Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

The global instant coffee market attained a value of USD 13.15 Billion in 2024. The market is further projected to grow in the forecast period of 2025-2034 at a CAGR of 4.90% to reach USD 21.22 Billion by 2034. The instant coffee market has witnessed significant growth, driven by the increasing demand for convenience among consumers with busy lifestyles. The market size continues to expand at a notable growth rate, as instant coffee becomes a preferred choice for many. Rising awareness of health and wellness has also influenced this demand, with consumers seeking healthier options. Distribution channels have evolved, making instant coffee more accessible worldwide, further contributing to its widespread appeal.

Base Year

Historical Year

Forecast Year

Value in USD Billion

2025-2034

Instant Coffee Market Outlook

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Major Market Drivers

The global instant coffee market is driven by growing consumer demand for convenience, busy lifestyles, and increasing awareness of health and wellness. These factors contribute to the rapid market expansion globally.

Key Market Trends

Innovation in flavours, the introduction of premium instant coffee products, and sustainable packaging are emerging key trends in the instant coffee market. Consumers are increasingly seeking quality and eco-friendly options in their coffee choices.

Geographical Trends

In the global instant coffee market, demand is rising significantly in emerging regions such as Asia-Pacific and Latin America. These areas benefit from rapid urbanisation, changing lifestyles, and growing coffee consumption trends.

Competitive Landscape

The competitive landscape in the global instant coffee market is highly fragmented, with key players like Nestlé and Starbucks. Companies are focusing on product differentiation, sustainability initiatives, and expanding their distribution channels to maintain market leadership.

Challenges and Opportunities

The global instant coffee market faces challenges such as fluctuating coffee bean prices and supply chain disruptions. However, opportunities lie in emerging markets, innovative products, and tapping into the growing demand for health-conscious options.

Increasing Consumer Preference for Convenience

The instant coffee market has experienced significant growth due to the increasing demand for instant coffee, driven by busy lifestyles and the desire for enhanced convenience. Consumers are increasingly opting for cold coffee and ready-to-mix sachets, making it easier to enjoy coffee on the go. The market size of instant coffee continues to expand, as brands introduce innovative product offerings, including single-serve packaging, which caters to the need for quick and easy solutions. This shift in consumer preference towards convenience has made instant coffee a popular choice worldwide. The rise in cold coffee consumption also reflects the market's adaptability to changing tastes. As demand continues to grow, the global instant coffee market is expected to thrive with more diverse and convenient options for consumers.

Growing Emphasis on Health and Wellness

The instant coffee market is increasingly influenced by the growing consumer focus on health and wellness. Consumers are now seeking coffee products that offer additional health benefits, such as functional components like green tea extract, ginseng, and guarana, which are believed to support metabolism and aid in weight management. These ingredients are being incorporated into various instant coffee products to appeal to health-conscious individuals. Additionally, green coffee, known for its antioxidant properties, is becoming a popular addition to instant coffee blends. One example of this trend is pumpkin spice instant coffee, which combines the familiar flavours of autumn with a focus on functional components. As consumers become more aware of the potential health benefits of these added components, the demand for green coffee products that provide both taste and wellness benefits is expected to grow. The global instant coffee market is adapting to this shift by offering innovative, health-focused options that cater to a wide range of preferences.

Growth of Distribution Channels

The instant coffee market has seen significant growth in recent years, driven by the expansion of distribution channels. Traditionally, offline distribution channels like supermarkets, hypermarkets, and convenience stores were the primary avenues for consumers to purchase instant coffee products. However, with the rise of e-commerce and online shopping platforms, the market reach of instant coffee brands has expanded significantly through online retail channels. This shift towards online platforms has allowed brands to cater to a larger audience, increasing instant coffee demand across various regions. Consumers now have access to a wide variety of instant coffee products, including innovative offerings such as toffee nut flavoured pods, all available at their fingertips. The convenience of purchasing through online platforms has reshaped how consumers engage with the instant coffee market, providing them with more options and convenience. The continued growth of e-commerce is expected to play a pivotal role in shaping the future of the instant coffee market, offering new opportunities for both established and emerging brands to reach a global consumer base.

