Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global household cleaning products market size USD 223.86 Billion in 2025. The market is further expected to grow in the forecast period of 2026-2035 at a CAGR of 4.60%, to reach USD 350.99 Billion by 2035, reflecting the increasing demand for efficient and safe homecare goods. Rising environmental concerns drive this growth, as consumers seek eco-friendly cleaning products that are effective yet safe for home use.

The market size in the U.S. plays a significant role in this expansion, with a robust market for household cleaning products, as more households turn to greener alternatives. As a result, the household cleaning products market continues to evolve, with innovations focused on sustainability and improving cleaning products’ performance to meet the rising demand for safer homecare goods, more environmentally friendly solutions.

Base Year

Historical Period

Forecast Period

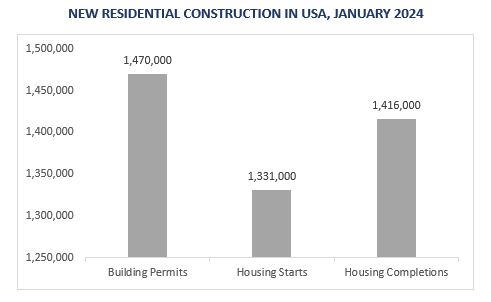

Data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development showed a rise in residential buildings, completing 14,16,000 constructions in January 2024, boosting global household cleaning product market.

The Swachh Bharat Mission, the world's largest sanitation initiative, led to the construction of over 100 million household toilets, raising sanitation coverage to 100% by 2019. This surge in cleanliness practices boosted the global household cleaning products market growth.

Government initiatives, health organizations, and media campaigns play pivotal roles in promoting cleanliness practices, thereby strengthening the global household cleaning products market.

Compound Annual Growth Rate

4.6%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The household cleaning products market is evolving as consumers prioritise hygiene and well-being within households. Cleaning products, formulated with ingredients that are both effective and safe, are in high demand. These products help maintain cleanliness while supporting healthier living environments. The increasing awareness of the benefits of safe and sustainable cleaning solutions has boosted the demand for household cleaning products, leading to innovations that address both cleaning performance and environmental impact, ensuring a better quality of life for consumers. In July 2024, Klin Space launched innovative organic cleaning products, focusing on safe, eco-friendly solutions for households. Founded by Iswarya, driven by a passion for safer home care, the brand offers biodegradable, non-toxic products like all-purpose cleaners and dish wash gels.

The household cleaning market has witnessed a significant surge in demand for cleaning products, particularly following COVID-19, as consumers prioritised hygiene and housekeeping. This shift in consumer behaviour led to a higher demand for household cleaning goods, with an increasing focus on products that ensure effective cleaning while promoting safety. However, the market faced challenges due to supply chain disruptions and raw material sourcing issues, affecting production. Despite these obstacles, the industry saw an uptick in facility expansions, which allowed for increased production capacity to meet the rising demand. The ongoing emphasis on hygiene and the need for cleaner, safer environments has driven this expansion, ensuring that the demand for cleaning products remains high in the coming years.

The global household cleaning products market growth is propelled by factors such as environmental consciousness, shifts in lifestyles, the growth of e-commerce, and a focus on individual and societal well-being.

As per the global household cleaning products market analysis, increasing environmental awareness and concerns over conventional cleaning products' adverse effects drive the household cleaner industry. Consumers seek eco-friendly solutions, spurring companies to develop biodegradable, non-toxic options with certifications like cruelty-free, meeting evolving regulations.

The global household cleaning products market developments are impacted by the shift towards urbanization, which has altered lifestyles, highlighting the need for compact living spaces and heightened cleanliness awareness. Urban residents demand efficient, time-saving cleaning items, a trend amplified by busy schedules.

The global household cleaning products market has seen substantial growth due to the rise of e-commerce, offering consumers enhanced accessibility and convenience. Online platforms enable browsing, comparison, and purchase of cleaning products, benefiting brands, and reaching remote areas. E-commerce democratizes the market, enabling smaller brands to compete, and fostering innovation and variety.

