Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India pre-school/childcare market is expected to increase at a CAGR of about 19.20% between 2025-2034. India is dominated by the rural economy. However, trends including the rise in nuclear families as well as disposable incomes due to globalisation will increase the proportion of the urban population. The rising urban market would have a positive effect on the demand for childcare facilities, which will aid the growth of the India pre-school/childcare market.

Base Year

Historical Year

Forecast Year

In 2021-22, pre-schools in India received an admission of around 9.5 million children.

Around 68% of the preschools in India are in the unorganised sector, but there has been a rise in the branded preschools as well.

As of 2023, there were around 25,300 private preschools registered in the country.

Value in USD Billion

2025-2034

India Pre-School/Childcare Market Outlook

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

India is dominated by the rural economy. However, trends including the rise in nuclear families as well as disposable incomes due to globalisation will increase the proportion of the urban population. The rising urban market would have a positive effect on the demand for childcare facilities, which will aid the growth of the India pre-school/childcare industry.

A dramatic increase in the employment rate of women over the last few years has mainly guided the growth of the Indian economy. The hectic lives of parents and late working hours have driven them to shift to pre-school and childcare programs, driving the growth of the Indian market. Increased involvement of women in the workforce has also increased the per capita income of families that further allows them to provide high-quality childcare and early education for their children.

Rise in Technological Advancements

There has been a rise in the integration of technology such as ERP systems and parent communication platforms which can improve the communication between parents and schools. Several preschool providers are integrating digital technology to offer interactive learning as well as personalised learning paths for young children to boost their cognitive development. As per the India pre-school/childcare market dynamics and trends, BYJU, a prominent ed-tech, offers BYJU’s Early Learn platform that offers videos, games, and animations, among others to enhance the development of young learners.

There is also a rise in the incorporation of smart classroom technology such as touch-based interactive devices that can make learning fun for kids. As per India’s Ministry of Education, smart classrooms are readily implemented at all education levels as part of the National Education Policy (NEP) of 2020.

AI and machine learning are the key trends of India pre-school/childcare market as they can offer customised lessons to the kid by analysing their learning patterns. For example, LEAD School leverages AI for customising the curriculum depending on young learner’s performance.

The involvement of parents in children’s social and emotional development is a crucial part of community learning. For instance, the Parental Engagement in Early Years initiative which was supported by the Delhi Government can promote parent’s involvement in kid’s learning with joint workshops and activities.

Development of Teacher Training Programs

There have been increased investments in teacher training programs, specifically customised training programs that can align with modern education and foster growth in young kids, fuelling the India pre-school/childcare market value. These initiatives ensure that the teacher offering the education possesses the required emotional, social, and cognitive skills to foster the minds of young kids. Under the National Education Policy (NEP) 2020, an institute called the National Institute of Open Schooling (NIOS) was launched which offers specialised courses for teachers.

Some private sector market players such as KLAY Schools and EuroKids offer in-house teacher training programs so that their teachers have the right knowledge for aiding the development of young learners. These institutes also offer personalised training approaches to the teachers so they can educate kids appropriately.

Growth of Community-Based Learning

Community-based learning programs can promote social and behavioural development among the students. Many programs are also encouraging the involvement of parents in these programs. Moreover, initiatives such as Shikshantar in Gurgaon encourage community-driven education where children engage in activities such as storytelling, art projects, and role-playing with their fellow children, increasing the India pre-school/childcare market opportunities.

Furthermore, there has been a rise in the Anganwadi centres in India as they promote early childhood education as well as community-based learning. UNICEF India stated that such learning methods can improve the social and emotional skills of young learners.

March 2024

Kido International, a UK-based leading provider of early education, announced the acquisition of Amelio Early Education, one of the major preschool and daycare providers in India. It aims to offer international-level preschool experience to the students and boost the growth of the India pre-school/childcare market.

September 2023

Safari Kid, a US-based preschool chain, announced that it is investing around Rs 100 crore for its expansion in India and to provide premium services. It aims to open 20 preschools by March 2024 and 50 overall schools by 2028.

