Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India data center market was valued to reach a market size of USD 5031.81 Million in 2025. The industry is expected to grow at a CAGR of 14.10% during the forecast period of 2026-2035. India data center market is driven by the expansion of the 5G technology, favourable governmental initiatives, and the growth in digital businesses and payments. These further aids to attain a valuation of USD 18818.31 Million by 2035.

Base Year

Historical Period

Forecast Period

The expansion in IT services increases the demand for data centers to control massive data traffic. In 2024, IT spending in India recorded a double-digit growth of 11.1%, totaling USD 138.6 billion up from USD 124.7 billion in 2023.

The growing digitalisation of the economy, with businesses investing more in cloud storage and rising consumer demand for data, is driving the need for expanded data center power capacity. In 2027, India’s data center industry is projected to add 384.9 MW of data center capacity.

Cities across India are experiencing significant data center growth. For instance, Hyderabad, with an existing IT capacity of 48.3MW, has 431MW in development, while Chennai, with 115.5MW of capacity, has an additional 271.5MW on the way. Between 2024 and 2030, over 2,000 MW of IT capacity is expected to come online across India’s major cities.

Compound Annual Growth Rate

14.1%

Value in USD Million

2026-2035

*this image is indicative*

In 2023, India was ranked the 13th largest data center market in the world with 138 data centers. Key data center hubs in India include Bengaluru, Hyderabad, Noida (Delhi-NCR), Pune, and Kolkata. Mumbai is the prime hub for data centers in India, attracting demand from BFSI, media, and IT sectors.

Data centers store and share applications and data. The growth in India’s data usage in both urban and rural areas supports the demand for data centers. In 2024, the total number of internet subscribers was 954.40 million, of which 398.35 million were rural internet subscribers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

India is seeing a rise in green data centers that reduce their environmental impact by utilising energy-efficient technologies and renewable energy sources like solar, wind, and hydropower. Nxtra by Airtel and the Hiranandani Group are leading the way with their focus on renewable power for data center operations, supporting the India data center market development.

The growth of the e-commerce sector is increasing the demand for data centers to host the web and back-end infrastructure that run the online facilities. By 2026, the Indian e-commerce market is projected to reach USD 163 billion, further driving the need for data centers.

The Indian government has undertaken multiple initiatives such as Digital Communications Innovation Square (DCIS) and Telecom Technology Development Fund (TTDF), to promote 5G subscriptions. During 2023-2040, 5G is expected to contribute approximately USD 455 billion to India’s economy.

As per India data center market report, India is well-positioned to become a leading data center hub in Asia, driven by the rise of 5G, increased internet usage in Tier 2 and 3 cities, and the growing demand for the Internet of Things (IoT) and Artificial Intelligence (AI).

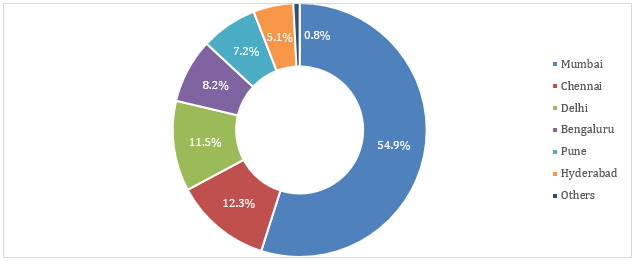

According to 2024 data, Mumbai accounts for the largest of 54.9% or 517.2MW of the national data center stock. Mumbai also has more data center capacity under development (1,209MW) than the rest of the country combined.

Figure: India Data Center Stock by City, 2024

The demand for 5G is driven by a surge in digital activities such as streaming, gaming, and social media driving higher data consumption.

By 2030, 5G will account for more than a third of total connections in India. During 2023-2040, 5G is expected to contribute approximately USD 455 billion to India’s economy. The 5G device ecosystem in India is rapidly evolving. In 2023, 17% of active 4G devices were 5G capable, totalling 134 million out of 796 million devices.

Figure: Top Internet Service Providers by Subscribers, 2024

Key industries such as manufacturing, retail, healthcare, and agriculture are incorporating the 5G technology to improve efficiency. By 2030, India's 5G market is expected to have 970 million subscribers. Furthermore, the growth in smart city projects aids 5G adoption. According to November 2024 data, India had issued a total of 8,066 smart city projects under the Smart Cities Mission (SCM). SCM was launched in June 2015 and is expected to extend till March 2025.

