Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global lithium compound market reached a volume of 430171.97 Tons in 2025. Innovations in battery technology, including improved energy density, faster charging capabilities, and longer lifespans are supporting the product demand. The industry is expected to grow at a CAGR of 7.50% during the forecast period of 2026-2035 to reach a volume of 886598.00 Tons by 2035. The rapid adoption of electric vehicles (EVs) has significantly increased demand for lithium-ion batteries, driving up the need for lithium compounds.

Base Year

Historical Period

Forecast Period

The Economic Commission for Latin America and the Caribbean stated in 2021 that Argentina contains 21.5% of the global lithium resources. With increased global demand for electric vehicles and renewable energy storage, Argentina’s significant lithium reserves position it as a crucial supplier, driving growth in the lithium compound market for battery production.

Australia’s position as the leading producer of lithium globally supports the lithium compound market by ensuring a steady supply of raw material for battery production. As the demand for electric vehicles and renewable energy storage grows, Australia’s dominant role in lithium extraction strengthens the market for lithium compounds, driving innovation and investment in battery technologies worldwide.

The European Automobile Manufacturers Association reported an 8.5% rise in U.S. car production in 2023, totaling 7,629,525 units, up from 7,033,378 units in 2022. This supports the lithium compound market by driving increased demand for lithium-ion batteries used in electric vehicles (EVs). As car manufacturers produce more vehicles, especially EVs, the need for lithium compounds grows, further bolstering the market for battery materials.

Compound Annual Growth Rate

7.5%

Value in Tons

2026-2035

*this image is indicative*

Lithium is a soft, silvery-white alkali metal found in compounds such as petalite and spodumene. Present in small quantities in nearly all igneous rocks and the waters of various mineral springs, lithium compounds have a wide range of applications, from plastics and synthetic rubber to textile dyes, fueling lithium compound demand. Global lithium production has tripled from 2010 to 2020, with forecasts suggesting an 18–20-fold increase in demand by 2050.

Lithium compounds play a vital role in battery technology, supplying lithium-ion batteries for electronics and electric vehicles, which boosts lithium compound market revenue. They also improve the strength and thermal resistance of glass and ceramics, while lithium grease acts as a high-performance lubricant in machinery and automotive uses, enhancing efficiency and longevity. In July 2024, International Battery Metals (IBAT) introduced a new lithium filtration technology in Utah, aiming to utilise its direct lithium extraction (DLE) method to produce nearly 5,000 metric tons of lithium annually.

The rapid adoption of electric vehicles (EVs) has significantly increased demand for lithium-ion batteries, driving up the need for lithium compounds. Additionally, the rising demand for energy storage solutions, especially from renewable sources like solar and wind, has further boosted the utilisation of lithium batteries, fueling lithium compound market growth. In August 2024, Hyundai introduced a new lithium-ion battery tailored for electric vehicles, boasting increased energy density and quicker charging times. This advanced battery is intended to enhance the driving range and performance of Hyundai’s forthcoming EV models.

The lithium compound market dynamics and trends are being influenced by technological advancements in battery technology. Improvements in energy density and charging speed have resulted in increased investment in lithium compounds, making them more attractive for various applications. Concurrently, major lithium producers are expanding operations and adopting new extraction and processing methods to improve efficiency and sustainability in response to rising demand. In September 2024, Lake Resources launched a lithium extraction project in Argentina using direct lithium extraction (DLE) technology, aiming to boost production efficiency and meet rising global demand for EV batteries.

Growing demand for electric vehicles, advancements in battery technology, and emphasis on sustainability in lithium extraction processes are some of the key trends boosting the market growth.

The lithium compound market is experiencing significant growth driven by the surge in electric vehicle adoption. As global efforts to reduce carbon emissions intensify, automakers are increasing production of EVs, which rely heavily on lithium-ion batteries. This trend is expected to continue, with analysts predicting a substantial rise in EV sales over the coming years. Consequently, demand for lithium compounds will escalate, prompting further investment in extraction and processing technologies to meet the needs of the automotive industry. This shift not only enhances lithium compound market opportunities but also encourages advancements in battery technology. Electric car sales approached 14 million in 2023, with 95% occurring in China, Europe, and the United States, according to the International Energy Agency. This surge brought the global electric car stock to 40 million, aligning with the Global EV Outlook 2023 forecast. The year-on-year increase was 35%, with 3.5 million more electric cars sold than in 2022.

