Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The GCC flavours and fragrances market size attained about USD 584.71 Million in 2025. The market is further expected to grow at a CAGR of 4.30% during the forecast period of 2026-2035 to reach approximately USD 890.81 Million by 2035.

Base Year

Historical Period

Forecast Period

Global fast-food chains, such as McDonald's Corporation, Herfy, and Kentucky Fried Chicken are widely popular in the region.

The region boasts an array of high-end, luxury perfume boutiques.

Natural flavours and fragrances are demanded as healthier alternatives to artificial ingredients.

Compound Annual Growth Rate

4.3%

Value in USD Million

2026-2035

*this image is indicative*

The incorporation of techniques such as mass spectrometry, gas chromatography, and sensory evaluation helps flavourists and perfumers conduct efficient fragrance and flavour analysis. The analysis of the flavour and fragrance profiles of end products helps manufacturers meet the changing consumer demand.

The GCC flavours and fragrances market development is driven by various factors, such as demand for luxury perfumes, natural ingredients in food and cosmetic products, an expanding foodservice sector, and the presence of numerous perfume manufacturers.

Some of the key trends are consumer demand for cruelty-free products and sustainable ingredients, a growing market for fast food products, rising per capita income, busy consumer schedules, and rising tourist footfall. These factors are collectively influencing the GCC flavours and fragrances market growth.

Rising demand for food flavourings food, increased adoption of natural cosmetic products, and growing interest in luxury fragrances are creating several opportunities in the GCC flavours and fragrances market

| Date | Company | Details |

| January 2024 | IFF | IFF has embarked on a collaborative research initiative with Unilever and Wageningen University & Research (WUR) in protein-flavour interactions to address flavour challenges in plant-based meat alternatives. |

| January 2024 | Givaudan | Givaudan launched the extension of its fragrance precursor collection with the addition of Scentaurus™ Vanilla. |

| January 2024 | Symrise | Symrise announced the inclusion of new citrus-flavoured taste ingredients as an extension to its conventional citrus flavour solutions. |

| November 2023 | Symrise | Symrise inaugurated a new era in the Middle East market through the establishment of Jardin Arabia, a dedicated creative centre for fine fragrance. |

| Trends | Impact |

| Demand for personal care products | The demand for luxury perfumes and deodorants is a crucial driver for fragrance ingredients. The popularity of gifting perfumes in GCC increases the demand for traditional fragrances. |

| Demand for food flavourings | The use of food flavourings in sweets, savoury dishes, and beverages to make food more appealing and mask the taste of less desirable ingredients, aids the GCC flavours and fragrances market growth. |

| A diverse population demanding various cuisines | To meet the needs of GCC’s diverse population, restaurants and food manufacturers are developing niche and fusion cuisines using a variety of flavours. |

| Natural flavours and fragrances as healthier alternatives to artificial ingredients | The demand for organic, natural, and ethically sourced raw materials in foods and personal care products, aids the demand for natural flavours and fragrances. |

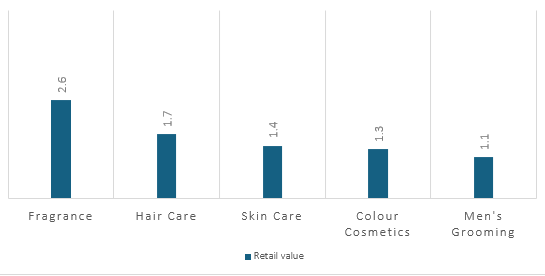

Figure: Retail Value of Top 5 Cosmetics and Personal Care Categories in GCC (2022); USD Billion

Key Insights:

Figure: Trends in Food Service Sector in the GCC region

The younger working-class population in GCC is willing to spend a substantial amount on luxury personal care products, including personalised perfumes that match their personalities and preferences. Further, the cultural diversity in the region is augmenting the demand for varied cuisines. Rising per capita income, busy consumer schedules, and the rising tourism sector are further expanding the food service sector.

As per the GCC flavours and fragrances market analysis, GCC countries are also witnessing the trend of natural and organic beauty and personal care products. Further, the changing consumer preferences are increasing the demand for better-quality and healthier food products. Consequently, the demand for natural flavours and fragrances is rising.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

"GCC Flavours and Fragrances Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Segment

GCC Flavours Market Breakup by Type

GCC Flavours Market Breakup by Form

GCC Flavours Market by Breakup Application

GCC Fragrances Market by Breakup Type

GCC Fragrances Market by Breakup Application

Market Breakup by Region

Artificial flavours segment is expected to hold a significant GCC flavours and fragrances market share due to the cost-effective pricing of artificial flavourings

The artificial segment is benefitted by the ease of producing artificial flavours. Artificial flavours require less processing, less energy and a significantly shorter production schedule, making it a preferred option. The lowered pricing of artificial flavours is also a key factor in its greater adoption. Prominent companies offering artificial flavours in GCC include Global Flavours and Fragrances, and Bell Flavors & Fragrances.

The natural segment, on the other hand, is driven by the trend of sustainability in the GCC region. Chefs use natural seasoning blends made from peppers, coriander, cumin, and garlic that provide foods with a variety of flavours. Further, natural fruit-flavoured beverages are popular in GCC as consumers demand refreshing and clean-label drinks.

