Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

The global direct selling market reached a value of nearly USD 175.19 Billion in 2024. The market is projected to grow at a CAGR of 1.70% between 2025 and 2034 to reach around USD 207.36 Billion by 2034.

Base Year

Historical Year

Forecast Year

Direct selling empowers companies to directly connect with consumers, sidestepping the extra expenses and profit margins linked to intermediaries.

Organic farmland acreage increased by 26.6% year-on-year to 96.4 million hectares in 188 countries.

Overall for the whole of agricultural production, China, in the year 2021, led the world's agricultural production at 1,095 million metric tonnes and strengthened its supremacy in the world agricultural industry.

According to direct selling market analysis, the United States followed at 605 million metric tonnes, followed by Brazil at 522 million metric tonnes.

Amway Corp., Herbalife Nutrition Ltd., Natura & Co are a few of the major companies in the market.

The Asia Pacific, the market for direct selling is witnessing a growing trend of increased expenditure on healthcare and cosmetic products.

Value in USD Billion

2025-2034

Direct Selling Market Outlook

*this image is indicative*

| Global Direct Selling Market Report Summary | Description | Value |

| Base Year | USD Billion | 2024 |

| Historical period | USD Billion | 2018-2024 |

| Forecast Period | USD Billion | 2025-2034 |

| Market Size 2024 | USD Billion | 175.19 |

| Market Size 2034 | USD Billion | 207.36 |

| CAGR 2018-2024 | Percentage | xx% |

| CAGR 2025-2034 | Percentage | 1.70% |

| CAGR 2025-2034 - Market by Region | North America | 2.1% |

| CAGR 2025-2034 - Market by Country | UK | 5.6% |

| CAGR 2025-2034 - Market by Country | USA | 2.1% |

| CAGR 2025-2034 - Market by Type | Single Level Marketing | 2.2% |

| CAGR 2025-2034 - Market by End Use | Household Goods | 2.3% |

| Market Share by Country | USA | 23.7% |

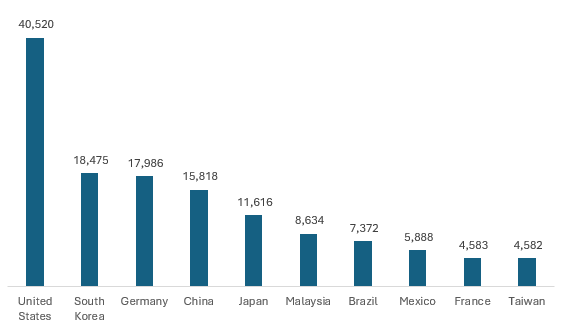

Figure: Top 10 Direct Selling Markets, 2022 (USD Million)

Direct selling, a time-honoured approach, involves the sale of products and services directly to consumers in locations beyond the confines of a stationary retail establishment. Certain direct selling enterprises provide exclusive products that are not readily accessible in traditional retail outlets. This presents consumers with a chance to acquire distinctive and specialised products tailored to their individual needs and preferences.

Some of the factors driving the growth of the direct selling market are the growing middle-class population in developing nations, the escalating accessibility of internet services, and the rise in disposable income as well as the convenience provided by this business model.

Rising awareness regarding health and beauty; high employment opportunities offered by direct selling; and rising internet penetration support direct selling market opportunities.

| Date | Company | Event |

| September 2023 | Natura & Co | Advanced its omnichannel strategy in the UK through a partnership with Superdrug, a major high-street retailer with over 830 stores. |

| August 2023 | Natura & Co | Successfully concluded the sale of Aesop to L'Oréal, a deal initially announced in April 2023 with a final enterprise value of USD 2.48 billion. |

| April 2023 | Amway China | Announced plans to invest USD 87 million in a five-year project to upgrade its Guangzhou production base infrastructure and facilities. |

| April 2023 | Herbalife | Unveiled 106 new product SKUs in Q1 2023, spanning all 95 markets of its global operation. |

| Trends | Impact |

| Rising awareness of health and beauty | With growing customers’ focus towards health and beauty, direct selling companies are offering products catering to wellness, nutrition, skincare, and fitness. |

| Growing online channel | A key trend of the direct selling market is integrating online platforms with direct selling and incorporating social commerce and affiliate marketing can broaden the customer reach and boost sales of key players. |

| Diverse workforce | Direct selling encompasses a diverse workforce with 20.2 million working full-time and 54.2 million part-time. Another 53.5 million include newcomers, product enthusiasts, and inactive members as of 2021. |

| Rising Internet penetration | In 2023-24, global internet users grew by 97 million, accounting for 5.35 billion people globally. The growing accessibility of internet services surges the sale of products and services directly to consumers. |

Establishing trust between a seller and a customer hinges on the provision of a customised buying experience. With the interactive nature of direct selling, businesses have the chance to offer individualised service, allowing them to gain a deeper understanding of their customers' needs, preferences, and goals.

Furthermore, the market for healthcare and wellness products is experiencing significant growth, while evolving lifestyles and an emphasis on self-care and personal appearance further contribute to capitalise on the demand for grooming products, including skincare, cosmetics, and hair care items. This is eventually contributing towards accelerating the demand of direct selling market.