Increased Incorporation of Creativity

Several preschool and childcare institutes are fostering the creativity of young kids through their programs. Several pre-schools in the country are using hands-on training for their learning programs. For example, some market players such as EuroKids and KLAY Prep are using hands-on and play-centred manners to promote the creativity and engagement of the kids through their imagination.

STEAM learning has also gained popularity in nursery school programs as it aims to encourage creativity and innovativeness and contribute to the India pre-school/childcare demand growth. For instance, In 2021, with the help of STEAM in educational practices, Amelio aimed to create an early education program that focused on arts integrated with science and mathematics which let children spark their creativity while learning fundamental subjects. These strategies mostly rely on art, storytelling, role-playing, and free play, among others.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Pre-schools are the educational facilities for children in the age group of 2 to 4 years, which concentrate on the early development of children's skills. These institutions facilitate early education for children to boost their self-esteem and improve their learning habits. Such learning spaces concentrate on improving their mental, emotional, and linguistic skills in order to develop their basic motor, cognitive, physical, psychological, linguistic, and emotional capabilities. They also conduct team-building exercises for children to encourage the value of teamwork while at the same time instilling a sense of compassion for their classmates.

Based on the facility, the India pre-school/childcare market can be divided into:

On the basis of ownership, the industry can be categorised as:

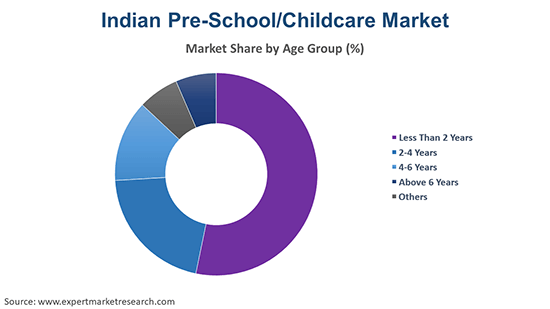

The age-group in the market can be grouped as:

Based on location, the industry can be divided into:

Based on major cities, the market can be divided into:

The regional markets for India pre-school/childcare market include:

By Facility Analysis

Full Day Care holds a substantial share in the market due to the rise of dual-income families in the country. As per the UNICEF India report, there has been a rise in the demand for full day care services which take care of children from morning to evening, contributing to India pre-school/childcare market revenue. These facilities offer meals, nap time, and playtime, among other activities.

By Ownership Analysis

The private segment is expected to gain significant growth in the market in the coming years as these institutes offer better quality service for the kids. The burgeoning prominence of Private institutions such as EuroKids, KLAY, and Kidzee, among others, offer full-day care and training programs to enhance the brain development of the children.

By Age Group Analysis

As per the India pre-school/childcare industry analysis, the age group between 2 to 4 years hold a substantial market share as this is the common age for the enrolment of young kids in early education programs. Young kids in this age group experience the most motor and cognitive development which makes it the most suitable age for providing early learning.

By Location Analysis

Standalone preschools hold the majority pre-school/childcare market share in India as they are very popular in urban and semi-urban areas. These institutes are specially designed for early learning and offer specialised curriculum and training which makes them the most appropriate choice for the parents.

By Major Cities Insights

Delhi-NCR region accounts for a significant market share. The growing phenomenon of nuclear families in the region has resulted in a rising demand for well-trained preschool services by professionally trained workers.

Besides this, the Indian education system is experiencing a rapid paradigm change with the introduction of lateral thought and experiential learning approaches in this area, which aids the demand of India pre-school/childcare market. This trend is gradually gaining popularity among parents, which has led them to move from kindergartens to pre-schools with a conventional teaching approach that focuses on the overall growth of students through an innovative approach.

South India India Pre-School/Childcare Market Analysis

This region typically holds significant market share due to the presence of cities such as Bangalore and Chennai where rapid urbanisation and presence of high-end pre-schools are boosting the segment growth. The increased penetration of branded pre-schools throughout Tier 1 and Tier 2 cities, combined with a growing population income in urban areas also increase the India pre-school/childcare industry revenue.