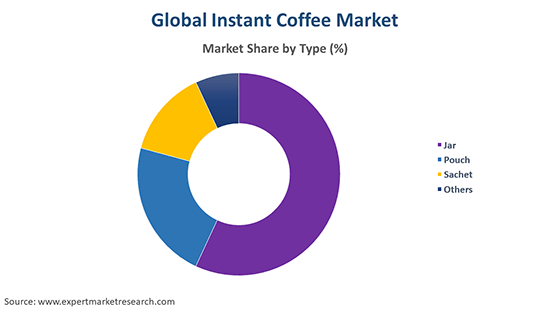

The instant coffee market is experiencing significant market segmentation, driven by key trends such as innovations in packaging and product type. As consumer preferences evolve, brands are diversifying their offerings, including single-serve and flavoured instant coffee options. Additionally, distribution channels are expanding, with both offline and online platforms playing a crucial role in making these products more accessible to a broader audience.

Breakup by Packaging

Jars in the global instant coffee market offer excellent durability and resealability, ensuring the coffee remains fresh for longer periods. They are often perceived as premium packaging, enhancing the product's overall appeal. Jars also provide convenience, allowing consumers to easily scoop the desired amount. Additionally, they are reusable, offering an environmentally friendly packaging option.

Pouches in the global instant coffee market are lightweight, cost-effective, and highly portable, making them ideal for on-the-go consumers. Their flexible design allows for efficient use of space, reducing shipping costs. Pouches are also eco-friendly, as they require less material than traditional rigid containers. They offer excellent barrier properties, maintaining the freshness and flavour of the coffee.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Breakup by Product Type

Spray dried instant coffee in the global market is produced by rapidly drying coffee extract using hot air, preserving the coffee’s flavour and aroma. This method is cost-effective, allowing for mass production. Spray dried coffee is highly soluble, making it a convenient option for consumers. It also has a longer shelf life due to the drying process.

Freeze dried instant coffee in the global market involves freezing the coffee extract and then removing moisture through a vacuum process. This method preserves the coffee’s natural flavour and aroma more effectively than spray drying. Freeze dried coffee is typically considered a premium option due to its superior quality. It also dissolves easily in hot water, offering a rich coffee experience.

Breakup by Distribution Channel

In the global instant coffee market, Business-To-Business (B2B) models offer significant benefits such as bulk purchasing and long-term supply agreements. B2B relationships provide manufacturers with consistent demand, while businesses like cafés, restaurants, and offices benefit from reliable, large-scale coffee supply. This model fosters efficient distribution and cost savings, allowing companies to offer competitive pricing for their customers.

Supermarkets and hypermarkets in the global instant coffee market provide consumers with convenient access to a wide variety of instant coffee brands and product types. They offer physical spaces where consumers can compare options and make informed purchasing decisions. These retail formats benefit from high foot traffic and broad market reach, driving substantial sales volume and allowing brands to increase visibility among a large audience.

Breakup by Region

The global instant coffee market in North America is experiencing steady growth, driven by changing consumer lifestyles and increasing demand for convenience. Busy work schedules and the desire for quick, easy coffee solutions have made instant coffee highly popular. In addition, growing health awareness has prompted consumers to seek healthier instant coffee options, such as those with functional ingredients like green tea extract or ginseng. North American consumers are also showing interest in premium instant coffee products, including speciality flavours and single-serve options. Major distribution channels, including supermarkets, hypermarkets, and e-commerce platforms, contribute to the widespread availability of instant coffee. The market is expected to continue growing as consumer preferences evolve, with brands innovating to cater to the diverse needs of coffee drinkers.

In Europe, the global instant coffee market is seeing significant expansion, influenced by a strong coffee culture and a shift towards convenience. The demand for instant coffee in European countries is driven by busy lifestyles and a preference for quick coffee solutions, particularly in countries with high coffee consumption rates. Furthermore, European consumers are becoming more health-conscious, prompting the rise of functional instant coffee products, such as those infused with antioxidants or adaptogens. E-commerce is playing an increasingly vital role in the distribution of instant coffee, as consumers turn to online shopping for a wider variety of products. The market is also evolving, with brands offering unique flavours, such as pumpkin spice and caramel, to cater to changing tastes and preferences.

The South Korea instant coffee market is being boosted by several factors. Firstly, the growing demand for convenient and quick solutions among busy consumers is driving the market. Instant coffee offers ease of preparation, appealing to working professionals and students who seek efficiency. Secondly, the increasing number of coffee enthusiasts and the culture of coffee drinking, especially among younger generations, are contributing to market growth. Thirdly, the rise in disposable incomes and changing lifestyles are encouraging consumers to spend more on premium instant coffee products. Additionally, the availability of diverse flavours, packaging options, and strong marketing campaigns by leading brands are attracting consumers. Furthermore, the ongoing trend towards healthier beverages, such as low-sugar and organic instant coffee options, is also positively impacting the market. Lastly, South Korea’s vibrant café culture is influencing consumers to explore instant coffee products as a convenient alternative.

