Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe e-bike market reached approximately USD 29.37 Billion in 2025. The market is expected to grow at a CAGR of 14.60% between 2026 and 2035 to attain a value of around USD 114.75 Billion by 2035.

Base Year

Historical Period

Forecast Period

The market in the UK is expected to grow at a CAGR of 15.3% in the forecast period.

The major factors driving the sales of e-bikes in Europe are the innovative features of the product, fully integrated batteries and drives, appealing designs, and the use of high-quality materials.

Accell Group, Riese & Müller GmbH and Powabyke UK Ltd are a few of the major companies in the market.

The growing preference for e-trekking, and e-MTB bikes, among others, owing to the increasing environmental consciousness, is augmenting the growth of the Europe e-bike market.

Compound Annual Growth Rate

14.6%

Value in USD Billion

2026-2035

*this image is indicative*

| Europe E-Bike Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 29.37 |

| Market Size 2035 | USD Billion | 114.75 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 14.60% |

| CAGR 2026-2035 - Market by Country | Germany | 17.5% |

| CAGR 2026-2035 - Market by by Battery | Lithium Ion Battery | 16.4% |

| CAGR 2026-2035 - Market by Application | Urban | 16.6% |

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The introduction and implementation of various favourable government regulations such as EU Directive 2002/24/EC to encourage the use of electric bikes are driving the market growth. The growing consumer inclination towards the use of e-bikes as an eco-friendly and efficient solution for commuting and the increasing fuel costs are expected to propel the demand of Europe e-bike market in the forecast period.

Some of the factors driving the Europe e-bike market growth are increasing concerns regarding environmental pollution, the rising popularity of e-cargo bikes, and the growing awareness regarding the health benefits associated with cycling. The growing demand for e-cargo bikes by logistical businesses in urban areas as a replacement for delivery vans is aiding their adoption. The rising focus on decarbonising the transportation sector is boosting the adoption of e-bikes in the region.

Increasing Adoption of E-mobility Solutions

European countries extensively adopt e-mobility solutions and have a strong presence of major companies. With the growing trend of e-mobility in France and the United Kingdom, the market for e-bikes is poised to witness robust growth in the forecast period.

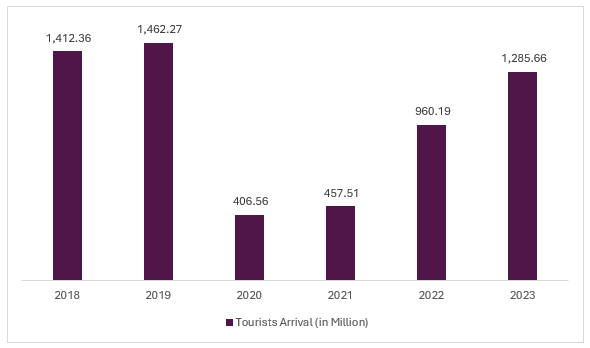

The implementation of mobility hubs aids in the growth of the Europe e-bike market over a wider area by utilising shared e-bikes or trial e-bikes. Additionally, the introduction of cycle stops that provide e-bike parking, storage, and charging services at restaurants and cafes, can boost the use of e-bikes for recreational activities and support the region’s tourism sector. The tourism sector of Europe is booming. In 2023, the tourism sector expanded by 6.3% compared to 2022, propelling the market growth. Furthermore, across Europe, people are inclined to switch to an e-bike for their daily commute and recreational activities, as these bikes are highly eco-friendly. While parents adopt e-cargo bikes to pick up and drop off their children, food delivery and logistics businesses use them to replace delivery vans in urban areas to overcome traffic congestion.

Favourable Government Initiatives

As government bodies are promoting the purchase of electric mobility through tax credits and incentives in order to fuel the usage of these environmentally friendly vehicles, the demand for e-bikes is surging, thereby adding to the Europe e-bike market revenue. For instance, the "Bonus Vélo" program allows residents to claim up to €400 towards the purchase of a new e-bike. This subsidy is available for individuals whose income falls below certain thresholds, and it can be combined with other incentives, such as the conversion bonus for those who stop using a car.

