Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

The global IT spending market size reached around USD 3.88 Trillion in 2024. The market is projected to grow at a CAGR of 3.50% between 2025 and 2034 to reach nearly USD 5.47 Trillion by 2034.

Base Year

Historical Year

Forecast Year

Investments in cloud infrastructure across various sectors support the IT industry growth.

Cybersecurity concerns are contributing to increased expenditure on safety and security of IT infrastructure across organisations.

Digitalisation in developing countries is accelerating investments in advanced IT solutions, driving market expansion.

Value in USD Trillion

2025-2034

IT Spending Market Outlook

*this image is indicative*

| Global IT Spending Market Report Summary | Description | Value |

| Base Year | USD Trillion | 2024 |

| Historical period | USD Trillion | 2018-2024 |

| Forecast Period | USD Trillion | 2025-2034 |

| Market Size 2024 | USD Trillion | 3.88 |

| Market Size 2034 | USD Trillion | 5.47 |

| CAGR 2018-2024 | Percent | XX% |

| CAGR 2025-2034 | Percent | 3.50% |

| CAGR 2025-2034 - Market by Region | Asia Pacific | 4.5% |

| CAGR 2025-2034 - Market by Country | India | 5.2% |

| CAGR 2025-2034 - Market by Country | China | 4.6% |

| CAGR 2025-2034 - Market by Type | Enterprise IT Services | 4.1% |

| Market Share by Country | Japan | 6.4% |

IT spending is the total money spent on IT systems and services by an organisation. IT spending is not only limited to IT organisations but is a significant aspect across diverse businesses, enabling the construction and maintenance of large-scale digital infrastructure and services. IT spending includes expenses related to hardware, software, professional services, cloud, and managed services.

As per the IT spending forecast, businesses are increasingly adopting methods to improve efficiency in their operations, often leveraging digital solutions. The occurrences of pandemics and closures on a global scale have reinforced the importance of robust IT infrastructure to support virtual collaborations. Robust digital infrastructure enables convenient, efficient, and secure working of organisations. Furthermore, the expansion of e-commerce, telehealth, and online education, among other sectors, has accelerated the need for virtual interactions, driving the integration of advanced IT solutions to provide improved communication services.

As per the IT spending statistics, increasing investments in cybersecurity; adoption of artificial intelligence; growing digital infrastructure in emerging economies; and rising use of cloud computing are the major trends in the IT spending market.

| Date | Company | Event |

| Jun 2023 | Amazon.com, Inc | Amazon Web Services announced that it is investing USD 100 million to set up the AWS Generative AI Innovation Center. |

| Jul 2023 | Wipro Ltd | Wipro Ltd, announced an investment worth USD 1 billion to train its 2.5 lakh employees in AI and support technology improvements across its product offerings, contributing to the IT spending by company size. |

| Jun 2022 | Ernst & Young Global Limited | Announced an investment of USD 1 billion in a next-generation technology platform. |

| Jul 2023 | KPMG | Announced to invest USD 2 billion to improve its professional services and AI offerings through an expanded partnership with Microsoft. |

| Trends | Impact |

| Surging cloud spending | Increasing reliance of businesses on cloud-based models due to their multiple benefits, including improved accessibility, cost-effectiveness, and scalability, is leading to a surge in average IT spends by industry. |

| Investments in cybersecurity | Growing concerns regarding cyberattacks and a focus on improving cybersecurity to ensure data protection are supporting the adoption of robust IT solutions. |

| Generative AI growth | Businesses are investing in automation and AI to enhance operational efficiency and address IT talent gaps, driving collaborations and adding to the overall spending. |

| Rising IT spending in the retail sector | Retailers are increasingly adopting cutting-edge retail technologies to be successful and profitable, as consumers seek streamlined and improved shopping experience. |

Both large and medium scale enterprises are investing in digitisation, automation as well as AI and cloud services, contributing to the IT infrastructure spending. By investing in cloud software, companies can minimise the need for expensive in-house servers, storage, networking, and some other hardware components. Further, the use of AI capabilities, for instance in software audit management helps improve performance even in data-heavy environments.

The digital transformation across diverse industries, including healthcare, retail, banking and finance, and entertainment, is a primary factor in increasing the IT spending market value. Moreover, organisations are focusing on improving their existing infrastructure and integrating advanced solutions to tackle the growing issues of data theft and security breach. The security of data is expected to remain a strategic focus area for businesses seeking to maximise efficiency and profitability.

The Cloud Application Infrastructure Services (PaaS) spending is projected to rise from USD 119,579 million in 2022 to USD 176,493 million by 2024, contributing to the IT spending industry. Cloud Application Services (SaaS) sees a significant jump from USD 174,416 million in 2022 to USD 205,221 million in 2023. Cloud Business Process Services (BPaaS) spending here is expected to grow from USD 61,557 million in 2022 and USD 66,339 million in 2023, to USD 72,923 million in 2024.

Spending on cybersecurity in 2021, reached USD 60.2 billion, and continued to grow in the subsequent years. As per the IT spending industry analysis, the upward trend is expected to continue, with spending forecasted to soar to USD 87 billion by 2024. This upward trajectory underscores the growing importance placed on cybersecurity measures amid increasing digitalization and the prevalent threat of cyber-attacks globally. The investments in cybersecurity are likely in response to the heightened need for robust security solutions to protect data and systems across various sectors.

