Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

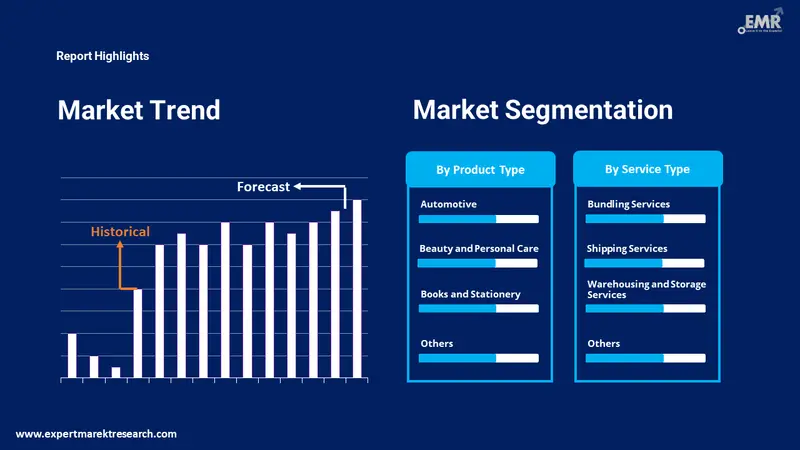

The global e-commerce fulfillment services market size was valued at USD 102.84 Billion in 2024. The market is further projected to grow at a CAGR of 9.20% between 2025 and 2034, reaching a value of USD 247.96 Billion by 2034.

Base Year

Historical Year

Forecast Year

In 2021, global e-commerce sales surpassed USD 5 trillion.

79% of e-commerce companies use a third-party logistics company for at least one channel of fulfillment.

It is anticipated that 51% of shoppers will adopt for same-day delivery by 2025.

Software solutions are used by 65% of eCommerce businesses for order fulfillment.

Value in USD Billion

2025-2034

E-Commerce Fulfillment Services Market Outlook

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

E-commerce fulfillment services include the processes and activities involved in delivering online orders to customers. They include picking, packing, shipping, tracking, and managing inventory and returns of e-commerce products. E-commerce services can be fulfilled either from the in-house fulfillment centres or third-party warehouses that charge based on the volume, storage, and weight of the inventory.

The e-commerce fulfillment services market is expected to grow significantly in the coming years, owing to the increasing demand for online shopping. The rising adoption of omnichannel retailing, the emergence of new technologies and automation, the expansion of cross-border e-commerce, and the need for cost-effective and efficient fulfillment solutions are other factors driving the e-commerce fulfillment services market growth. E-commerce fulfillment services can help online retailers improve customer satisfaction, loyalty, and retention, as well as enhance their competitive edge and profitability.

Rising demand for same-day or next-day delivery, increasing use of automation and robotics, and growing adoption of omnichannel retailing are boosting the market growth

| Date | Company | Announcement |

| October 2023 | Ingram Micro | Distribution alliance with Supermicro for the markets in the Middle East and Africa |

| April 2023 | FedEx Corp | Combining FedEx Ground and FedEx Express to cut costs and better compete with rivals |

| January 2021 | Amazon.com, Inc. | Expanded airway fleet by acquiring 11 Boeing 767-300 aircraft from WestJet and Delta |

| September 2019 | Amazon.com, Inc. | Expanded operations in Ontario with a new fulfillment centre in Scarborough |

| Trends | Impact |

| Rising demand for same-day or next-day delivery | Increases the operational efficiency and customer satisfaction of e-commerce companies and incentivise fulfillment centres to ptimize their logistics and inventory management. |

| Growing adoption of omnichannel retailing | Enables e-commerce companies to offer multiple options for customers to order, pay, and receive products, such as online, in-store, or curbside pickup by integrating their systems and processes across different channels. |

| Increasing use of automation and robotics | Enhances the speed, accuracy, and safety of fulfillment operations. Market players are investing in robotic systems for automating warehouse and storage operations in fulfillment centers. |

| Emerging sustainability and social responsibility concerns | Encourages e-commerce fulfillment companies to adopt green practices and reduce their environmental impact, such as using renewable energy, biodegradable packaging, and carbon-neutral delivery. |

The accessibility to shop from anywhere through smartphones has significantly reduced the amount of time and efforts spent on shopping, which is a major factor contributing to the e-commerce fulfillment services market development.