In Germany, the federal government offers the "Environmental Bonus" (Umweltbonus), providing financial incentives for purchasing electric vehicles, including e-bikes. The amount varies based on the type of e-bike and battery capacity. Meanwhile, in Madrid, Spain, residents could receive up to 50% of the purchase price for an e-bike, with a maximum subsidy of €600 between April 17, 2024, to September 30, 2024. This initiative was part of broader efforts to promote zero-emission mobility options across the region.

February 2024

Riese & Müller GmbH launched a new entry-level cargo bike model with a Bosch performance line motor named Carrie. The Bosch Performance Line motor offers reliable assistance with 75 Nm of torque. An additional 27 kg can be carried in the carrier with the MIK system when a child seat is fitted.

December 2022

Mate announced the launch of its new E-cargo bike with an SUV model with initial offerings in the UK and Europe. The e-cargo bike is made with 90% recycled aluminium and is launched as an alternative to a car.

The growing demand for e-cargo bikes by logistical businesses in urban areas as a replacement for delivery vans is aiding their adoption. Further, individuals intending to transport goods to different locations also find e-bikes advantageous compared to cars, which can boost the Europe e-bike demand. For instance, companies such as DHL and IKEA have integrated e-cargo bikes into their logistics networks, recognising the environmental benefits and operational efficiencies they offer. For instance, DHL has reported that nearly 60% of its inner-city deliveries in the Netherlands are now made using cargo bikes, demonstrating a shift towards greener logistics solutions. Amazon has also launched e-cargo bike deliveries in cities like Norwich, aiming to decarbonise its operations and improve air quality while enhancing delivery efficiency.

According to a report by EIT InnoEnergy, mixed fleets of e-cargo bikes and e-vans could save urban logistics firms approximately €554 million annually by 2030 while reducing last-mile emissions by up to 80%.

E-bikes remain significantly more expensive than traditional bicycles, with prices often ranging from €1,000 to €5,000 or more, depending on features like battery capacity and motor power. As per the Europe e-bike industry analysis, despite decreasing battery costs, the high upfront cost can be a barrier to widespread adoption, especially in price-sensitive markets.

The limited range of e-bike batteries continues to be a concern for long-distance riders. While newer models feature improved battery life, many e-bikes still have a range of only 50-100 km on a single charge, depending on factors like terrain and rider weight. Moreover, battery performance can be significantly impacted by extreme weather conditions, especially in colder climates. Furthermore, the lack of a widespread, accessible charging infrastructure, particularly in rural areas, limits the convenience of using e-bikes for longer commutes.

The growing commercial sector in the region is supporting the use of e-cargo bikes in logistics and delivery services as they can be parked closer to the destination and are less affected by congestion. The European Union's Green Deal aims to make Europe climate-neutral by 2050, promoting low-emission transport options like e-cargo bikes that further increase Europe e-bike market opportunities. Cities like London have implemented Low Emission Zones (LEZs), encouraging businesses to switch to these sustainable alternatives.

In Milan, cargo bikes have proven to be as efficient as delivery vans, often surpassing them in flexibility and speed within city traffic. Research by TRT Trasporti e Territorio indicated that bike couriers in Amsterdam are 25% more productive than their van counterparts, while London has seen a 55% reduction in logistics-related emissions due to the introduction of cargo bikes.

Figure: Total number of International Arrived Tourists in Europe (in Million), 2019-2025

“Europe E-Bike Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Drive Units

Market Breakup by Battery

Market Breakup by Application

Market Breakup by Region

By Type Insights

Pedal-assisted bikes with ergonomically designed seats have provided bikers comfort while reducing the strain on their wrists and neck. There is an availability of versatile e-bikes, such as pedal-assisted e-bikes in a variety of models that meet the needs of European cyclists and increase the Europe e-bike market value. Additionally, the development of pedal-assist e-bikes integrated with IoT and real-time tracking technology that alerts owners of theft attempts is supporting their adoption.

