Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Genoa Bunker Fuel market reached a volume of 1018.43 Kilo Tons in 2025. This market is further expected to grow at a CAGR of 3.71% between 2026 and 2035, and it is expected to reach to a volume of 1466.01 Kilo Tons by 2035.

Base Year

Historical Period

Forecast Period

The Ports of Genoa are among Europe's largest, handling significant volumes of goods and passengers. They constitute Italy's foremost port cluster, renowned for handling diverse traffic and serving as the primary logistics hub for Northern Italy's industries.

Genoa's pivotal position as a major Mediterranean port renders it a vital nexus for maritime commerce, leading to substantial bunker fuel demand.

Western Ligurian Sea Port Authority which covers Genoa Port is striving to reduce dependence on fossil fuels by exploring techniques to increase green energy production by utilizing solar, wind, and ocean waves, and engaging in research on the adoption of innovative green fuels.

Compound Annual Growth Rate

3.71%

Value in Kilo Tons

2026-2035

*this image is indicative*

Genoa offers a wide range of bunker fuel options, including traditional marine fuels like heavy fuel oil (HFO) and lighter options such as marine gas oil (MGO) and low-sulfur fuel oil (LSFO). This variety allows vessels to choose the most suitable fuel based on their requirements and compliance with environmental regulations.

In Italy, the primary seaport known for its bunker fuel availability is the Port of Genoa (Genova). Genoa is one of Italy's largest and busiest ports and serves as a key hub for maritime trade and fuel bunkering operations in the Mediterranean Sea. The port's comprehensive facilities and strategic location make it a crucial point for refueling operations, offering a wide range of services including bunkering for ships passing through or operating in the region. The ports of Marseille and Barcelona of Spain compete with the Port Genoa to be the largest in the Mediterranean. The increasing government efforts to improve port infrastructure are expected to support the Genoa bunker fuel market development.

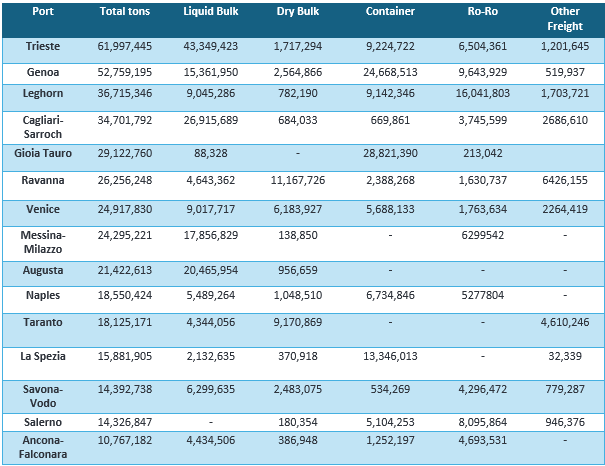

Figure: Italy Bunker Fuel Market, Top 15 Italian Ports per Handled Freights (Tons), 2019

Significant logistics activities; advantage of infrastructure and expansion projects in Genoa; prominent collaborations and innovations; and growing use of green and sustainable fuels are the key trends impacting the Genoa bunker fuel market growth.

The logistics and shipping sector in Northern Italy heavily relies on the Ports of Genoa, with 70% of companies utilizing its facilities, and approximately one third of the country's container traffic passing through its terminals. Annually, the Port of Genoa handles around 2.5 million TEUs (twenty-foot equivalent units) of containerised cargo. This surge in logistics and shipping activity has significantly contributed to the Genoa bunker fuel market expansion.

The bunker fuel market favours the advantages of robust infrastructure, encompassing storage facilities, refineries, and distribution networks, which ensure dependable supply chains. Notably, the construction of the New Breakwater in Genoa, which is expected to be completed by 2026, stands out as Italy's largest port project with an aim to accommodate ships exceeding 400 meters in length and 60 meters in width, including "World Class" cruise ships, thereby enhancing the port's capabilities significantly.

Collaboration between stakeholders such as fuel suppliers, shipping companies, and regulatory bodies fosters innovation and ensures the sustainability of the bunker fuel market. For instance, in 2022 with a brand license agreement with PAD Mult energy, one of Italy's top fuel retailers, Shell re-enters the Italian market and broadens its global reach. Under the terms of the deal, 500 service stations in Italy will be rebranded as Shell by PAD Mult energy.