Moreover, the deployment of latest technologies like robotics and automation into the e-commerce fulfillment services market has resulted in increased productivity and helped speed up delivery times. This trend is likely to add to the e-commerce fulfillment services market growth.

In addition, due to a significant number of sales being generated from metropolitan areas, the location of the fulfillment centres is of prime importance. Thus, the concentration of sizeable fulfillment centres near significant cities is a major contributor to the e-commerce fulfillment services market expansion as it reduces the cost of transportation and shipping services.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global E-Commerce Fulfillment Services Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type:

Market Breakup by Service Type:

Market Breakup by Region:

Beauty and personal care products captures the largest market share due to the high influence of social media and wide availability of these products on online websites

In types of products, beauty and personal care segment is anticipated to lead the e-commerce fulfillment services market share in the forecast period. Beauty and personal care include products such as cosmetics, skincare, haircare, fragrances, oral care, and personal hygiene. Global online sales of beauty and personal care products reached USD 65.6 billion in 2020, growing by 20% from 2019. The main drivers of this segment are the rising demand for natural and organic products, the influence of social media and influencers, and the convenience of online shopping. Some of the leading online retailers in this segment are Amazon, Alibaba, Sephora, and Nykaa.

Consumer electronics segment in order fulfillment market includes products such as smartphones, tablets, laptops, desktops, TVs, cameras, audio devices, gaming consoles, and accessories. The segment’s growth is driven by the increasing adoption of smart devices, the emergence of new technologies such as 5G and IoT, and the growth of online platforms such as Amazon, Best Buy, and JD.com. Furthermore, the growing demand for consumer electronics and the need for proper multi-layer packaging for electronics to rule out the risk of damage during transit is propelling the demand for e-commerce fulfillment services.

Clothing and footwear includes apparel, shoes, bags, jewellery, and accessories. This segment is expected to see a steady growth in the coming years, due to the increasing preference for fast fashion and sales of clothes online. With frequently changing fashion trends, people are buying new clothes and shoes at a faster rate. The global online sales of clothing and footwear reached USD 525.1 billion in 2020, which, in turn, can increase the overall e-commerce fulfillment services market size as well.

Shipping and bundling services contribute significantly due to high implementation of trade-liberalisation policies in various countries

According to e-commerce fulfillment services market report, bundling services allow online retailers to pack multiple items in one package, which can reduce shipping fees and enhance customer loyalty. Shipping services involve transporting the products from the fulfillment centers to the customers' addresses using various carriers, such as couriers, postal services, or freight forwarders. Warehousing and storage services refer to storing the products in suitable and safe locations and handling the picking, packing, and dispatching of orders.

The growth of the shipping services segment in e-commerce fulfillment services market is expected to be driven by the increasing trade-liberalisation policies of various countries and the growing cross-border shipments globally. Besides, the growing inclination of the population towards international brands and imported items, in line with their rising disposable incomes has further compelled the growth of this segment and has positively impacted the e-commerce fulfillment services market outlook.

The warehousing and storage services segment on the other hand, held a considerable e-commerce fulfillment services market share due to the incorporation of automated mobile robots (AMR) and augmented reality (AR) which has increased warehousing efficiency. Robotic order picking and automated stacking systems are expected to drive this segment’s growth.

Market players are focusing on services and fleet expansion to gain a competitive edge in the market and to fasten their delivery services

| Company Name | Year Founded | Headquarters | Products/Services |

| Amazon.com, Inc. | 1994 | Washington, United States | E-commerce, cloud computing, digital streaming, artificial intelligence, fulfillment services, etc. |

| eFulfillment Service, Inc. | 2001 | Michigan, United States | Fulfillment services, order fulfillment, inventory management, shipping, returns processing, etc. |

| Ingram Micro, Inc. | 1979 | California, United States | Information technology products and services, supply chain management, cloud computing, e-commerce fulfillment, etc. |

| Red Stag Fulfillment | 2013 | Tennessee, United States | Fulfillment services, order fulfillment, warehousing, inventory management, shipping, kitting, etc. |

Other market players in global e-commerce fulfillment services market include ShipNetwork, ShipBob, Inc., Shipfusion Inc., Xpert Fulfillment, Sprocket Express Plainville, MA, and FedEx Corporation, among others.

