Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global laser diode market reached a value of nearly USD 11.88 Billion in 2025. The market is assessed to grow at a CAGR of 7.70% during the forecast period of 2026-2035 to attain a value of around USD 24.94 Billion by 2035. The market is being aided by the robust growth of the consumer electronics sector, the increasing trend of miniaturisation, technological advancements and innovations, the expansion of telecom networks, advancements in semiconductor manufacturing technologies, and the increasing emphasis on sustainability.

Base Year

Historical Period

Forecast Period

The expansion of global telecom networks, the rapid growth of cloud computing and data centre operations, and the rise of 5G technology are surging the demand for optical transceivers using high-performance laser diodes. In 2022 alone, over 1.5 billion optical transceivers using laser diodes were sold to telecom companies and data centres around the world. This surge in optical transceiver sales is encouraging the miniaturisation of laser diodes to fit into the small form factor of optical modules.

Laser printers heavily rely on laser diodes for the printing process. Approximately 80 million laser printers were sold in the year 2022 targeting the home offices and the small businesses. The increasing sales of laser printers are prompting manufacturers to scale up the production of laser diodes and meet the needs of printer manufacturers. Moreover, the surging affordability of laser printers is expected to further boost their adoption among small businesses and home offices, driving the laser diode market growth.

Laser therapy devices use laser diodes to produce low-level laser light for different therapeutic applications such as wound healing, pain management, and tissue repair. Over 5 million laser therapy devices were sold in 2023, mainly to hospitals and clinics. With more hospitals and clinics using laser therapy for non-invasive treatments, the demand for specialised laser diodes that are designed for specific medical applications and meet stringent safety, efficiency, and performance standards is increasing.

Compound Annual Growth Rate

7.7%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Laser Diode Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 11.88 |

| Market Size 2035 | USD Billion | 24.94 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 7.70% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 9.6% |

| CAGR 2026-2035 - Market by Country | India | 10.6% |

| CAGR 2026-2035 - Market by Country | China | 10.1% |

| CAGR 2026-2035 - Market by Type | Optically Pumped Semiconductor Laser (OPSL) | 8.5% |

| CAGR 2026-2035 - Market by Application | Medical Applications | 8.8% |

| Market Share by Country 2025 | USA | XX% |

The laser diode market expansion is being fuelled by the increasing demand use of laser diodes in industrial sensing applications such as laser triangulation, distance measurement, and spectroscopy due to their reliability, high precision, and accuracy. Laser diodes are also increasingly used in vibration sensing applications to monitor the structural integrity of machinery, buildings, and infrastructure.

There is a rising integration of laser diodes in smart sensors and IoT devices for precise data collection and measurement and monitoring of various parameters like humidity, temperature, and pressure. Moreover, the development of laser diodes with resistance to moisture, improved heat tolerance, and vibration durability for use in high-stress environments, such as aerospace, defence, and automotive is propelling the market.

Advancements in semiconductor manufacturing technologies are leading to the development of high-performance and more efficient laser diodes. Manufacturers are focusing on improving the speed, precision, and cost-efficiency of production processes, making laser diodes more affordable and high-performing. Manufacturers are also adopting automation technologies to scale up laser diode production and maintain their quality.

One of the major value drivers in the laser diode market is increased demand for high-speed data transmission due to 5G technology. Quite importantly, laser diodes play a role that allows telecom corporations to expand their networks speedily and more conveniently through optical communication. The process creates a positive cycle that raises sales revenue for the manufacturers while also spurring innovation in laser technology, bolstering the laser diode market dynamics and trends. Companies that adapt to this will be the ones who develop advanced yet cost-effective laser solutions that work and end up thriving in this fast-paced market.

The demand for laser diodes is also being stimulated by growing needs in optical communications that continually advance consumer electronics, as well as the application of this field in medicine. The factors that initially challenged growth included high manufacturing costs and interruptions in supply chains. Companies overcame challenges through advanced production technologies, optimization of supply chains, and cost-effective solutions, thereby boosting the laser diode demand. This strategic focus, therefore, provided for efficiency improvement, cost reduction, and also the ability to fulfil demands in different sectors.