Cleaning products play a vital role in preserving personal hygiene, eliminating dirt, minimizing germs, extending product longevity, and fostering healthier, more comfortable living and working spaces. Essential for cleanliness, hygiene, and sanitation, these products cater to various needs such as surface cleaning and laundry care within the diverse household cleaning products market.

Complete Transparency of Ingredients on Labels to Drive Market Growth

The household cleaning market is witnessing significant growth, driven by increasing consumer demand for transparency in product ingredients. Buyers want to know the exact contents of cleaning products, which boosts consumer confidence. As consumers become more mindful of the ingredients in household products, manufacturers are focusing on providing clear information about the ingredients they use. This transparency not only builds trust but also aligns with the growing trend of conscious consumerism, further supporting market growth. In September 2024, Castrol India expanded its Auto Care portfolio with the launch of two new products: the Castrol Microfibre Cloth and Castrol Shiner Sponge. These additions complement existing offerings, enhancing vehicle interior and exterior care, while strengthening Castrol's position in the automotive care market.

Rising Demand for Natural Products Fuels Market Growth

The global household cleaning market has shifted significantly due to rising environmental concerns, with consumers increasingly opting for green and natural goods. This shift towards eco-friendly products is boosting growth as demand for natural and green products rises. As buyers become more aware of the environmental impact of traditional cleaning solutions, the market is embracing cleaner, safer alternatives. The growing preference for eco-friendly and natural products is driving manufacturers to innovate, further strengthening the market's commitment to sustainability. In January 2025, Natural Grocers expanded its private-label household cleaning line with six new vegan, cruelty-free products. Free from parabens, phthalates, sulfates, and synthetic fragrances, these eco-friendly items come in sustainable sugar-cane containers. The company emphasises transparency, listing full ingredients despite no legal requirement.

The market is being driven by consumers' increasing preference for safer alternatives to harsh chemical products. As awareness grows around the potential dangers of traditional cleaning agents, consumers are willing to pay more for eco-friendly and non-toxic options, boosting demand for cleaner, safer products. This shift towards healthier cleaning solutions is shaping the market's future trajectory.

Shift to Urban Lifestyles has Increased Demand for Convenient Products, Fueling Market Growth

The global household cleaning market is experiencing increased demand for household cleaning products, driven by urbanization and the rise of urban living. As consumers seek more convenient, time-saving cleaning solutions, innovation plays a key role in developing products that meet these needs. The demand for such products continues to grow as urban dwellers prioritise ease of use and efficiency. This trend is expected to drive the demand for innovative cleaning solutions, shaping the market's future trajectory. In January 2025, Clean Mama partnered with pOpshelf and Core Home to launch an exclusive line of cleaning, storage, and laundry products in 21 U.S. states. This collaboration made Clean Mama’s products more accessible, aligning with the brand's mission to simplify homekeeping and bring stylish, functional solutions to more households.

Limited Market Growth Due to Insufficient Customer Retention and Product Differentiation

The global household cleaning market faces several restraints that may limit its growth. Medium-sized manufacturers struggle to compete with larger companies, which have better resources and distribution networks. Consumer behaviour, including preferences shaped by psychographic, demographic, and behavioural factors, plays a significant role in the demand for household cleaning products. However, many consumers exhibit limited product loyalty, leading to challenges in retaining customers. Additionally, the lack of product distinctiveness from medium-sized manufacturers makes it difficult for them to stand out in the market. The need for differentiation through innovative solutions becomes crucial to overcome these obstacles and drive market growth, as consumer preferences evolve.

