Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global electrochromic glass market value reached around USD 2.04 Billion in 2025. The market is further expected to grow at a CAGR of 8.40% in the forecast period of 2026-2035 to attain USD 4.57 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

8.4%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Electrochromic Glass Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 2.04 |

| Market Size 2035 | USD Billion | 4.57 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 8.40% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 10.9% |

| CAGR 2026-2035 - Market by Country | India | 12.5% |

| CAGR 2026-2035 - Market by Country | Brazil | 9.2% |

| CAGR 2026-2035 - Market by Application | Display | 9.4% |

| CAGR 2026-2035 - Market by End Use | Automotive | 9.6% |

| Market Share by Country 2025 | Brazil | 2.6% |

The electrochromic glass market is witnessing significant growth, driven by increasing demand for energy-efficient building materials and smart glass technology. With a projected market share expansion, electrochromic glass offers dynamic light control and temperature regulation, making it ideal for commercial and residential applications. This innovative technology enables windows to change tint, enhancing privacy and reducing glare while contributing to energy savings. Key sectors, including automotive, architecture, and electronics, are adopting electrochromic solutions, further boosting market demand. As environmental sustainability becomes a priority, the integration of electrochromic glass in green building designs is gaining traction. Major players in the market are investing in research and development to enhance product performance and affordability, positioning themselves for future opportunities in this growing industry. The electrochromic glass market is set to redefine modern living and contribute to smarter, more energy-efficient spaces.

The rising applications of the electrochromic glass in construction and automotive industries is increasing the overall demand of electrochromic glass market. In the automotive industry, as smart technology features become a major criterion influencing the customers’ purchasing decision, the adoption of electrochromic glass panels as a cheaper, low-energy alternative to windows and automated sunroof panels is expected to increase.

Meanwhile, in the construction sector, electrochromic glass demand is gaining traction in residential and commercial sectors, owing to the rapid development of hospitals, schools, colleges, houses, and offices, among other. Over the forecast period, the growing technological advancements, and the increasing demand for energy-efficient solutions in major industry verticals are anticipated to enhance the growth of the electrochromic glass market.

As per the U.S. Census data, monthly spending on private and public construction in the U.S. from 2005 to 2022 indicates several key trends. Residential construction spending peaked around early 2006 at approximately USD 700 billion, then declined sharply to about USD 250 billion by early 2009. It remained relatively stable until around 2012, after which it began a steady increase, reaching around USD 900 billion by early 2022.

As per electrochromic glass industry analysis, the non-residential construction spending increased gradually from 2005 to 2008, peaking at about USD 400 billion, followed by a decline to around USD 250 billion by early 2011. It then experienced fluctuations but generally trended upwards, reaching around USD 500 billion by early 2022.

Meanwhile, public construction spending showed a more stable trend, starting at around USD 250 billion in 2005, with minor fluctuations throughout the period. It reached a high of about USD 350 billion in 2009, then decreased slightly and stabilised around USD 300 billion from 2014 onwards. These trends in construction sectors have majorly impacted the electrochromic glass industry revenue and will continue to do over the forecast period as well.

As per the Bureau of Labor Statistics (BLS) current employment statistics, from January 2022 to May 2024, year-over-year change in total nonfarm and construction employment has experienced several trends:

As per the ACEA data on world vehicle production, 85.4 million motor vehicles were produced globally in 2022, reflecting a 5.7% increase compared to 2021. Greater China led the production with 27,222 thousand units in 2022, up from 26,411 thousand units in 2021, which has resulted in growth of the electrochromic glass industry. North America also saw significant growth, with production rising from 13,596 thousand units in 2021 to 14,901 thousand units in 2022. Similarly, South Asia experienced an increase from 8,356 thousand units in 2021 to 10,230 thousand units in 2022. Japan/Korea's production went up slightly from 11,065 thousand units in 2021 to 11,334 thousand units in 2022. South America and the Middle East/Africa also saw increases, with South America producing 3,025 thousand units in 2022 compared to 2,796 thousand units in 2021, and the Middle East/Africa producing 2,294 thousand units in 2022 compared to 2,103 thousand units in 2021. However, Europe saw a slight decline in production, decreasing from 16,480 thousand units in 2021 to 16,391 thousand units in 2022. Overall, the global vehicle production market showed a positive trend in 2022 compared to the previous year.

As per the Society of Indian Automobile Manufacturers (SIAM) data, the automobile production trends from 2018-19 to 2023-24 show significant fluctuations across various vehicle categories. Passenger vehicles saw a decline from 40,28,471 units in 2018-19 to 30,62,280 units in 2020-21, followed by a steady recovery to 49,01,844 units in 2023-24. Commercial vehicles experienced a similar trend, decreasing from 11,12,405 units in 2018-19 to 6,24,939 units in 2020-21, and then increasing to 10,66,429 units in 2023-24. Three-wheelers dropped from 12,68,833 units in 2018-19 to 6,14,613 units in 2020-21, before rising to 9,92,936 units in 2023-24. Two-wheelers also saw a decline from 2,44,99,777 units in 2018-19 to 1,80,34,941 units in 2020-21, with subsequent growth to 2,14,68,527 units in 2023-24. Quadricycles had minor fluctuations, with production numbers varying from 5,388 units in 2018-19 to 3,836 units in 2020-21, and then increasing to 5,006 units in 2023-24. According to analysis of electrochromic glass industry in India, the grand total of automobile production decreased from 3,09,14,874 units in 2018-19 to 2,26,55,609 units in 2020-21, and then recovered to 2,84,34,742 units in 2023-24.