Advancements in laser diode efficiency and performance; rising trend of miniaturisation; growing focus on sustainability; and technological advancements are favouring the laser diode market expansion.

Advancements aimed at boosting the efficiency and performance of laser diodes and meeting their increasing demand in sectors like healthcare, telecommunications, consumer electronics, and electronics are aiding the market. There is a rising use of materials such as gallium nitride (GaN) and gallium arsenide (GaAs) to enhance the efficiency, power output, and operational life of laser diodes. The growing integration of quantum dots and quantum wells in laser diode structures to improve their performance and energy efficiency is further driving the market. Moreover, the increasing demand for high-power laser diodes in applications such as welding, material processing, and cutting due to their precision and high-speed operations is propelling the market.

The growing trend of miniaturisation and the rising demand for efficient, compact, and high-performance devices are aiding the laser diode market expansion. The miniaturisation of laser diodes is surging its usage in wearables and smartphones in applications such as optical communication, facial recognition, and sensors. The increasing demand for more feature-rich and thinner smartphones and wearables is surging the usage of miniature laser diodes. The development of miniaturised laser diodes in fibre-optic communication systems for integration within network infrastructures and data centres is fuelling the market. In addition, the miniaturisation of laser diodes is anticipated to drive the development of more compact Light Detection and Ranging (LiDAR) systems for use in ADAS technologies and autonomous vehicles in the forecast period.

The growing environmental concerns, the increasing demand for energy-efficient technologies, and rising resource conservation efforts are shaping the laser diode market dynamics and trends. Laser diodes are more energy-efficient than traditional light sources, such as incandescent bulbs and LEDs, making them crucial for applications such as consumer electronics, telecommunications, and industrial processes. Manufacturers are increasingly improving the performance of laser diodes to enhance their energy efficiency, making them even more environmentally friendly by reducing their energy demands. They are also focusing on developing materials that are non-toxic and safe for the environment, aligning with regulations like the European Union’s RoHS. Moreover, laser diode manufacturers are adopting sustainable production practices, using recyclable materials for packaging, reducing emissions during production, and minimising the use of non-renewable resources in the manufacturing process to reduce the overall environmental footprint.

Advancements in technology and the development of quantum dot (QD) lasers are revolutionising the laser diode market landscape. Quantum dot lasers boast lower power consumption, higher efficiency, and superior temperature stability as compared to traditional laser diodes, boosting their use in applications like high-definition displays, telecommunications, and data storage, among others. Increasing research activities aimed at developing innovative materials and structures that improve the power output of laser diodes while maintaining their efficiency are anticipated to aid the market. Furthermore, manufacturers are increasingly focusing on developing customised laser diode solutions that meet the specific needs of different sectors. In the coming years, the increasing integration of laser diodes into smart systems and IoT devices to offer efficient lighting is anticipated to aid the market.

Laser diodes are increasingly used in medical applications, driving market growth significantly.

One of the most important trends within the laser diode market is the increasing usage of laser diodes in medical procedures, especially in laser surgeries and dermatological treatments. Such trends of laser diode market are relevant to the increased interest in the medical sector in minimally invasive techniques that minimise the extended periods of recovery for patients. Other players in this area include Coherent, Inc., among other providers of advanced laser systems for medical applications.

Infrastructure, technology, automotive, renewable energy, and emerging markets drive Laser Diode demand.

Key growth drivers include 5G expansion, consumer electronics, medical technology, energy efficiency, and advancements in manufacturing processes.

Challenges include high costs, supply chain issues, competition, R&D demands, and regulatory compliance hurdles.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Laser Diode Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of type, the market can be divided into:

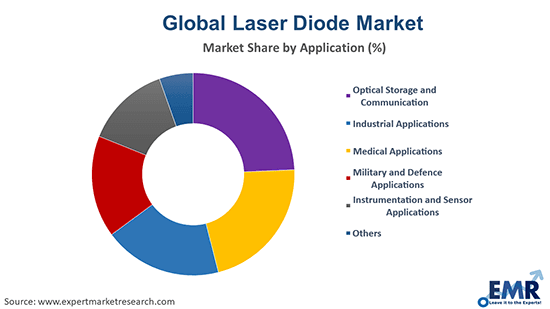

On the basis of application, the market can be segmented into:

