Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global IT training market size was valued at USD 91.85 Billion in 2025. The industry is expected to grow at a CAGR of 6.20% during the forecast period of 2026-2035 to reach a valuation of USD 167.62 Billion by 2035.

The rising shift towards cloud computing is driving the demand for professionals skilled in security, cloud architecture, and management. The rising popularity of certification and training programmes for cloud professionals is driving the IT training market expansion. In November 2023, CGS stated that its subsidiary, CGS Immersive, has expanded. Enterprise Operations and Training & Performance are the two main areas of concentration for the expansion. The Training & Performance offering offers enterprise-ready learning solutions by leveraging technologies like XR, AI, RPA, and IoT. By incorporating AI operations and cutting-edge technology into business process outsourcing services, the Enterprise Operations solution improves productivity and teamwork. Besides, various sectors, such as healthcare, finance, manufacturing, and retail, among others, are boosting the requirement for customised IT training programmes to address their unique challenges.

With the growing trend of data science and big data, the demand for data professionals who can analyse vast amounts of data and extract meaningful insights to guide decision-making is increasing. Hence, individuals and organisations are seeking IT training programmes in machine learning, AI, and data science, among others. Organisations increased spending on compute and storage hardware infrastructure for AI deployments by 97% year-over-year in the first half of 2024, reaching USD 47.4 billion.

A significant growth driver in the global IT training market is micro-credentialing, which provides a highly focused, skill-specific learning pathway. Such bite-sized courses enable learners to acquire the skills they need speedily and quickly react to the fast-paced demands of the tech industry, thereby boosting the growth of the IT training market. For example, websites such as LinkedIn Learning and Coursera provide micro-credential programs in data analytics and cloud services. This trend is appealing to professionals seeking immediate upskilling, as well as to many employers seeking emerging, specialised competencies in a competitive job market.

Base Year

Historical Period

Forecast Period

With more IT requests handled remotely, the need for IT professionals to create specific skills for remote support, troubleshooting, and communication is increasing. Presently, 70% of IT requests are resolved remotely, an increase of 30% since 2020, when remote work became more routine. Hence, IT programmes are increasingly focusing on remote management tools, virtual support techniques, and soft skills like communication. Moreover, remote IT support requires effective communication, hence IT training programmes are actively emphasising customer service skills such as active listening, providing clear instructions remotely, and troubleshooting over the phone.

There is a rising integration of AI-driven chatbots that enhance customer service, improve efficiency in handling support queries, and reduce response times. Around 40% of IT support teams have AI-driven chatbots integrated into their systems, which has reduced response times by 25% and increased customer satisfaction scores. As businesses increasingly adopt AI-driven chatbots, the need for IT training programmes that offer specialised courses focusing on machine learning, AI, and natural language processing (NLP) technologies is increasing, thus bolstering the IT training market growth.

Organisations are increasingly allocating more resources to cybersecurity, heighting the need for professionals with specialised knowledge in areas like incident response, threat detection, penetration testing, and vulnerability management. Cyber threats have increased by 40% year over year, and they make up to 60% of the IT support budget that goes into cybersecurity measures. Hence, IT training providers are responding by expanding their offerings to include advanced cybersecurity certifications and courses, such as Certified Ethical Hacker (CEH), Certified Information Systems Security Professional (CISSP), and Certified Cloud Security Professional (CCSP). In addition, the evolving nature of cyberthreats is boosting the requirement for IT training programmes that focus on continuous learning models and address new cybersecurity challenges.

Compound Annual Growth Rate

6.2%

Value in USD Billion

2026-2035

*this image is indicative*

| Global IT Training Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 91.85 |

| Market Size 2035 | USD Billion | 167.62 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.20% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.9% |

| CAGR 2026-2035 - Market by Country | India | 7.2% |

| CAGR 2026-2035 - Market by Country | Canada | 6.7% |

| CAGR 2026-2035 - Market by Type | IT Infrastructure Training | 6.6% |

| CAGR 2026-2035 - Market by End Use | Corporate | 7.0% |

| Market Share by Country 2025 | USA | 27.4% |

Evolving digital technologies are surging the need for a skilled workforce in fields such as cybersecurity, software development, cloud computing, data analytics, and artificial intelligence (AI). As per industry reports, there were nearly 470,000 job openings in the U.S. for cybersecurity-related skills between May 2023 and April 2024, highlighting the broad demand for cybersecurity expertise across various job roles. This is boosting the demand for IT training courses, boot camps, and certifications that offer specialised knowledge in emerging technologies. In addition, the rise in demand for digital skills is leading to the proliferation of online learning platforms that offer accessible, flexible, and affordable IT training, thereby supporting the growth of the IT training market.