The market’s competitive landscape is shaped by key players who dominate the instant coffee industry. Market research reveals that major companies continually innovate to maintain their positions, introducing new products and improving flavours. These market players, including industry giants, influence trends and consumer preferences, driving growth in the global instant coffee market and strengthening its competitive nature.

In the global instant coffee market, instant coffee companies are increasingly diversifying their product offerings to cater to the growing demand for new flavours and functional benefits. Popular trends include the introduction of matcha, turmeric, and adaptogens in instant coffee, appealing to the health-conscious segment. These innovative products are often packaged in eye-catching packaging designs, enhancing consumer convenience. Additionally, companies are focusing on reducing their environmental footprint, with some implementing fair trade practices and adopting carbon-neutral production processes. Partnerships with sustainable suppliers are helping instant coffee exporters strengthen their supply chains and market reach. As the demand for premium, health-focused instant coffee products rises, companies are prioritising eco-friendly packaging and transparent sourcing to appeal to conscious consumers. The shift towards these practices highlights the industry's commitment to sustainability while providing high-quality, convenient products to a global audience. This growing focus on sustainability and innovation is likely to shape the future of the instant coffee market.

March 2025

Andhra's Araku Coffee earned organic certification and secured buyers from Europe. Launched in 2019, the initiative involved 2,600 tribal farmers cultivating coffee across 2,275 hectares in Chintapalli and GK Veedhi mandals. Supported by Tata Group, this project focused on promoting sustainable, organic coffee production for international markets.

February 2025

Starbucks launched the Crema Collection Premium Instant Coffee, crafted to replicate the creamy texture and foamy layer of café lattes. Available in Salted Caramel, Madagascar Vanilla, and Molten Chocolate flavours, the product targeted consumers looking for convenient, flavourful coffee experiences at home.

September 2024

Nespresso, a brand owned by Nestlé, launched its first ready-to-drink coffee, the Master Origins Colombia. The beverage featured premium Colombian coffee beans combined with locally sourced honey. This limited-edition product was made available in the U.S., reflecting Nespresso's dedication to both functionality and sustainability.

January 2024

JDE Peet’s completed the acquisition of Maratá’s coffee and tea business from the José Augosto Viera (JAV) Group. This acquisition strengthens JDE Peet’s presence in Brazil, offering significant volume and value growth prospects. Maratá’s portfolio, including Café Maratá and Chá Maratá, complements JDE Peet’s existing operations, expanding its regional reach and product offerings in Brazil.

May 2023

Kraft Heinz launched IHOP-branded coffee, available in three roasts: signature blend, Buttery Syrup, and Chocolate Chocolate Chip. Made with 100% arabica beans, the coffee was sold in K-Cup pods and bagged grounds, retailing at USD 7.99. This collaboration aimed to leverage Kraft Heinz’s expertise and IHOP’s popularity to attract new consumers.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global instant coffee market reached a value of USD 13.15 Billion in 2024.

The market is projected to grow at a CAGR of nearly 4.90% in the forecast period of 2025-2034.

The market is estimated to reach a value of about USD 21.22 Billion by 2034.

The global instant coffee market is currently being driven by the introduction of various new flavours, such as mocha, green bean, Italian roast, and others, aimed at expanding the consumer base.

The premiumisation and affordability of instant coffee, growing demand for single-serve packaging, and introduction of new flavours, are expected to be the key trends guiding the growth of the market.

Regionally, the market is divided into Europe, Asia Pacific, North America, Latin America, and the Middle East and Africa, with Europe currently leading the global market.

The global instant coffee market can be divided into two segments based on product type: spray-dried and freeze-dried. At present, spray-dried instant coffee holds a dominant position in the market.

The global instant coffee market has been categorised based on packaging into jars, pouches, sachets, and others. Of these, pouches account for the largest share of the market.

The global instant coffee market can be classified by distribution channel into business-to-business, supermarkets and hypermarkets, convenience stores, online, and others. At present, supermarkets and hypermarkets hold the largest share of the market.

Key players in the global instant coffee market include Nestlé, Starbucks Corporation, KRAFT Foods, Tata Consumer Products Limited, Tchibo Coffee International Ltd, Strauss Group, Jacobs Douwe Egberts, Matthew Algie & Company Ltd, and Kraft Foods Inc., among others.

The unexpected onset of the COVID-19 pandemic has resulted in a shift in consumer preferences, moving away from traditional brick-and-mortar stores towards online retail platforms for purchasing instant coffee.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Packaging |

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share