Based on region, the market can be segregated into:

| CAGR 2026-2035 - Market by | Type |

| Optically Pumped Semiconductor Laser (OPSL) | 8.5% |

| Injection Laser Diode (ILD) | XX% |

| CAGR 2026-2035 - Market by | Application |

| Medical Applications | 8.8% |

| Industrial Applications | 8.2% |

| Optical Storage and Communication | 7.9% |

| Military and Defence Applications | XX% |

| Instrumentation and Sensor Applications | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 9.6% |

| North America | 7.9% |

| Europe | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

ILDs are in demand for telecom, while OPSLs grow in medical applications, enhancing efficiency and versatility.

Both Injection Laser Diodes (ILD) and Optically Pumped Semiconductor Lasers (OPSL) are in growing demand across the various fields of application. ILDs are applied in the transmission of data in the telcos space, meaning that they find use both in the transmission from the expansion of fibre optic networks as well as in the 5G technology. As such, for example, Cisco is integrating ILDs in its products in the networking equipment to enhance speed and efficiency.

As per laser diode market analysis, OPSLs have been increasingly used and are now taking the lead in medical applications, such as for dermatology and surgery. It is likely to garner an 8.5% CAGR through 2032 because they can be versatile and efficient. Key players like Coherent, Inc. utilise OPSLs for advanced laser therapies, which will create a new reliance on both types in critical industries.

Laser diodes drive market growth in communication, industrial, medical, military, and sensor applications.

Each application of laser diodes significantly contributes to market growth. In optical storage and communication, the increasing demand for high-speed data transfer drives the need for laser diodes in fibre optic networks. For industrial application, laser diodes help in giving precisions in the cutting and welding process during the manufacture, thus making production productivity and efficiency in the working place increase.

As per laser diode industry analysis, the medical applications of laser diodes are to expand with an 8.8% CAGR through 2032. For the medical sectors, the increasing number of minimally invasive surgeries coupled with the more advanced laser treatments raises the demand on laser diodes. In fields like military and defence, laser diodes are needed for targeting systems and communication technologies; therefore, applications are more reflective of the amount of defence spending. Applications in instrumentation and sensor areas mainly come with improved accuracy and reliability of sensors for environmental monitoring and automation. The markets for new and emerging applications on consumer electronics and renewable energy determine market growth.

North America Laser Diode Market Dynamics

Consumer trends drive the laser diode market in North America. In 2022, 35% of laser diode sales were attributed to medical applications and is growing with more widespread acceptance in aesthetic and surgical applications. Consumer electronics was the next dominant segment. It represented some 15 million laser projectors sold in 2022 to support home entertainment systems, as well as the fact that 45% of households own smart devices that include a laser sensor, which is one area with significant growth potential. Energy-efficient technologies are also worth considering-it is growing at 20 percent a year, for example, laser lighting solutions for residential use, accelerating the demand of the laser diode market.

| CAGR 2026-2035 - Market by | Country |

| India | 10.6% |

| China | 10.1% |

| Canada | 8.2% |

| Japan | 8.2% |

| USA | 7.8% |

| Australia | 7.7% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Europe Laser Diode Market Opportunities

Europe is an investment region regarding laser diodes primarily driven by demand for high-performance medical devices and manufacturing techniques. Solar panels production as part of laser applications toward renewable energy sources is also growing in the region. Furthermore, the rollout of 5G networks necessitates the growth of optical communication techniques. Integration of laser technology into autonomous vehicles and safety features enhances market potential in the automotive sector. With key players investing in innovation, Europe would be well-poised for solid growth in the application of laser diodes, aiding the Europe laser diode industry.

Asia Pacific Laser Diode Market Insights

The Asia Pacific laser diode market is dominated significantly by increasing demand in telecommunications, with over 1.5 billion mobile connections established in 2022. China leads the way in the region, accounting for around 45% of the market, driven by strong growth in consumer electronics, with 30 million laser printers sold last year. The medical sector is expanding rapidly, with around 12 million laser devices used for various treatments. The laser technology has been incorporated into the automotive sector with ADAS. The introduction of features in advanced driver-assistance systems has enhanced market prospects through various applications.