North America is one of the prominent regions due to increasing e-commerce retail sales

The e-commerce fulfillment services market in North America is expected to witness significant growth due to the high penetration of internet and smartphone users, the presence of major e-commerce platforms such as Amazon and Shopify, and the increasing demand for online shopping. According to the U.S. Census Bureau, the e-commerce retail sales in the U.S. reached USD 791.7 billion in 2020, an increase of 32.4% from 2019. The e-commerce fulfillment services providers in the region are offering innovative solutions such as same-day delivery, curbside pickup, and contactless delivery to cater to the changing consumer preferences and expectations.

According to the e-commerce fulfillment services market report, Asia Pacific region is anticipated to be the fastest-growing market during the forecast period, owing to the rising disposable income, growing middle-class population, and expanding e-commerce sector in the emerging economies such as India, China, Indonesia, and Vietnam. According to the United Nations Conference on Trade and Development (UNCTAD), the e-commerce sales in the Asia Pacific region accounted for 50% of total sales in 2019, with China being the largest e-commerce market in the world. The e-commerce fulfillment services market in the region is also driven by the increasing adoption of digital payment methods, the availability of low-cost labour and land, and the supportive government policies and initiatives to promote e-commerce development.

The e-commerce fulfillment services market in the Middle East and Africa is projected to grow at a moderate rate during the forecast period, due to the improving internet infrastructure, the rising popularity of social media and online platforms, the growing awareness and trust among consumers, and the emergence of local and regional e-commerce players. According to statistics, the e-commerce revenue in the Middle East and Africa region amounted to USD 28.8 billion in 2020 and is expected to reach USD 54.7 billion by 2025. The e-commerce fulfillment services market in the region is also influenced by the increasing demand for cross-border e-commerce and the development of the logistics and transportation sector.

Furthermore, the European e-commerce fulfillment services market is estimated to witness substantial growth during the forecast period, due to the high internet and e-commerce penetration, the presence of well-established e-commerce platforms such as Alibaba, Amazon, and Zalando, and the growing consumer preference for online shopping. According to the European Commission, the e-commerce turnover in Europe increased by 12.7% in 2020. The market in Europe is also supported by the advancement of technologies such as artificial intelligence, robotics, and cloud computing, the integration of omnichannel strategies, and the favourable regulatory framework for e-commerce.

E-Commerce Fulfillment Services Market Size

E-Commerce Fulfillment Services Market Trends

E-Commerce Fulfillment Services Market Share

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2024, the market reached an approximate value of USD 102.84 Billion.

The e-commerce fulfillment services market is expected to grow at a CAGR of 9.20% between 2025 and 2034.

The market is estimated to witness a healthy growth in the forecast period of 2025-2034 to reach USD 247.96 Billion by 2034.

The rapidly growing preference for online shopping, increasing number of online retailers, and rising preference for outsourcing fulfillment services are the major drivers of this market.

Key trends aiding market expansion include the deployment of latest technology, growing concentration of fulfillment centres near metropolitan regions, and increasing sales of consumer electronics on e-commerce platforms.

Major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

E-commerce fulfillment services refer to all the operations that take place at an e-commerce company or provider post receiving an order like checking inventory, packing items, transporting orders to the customer’s shipping destination, and handling returns and exchange.

The four major types of order fulfillment are: in-house, outsourced, hybrid and drop shipping.

The key service types include bundling services, shipping services, and warehousing and storage services, among others.

Key players in the market are Amazon.com, Inc., eFulfillment Service, Inc., Ingram Micro, Inc. ShipNetwork, Red Stag Fulfillment, ShipBob, Inc., Shipfusion Inc., Xpert Fulfillment, Sprocket Express Plainville, MA, and FedEx Corporation, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Service Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share