As per the Society of Indian Automobile Manufacturers (SIAM) data on automobile domestic sales trends from 2018-19 to 2023-24, the following observations are made:

Passenger vehicles sales declined from 33,77,389 units in 2018-19 to 27,11,457 units in 2020-21, before recovering to 42,18,746 units in 2023-24. Commercial vehicles sales decreased from 10,07,311 units in 2018-19 to 5,68,559 units in 2020-21, and then rose steadily to 9,67,878 units in 2023-24. The recovery of sales has influenced electrochromic glass market share in India as these vehicles use the product for making window components. Three-wheelers saw a significant drop from 7,01,005 units in 2018-19 to 2,19,446 units in 2020-21, with a subsequent recovery to 6,91,749 units in 2023-24. Two-wheelers experienced a decline from 2,11,79,847 units in 2018-19 to 1,51,20,783 units in 2020-21, then increased to 1,79,74,365 units in 2023-24. Quadricycles had minimal fluctuations, with sales numbers varying from 627 units in 2018-19 to 725 units in 2023-24. The grand total of domestic sales decreased from 2,62,66,179 units in 2018-19 to 1,86,20,233 units in 2020-21 and then recovered to 2,38,53,463 units in 2023-24.

The global shift towards eco-friendly and sustainable or green buildings is a major trend in electrochromic glass market as it has driven the adoption of electrochromic glass, which has capacity to save energy by a substantial level. This is why the product is becoming a central element in smart and modern buildings.

Moreover, this innovative technology provides comfort for users and allows the users to control the amount of light passing through space, which is why it makes a promising solution for various construction, aerospace, and automotive applications.

In May 2023, Glass Dyenamics, a leading electrochromic glass company, recently completed 150,000 cycles over 5,000 hours under ASTM E2141-21 durability conditions. This achievement was in collaboration with the U.S. Department of Energy's National Renewable Energy Laboratory (NREL). The adoption of electrochromic windows can avoid 78 million metric tons of CO₂ emissions annually by 2030, which is equivalent to the energy use of 9,393,008 million homes for an entire year and can save more than USD 19 billion in utility bills.

In February 2022, Nio Capital invested in Ambilight, which is a developer of electrochromic technology that adjusts light transmission in glass. This investment enabled Nio to incorporate colour-changing glass roofs in its latest automotive models.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Electrochromic Glass Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

The significant applications of the product include:

The major end uses of the product are:

Breakup by Region

| CAGR 2026-2035 - Market by | Application |

| Display | 9.4% |

| Window | XX% |

| Mirror | XX% |

| CAGR 2026-2035 - Market by | End Use |

| Automotive | 9.6% |

| Construction | XX% |

| Aerospace | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 10.9% |

| Middle East and Africa | 9.1% |

| Europe | 6.4% |

| North America | XX% |

| Latin America | XX% |

| Market Share by | Country |

| Brazil | 2.6% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

With the recovery of the construction sector post 2021, the market is expected to witness a surge in demand due to its increasingly common use in windows, displays, and sunroofs, especially in developed regions. The electrochromic glass allows engineers and builders to create more comfortable indoor spaces by developing building facades that can eliminate glare, solar heat gain, and UV exposure. Moreover, being an energy-friendly alternative to automated windowpanes/shutters, the product is expected to witness increased adoption in commercial spaces, along with other smart glass options, thus, driving the market expansion.

The market share in North America is growing due to the rapid adoption of electrochromic glasses in residential and commercial sectors. This is due to the rising demand for innovative smart glass products and the stringent regulations pertaining to energy conservation in the United States and Canada. In addition, the electrochromic glass market dynamics and trends in the region are influenced by the technological advancements in the small, medium, and large enterprises, aimed towards bolstering the comfort of employees working inside the closed doors. Furthermore, the presence of major electrochromic glass manufacturers in the region is likely to augment the market growth in the forecast period.

| CAGR 2026-2035 - Market by | Country |

| India | 12.5% |

| China | 10.4% |

| Brazil | 9.2% |

| USA | 6.8% |

| Germany | 6.2% |

| Canada | XX% |

| UK | XX% |

| France | XX% |

| Italy | 5.3% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report also gives a detailed analysis of the following key players in the electrochromic glass market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global electrochromic glass market attained a value of nearly USD 2.04 Billion.

The market is estimated to grow at a CAGR of 8.40% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 4.57 Billion by 2035.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major drivers of the market include the growing product adoption in residential and commercial construction business operations, the increasing demand for cost-effective and low-energy alternatives to automated sunroof panels in vehicles, and the growing construction sector.

The key trends guiding the market include technological advancements and innovations and the introduction of stringent government regulations aimed at energy conversion.

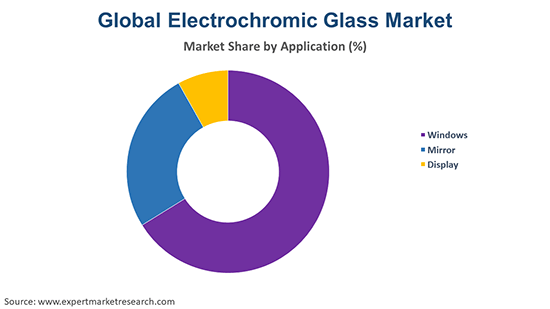

Windows, mirror, and display are the major applications of the product.

Construction, automotive, and aerospace, among others, are the different end uses of electrochromic glass.

The major players in the market are AGC Inc., Chromogenics AB, Kinestral Technologies, Inc., Polytronix, Inc., and Smartglass International Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share