Innovations in battery technology, including improved energy density, faster charging capabilities, and longer lifespans, are reshaping the lithium compound market. These advancements make lithium-ion batteries more efficient and appealing for various applications, including consumer electronics and renewable energy storage. As manufacturers develop next-generation batteries, the focus on enhancing lithium compounds to meet performance demands will intensify. This trend fosters greater investment in research and development, driving competition among producers and ultimately benefiting consumers with better battery options. The emphasis on technological innovation is crucial for sustaining growth in the lithium compound industry. In September 2024, Panasonic Energy Co., Ltd. announced the completion of preparations for mass production of 4680 cylindrical automotive lithium-ion batteries at its revamped Wakayama factory. This new cell format offered five times the capacity of the 2170 cell, enhancing EV performance and reducing production costs.

There is a growing emphasis on sustainability in lithium extraction processes, responding to environmental concerns associated with traditional mining practices. Companies are increasingly adopting direct lithium extraction (DLE) technologies, which promise to reduce water usage and minimize land disruption. These methods not only improve efficiency but also align with global sustainability goals. As consumers and regulators demand greener practices, the shift toward sustainable extraction will become a defining trend in the lithium compound market. This focus on eco-friendly practices can enhance brand reputation and attract investment, further driving lithium compound demand growth. In October 2024, Piedmont Lithium launched its new facility for sustainable lithium extraction in North Carolina. This facility utilises advanced methods to lower carbon emissions and minimize water usage in the lithium production process.

The growing demand for consumer electronics, particularly smartphones, laptops, and tablets, is a significant driver of the lithium compound market. According to the International Data Corporation (IDC), are forecast to grow 6.2% year-over-year in 2024 to 1.24 billion units, marking a steady increase driven by technological advancements and growing consumer interest. Similarly, the demand for laptops and tablets surged in recent years due to remote working and learning trends. These devices rely on lithium-ion batteries, which require high-quality lithium compounds for efficient energy storage and longevity. The need for compact, lightweight, and long-lasting batteries is pushing manufacturers to seek out high-performance lithium compounds. This increasing reliance on lithium-ion batteries across consumer electronics continues to provide robust growth opportunities for the lithium compounds market.

The expansion of the lithium supply chain is a critical factor driving the growth of the market. Increased investments in lithium mining and refining, particularly in lithium-rich regions like South America’s "Lithium Triangle" (which includes Argentina, Bolivia, and Chile), are meeting the rising global demand for lithium. Latin America which includes Bolivia, Argentina, and Chile account for around 60% of identified lithium. According to the U.S. Geological Survey (USGS), identified lithium resources rose from 53 million tons in 2018 to 89 million tons in 2022.

Argentina accounts for at least four active lithium operations, while two more are expected to reach production by the end of the year and at least 40 additional mines are in the various stages of construction. Additionally, major companies such as Albemarle and SQM have ramped up investments in lithium extraction and refining to cater to the booming demand from electric vehicles and renewable energy storage systems. This supply chain expansion is crucial for meeting the growing need for lithium compounds, ensuring market stability and facilitating future growth.

The lithium compound market faces several key restraints. Environmental concerns surrounding extraction and processing can lead to regulatory hurdles and community opposition, increasing costs. Supply chain challenges from geopolitical tensions and trade restrictions create price volatility.

High production costs deter new entrants, limiting competition and innovation. Additionally, emerging battery technologies may threaten lithium demand, while limited availability of high-quality lithium resources complicates project development and increases competition for existing supplies, potentially hindering overall growth in the lithium compound market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Lithium Compound Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