The growth in digital businesses and digital payment drives the demand for data centers to facilitate smooth customer transactions. In FY 2023-24, the total number of digital payment transactions volume increased to USD 2.27 billion (INR 18,737 crore), up from USD 0.30 billion (INR 2,071 crore) in FY 2017-18, constituting a growth rate of 44%. The introduction of UPI has further facilitated digital payment growth, aiding the demand for data centers. In 2024, the value of UPI-based payments reached over USD 2.4 trillion (INR 200 trillion).

The growth in the telecom industry supports the India data center market. Telecommunication data center automates traffic flow between services in a virtual network, optimising the use of network resources and improving application performance by selecting the optimal routing path.

In 2024, India was the world's second-largest telecommunications market, with a subscriber base of 1.20 billion.

India’s growth in e-commerce, 5G adoption, IoT integration, and favourable government policies drive India data center market growth.

As businesses become more reliant on technology, they require more specialised services like cybersecurity, disaster management, and compliance management. By providing these services, market players can differentiate themselves and provide more value to customers. In 2023, India experienced over 79 million cyberattacks, a 15% increase compared to 2022.

Cloud computing enables data center operators to adjust resources quickly and efficiently, eliminating the high costs and downtime of physical infrastructure changes. In 2023, Indian public cloud services generated a revenue of USD 8.3 billion, and by 2028, it is expected to attain a value of USD 24.2 billion.

Data centers are crucial to process the massive increase in data traffic from connected devices. By 2030, 5G telecom networks are expected to represent nearly 2% of India's GDP, contributing about USD 180 billion in revenue. In 2023, around 69% of organisations in India were identified as "Digital Businesses" with a clear digital strategy and technology integration.

India is witnessing a rise in digital transactions, significantly becoming a cashless economy. India's digital payment revolution is being spearheaded by UPI, which achieved a record 16.73 billion transactions in December 2024. Furthermore, as per 2023 records, India accounts for around 49% of global real-time payment transactions, representing a strong digital payment sector, further necessitating strong data center infrastructure and impacting the demand of India data center market.

India's robust IT sector has led to the establishment of local operations by several global IT corporations, ranging from major banks to technology firms, seeking to capitalise on lower labour and operational costs. According to January 2025 data, India has the presence of 65,803 software companies, representing an increase of 3.36% from 2023.

By 2030, India's consumer digital economy is expected to become a USD 1 trillion market up from USD 537.5 billion in 2020, driven by the strong adoption of online services such as e-commerce and edtech in the country. UPI has revolutionised digital payments with UPI transactions growing from 0.92 billion in FY 2017-18 to 131.16 billion in FY 2023-24, accelerating the India data center market.

The increasing demand for energy and resources from various sectors, including data centers, is raising growing concerns about the environmental impact of these facilities. Moreover, the increasing energy costs and the need for more sustainable business practices are resulting in an increased focus on developing sustainable and environmentally friendly data centers, also known as green data centers. The trend is further pushed by the presence of government initiatives such as the “Green Base Data Center” scheme, launched by the Ministry of Electronics and Information Technology (MeitY), further supporting the establishment of green data centers.

India is witnessing an adoption of edge computing which improves performance and reduces latency. Edge computing is considered key for Indian market, due to the presence of several remote areas with poor connectivity. Companies in India data center market are actively establishing edge computing infrastructure in rural areas enabling businesses to provide better services to their customers, even in areas with limited connectivity. As per 2024 report, Akamai Technologies, a global cloud computing company is focusing on establishing cloud computing facilities in Indian cities such as Delhi, Bengaluru and Hyderabad.

Despite the rapid growth of data centers in India, the industry faces several challenges, with one of the biggest being an inadequate power supply. In India, the power supply is often unreliable, and frequent outages can pose a major issue for data centers that rely on continuous power to function.