Electric bikes with throttles meet consumers’ needs for cycling to maintain their health, as well as the need for speed and efficiency. The government regulations for enhanced security raise the adoption of such bikes. For instance, the manufacturer has undergone "type approval" in order to comply with the UK law known as L1e, which essentially covers low-powered mopeds.

By Drive Units Insights

Hub motors currently holds the largest Europe e-bike market share due to their simplicity, reliability, and cost-effectiveness. These motors are integrated into the wheels of the e-bike, providing a direct drive that eliminates the need for complex transmission systems. This design results in a lightweight, efficient, and low-maintenance solution, making it popular among consumers. Hub motors are especially favoured for urban commuting e-bikes, where ease of use and affordability are key factors.

By Battery Insights

Lithium-ion batteries hold the highest share in the European market and are expected to grow at a CAGR of 16.4% between 2026 and 2035 due to their superior energy density, longer lifespan, and lightweight design. They offer a greater range per charge compared to other battery types, making them ideal for e-bikes used for commuting and leisure, further contributing to the Europe e-bike demand growth. Their fast charging times, high efficiency, and declining cost also contribute to their popularity. Lithium-ion batteries are commonly used in most modern e-bikes as they provide the necessary power while keeping the bike lightweight and portable.

By Application Insights

Urban e-bikes are expected to grow at a CAGR of 16.6% in the forecast period. This is mainly due to the increasing demand for environmentally friendly and convenient transportation solutions in cities. Urban e-bikes are ideal for daily commuting, offering ease of use, low maintenance, and efficient travel on city streets. Their compact design and ability to navigate through traffic make them highly attractive for short-distance travel. As cities continue to focus on reducing pollution and promoting green transportation, the demand for urban e-bikes is expected to remain strong in Europe.

The German market is expected to grow at a CAGR of 17.5% in the forecast period. In Germany, e-bikes are the most popular type of electric transportation as they are not only sustainable but also serve as a form of exercise and recreation. The increasing preference for affordable and sustainable personal mobility solutions has boosted the Europe e-bike industry revenue. According to industry reports, 48% of the households in the country owned electric bikes in 2022.

| CAGR 2026-2035 - Market by | Country |

| Germany | 17.5% |

| United Kingdom | 15.3% |

| France | XX% |

| Italy | XX% |

| Others | XX% |

In August 2022, the French government announced incentives up to USD 4073 to enable citizens to buy an electric bike. This grant, applicable to lower-income households in low-emission urban zones, aims to bolster active mobility and reduce pollution in the country, further increasing the growth of the Europe e-bike industry. Long-term rental services such as Véligo Location offering extended rentals of e-bikes and e-cargo bikes at a cost-effective price are supporting the adoption of electric bikes in the country.

In Spain, the infrastructure of bike-sharing services and the presence of e-bike manufacturers expand the Europe e-bike market growth. With start-ups like Rayvolt in the country, the availability of innovative and aesthetic e-bikes with advanced technologies, high efficiency, low noise levels, and features like regenerative braking, among others, is increasing, influencing the Europe e-bike market dynamics and trends.

Countries like Sweden, Denmark, and Norway are experiencing slower but steady adoption of e-bikes. In colder climates, the adoption rate is not as high as in southern Europe due to harsh weather conditions affecting battery performance and road usability in winter months. In 2023, 87% of cars sold in Norway were electric, which offers a positive avenue for the usage of e-bikes.

Startups are playing a pivotal role in driving innovation and sustainability within the transportation sector. Some companies focus exclusively on developing sleek, lightweight e-bikes aimed at urban commuters. Meanwhile, some other startups emphasise smart urban cycling solutions with stylish electric bikes equipped with advanced technology for theft protection and connectivity, influencing the Europe e-bike demand forecast. They have also diversified their product line to include not just e-bikes but also electric motorcycles and mopeds, targeting a broader audience interested in zero-emission transport solutions.