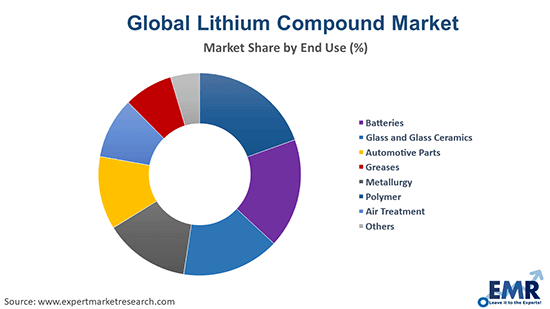

Market Breakup by End Use

Market Breakup by Region

Market Analysis by Type

Lithium metal is recognized for its high energy density, making it an excellent choice for electric vehicles (EVs) and portable electronics, resulting in longer battery life and greater driving range. As per the lithium compound market analysis, the market is driven by its lightweight characteristics, which greatly decrease the overall weight of batteries, improving efficiency and performance. Moreover, lithium metal batteries facilitate rapid charging, enhancing user convenience. They also offer an increased cycle life compared to traditional lithium-ion batteries, which minimises the need for frequent replacements and promotes overall sustainability in energy storage solutions. In August 2024, SES AI Corporation successfully passed safety tests for its 100Ah lithium-metal batteries under China's GB38031-2020 Electric Vehicles Traction Battery Safety Standard. The tests covered overcharging, discharging, short circuits, heating, temperature cycling, and crushing, confirming the batteries safety for automotive applications.

Lithium chloride plays a vital role in various industrial processes, particularly in the production of lithium-ion batteries, thereby enhancing their performance. Its effective desiccant properties enable it to absorb moisture from the air, making it valuable for humidity control and drying applications. Furthermore, lithium chloride is an important reagent in chemical synthesis, aiding in the production of various lithium compounds used in pharmaceuticals and related fields. Its relatively low toxicity makes it safer to handle, fostering a more sustainable manufacturing approach and contributing to the lithium compound industry revenue. In April 2024, Vulcan Energy Resources began producing climate-neutral lithium chloride at its Landau, Germany plant, marking Europe’s first lithium production. The Upper Rhine Valley holds Europe’s largest geothermal and lithium resource, with extraction efficiencies reaching 95% using Direct Lithium Extraction by Adsorption.

Market Analysis by End Use

Lithium compounds improve the mechanical strength and thermal resistance of glass and glass ceramics, making them suitable for high-performance applications such as windows and cookware. By lowering melting points, lithium enables energy savings and the creation of intricate designs. It also improves chemical durability, increasing the glass's resistance to weathering and chemical exposure. Lithium-based products are generally lighter than conventional glass, leading to weight reduction in various architectural and automotive applications, which fuels the growth of the lithium compound market. In April 2024, Schott AG launched its new lithium-containing glass ceramics targeted at the automotive industry. These materials are designed to offer excellent heat resistance and lightweight characteristics, improving vehicle safety and performance. Schott's innovation highlights the increasing demand for advanced materials in contemporary automotive design.

Lithium compounds are essential for producing lightweight and durable materials in automotive applications, which enhance vehicle performance and fuel efficiency. They offer excellent corrosion resistance, prolonging the lifespan of automotive components and reducing maintenance expenses. Lithium's thermal stability allows components to endure high temperatures, ensuring reliability in essential systems such as engines and brakes.

Moreover, lithium enables the development of innovative composite materials, driving progress in automotive design and sustainable manufacturing practices, thus impacting the demand of the lithium compound market. In January 2024, LG Energy Solution announced its equity investment in Sion Power, an Arizona-based startup with key patents in lithium metal battery technology. These batteries use a lithium metal anode for improved energy efficiency, though development has faced challenges, such as dendrite formation, which affects battery life and stability.

Europe Lithium Compound Market Analysis

Europe is witnessing a notable increase in the lithium compound demand, particularly in Germany, Italy, and France. Discoveries of lithium deposits in Germany and Portugal are decreasing import reliance and strengthening supply chain security, while supportive government policies are promoting battery production and renewable energy in Europe. In September 2024, AMG Lithium opened Europe’s first lithium refinery in Bitterfeld-Wolfen, Germany, at a cost of €140 million. The plant will produce 20,000 tonnes of lithium hydroxide annually, sufficient for 500,000 electric vehicles.

North America Lithium Compound Market Trends

The North American lithium compound market value is poised for significant growth, driven by leading brands like Albemarle Corporation, Livent Corporation and Piedmont Lithium. The growing electric vehicle market in North America boosts demand for lithium-ion batteries, while untapped lithium resources in regions like Nevada and North Carolina enhance supply chain security and reduce import reliance. The North American Lithium Complex (NAL) in La Corne, Quebec, features an open-pit mine, a refinery, and a facility capable of processing 3,800 tons of ore daily, making it the largest hard rock lithium producer in North America.