Software spending increased from approximately USD 790.39 billion in 2022 to about USD 879.63 billion in 2023, marking a growth of 11.3% to the overall IT spending industry revenue. This indicates a robust expansion in the software sector, possibly due to increased demand for new technologies and digital transformation initiatives. Expenditure in IT services expanded from USD 1,258.2 billion in 2022 to USD 1,357.9 billion in 2023, representing a growth of 7.9%. The increase in IT services spending could be attributed to the growing need for specialized IT support, cybersecurity services, and cloud management. The data suggests a dynamic IT spending environment where software and IT services are seeing increased investment, highlighting the importance of digital infrastructure and services in the current economic landscape.

1. Technological Advancements: Rapid development in technologies such as artificial intelligence, machine learning, cloud computing, and the Internet of Things (IoT) drive up IT spending as companies invest in new systems and infrastructure.

2. Cybersecurity Needs: Growing cyber threats necessitate increased spending on cybersecurity measures, including advanced security software, infrastructure upgrades, and continuous monitoring services.

3. Cloud Migration: The shift from on-premise data centers to cloud-based solutions can lead to significant costs in terms of migration, subscription fees, and cloud infrastructure management to aid the growth of the IT spending industry.

4. Regulatory Compliance: Adherence to regulations like GDPR, HIPAA, and other data protection laws requires ongoing investment in compliance-related technologies and processes.

5. Workforce Training and Development: As new technologies are adopted, there is a need for continuous training and development of IT staff, which contributes to increased spending.

6. Inflation: Rising costs of hardware, software, and IT services due to inflation directly affect overall IT expenditure.

7. Vendor Pricing: Changes in pricing models by key IT vendors, including subscription-based services and licensing fees, can impact overall IT costs.

8. Digital Transformation Initiatives: Businesses in the IT spending industry undergoing digital transformation require substantial investment in new technologies, integration services, and consulting, driving up IT spending.

9. Maintenance and Upgrades: Continuous maintenance and periodic upgrades of existing IT infrastructure to ensure optimal performance and security also contribute to ongoing IT costs.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global IT Spending Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Region

| Market Share by | Country |

| Japan | 6.4% |

| USA | XX% |

| Canada | XX% |

| CAGR 2025-2034 - Market by | Type |

| Enterprise IT Services | 4.1% |

| Data Centre Systems | 3.9% |

| Communications Services | 3.7% |

| Enterprise Software | XX% |

| Devices | XX% |

Enterprise software is further divide by type into business intelligence software, content management software, customer relationship management software, enterprise resource planning software, supply chain management software, and others. Meanwhile, enterprise IT services are categorised by type into customised software and app development, and services including IT consulting, among others.

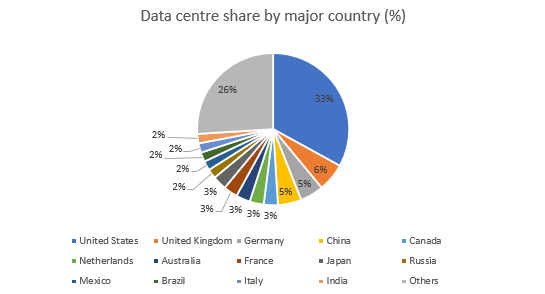

Data centre systems account for a significant share of the global market

There is a growing need for data centres, supported by changing work habits and the growth of cloud-based technologies, which can boost the IT spending market revenue. The growing connectivity to the internet and digital transformation across various sectors are increasing the need for fast communication lines and data transmission technologies. The importance of stable communication and passing of the maximum amount of data per unit of time is encouraging organisations to constantly improve their data centre offerings.

| CAGR 2025-2034 - Market by | Country |

| India | 5.2% |

| China | 4.6% |

| Brazil | 3.9% |

| Mexico | 3.6% |

| UK | 3.4% |

| USA | XX% |

| Canada | 3.2% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Australia | 3.1% |

| Germany | 3.0% |

North America accounts for a significant share of the global IT spending market. Companies in the region are increasingly investing in technology initiatives at a higher-level, with-IT spending accounting for 13% of company revenue. Businesses are focusing on improving operational efficiency through investments in cloud and are increasingly spending on infrastructure consulting services and infrastructure as a service (IaaS) solution to support their technological needs. The presence of well-established technological infrastructure in the region supports the demand of IT spending market. Meanwhile, the Asia Pacific and the Middle East and Africa are expected to be emerging markets, supported by economic stability and favourable government initiatives to support digitalisation across sectors.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2024, the market attained a value of nearly USD 3.88 Trillion.

The market is assessed to grow at a CAGR of 3.50% between 2025 and 2034.

The market is estimated to witness a healthy growth in the forecast period of 2025-2034 to reach about USD 5.47 Trillion by 2034.

The major market drivers include the increasing trend of digitisation, the rising adoption of cloud solutions, and the use of innovative technologies to improve the performance of data-heavy environments.

The emerging trends include the growing awareness regarding the benefits of AI audit management, the rising economic development, and the increasing investments to boost the security of IT.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major types of IT spending in the market are data centre systems, enterprise software, enterprise IT services, devices, and communication services.

IT spending is the total money spent on IT systems and services by an organisation. IT spending is not only limited to IT organisations but is a significant aspect across diverse businesses, enabling the construction and maintenance of large-scale digital infrastructure and services.

Cloud Application Infrastructure Services (PaaS), Cloud Application Services (SaaS), and Cloud Business Process Services (BPaaS) contribute significantly to the market.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| Report Features | Details |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share