, especially in the areas of social media, video, mobile, and advertising; the adoption of data-driven advertising, which leverages data analytics, artificial intelligence, and machine learning; the emergence of new media platforms and formats, such as connected TV, streaming services, podcasts, and influencer marketing; and the challenges of privacy, which require the media planners and buyers to comply with General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

Asia Pacific is the fastest-growing market for media planning and buying due to the rapid economic development and the increasing internet and mobile penetration. Some of the key trends in the Asia Pacific media planning and buying market are the dominance of digital media, especially in the areas of mobile, social, e-commerce, and gaming; the diversity and fragmentation of the media landscape, which varies by country, culture, and language; and the growth of local and niche media content, such as Bollywood, K-pop, anime, and esports, which cater to the specific tastes and preferences of the region.

Europe also holds a significant share in media planning and buying market due to the high level of media literacy, the strong media regulation, and the presence of established media agencies and advertisers in the region. Some of the key trends in the European media planning and buying market are the consolidation of the media industry, which leads to the formation of large and integrated media groups, such as Publicis, WPP, and Dentsu; emergence of new media players, such as Netflix, Amazon, and Spotify, and the implication of the media regulation, which affects the media planning and buying strategies and practices, such as the GDPR, the ePrivacy Directive, and the Digital Services Act.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2024, the media planning and buying market reached an approximate value of USD 478.07 Billion.

The market is expected to grow at a CAGR of 4.00% between 2025 and 2034.

Media planning and buying is the process of designing, negotiating, and executing a strategic plan to reach a target audience through various media channels. Media planning and buying involves selecting the best media platforms, formats, and placements to achieve the campaign objectives and optimise the return on investment. It is done by agencies, advertisers, or media owners.

The major market drivers include rising disposable incomes, increasing population, growing screen time, lower data rates in emerging economies, and the rising demand for personalised and data-driven advertising.

Key trends aiding media planning and buying market expansion include the addition of new screens and applications that complement television, the shift towards online video, and the surging digital advertising spending.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Traditional and digital are the major types of media planning and buying in the market.

FMCG, auto, e-commerce, retail, telecom, BFSI, services, consumer durables, education, and real estate, among others, are the leading industries of media planning and buying in the market.

Media planning involves determining the best combination of media channels to achieve campaign objectives, while media buying focuses on negotiating and purchasing ad placements on those selected channels.

Key players in the market are Starcom Worldwide, Inc., MediaCom, Carat, Vizeum, Horizon Media, WPP plc, Omnicom Group Inc., Publicis Groupe, Interpublic Group (IPG), Havas Group, Dentsu Inc., Hakohodo DY Holding Inc., Mindshare Worldwide, MDC Partners Inc., and Acxiom LLC, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup Type |

|

| Breakup by Industries |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share