Alternative fuels now have more prospects in the Genoa bunker market owing to the move towards greener and more sustainable fuels. Shipowners seeking to cut emissions are finding that liquefied natural gas (LNG), biofuels, and other alternative fuels are viable options. For instance, in collaboration with IPLOM, a local refinery of Genoa, Fratelli Cosulich Group successfully completed the first biofuel supply on a container vessel in Genoa in 2024. The company plans to produce and supply its own bio VLSFO in order to meet EU regulations and lessen the greenhouse gas intensity of marine fuels.

Italy's extensive coastline, stretching over 7,600 kilometres, provides ample opportunities for port development and maritime activities. The country boasts several major ports, including Genoa, Naples, and Trieste, which are crucial hubs for both domestic and international trade. These ports are equipped with modern infrastructure and facilities, making them attractive destinations for shipping companies and logistics providers. For instance, in the first three quarters of 2023, the port of Genoa handled a total of 41.16 million tonnes of goods. Increase in marine trade activities is leading to the Genoa bunker fuel market growth with the rise in export-import activities.

The growing usage of scrubbers within marine bunkers for the consumption of high-sulfur oil in Italy is part of a broader trend in the shipping industry towards compliance with environmental regulations, particularly the International Maritime Organization's (IMO) sulfur emission limits. The use of scrubbers in the Genoa bunker fuel market enables ships to continue using HSFO, which is typically cheaper than low-sulfur fuel oil (LSFO) or marine gas oil (MGO), thereby helping reduce operating costs.

“Genoa Bunker Fuel Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Fuel Grade

Market Breakup by Commercial Distributors

Market Breakup by End Use

Based on fuel grade, very low sulphur fuel oil (VLSFO) is expected to account for a significant share of the Genoa bunker fuel market

The environmental concerns and the strict regulations by the Italian government related to emissions from maritime industry are anticipated to limit the usage of the heavy bunker fuels by limiting the content in bunker fuel to 0.10 percent. HSFO supply in the region has been constrained since the EU banned imports of Russian oil products almost a year ago.

Very Low Sulphur Fuel Oil (VLSFO) reduces air pollution, lowers sulphur oxide emissions, improves air quality, supports marine ecosystem health, and complies with global maritime regulations, making it environmentally preferable.

Based on commercial distributors, large independent distributors dominate the Genoa bunker fuel market share

According to the Genoa bunker fuel market analysis, large independent distributors commonly maintain efficient logistics and supply chain operations, enabled by their extensive storage facilities, blending capabilities, and established distribution networks. This infrastructure allows them to reliably deliver bunker fuel in a timely manner.

Due to their smaller customer base, small independent distributors have the capacity to offer personalized and attentive service to their customers. This enables them to foster strong relationships, comprehend individual needs, and deliver tailored solutions, thereby elevating levels of customer satisfaction and loyalty.

The market players are engaged in price competition, service innovation, and strategic partnership to gain a competitive edge.

Headquartered in Genoa, Italy, Alpha Trading SPA is a petroleum distribution company specializing in providing fuel and diesel to ships in ports. It serves as a bunker's supplier in the Mediterranean Sea and operates within the Italian domestic market, offering fuel oil, distillate, and modified bitumen.

Founded in 1962, The Saras SPA engages in the energy sector and among Europe's independent oil refiners. It offers various fuel categories including diesel, gasoline, heating gasoil, LPG, virgin naphtha, aviation fuel, and bunkering.

Basile Petroli SPA, headquartered in Taranto, Puglia, specializes in trading petroleum products, focusing on selling and distributing fuels and lubricants across interregional markets for various sectors including industries, agriculture, automotive, heating, and marine.

Founded in 1857, Fratelli Cosulich S.p.A. is engaged in marine fuel supply, delivering top-quality bunkering services globally. The Group specializes in maritime logistics, offering tailored solutions for ship management, agency services, and efficient supply chain management.

Enilive S.p.A., a global energy company, is involved in natural gas and oil exploration, development, and extraction, alongside power generation from traditional and renewable sources, as well as refining and chemicals.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The Genoa bunker fuel market reached a volume of 1018.43 Kilo Tons in the year 2025.

The market is projected to grow at a CAGR of 3.71% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of 1466.01 Kilo Tons by 2035.

The key types are residual fuel, distillate fuel, and others.

The end uses include containers, bulk carriers, general cargo, and tankers.

The commercial distributors are large independent, small independent, and oil majors.

The factors driving the market include the rising use of green and sustainable fuels, prominent logistics and shipping activities, and the growing usage of scrubbers.

The key players in the market include Alpha Trading SPA, Saras SPA, Basile Petroli SPA, FRATELLI COSULICH S.p.A., and Enilive S.p., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Fuel Grade |

|

| Breakup by Commercial Distributors |

|

| Breakup by End Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share