The burgeoning presence of key market players such as EuroKids and KLAY Schools in these cities offers easy access to upper-class and middle-class families to enroll their children in the top institutes of the country.

North India India Pre-School/Childcare Market Trends

North India is also expected to witness significant growth due to the presence of prominent preschool and childcare providers in the NCR region. The rise of nuclear families and single parents in big cities due to job purposes further fuels segment growth and positively impacts India pre-school/childcare demand forecast.

In addition, the growing change in the Indian education sector, together with a rising awareness among parents in this region of the value of early childhood education, will further boost the urban preschool/childcare market in India during the forecast period.

The report gives a detailed analysis of the following key players in the India pre-school/childcare market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds. Several companies are focusing on improving the cognitive development of children through their play-based activities and self-paced programs.

Founded in 2003, it is one of the most prominent preschool chains in Asia. This institute follows the ILLUME curriculum which focuses on child-centric and self-paced learning. This institute offers structured programs for fostering the proper growth of the kids in preschool as well as kindergarten.

Founded in 2005, this is one of the most popular preschool chains in India with around 1200 branches worldwide. It offers features such as smart classrooms and Speak-O-Kit which educates kids through innovative and audio-visual training methods to enhance their learning experience.

Founded in 2001, Eurokids is another major market player in India pre-school/childcare industry which boosts around 1000 centres in India. It offers an EUNOIA curriculum which can help young learners achieve emotional, social, and cognitive development to help them adjust well in school later on.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major players in the market are Shemrock, Hello Kids Education India Pvt., and Little Millennium, among others.

Several startups in the country are readily contributing to the modernisation in early education so that kids can possess proper cognitive and motor skills. Several new companies are leveraging digital technology and smart classroom training to make learning fun and interactive for their young learners, to boost pre-school/childcare demand in India.

FlintoClass

FlintoClass is one of the fastest growing startups in the country which offers preschool curriculum and learning kits for kids aged 2 to 6. It offers both online and offline activities for promoting young learner’s development. This company gained significant recognition during the pandemic by helping preschools shift to online digital models.

ProEves

This preschool platform allows parents to connect with well-known and reliable childcare centres in India. It offers the location, review, and services, among other features by different preschools so that the parents can make an informed and best decision regarding their children.

August 2024

Makoons Play School won the reward for the Leading Preschool in India (Bronze) at the Business World Top Education Brand Summit and Awards which was held in Delhi. This reward was given due to its role in promoting quality education and nurturing an environment at a young age.

July 2024

The state government of Uttar Pradesh aims to develop 4000 new play schools in the second phase to deliver quality education to young learners. Earlier the government had established 4000 play schools for children aged between 3 to 6 years.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 19.20% between 2025 and 2034 .

The major market drivers include rising in the employment rate of women, hectic work schedules of parents, rising nuclear families, increasing per capita incomes of the families, and the rising demand for high quality education for younger children.

The key trends guiding the market include the increasing penetration of branded pre-schools in tier-II and tier-III cities, a growing population in urban areas, and rising demand for well-trained pre-school services with professionally trained workers.

North India, West and Central India, South India, and East India are the major regions in the market.

Full day care and after school care are the leading facilities in the market.

The significant ownership segments of pre-school/childcare considered in the market report include public and private.

The major age groups considered in the market report are less than 2 years, 2-4 years, 4-6 years, and above 6 years, among others.

The leading locations of pre-school/childcare are standalone, school premises, and office premises.

Delhi-NCR, Bengaluru, Hyderabad, Chennai, Mumbai, Kolkata, and rest of India are the major cities in the market.

The key market players include Kidzee, Bachpan, Eurokids, Shemrock, Hello Kids Education India Pvt., and Little Millennium, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Facility |

|

| Breakup by Ownership |

|

| Breakup by Age Group |

|

| Breakup by Location |

|

| Breakup by Major cities |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share