The increasing focus on cybersecurity, buoyed by rising cyber threats, data breaches, and regulatory environments, is driving the IT training market growth. As per the Internet Crime Report 2024, Internet Crime Complaint Center received more than 4,800 complaints from organisations belonging to a critical infrastructure sector that were affected by a cyber threat in the United States. A total of 263,455 cybercrime complaints were filed, resulting in reported losses exceeding USD 1.571 billion. With the growing frequency and sophistication of cyberattacks, organisations are seeking experts to implement, design, and manage security measures to protect critical infrastructure is increasing.

The growing trend of personalisation and the increasing demand for tailored learning experiences among organisations and individuals are surging the IT training market value. IT training programmes are increasingly evolving to offer customised curriculums and develop expertise in specific technologies or tools relevant to the roles of learners. Recent developments show a rise in adaptive learning platforms that use AI to customize content delivery based on learner progress and preferences. Companies are investing in upskilling their employees to stay competitive, especially as digital transformation accelerates across sectors.

The growing integration of automation technologies and artificial intelligence into business processes to streamline operations, drive innovations, and enhance efficiency is revolutionising the IT training market landscape. As per a report by McKinsey, over the next three years, 92% of companies plan to increase their AI investments. IT training providers are increasingly offering specialised courses focused on machine learning, AI programming, data analysis, and robotic process automation (RPA). Additionally, emerging markets in Asia-Pacific, particularly India and Southeast Asia, are witnessing rapid growth in IT training adoption. Companies there are prioritizing upskilling to support expanding tech sectors and outsourcing industries.

Governments across countries like China, India, and Japan aim to improve the standard of IT education among rural and semi-rural communities with restricted access to education infrastructure. Over the recent years, IT training in the United States, India, China, and South Korea has become increasingly relevant. These governments have made substantial progress in IT training market. India’s National Digital Literacy Mission continues to expand its reach, focusing on equipping underserved populations with basic to advanced IT skills to improve employability. The goal of NDLM is to train 52.5 lakh people in IT so they can become IT literate and increase their employment prospects. It supports the government's Digital India campaign, which aims to literate more than 250 million people.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“IT Training Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of application, the market can be segmented into:

Key Insight: IT infrastructure training is gaining traction because a large number of adopting organisations are promoting cloud services and offering remote solutions. Organisations prioritise training to ensure staff can maintain and optimize infrastructure efficiently, making it a stable and ongoing market segment with steady adoption across industries undergoing digital transformation. For instance, in January 2025, Amazon Web Services (AWS) announced plans to invest approximately USD 11 billion in Georgia to bolster its cloud computing and AI infrastructure, aiming to support the growing demand for advanced data centers required for AI-driven innovations and cloud services.

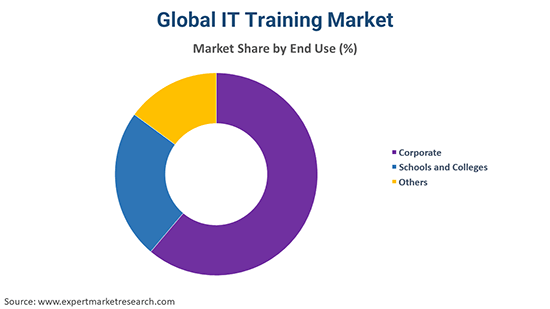

Based on end use, the market can be categorised into:

Key Insight: IT training is commonly utilised in the corporate sector in the task of upskilling workers with some of these emerging technologies in a bid to improve productivity and innovation. Since the market is dynamic, the companies realise that continuous learning is necessary for them to stay competitive, and this has led them to tap different training programs. As per IT training market analysis, the corporations are making various efforts to ensure students out of schools and colleges will be equipped with essential technology skills for the job market, an aspect that is being enhanced by making use of the blended learning technique in educational institutions, which enables students to be keenly attentive.

Based on region, the market can be segregated into:

Key Insight: The driving factors for the North America IT training market include rapid technological advancements and a rising demand for skilled labour in areas such as cybersecurity and data analytics. Consequently, any form of upskilling investment is on an upward growth trajectory, with organisations investing in training workers for the purpose of staying ahead of the curve. Moreover, the trend of remote work has accelerated the development in demand for online solutions in training. The competencies in the providers for training and continuous updates in curricula add to the market dynamics requiring innovation and adjustments from educational institutions.

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 6.9% |

| Latin America | 6.4% |

| North America | 5.9% |

| Europe | XX% |

| Middle East and Africa | XX% |

Growing Importance of Enterprise Software Training in Modern Business

Enterprise software training is critical as companies implement sophisticated ERP, CRM, and collaboration tools. Training helps improve user adoption and productivity while reducing costly errors. The shift toward SaaS platforms and continuous software updates ensures ongoing demand, especially in large organizations aiming to optimize workflows and business processes.