The nature-identical segment of the GCC flavours and fragrances market report refers to the flavours purified from an aromatic source or synthesised and consist of the same chemical composition as natural products. The use of nature-identical flavours is considered a sustainable alternative, where certain natural sources are scarce or expensive.

Soaps and detergents hold a significant market share due to rising hygiene consciousness in the region

Soaps and detergents account for a significant share in the GCC flavours and fragrances market. It is driven by the increasing demand for hygiene products. Detergent producers integrate perfumes that adhere to stringent safety guidelines, following the standards established by the International Fragrance Association (IFRA) and the Research Institute for Fragrance Materials (RIFM). Prominent soap and detergent manufacturers in the GCC include Knooz Al-Ardh Detergent Manufacturing CO. LLC, Fayfa Chemicals Factory LLC, Procter & Gamble Co., and The Camel Soap Factory.

The GCC flavours and fragrances market forecasts that the cosmetics and toiletries segment will also likely account for a significant market share. Changing social and cultural norms in society are increasing the acceptance of beauty and cosmetic products in the region. With around 50% of the Saudi Arabian population below 30 years of age, spending on beauty products is on the rise.

The fine fragrances segment is expected to grow at a high rate during the forecast period. The presence of several perfume manufacturers aids the consumption of fragrances. For instance, Dubai in the UAE is a manufacturing hub of perfumes. It is home to prominent Arabic-style fragrance houses, including Ajmal, Rasasi, Lattafa, Swiss Arabian, and Samawa. Non-alcoholic perfume oils are popular among the Arabs. These are made from pure fragrance oils. This is propelling the GCC flavours and fragrances market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The market players are increasing their collaboration, partnership, and research and development activities to gain a competitive edge in the market

| Company Name | Year Founded | Headquarters | Products/Services |

| Symrise AG | 2003 | Deutschland, Germany | Fragrances, flavourings, food ingredients, and cosmetic active ingredients. |

| Givaudan International SA | 1895 | Vernier Switzerland | Fragrances: Acetal CD, Acetal E, Adoxal, etc. Flavours: Feel Good’ Food Experiences, Does Good’ Food Experiences |

| International Flavors & Fragrances Inc. | 1958 | New York, United States | Natural flavours, liquid, powder, and encapsulated flavours, natural fragrances, operanide, bioscience solutions, etc. |

| Bell Flavors & Fragrances | 1912 | Illinois, United States | Flavours, fragrances, and botanicals |

Other key players in the GCC flavours and fragrances market include DSM-Firmenich AG, RFF International, Senovia, Gulf Flavours & Food Ingredients FZCO, and Global Flavours and Fragrances, among others.

Saudi Arabia is one of the prominent regions due to the expanding food processing and soap and detergent sector

According to the flavours and fragrances market in GCC, Saudi Arabia boasts a developing food manufacturing and processing sector, supported by a growth in income, and significant economic alliance. The food sector of Saudi Arabia is set for a USD 20 billion boost by 2035, driven by increasing investments. Further, individuals aged 15-44, comprising about 53% of the population are significant consumers of flavourful fast foods, contributing to the growth of the flavours and fragrances market in the GCC. The market for detergents in the Kingdom is growing steadily driven by the growth in complementary markets, such as textiles. In 2022, the Kingdom’s textiles and fabrics sector recorded over USD 1 billion worth of investment.

The United Arab Emirates UAE is a prominent perfume producer in the GCC. Fragrances are consumed by local perfume producers, including Rasasi Perfumes Industry LLC, Yas Perfumes, and Ajmal Perfumes. The country is expected to significantly contribute to the GCC flavours and fragrances market development during the forecast period.

Further, the expanding fast food sector in Kuwait is increasing the demand for flavours in the region. The average monthly expenditure on food and drinks by Kuwaitis accounts for USD 1,200, while expats spend about USD 520 per month. Kuwait has the presence of 12,000 restaurants, of which 5,500 come under the dessert segment, while 3,000 are cafes.

Latin America Waterproofing Market

United Kingdom B2B Mayonnaise Market

Latin America Renewable Energy Market

United Kingdom Carbon Black Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the GCC flavours and fragrances market reached an approximate value of USD 584.71 Million.

The market is expected to grow at a CAGR of 4.30% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach about USD 890.81 Million by 2035.

The major drivers of the market include rising demand for ingenious fragrances, demand for luxury personal care products, and a diverse population demanding varied cuisines.

Key trends aiding the market expansion in GCC include an expanding food service sector, demand for natural ingredients in foods and cosmetic products, and a growing interest in luxury fragrances.

The different types of flavours in the market are artificial, natural, and nature-identical.

The major types of fragrances in the market are synthetic and natural.

The major countries for flavours and fragrances in the GCC region are Saudi Arabia, the United Arab Emirates, Kuwait, Qatar, Bahrain, and Oman.

The key players in the GCC flavours and fragrances market are DSM-Firmenich AG, Symrise AG, Givaudan International SA, International Flavors & Fragrances Inc., Bell Flavors & Fragrances, RFF International, Senovia, Gulf Flavours & Food Ingredients FZCO, and Global Flavours and Fragrances, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Segment |

|

| GCC Flavours Market Breakup by Type |

|

| GCC Flavours Market Breakup by Form |

|

| GCC Flavours Market by Breakup Application |

|

| GCC Fragrances Market by Breakup Type |

|

| GCC Fragrances Market by Breakup Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share