Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Latin America baby furniture market reached a value of approximately USD 5155.26 Million in 2025. The market is projected to grow at a CAGR of 5.10% between 2026 and 2035, reaching a value of around USD 8477.69 Million by 2035.

Base Year

Historical Period

Forecast Period

In 2023, the Latin America and the Caribbean region’s GDP grew by 2.2% while the GDP per capita was USD 10,070.4. The well-being of the economy boosts the disposable income of the middle-class population, which positively influences the baby furniture market.

KYK - Indústria e Comércio de Móveis Ltda, Matic Móveis, and GRAND HOME SA DE CV are some of the major companies in the market.

By 2027, the LATAM e-commerce market is set to grow by 25%, thus, supporting the baby furniture market expansion.

Compound Annual Growth Rate

5.1%

Value in USD Million

2026-2035

*this image is indicative*

| Latin America Baby Furniture Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 5155.26 |

| Market Size 2035 | USD Million | 8477.69 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.10% |

| CAGR 2026-2035 - Market by Country | Peru | 5.9% |

| CAGR 2026-2035 - Market by Country | Colombia | 5.6% |

| CAGR 2026-2035 - Market by Material | Plastic | 5.3% |

| CAGR 2026-2035 - Market by End Use | Commercial | 5.5% |

| Market Share by Country 2025 | Brazil | 23.8% |

In 2021, the infant population (aged 0-4 years) in Latin America and the Caribbean was 49,740 thousand. Moreover, Latin America is one of the urbanised regions in the world and by 2050, 90% of Latin Americans will live in cities. As of 2022, around two-third of the population lives in cities of 20,000 inhabitants or more.

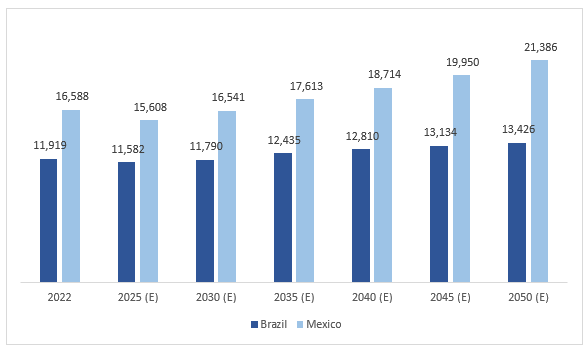

One of the factors driving the Latin America baby furniture market growth is rising disposable incomes. Moreover, by 2035, the disposable income per capita in Brazil and Mexico – the two largest markets of the region, is anticipated to increase to USD 12,435 and USD 17,6113, respectively from USD 11,919 and USD 16,588 in 2022. Additionally, the growth in sustainability concerns and demand for non-toxic baby furniture among Latin Americans compels manufacturers to produce baby furniture from sustainable materials.

Figure: Disposable Income Per Capita in Brazil and Mexico, 2022-2050 (E), in USD

Expansion of childcare centres, surge in disposable incomes, rising demand for sustainable furniture products, and expanding retail channels, including e-commerce, are the major factors propelling the Latin America baby furniture market demand

Childcare centres use baby furniture such as cots, playpens, cribs, and changing tables. Further, the growing participation of women in workforce is increasing the demand for day care services, which in turn, is expected to boost the baby furniture market expansion.

The well-being of the economy boosts the disposable income of the middle-class population, which positively influences the market demand.

Urbanisation leads to smaller living spaces, creating a demand for compact and convenient baby care solutions including changing table and baby cots.

Online channels offer better product visualisation and convenient doorstep delivery while increasing the accessibility of baby furniture to consumers. As of 2022, eCommerce contributed 11% of retail in LATAM countries.

The Latin America e-commerce market currently boasts over 300 million digital buyers, and this number is poised to surge by over 20% by 2027. According to industry reports, the e-commerce sector in Latin America is expected to grow by 25% between 2021 and 2025, presenting a huge opportunity for merchants to reach new customers by offering their products and services online. Companies such as Ikea, Amazon, and Pottery Barn Kids deliver baby furniture to the doorsteps of consumers.