As per IT training market analysis, in database and big data training, there is a growing demand on the part of businesses that use data analysis for better decision-making. Major tech conferences highlight significant interest in training programs focused on big data frameworks like Apache Hadoop and Spark, as well as cloud data services offered by providers such as AWS, Google Cloud, and Microsoft Azure.

Expanding IT Training and STEM Focus Driving the Market Growth

As per the IT training market report, educational institutions are expanding IT training to prepare students for future tech careers. Growing emphasis on STEM education and partnerships with technology firms are enhancing curriculum relevance. This segment supports early talent development, ensuring a steady pipeline of skilled graduates entering the workforce. As per industry reports, almost 50 million people have watched the top 20 introductory AI courses on YouTube. They’ve seen over 92.2 hours of learning. This big change has made learning more flexible and focused on skills.

The Europe IT training market is witnessing rising digital transformation in various industries, and businesses seek specialised training in artificial intelligence, cloud computing, cybersecurity, etc. The government-based initiatives to encourage higher levels of digital skills also develop a sense of infrastructure for developing and implementing training. In early 2025, the European Commission announced a €1 billion investment under the Digital Skills and Jobs Coalition to boost digital training across member states, focusing on AI, cybersecurity, and cloud skills. This fund supports public-private partnerships to expand access and quality of IT training programs.

| CAGR 2026-2035 - Market by | Country |

| India | 7.2% |

| Canada | 6.7% |

| China | 6.6% |

| Brazil | 6.5% |

| Australia | 5.2% |

| USA | XX% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 5.1% |

| Saudi Arabia | XX% |

| Mexico | XX% |

The transition into a digital space and high demand for high-tech skills drive the aggressive growth of the Asia Pacific IT training market. Extensive investment in IT education for fast-growing tech industries keeps the investment levels for countries such as India and China. China’s Ministry of Education has launched several initiatives to integrate IT skills into mainstream education, aiming to train over 100 million people in digital skills by 2025. This includes expanding coding and AI courses in schools and universities, alongside public-private partnerships with tech giants investing in skill development programs.

Key players in the global IT training market are focusing on expanding their digital learning platforms to offer flexible, scalable training solutions. They are investing in developing updated course content that aligns with emerging technologies like AI, cloud computing, and cybersecurity. Partnerships with industry leaders and certification bodies help enhance the credibility and relevance of their programs, attracting a broader audience. These companies are also leveraging data analytics and AI to personalize learning experiences, improving engagement and outcomes. Additionally, they are increasing efforts to enter new markets by localizing content and adapting to regional skill demands. Emphasis on hybrid training models supports diverse learner needs, balancing online and in-person options.

Computer Generated Solutions, a firm established in 1978 and has its headquarters in Detroit, Michigan. It provides IT training programs that consist of customised training on software applications, cloud technologies, and cybersecurity. They allow for hands-on and certification training to maintain workforce skills in line with an organisation's needs.

Tech Data Inc., a 1974-established company situated in Clearwater, Florida, ensures that it offers the widest range of IT training to assist clients optimally use technology. The company specialises in product training for resellers and partners. Online courses and certifications include cloud computing, cybersecurity, and data analytics to Corpex's services portfolio.

Corpex, a training company that focuses on IT and specialises in business transformation and digital skills, founded in 2013 at Melbourne, Australia, offers solutions from the company offer customised training in cloud technologies, project management, and IT governance, amongst others, designed to develop the skills required for thriving professionals in this digital world.

Headquartered in Round Rock, Texas, Dell was founded in 1984 and provides a broad range of IT training programs available through Dell Technologies Education Services. The services the company has to offer run the gamut from general technical training on Dell products, certification courses and training on cybersecurity and data management, all intended to enhance the power of both the IT professional and organisation.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players in the IT training industry include IBM and Oracle, among others.

Stay ahead with the latest trends in the Global IT Training Market 2026. Download a free sample or contact us to explore strategic insights and growth opportunities for your business in this fast-evolving sector.

IT Training And Certification Market Insights

Digital Workforce Upskilling Solutions

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 91.85 Billion.

The market is projected to grow at a CAGR of 6.20% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 167.62 Billion by 2035.

The major drivers of the market include rising disposable incomes, increasing population, rising number of IT students and workers, and the rising usage of smartphones and smart wearables.

Various governments and public institutions are devising strategies and programmes to promote the advancement of education and e-learning technology, which is expected to be a key trend guiding the growth of the market.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

IT infrastructure training, enterprise application and software training, cyber security training, and database and big data training, among others, are the significant applications of IT training.

The major end uses of IT training are corporate and schools and colleges, among others.

The leading players in the market are Computer Generated Solutions, Tech Data Inc., Corpex, Dell, IBM, and Oracle, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share