Strong Demand to Drive Growth in the Laundry Detergent Segment

Laundry detergents effectively remove stains, dirt, and odors from clothes, offering both cleaning power and fabric care. They come in various forms, including liquids, powders, and pods, catering to different consumer preferences. These products help maintain the quality of fabrics while ensuring hygiene and freshness, driving demand in the global household cleaning market. In August 2023, ARM & HAMMER™ launched Power Sheets, a liquidless laundry detergent, becoming the first major brand in the sheets detergent category on Amazon in the U.S. Partnering with Victoria Justice, the eco-friendly innovation eliminates plastic waste while delivering effective cleaning performance, offering convenience and freshness.

Surface cleaners are essential for maintaining cleanliness and hygiene in the home, tackling dirt, grime, and bacteria on various surfaces like countertops, floors, and appliances. Available in sprays, wipes, and liquids, these products provide quick and effective solutions for everyday cleaning. They cater to consumers seeking convenience, offering versatility for use in kitchens, bathrooms, and other high-touch areas. The demand for surface cleaners continues to grow as consumers prioritise hygiene, especially in the wake of heightened health awareness and sanitation concerns.

Dishwashing products, including liquid detergents, powders, and dishwasher tablets, are designed to effectively clean dishes, cutlery, and cookware. These products remove food residues, grease, and stains while ensuring items remain hygienic. With a range of options, from hand-washing liquids to machine detergents, they meet various consumer needs for convenience and efficiency. In the June quarter of 2024, Australia completed 44,853 dwellings, with 28,228 being private new houses, reflecting an 11.4% increase (ABS 2024). This growth is driving demand for dishwashing products, which help maintain kitchenware and support the global household cleaning market.

Supermarkets and Hypermarkets Fuel Growth in the Household Cleaning Products Segment

Supermarkets and hypermarkets play a significant role in the global household cleaning products market by offering a wide range of cleaning solutions. Their accessibility, extensive product variety, and competitive pricing attract consumers. These retail channels also provide the convenience of in-store shopping, allowing customers to make quick purchasing decisions. Astonish launched its vegan cleaning products in Tesco stores nationwide from October 2024. The brand secured 10 product listings across 200 stores, including specialist and core range items, marking a significant milestone in expanding its retail presence.

Online platforms have become a vital sales channel for household cleaning products, offering the convenience of home delivery and a broader range of options. Consumers can easily compare prices, read reviews, and access exclusive online deals. With the increasing trend of e-commerce, more consumers are opting for online shopping, making it a key driver for the growth of the global household cleaning products market, especially during the rise of digital and contactless shopping experiences.

The Asia Pacific region is witnessing substantial growth in the global household cleaning products market, driven by rapid urbanisation, increasing disposable incomes, and shifting consumer preferences towards convenient and eco-friendly cleaning solutions. Countries like China, India, and Japan are leading the market, with rising awareness of hygiene standards and the demand for innovative cleaning products. Additionally, the growing middle-class population in emerging economies is significantly contributing to the uptake of household cleaning products. The trend towards sustainable and chemical-free alternatives is also gaining momentum, prompting manufacturers to introduce more eco-friendly options. In November 2024, KEENON Robotics and Truly Robotics showcased new cleaning robots, including the KLEENBOT C20 and C25, at Food & Hotel Asia-HoReCa Singapore 2024. These robots, designed for both small and large spaces, impressed attendees with their efficient, multi-functional cleaning capabilities, drawing significant industry interest.

North America remains one of the largest and most mature markets for household cleaning products, with the U.S. and Canada at the forefront of this growth. Consumers in the region are increasingly demanding innovative, eco-friendly, and efficient cleaning solutions, leading to a rise in green cleaning products and sustainable packaging. This shift towards environmentally conscious choices is driven by growing environmental awareness and concerns over the harmful effects of chemicals in traditional cleaning products. Additionally, the convenience of online shopping and the availability of a wide range of cleaning solutions across various retail channels further fuel market expansion. In July 2024, Clean Habits launched its probiotic-based cleaning products in North America, introducing HEIQ Synbio Technology for long-lasting, non-toxic cleaning. The range, including multi-purpose sprays and pet stain removers, has gained early retail interest from major chains like CVS, Walgreens, and Walmart.