Furthermore, the expanding middle class population drives the demand for innovative and functional baby furniture that ensures the safety of children. Parents' concerns regarding the health of their children aid the demand for baby furniture products made with sustainably harvested wood and non-toxic paints. Key manufacturers of sustainable baby furniture products include Nestig, and Ikea.

“Latin America Baby Furniture Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Material

Market Breakup by Product Type

Market Breakup by End Use

Market Breakup by Country

| CAGR 2026-2035 - Market by | Country |

| Peru | 5.9% |

| Colombia | 5.6% |

| Mexico | 5.0% |

| Brazil | XX% |

| Argentina | XX% |

| Chile | XX% |

| Others | XX% |

By material, wood is expected to hold a significant market share as parents are increasingly conscious of using furniture with non-toxic paints and finishes, free from harmful chemicals and volatile organic compounds (VOCs).

Wood is perceived as a safer, sturdy, and a long-lasting material. It is also considered a relatively eco-friendly material compared to synthetic options. In fact, Peru’s average furniture production index (base year 2007) stood at 193.7 in 2023. In 2022, the country experienced record growth of 161.4% in the furniture industry compared to the base year. It stands at 249.0 in April 2024.

Plastic furniture is relatively lightweight and affordable, making it accessible to a broader range of consumers, especially in urban settings with limited space. This affordability is crucial for families on a budget with growing babies and changing requirements. With urban density in Latin America and the Caribbean reaching 82% in 2023, the practicality and convenience of plastic furniture make it an ideal choice for urban living.

In neonatal units and paediatric wards, metal baby furniture is often chosen for its durability and high hygiene standards. Common items include metal bassinets and cribs, which are essential for the care and safety of newborns and infants in these settings.

Major market players are focusing on expanding their online presence, adopting aggressive marketing strategies and are utilizing sustainable materials to attract more customers

Headquartered in Brazil and founded in 1981, the company offers its products under the brand name Somniare, a pioneering manufacturer of children's furniture. Its product portfolio includes closets, baby crib, beds, dressers, and others.

Headquartered in Mexico, the company produces wooden furniture design, balancing functionality, design, and quality. It offers various types of furniture products including Sky Crib Bed, Nordic Pop Bureau, Scania Double Bed, and Pearl Trunk Bench, among others.

Headquartered in the United States and founded in 2002, Foundations Worldwide is a leading provider of nursery furnishings, available at diverse brick-and-mortar and e-commerce retailers. The company offers various types of baby furniture products including child care cribs, play yards, rockers, and others.

Headquartered in Netherlands and founded in 1943, the company has a global presence with 12 franchisees and an extensive supply chain. It offers various types of baby furniture products including children's storage and organization, cots and cots mattresses, and others.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Latin America baby furniture market include Matic Móveis, and Dorel Industries Inc.

Brazil is a prominent region due to the government support for daycare services

In Brazil, the number of preschool students reached 8.3 million in 2022. The municipalities' annual average expenditure per child is around USD 5,000. Daycare maintenance and structural costs approach USD 3,500, with preschool costs slightly higher.

The total number of births registered in Mexico reached 1,891,388 in 2022, marking a 16.1% increase compared to 2020, which saw 1,629,211 births. Further, in Mexico, in January 2024, New Mexico became the first state that guarantees a right to early childhood education.

Peru witnessed an increase in its urban population, rising from 26,076,635 in 2020 to 26,466,645 in 2021, marking a growth of 1.5%, thus driving the furniture demand.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Latin America baby furniture market was valued at USD 5155.26 Million.

The baby furniture market in Latin America is expected to grow at a CAGR of 5.10% between 2026 and 2035.

The Latin American market for baby furniture is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 8477.69 Million by 2035.

The major drivers include growing disposable income, expansion of e-commerce channels, and growth in daycare services.

The key trends include the growing demand for sustainable baby furniture with innovative design.

The different materials used in furniture production include wood, plastic, metal, and others.

The major end users of baby furniture include residential and commercial.

The major players in the market include KYK - Indústria e Comércio de Móveis Ltda, Matic Móveis, GRAND HOME SA DE CV, Inter IKEA Systems B.V., Foundations Worldwide, Inc., and Dorel Industries Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material |

|

| Breakup by Product Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share