Asia Pacific Lithium Compound Market Insights

In China, brands such as Tianqi Lithium Corporation, Ganfeng Lithium and China Lithium Corporation (CLIC) highlight the growing lithium compound market share in the Asia-Pacific region. The Asia-Pacific region benefits from abundant lithium resources, especially in Australia and China, while government support through policies and incentives enhances clean energy production and usage. In March 2023, Tianqi Lithium announced an expansion of its lithium hydroxide production capacity to meet rising electric vehicle demand.

Latin America Lithium Compound Market Analysis

Key markets in the region include Brazil, Mexico, and Argentina, where there is significant demand for lithium compound market. According to the 2023 report by the U.S. Geological Survey, Argentina possesses 20.55% of the global brine lithium resources, establishing itself as a major contender in the international lithium industry.

Middle East and Africa Lithium Compound Market Driving Factors

The African lithium compound market is experiencing growth, particularly in Egypt, Ethiopia, and Morocco. Africa's significant lithium deposits, especially in Zimbabwe, Namibia, and South Africa, attract local and international investment, boosting exploration and production in the lithium market. In July 2024, Argus launched two lithium spodumene prices based on southern Africa. Several producers in Zimbabwe, the DRC, Namibia, and South Africa began output, enhancing Africa's role in the global lithium market.

Innovative startups in the lithium compound market offer numerous benefits, including advanced extraction technologies that improve efficiency and reduce environmental impact. They emphasize sustainability through recycling and waste reduction, and their flexibility allows for customized solutions. Increased competition fosters innovation and lowers costs. Additionally, collaborations with established firms enhance research and development, while job creation supports local economies. Lastly, new entrants diversify the supply chain, enhancing supply security in the growing lithium market, ultimately driving growth and sustainability.

American Battery Technology Company (2022): This startup is focused on lithium-ion battery recycling and resource recovery. They aim to create a circular economy by recycling used batteries to recover valuable lithium and other metals, reducing the need for new raw materials.

Green Lithium (2023): Based in the United Kingdom, Green Lithium is working on establishing a sustainable lithium hydroxide refinery. Their goal is to reduce the carbon footprint of lithium production while supporting the growing demand for battery-grade lithium in Europe.

Key players in the specialty chemicals market, particularly in the lithium industry, focus on producing lithium compounds for batteries, especially for electric vehicles and energy storage. Emphasising sustainability, these companies invest in innovative extraction technologies and efficient production processes. Their commitment to responsible sourcing and environmental stewardship positions them as crucial contributors to the transition to clean energy solutions.

Founded in 1994 and headquartered in Charlotte, NC, Albemarle is a leading manufacturer of specialty chemicals, focusing on lithium compounds for battery production. With a strong commitment to sustainability and innovation, the company is crucial in the energy transition, providing essential materials for electric vehicles and energy storage.

Established in 1968 and based in Santiago, Chile, SQM is a prominent producer of lithium and fertilizers, making a significant impact on the lithium market. The company supplies essential components for electric vehicle batteries and is dedicated to sustainable practices and innovation, playing a key role in the rising global demand for clean energy.

Founded in 1884 and located in Philadelphia, PA, FMC is a diversified company specializing in agricultural solutions and lithium production. FMC develops lithium compounds for batteries, supporting the electric vehicle sector. The company emphasizes sustainability and innovation, strengthening its position in the shift toward renewable energy.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the lithium compound market reached an approximate volume of 430171.97 Tons.

The market is assessed to grow at a CAGR of 7.50% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach around 886598.00 Tons by 2035.

The major drivers of the market are the rising demand for lithium compounds in developing regions, increasing utilisation of lithium-ion batteries in portable electronic devices, the growing construction sector, and the increasing demand for electric vehicles.

The key trends guiding the growth of the market include growing technological advancements and increased investment in research and development activities by the key players.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Lithium carbonate, lithium hydroxide, lithium concentrate, lithium metal, lithium chloride, and butyllithium, among others, are the different lithium compound types in the market.

The various end uses of lithium compounds are batteries, glass and glass ceramics, automotive parts, greases, metallurgy, polymer, and air treatment, among others.

The major players in the global lithium compound market are Albemarle Corporation, SQM S.A., and FMC Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share