Several factors contribute to labour shortages in the India data center market, including the need for specialised skills, the rapid pace of technological advancements, and the growing complexity of data center operations. This shortage of qualified professionals can hinder the industry’s ability to meet the rising demands of enterprises, potentially leading to higher operational costs, decreased efficiency, and increased security vulnerabilities.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“India Data Center Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of components, the market can be divided into the following:

On the basis of Infrastructure, the market can be divided into the following:

On the basis of industry, the market can be divided into the following:

Based on region, the market can be segregated into:

Market Analysis by Component

The increasing demand for data centers in India is driven by the extensive data storage and processing needs of hyperscale cloud providers, over-the-top (OTT) platforms, and artificial intelligence (AI) companies. During 2019-2024, India witnessed an increase of 54% in active companies, reaching 1.78 million by October 2024.

Public cloud spending in India is growing at a rate of 18% annually, driven by the increasing adoption of software-as-a-service (SaaS) models in response to the ongoing digital transformation, further supporting the India data center market growth.

Market Analysis by Infrastructure

As per India data center market analysis, by 2026, the Indian data centre sector is estimated to add 604MW of capacity, which will require 7.3 million sq ft of space and an investment of USD 3.8 billion. The increasing adoption of artificial intelligence and the rollout of 5G across the country is pushing the need for increased data centre capacities.

Further, the rising internet connectivity across the country is pushing the requirement for data centre networks and efficient servers. India is witnessing average download speeds increasing from 4.18 Mbps to 105.85 Mbps during 2014 to 2024, representing a rise of 2,432.29%.

As per august 2024 records, India is home to around 1,300 AI companies, with AI anticipated to drive the demand for high-density server racks, ranging from 5 to 50 kW.

There is a growing demand for electrical infrastructure driven by the data centre growth in India. It is estimated that during 2024-2027, the data centre power consumption to increase by 678 MW to 1,400 MW, significantly increasing the demand for generators, switchgears, PDUs and UPS systems. Switchgears are key factors in data center's power distribution as it is used to control and distribute power and to disconnect faults, while PDU is responsible for controlling electrical power.

Cooling systems and rack cabinets are crucial for preventing overheating in data centers. They maintain optimal temperatures, ensure proper airflow, and support equipment reliability, efficiency, and longevity, even in densely packed and high-performance IT environments.

This trend in India data center market is further supplemented by the growing investment in the sector. For instance, in October 2024, RackBank announced an 80MW AI-optimised data center in Indore, Madhya Pradesh that will feature Varuna liquid immersion cooling immersion technology, rear door heat exchangers, and rack densities of 50-150kW, targeting PUE of 1.1 to 1.3.

Market Analysis by Industry

Data centers enable the BFSI sector to process high volumes of transactions within milliseconds, ensuring seamless operations in a time-critical industry.

UPI has transformed digital payments in the country, with transaction volumes 131,160 million in FY 2023-24, reflecting a remarkable CAGR of 129% from FY 2017-18, supporting the India data center market expansion.

Data centers manage critical data from sensors, machine logs, and supply chains, supporting India’s manufacturing sector, set to reach USD 1 trillion by 2025-26.

In January 2024, Digital Realty launched a data center, including a 100 MW facility in Chennai’s manufacturing hub, highlighting rising demand for digital transformation.

In government and defence, data centers manage sensitive data for citizen services, intelligence, and military operations. India’s Digital Public Infrastructure (DPI) includes Aadhaar (1,383.4 million IDs), UPI (241,000 million transactions), DigiLocker (370.46 million users, 7,760 million documents), and DIKSHA (5,563.7 million sessions, 179.5 million enrolments, 143.7 million completions).

As per the India data center market analysis, in 2024, India's telecom sector is expanding with over 50% of the country’s population considered to be active internet user, thus pushing the major telecom players to significantly invest in their data center capabilities.

Leveraging the growing trend, Airtel plans to launch multiple new hyperscale and enterprise data centers across key metro cities in the next 3-5 years.

The installed IT capacity in National Capital Region (NCR) is expected to grow from 61 MW in FY 2023 to 260 MW in FY 2026. Edge data centers are driving the capacity editions.

In December 2024, VueNow headquartered in Mumbai, launched two new Edge Data Centers in Uttar Pradesh’s Malihabad and Ambedkar Nagar. The company, supported by the Uttar Pradesh Government, is working towards setting up 750 Edge Data centers in the state by 2028, making it the world's largest and densest Edge Data center network.