In the Middle East and Africa, the household cleaning products market is seeing steady growth, with demand being driven by an increasing population, urbanisation, and rising living standards. As disposable incomes grow, consumers are seeking premium and more efficient cleaning solutions. While traditional cleaning products remain popular, there is a noticeable shift towards eco-friendly and multi-purpose cleaning products. E-commerce platforms are also gaining traction, making it easier for consumers to access a wider variety of products in the region.

Latin America’s household cleaning products market is experiencing gradual growth, supported by urbanisation and an expanding middle class. The demand for cleaning solutions is rising as consumers seek convenient and effective products. In countries like Brazil and Mexico, there is a growing preference for affordable yet high-quality cleaning products. The shift towards environmentally friendly options is also gaining momentum, driven by increased awareness of sustainability and health concerns across the region.

The South Korean household cleaning products market is witnessing steady growth, driven by high consumer awareness of hygiene and cleanliness. South Koreans are increasingly favouring premium, effective, and eco-friendly cleaning solutions, with many opting for innovative and convenient products. There is a growing demand for specialised cleaners, such as antibacterial and multi-purpose products. E-commerce platforms are rapidly becoming the preferred shopping method, offering a wide range of cleaning products with easy accessibility and convenient delivery options.

Key Players Prioritise New Product Launches to Strengthen Their Market Position

The household cleaning products market is characterised by intense competition, with key companies focusing on innovation and new product launches to strengthen their market presence. Leading players are continuously introducing advanced cleaning solutions to meet the growing demand for effective and eco-friendly products. With consumers becoming more health-conscious and environmentally aware, companies are adapting to these changes by developing sustainable products that combine convenience, performance, and environmental responsibility. This dynamic market is expected to witness significant growth as brands strive to meet evolving consumer needs.

Unilever PLC, founded in 1929 and based in the United Kingdom, is a distinguished manufacturer and distributor of fast-moving consumer goods. Its extensive product portfolio spans food items, beauty and personal care products, beverages, home care products, as well as vitamins, minerals, and supplements.

Reckitt Benckiser Group PLC, established in 2007 and headquartered in the United Kingdom, offers a diverse array of products including air fresheners, laundry detergents, dishwashing liquids, disinfectant sprays, household cleaners, and personal care items.

Henkel AG & Co. KGaA, founded in 1876 and based in Germany, operates in both industrial and consumer sectors, providing a range of products such as popular hair care products, laundry detergents, fabric softeners, as well as adhesives, sealants, and functional coatings.

The Procter & Gamble Company, established in 1837 and headquartered in the United States, is a leading manufacturer and marketer of fast-moving consumer goods. Its product line includes conditioners, shampoos, male and female razors and blades, toothbrushes, toothpaste, dishwashing liquids, detergents, surface cleaners, and air fresheners.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Global Household Cleaning Products Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Distribution Channel

Market Breakup by Region

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 4.60% between 2026 and 2035.

Increasing demand for natural products is boosting demand for household cleaning products.

The market is categorised according to its product type, which includes laundry detergents, surface cleaners, dishwashing products, and others.

The market key players are Unilever PLC, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, Procter & Gamble Company, Kao Corporation, S.C. Johnson & Son Inc., Colgate-Palmolive Company, Church & Dwight Co., Inc., McBride plc, Goodmaid Chemicals Corporation Sdn. Bhd, and Godrej Consumer Products Ltd., among others.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The various distribution channels of the market are supermarkets and hypermarkets, convenience stores, and online, among others. Currently, supermarkets and hypermarkets hold the largest market share.

The laundry detergents segment is the leading segment and holds the largest market share.

Asia Pacific dominates the global market share.

The full disclosure of ingredients in products is driving the growth of the household cleaning products market during the forecast period.

In 2025, the household cleaning products market reached an approximate value of USD 223.86 Billion.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 350.99 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share