Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Haemophilia treatment market was valued at USD 15.95 Billion in 2025, driven by the increased rate of research and development to determine the appropriate and effective treatments and therapies across the 8 major markets. The market is anticipated to grow at a CAGR of 7.50% during the forecast period of 2026-2035 to achieve a value of USD 32.87 Billion by 2035.

Base Year

Historical Period

Forecast Period

The rising awareness and early diagnosis of haemophilia are driving increased demand for preventive therapies and personalised treatment options across developed and emerging healthcare markets.

Ongoing advancements in gene therapy and recombinant factor products are expected to transform long-term treatment, improving patient outcomes and reducing overall healthcare burdens.

Strategic partnerships and product innovation by biopharmaceutical companies are fostering robust growth.

Compound Annual Growth Rate

7.5%

Value in USD Billion

2026-2035

*this image is indicative*

Haemophilia is a rare inherited bleeding disorder in which the blood does not clot properly due to the absence or deficiency of clotting factors, typically factor VIII or IX. This condition leads to prolonged bleeding, spontaneous haemorrhages, and joint or muscle damage if untreated. Haemophilia is more common in males and is often diagnosed in early childhood. Treatment involves regular replacement therapy using clotting factor concentrates, either plasma-derived or recombinant. Newer therapies, including gene therapy and extended half-life factors, aim to reduce bleeding episodes, improve quality of life, and offer more convenient treatment regimens.

Innovative Prophylactic Therapies to Strengthen Market Growth

Advances in targeted therapies and rising preference for effective prophylactic treatments are significantly propelling the market. For instance, in March 2025, the US FDA approved Qfitlia (fitusiran), a first-in-class antithrombin-lowering therapy designed to prevent or reduce bleeding episodes in haemophilia A or B patients with or without inhibitors, aged 12 years or older. Based on ATLAS Phase 3 trial data, it demonstrated meaningful bleed protection across diverse haemophilia populations. This approval is expected to boost market expansion by offering a new, efficient treatment pathway and attracting investment in prophylactic research and development.

Emphasis on Gene Therapies to Drive Haemophilia Treatment Market Value

Gene therapy advancements and a rising demand for long-acting, durable solutions continue to shape the market landscape. For instance, in February 2025, CSL presented four-year data from its HOPE-B study on HEMGENIX® (etranacogene dezaparvovec-drlb), which confirmed the long-term safety and effectiveness of this single-infusion gene therapy for adults with haemophilia B. The results, shared at the 18th EAHAD Congress, highlighted sustained factor IX levels, reduced bleeding episodes, and elimination of routine prophylaxis. This news strengthens confidence in gene therapy's transformative role, likely accelerating its adoption, broadening eligible patient access, and positively influencing global market growth.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Haemophilia Treatment Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Disease Type

Market Breakup by Treatment Type

Market Breakup by Patient

Market Breakup by Route of Administration

Market Breakup by End User

Market Breakup by Region

Haemophilia A to Lead the Disease Type Segment

Haemophilia A is projected to hold the largest market share by disease type, primarily due to its higher prevalence compared to other types. Increased awareness, genetic screening, and diagnosis have contributed to early identification and management. The Centers for Disease Control and Prevention (CDC) estimates revealed that nearly 12 in 100,000 males are affected by the genetic disorder in the United States. Additionally, there are around 400 newborn males each year born with Haemophilia A in the United States. Market expansion is further driven by ongoing research and a strong pipeline of factor VIII therapies. Government support and improved healthcare access in developing regions are also boosting this segment. Continuous innovations, including gene therapy and long-acting recombinant factors, make Haemophilia A treatments more sustainable, positioning this segment as the key driver of future market value and development.

Replacement Therapy to Lead the Share by Treatment Type

Replacement therapy is expected to dominate the market share by treatment type, owing to its established clinical efficacy and widespread adoption. It directly addresses clotting factor deficiency, reducing the frequency and severity of bleeding episodes. Technological advancements in recombinant products and prophylactic regimens are improving patient outcomes, boosting market uptake. The growing availability of long-acting factors and increasing patient compliance support sustained growth. This segment benefits from increasing R&D investments and favourable reimbursement policies, making it central to the treatment paradigm and a major contributor to rising market demand and therapeutic innovation.

Adults Segment to Dominate the Haemophilia Treatment Market Segmentation by Patient

The adult patient segment is poised to lead the market by patient type, due to the cumulative burden of haemophilia and the need for long-term management. Many adults experience complications such as joint damage, which necessitate ongoing treatment, increasing the market value. Additionally, rising diagnosis rates in adulthood and greater access to advanced therapies enhance this segment’s dominance. Expanding adult patient registries and growing awareness campaigns are also contributing to improved healthcare engagement. The adult population is more likely to seek regular care, which drives consistent market demand and supports the long-term development of treatment solutions.

Intravenous Route Dominating the Haemophilia Treatment Market by Route of Administration

The intravenous route of administration remains the leading segment due to its reliability in delivering factor replacement and bypassing agents directly into the bloodstream. This method ensures rapid therapeutic action, especially during acute bleeding episodes. Its dominance is supported by its longstanding clinical use and compatibility with both on-demand and prophylactic therapies. While newer methods like subcutaneous delivery are emerging, intravenous administration continues to be the gold standard, particularly in severe cases. Robust clinical data, patient familiarity, and integration into home treatment regimens position this segment as a stable and growing contributor to overall market expansion.