Ampler Bikes

Founded in 2014 and based in Estonia, Ampler Bikes focuses on creating lightweight and stylish e-bikes designed for urban commuting. The company aims to address the gap in sustainable urban mobility by offering high-quality, easy-to-use electric bicycles. The startup in Europe e-bike market emphasises a seamless user experience, integrating advanced technology into its bikes while maintaining a sleek design that appeals to modern consumers.

Cowboy

Established in Brussels in 2017, Cowboy is dedicated to developing innovative electric urban bikes that combine style with functionality. The company offers three distinct models, each equipped with smart features such as GPS tracking and anti-theft technology. With a focus on sustainability and urban mobility, Cowboy aims to make cycling more accessible and appealing to a broader audience, positioning itself as a leader in the electric bike segment.

Major players in the Europe e-bike market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge. Investment in production capacity remains strong to enhance manufacturing capabilities across various EU countries. Companies are also responding to the increasing demand for pedal-assisted bikes, which dominate the market due to their practicality and ease of use. Additionally, the market is benefiting from supportive policies under the European Green Deal, which promotes cycling as a sustainable mode of transport.

Accell Group, headquartered in the Netherlands and founded in 1998, is one of the leading companies in the European market in the e-bikes segment and the second largest in bicycle parts and accessories. Accell Group provides numerous e-bikes under different brands which target different market segments. The e-bike brands provided by the company include Koga, Winora, Sparta, Cargon and Lapierre.

Riese & Müller GmbH in Europe e-bike market is engaged in manufacturing premium e-bikes, e-cargo bikes, and folding bikes. The company engages in application-oriented product development, innovative e-bike technology, and powerful riding dynamics. The company provides a wide range of e-bikes under different segments which include cargo, compact, commuter, tour, and others.

Headquartered in the UK and founded in 1888, Powerbyke offers a wide range of e-bikes with advanced lightweight nimble alloy frames and powerful lithium battery technology. Powabyke UK Ltd. offers a wide range of e-bikes under its portfolio, including Sinope Step-Through Hybrid 28″ 14ah 85nm, La Rue, Pulze Ladies Electric Bike, and others.

Headquartered in the Netherlands and founded in 2006, the company is engaged in developing, manufacturing, and selling innovative electric bicycles for urban commuters. The company has more than 750 sales and service points in the Netherlands, Belgium, Germany, and Austria. QWIC offers numerous e-bikes under four different segments, including Adventure, Comfort, Performance, and Urban. The brands offered by the company include Mira, Premium Q, Premium I and Premium Carrier.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Europe e-bike market include Kalkhoff Werke GmbH, among others.

December 2022

UTurn Investments, an independent family fund company, invested in 3T to support the growth of the Italian bike brand. The investment was aimed at improving the capacity of production and expanding it to international markets.

July 2022

Riese & Müller announced the relaunch of Packster 70 just in time for Eurobike 2022, with quality focused specifically on the steering system. The relaunch was carried out with the company’s commitment towards maximum customer safety.

Folding Bikes Market

Electric Bike Market

Home Exercise Bike Market

E-Bike Market

United Kingdom E-bike Market

United States E-Bike Market

United States Electric Cargo Bikes Market

Italy E-Bike Market

Europe Electric Cargo Bikes Market

North America Electric Cargo Bikes Market

Europe E-Bike Adoption in Urban Areas

Europe Urban E-Bike Components Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was nearly USD 29.37 Billion.

The market is projected to grow at a CAGR of 14.60% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 114.75 Billion by 2035.

The major drivers include the sustainability benefits associated with e-bikes, the health benefits provided by cycling, and the growing popularity of e-cargo bikes.

The key trends aiding the market include growing demand for e-bikes for e-commerce and logistics purposes and expansion of charging infrastructure.

The different types of e-bikes include pedal-assisted and throttle assisted.

The major applications of e-bike include urban, tracking, cargo, and MTB, among others.

The major players in the market include Accell Group, Riese & Müller GmbH, Powabyke UK Ltd, QWIC and Kalkhoff Werke GmbH, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Drive Units |

|

| Breakup by Battery |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share