Latin America Laser Diode Market Drivers

The major influencing factors of the Latin America laser diode market are as follows. Latin America is witnessing growth in the rapidly developing sector of telecommunications, especially cell connectivity, that demands efficient optical communication systems. Advances in medical technology are driving laser diode market share in Latin America for surgical and cosmetic procedures, which is expected to reach 10 million laser devices by 2025. The growing use of laser technology in manufacturing sectors and increased adoption in automation increase productivity. Moreover, the development across the region toward renewable energy solutions propels growth for laser applications in the production of solar panels.

Middle East and Africa Laser Diode Market Trends

The trends in the Middle East and Africa laser diode market are steadily gaining importance - both on the technological front and demand-led regional terms. Telecommunication investments in 5G infrastructure are increasingly generating high-speed optical communication system requirements. The healthcare sector is also growing wherein laser diodes are entering more fashionable aesthetic treatments and surgeries, supporting the laser diode market growth. Therefore, the focus on renewable energy projects in the region is helping laser applications grow for solar energy generation. Laser diodes are finding a new direction in the automotive world too as smart technology opens up new directions.

Laser diode startups innovate, focusing on niche applications to gain their market share. They are offering specialised products to distinct markets such as medical technology, telecommunication, and automotive. Most of them depend on advanced manufacturing to cut the costs and increase the performance. Partnerships with large companies and investments in R&D activities help to strengthen their market position and competitive advantage.

Founded in 2015 and headquartered in San Jose, California, Molecular Devices focuses on developing advanced laser technologies for life sciences. This startup brings innovative laser diodes for applications in diagnostic and imaging use cases, giving enhanced accuracy in both research and diagnostics in the medical field. Their products focus on making the lab more efficient and accurate.

Luminus Devices

Founded in 2010 and headquartered in Billerica, Massachusetts, Luminus Devices is a leading provider in high-performance laser diodes for any application. This company will serve with high performance in lighting, display, and medical. Their products will be compact and energy-efficient laser diodes that enable better performance in consumer electronics and industrial applications.

Laser diode key players are bringing efficiency progressions of the product and developing applications within telecommunications, medical technology, and consumer electronics. It is a break-through with new advanced materials and manufacturing processes, which reduces costs and improves performance. These laser diode companies are also engaged in strategic partnership and collaboration drives to penetrate new markets or emerging and growing markets and meet the increasing global demand.

Coherent, Inc. is headquartered in Santa Clara, California, and it was established in 1966. This laser-based solutions firm meets all sorts of demands as far as laser diodes are concerned for either medical, industrial, or scientific applications. Their products include high-performance semiconductor lasers and laser systems for accuracy in manufacturing, telecommunications, and healthcare.

Founded in 1990 in Oxford, Massachusetts, IPG Photonics Corporation is an acknowledged leader in the field of fibre laser technology. The company offers a range of laser diodes, including high-power fiber lasers and semiconductor laser products for material processing, telecommunications, and medical applications for efficiency and reliability.

OSRAM was established in 1919 in Munich, Germany. Today, the company invests heavily in laser diode technology and is producing a broad portfolio of laser diodes for automotive lighting applications, industrial applications, and consumer electronics. The innovative products of OSRAM are designed for best performance and energy efficiency.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players in the laser diode industry includeTRUMPF and Jenoptik AG, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 11.88 Billion.

The market is projected to grow at a CAGR of 7.70% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 24.94 Billion by 2035.

The major drivers of the market include rising disposable incomes, increasing population, rising applications in the military and defence, and the thriving demand for luxury vehicles.

The rising adoption of laser diodes in the automotive industry and increasing popularity of portable electronic devices are expected to be major trends guiding the growth of the market.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

The injection laser diode (ILD) and optically pumped semiconductor laser (OPSL) are the types of laser diode in the market.

The various applications of laser diode in the market are optical storage and communication, industrial applications, medical applications, military and defence applications, and instrumentation and sensor applications, among others.

The leading players in the global laser diode market are Coherent, Inc., IPG Photonics Corporation, OSRAM, TRUMPF, and Jenoptik AG, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share