Hospitals to Lead the Haemophilia Treatment Market Share by End User

Hospitals are expected to maintain their position as the dominant end user in the market, driven by the need for advanced medical supervision and infusion capabilities. These settings are essential for initiating treatment, managing severe cases, and conducting gene therapy. The presence of specialist haematology units and access to multidisciplinary care also enhance treatment outcomes. Inpatient services remain critical for acute and surgical interventions. With increasing hospital-based care in developing markets and continuous infrastructure improvements, this segment is projected to experience steady growth, reinforcing its central role in market development and healthcare delivery.

The United States is likely to retain the largest market share owing to its early adoption of gene therapies, robust insurance coverage, and the strong presence of biopharmaceutical innovators. High diagnosis rates and extensive clinical trials fuel market maturity. Germany and France are rapidly expanding due to structured haemophilia registries and government-backed reimbursement schemes. The United Kingdom’s NHS initiatives support equitable access. Meanwhile, Japan sees steady growth through strategic biosimilar use, and India is witnessing gradual market penetration via global NGO support. Italy and Spain show modest expansion, primarily in recombinant therapies. However, the U.S. continues to lead due to its advanced infrastructure and treatment innovation pipeline.

The key features of the market report comprise clinical trials analysis, patent analysis, grants analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:

Founded in 1923 and headquartered in Bagsværd, Denmark, Novo Nordisk A/S is a global healthcare company renowned for its leadership in diabetes care, obesity treatment, and rare blood disorders. Within the haemophilia treatment market, the company offers a strong portfolio including recombinant factor VIII and IX products, such as Novoeight® and Rebinyn®. Novo Nordisk is committed to advancing treatment access and innovation through research into long-acting and gene therapy-based haemophilia solutions. Its deep expertise in biologics and sustained investment in rare disease therapies drive its influence in the global landscape.

Established in 1849 and headquartered in New York City, United States, Pfizer Inc. is a multinational pharmaceutical leader with a diverse therapeutic portfolio. In the haemophilia treatment market, Pfizer offers key products like BeneFIX® (factor IX) and Xyntha® (factor VIII), which are widely used for replacement therapy in haemophilia B and A patients, respectively. Pfizer's strategic focus includes enhancing patient outcomes through longer-acting formulations and improved delivery systems. With a strong research and development backbone, Pfizer continues to explore gene therapy and personalised care models to broaden its impact in the haemophilia domain.

Headquartered in Leverkusen, Germany, and founded in 1863, Bayer AG is a globally recognised life sciences company with a focus on healthcare and agriculture. In the field of haemophilia treatment, Bayer is known for its flagship recombinant factor VIII therapy, Kogenate®, and its successor, Jivi®, a long-acting treatment option for haemophilia A. Bayer’s research centres concentrate on innovative therapies that improve bleeding control and reduce treatment frequency. The company's global footprint and commitment to patient-centric solutions help solidify its role as a prominent player in the haemophilia treatment landscape.

CSL Behring, a subsidiary of CSL Limited, was founded in 1904 and is headquartered in King of Prussia, Pennsylvania, United States. Specialising in biotherapies for rare and serious conditions, CSL Behring is a major contributor to the haemophilia treatment market. Its portfolio includes recombinant therapies such as Afstyla® and Idelvion®, addressing haemophilia A and B respectively, as well as plasma-derived treatments. The company is also actively involved in advancing gene therapy research. CSL Behring’s global reach and deep expertise in immunology and haematology position it as a leader in haemophilia care.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market attained a value of USD 15.95 Billion in 2025.

The market is likely to grow at a CAGR of 7.50% during the forecast period of 2026-2035 to attain a value of USD 32.87 Billion by 2035.

The different types include Haemophilia A, B, and C, among others.

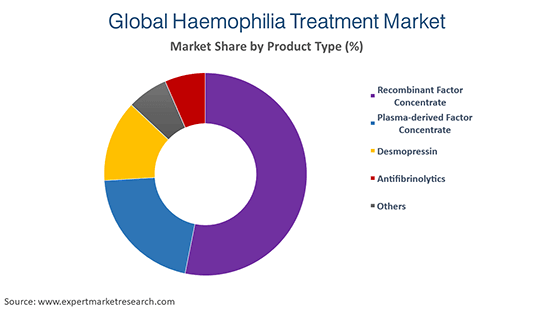

The product types include recombinant coagulation factor concentrate, plasma derived coagulation factor, concentrate, desmopressin, and antifibrinolytics agents.

The therapies can be categorised into replacement therapy, gene therapy, and immune tolerance induction therapy, among others.

The treatment channels include private and public channels.

The distribution channels include hospital pharmacy, retail pharmacy, and online pharmacy, among others.

Key players of the market are Novo Nordisk A/S, Pfizer Inc, Bayer AG, Biogen Inc., CSL Behring, Grifols SA, Octapharma AG, Kedrion S.p.A Ferring Pharmaceuticals Inc., and F. Hoffmann-La Roche Ltd.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Diseases Type |

|

| Breakup by Treatment Type |

|

| Breakup by Patient |

|

| Breakup by Route of Administration |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share