South India data center market is expected to play a crucial role in the global data center landscape with capacity projected to grow 65% by 2030. In 2024, the combined installed data center capacity in Chennai, Bengaluru, and Hyderabad was approximately 200 MW with 190 MW under construction and an additional 170 MW planned.

In March 2023, the Web Werks - Iron Mountain Data Centers (IMDC) Joint Venture launched the first phase of a new facility in the Karnataka region of the country in Bangalore. The BLR-1 is a Tier III-designed data center that can support up to 4MW of IT load.

Under its 2023 IT policy, Madhya Pradesh offered a land subsidy of up to 75% for the establishment of data centers, along with capital expenditure support of 25% for the first five data centers that make a minimum investment of USD 60.55 million.

In October 2024, RackBank launched India’s first purpose-built AI data center, designed to support 60,000 GPUs and 80MW power. Positioned as a key hub for AI and cloud services, it offers low-latency connectivity and strengthens India’s technological infrastructure.

The India data center market players are engaging in geographical expansion to major hubs, strategic partnerships, strengthening Presence with AI-Enabled Facilities and Government Partnerships, significantly contributing to market growth.

Founded in 2019, Yotta designs, builds, and operates infinitely scalable data center parks, catering to the evolving needs of the digital era. Yotta currently operates two data centers: Yotta NM1 in Navi Mumbai, Maharashtra, and Yotta D1 in Greater Noida, Delhi-NCR.

Founded in 2021, AdaniConneX, a joint venture between the Adani Group and EdgeConneX, was established to develop a 1 GW national data center platform aimed at driving the growth of Digital India. AdaniConneX operates a robust network of state-of-the-art data centers strategically located in Chennai, Hyderabad, Mumbai, Noida, Pune, and Vizag.

Founded in 2014, Pi DATACENTERS® operates with a cumulative built-up area of 500,000 sq. ft. and a power capacity of 60 MW, supported by a dedicated in-house substation. It stands as India’s first Greenfield and the world’s fourth-largest Uptime Institute TIER IV Certified Data Center.

Founded in 2007, The company operates its datacenters with a remarkable 250 MW operational capacity, spanning 15 datacenters across 8 major markets and continually growing. CtrlS owns and operates multiple subsidiaries, including Cloud4C, Pioneer Labs, SCHNABEL, Cloud4C Automation, and Cloud4C Digital.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the India data center market are Arshiya Limited., NTT Global Data Centers, Sify Technologies Limited, and Reliance Communications Ltd, among others.

United States Data Center Market

United Kingdom Data Center Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 5031.81 Million.

The India data center market is assessed to grow at a CAGR of 14.10% between 2026 and 2035.

The India data center market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 18818.31 Million by 2035.

The market is being aided by the increasing digital transformation, the introduction of various favourable government initiatives to boost investments in data centers, and the expansion of data center solutions.

The market growth can be attributed to the growing demand for high-speed data with low latency, the increasing adoption of data centers in the telecom industry, and the growing usage of data centers in the healthcare industry.

The major regions in the market in India include North India, South India, Central India, East India, and West India.

The various components of data center are services and solution.

The major IT infrastructures of data center in the market are network, server, and storage.

The significant electrical infrastructures in the market are UPS systems, generators, transfer switches and switchgears, and PDUs, among others.

The different mechanical infrastructures of data center are cooling systems and rack cabinets, among others.

The several general construction segments of data center are building development, installation and commissioning services, building design, physical security, and data center infrastructure management, among others.

The major industries of data center are banking, financial services, and insurance, healthcare, government and defence, manufacturing, IT and telecom, retail, and energy, among others.

The major players in the market are CTRLS Datacenters Ltd., Arshiya Limited., NTT Global Data Centers, Sify Technologies Limited., YottaData Services Private Limited, AdaniConnex Private Limited, Reliance Communications Ltd. (Reliance Datacenter), Pi DATACENTERS Pvt.Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Components |

|

| Breakup by Infrastructure |

|

| Breakup by IT Infrastructure |

|

| Breakup by Electrical Infrastructure |

|

| Breakup by Mechanical Infrastructure |

|

| Breakup by General Construction |

|

| Breakup by Industry |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share