The economy of wellness around the world, in 2022, stood at USD 5.6 trillion. According to the Global Wellness Institute, leading the charge were personal care and beauty at USD 1,089 billion, while healthy eating, nutrition, and weight loss trailed at USD 1,079 billion. The sector for physical activity contributed USD 976 billion, while wellness tourism contributed to the tune of USD 651 billion. This equates to USD 611 billion associated with public health, prevention, and personalized medicine, and the compendium of traditional and complementary medicine recorded expenditures totaling USD 519 billion. Mental wellness tacked on another USD 181 billion, while wellness real estate added USD 39 billion.

This further strikingly high growth of the wellness economy provides an opportunity for the direct selling demand growth to globalise. The reason is that the ongoing changing trend of direct-selling commodities involving more personalised health and beauty solutions, wellness and fitness programs to add on nutritional products, places this industry in a good position to benefit from the USD 1,079 billion nutrition market and the USD 1,089 billion personal care market. Additionally, the growing wellness tourism market, with a turnover of USD 651 billion, contributes to opening further avenues for direct selling in the wellness travel packages and experiences.

As per the International Trade Administration, Department of Commerce, United States of America, global B2C eCommerce revenues reached USD 3.64 trillion in 2022, growing steadily at 14.4% per annum from USD 1.45 trillion in 2017. The break-up of B2C is: Electronics - USD 1.18 trillion Fashion - USD 781 billion Furniture - USD 526 billion Toys, Hobby, DIY - USD 318 billion. Other major sectors were the BHPHC at 274 billion dollars, media at 222 billion dollars, beverages at 190 billion dollars, and food at 566 billion dollars.

Following this trend toward growth, it is highly predicted that the worldwide B2C e-commerce revenue would reach USD 5.56 trillion in 2027. Consumer electronics will be at the top of this list with USD 1.35 trillion, followed by Fashion at USD 1.10 trillion. Furniture will score USD 620 billion, and the Toys, Hobby and DIY sector will achieve USD 303 billion. Biohealth Pharmaceuticals (BHPHC), media, beverages and food will also grow by large magnitudes with expected revenues of USD 274bn, USD 193 bn, USD 382bn and USD 620bn.

This exponential growth in eCommerce is going to have a huge impact on the growth of direct selling industry. Since more and more consumers are being lured to online shopping, according to the International Trade Administration, this, in turn, will be providing a fertile field in which direct selling companies can grow further in terms of their digital presence. Direct sellers can tap into this projected USD 5.56 trillion market by using eCommerce platforms, thereby extending their reach and sales potential. It is here that digital strategies will strongly come in to help direct-selling businesses fully exploit the embryonic online retailing environment.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global Direct Selling Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:

On the basis of type, the market is divided into:

On the basis of application, the market is segmented into:

On the basis of region, the market is segregated into:

| CAGR 2025-2034 - Market by | Type |

| Single Level Marketing | 2.2% |

| Multi-Level Marketing | xx% |

| CAGR 2025-2034 - Market by | Application |

| Household Goods | 2.3% |

| Cosmetics | 2.0% |

| Wellness | xx% |

| Others | xx% |

| CAGR 2025-2034 - Market by | Region |

| North America | 2.1% |

| Asia Pacific | 1.3% |

| Europe | xx% |

| LAMEA | xx% |

Multi-level marketing is expected to hold significant direct selling market share as it relies on individuals rather than traditional retail outlets

The MLM model places the selling responsibility in the hands of independent distributor networks. In the MLM structure, these distributors are not considered company employees; rather, they function as independent business owners who build and manage their distributor networks to facilitate product sales.

Meanwhile, in single-level marketing, independent sales representatives act as distributors for brands. As per direct selling industry analysis, this model of marketing is expected to streamline and revolutionise the direct selling market landscape in the forecast period.

The demand for wellness products from direct selling is significantly rising amid rising disposable incomes

Wellness products are anticipated to hold a significant share in the direct selling market due to increasing global disposable income and rising health-consciousness. According to direct selling industry statistics from Global Wellness Economy, the wellness economy is expected to reach USD 7.0 trillion in 2025, with a 9.9% average annual growth. Some of the leading wellness direct-selling companies are Amway, Herbalife, Infinitus, PM-International, Melaleuca, Nu Skin, Young Living, and Forever Living amongst others.

Moreover, the sales of cosmetics from direct selling are likely to increase in the forecast period as key players in the market focus on personalisation, research and development, and premiumisation.

The direct selling industry in Asia Pacific is anticipated to hold a dominant position in the direct selling market. South Korea is the 2nd largest market globally, accounting for 11% of the market. According to the WFDSA 2022 statistics, the market has approximately 8 million independent representatives in retail sales. Factors contributing to the rise in the demand for direct selling across the region include rising incomes, a heightened awareness of health and beauty concerns, and the expanding middle-class population.

| Market Share by | Country |

| USA | 24% |

| Canada | xx% |

| UK | xx% |

| Germany | xx% |

| France | xx% |

| Italy | xx% |

| China | xx% |

| Japan | xx% |

| India | xx% |

| Australia | xx% |

| South Africa | xx% |

| Brazil | xx% |

| Mexico | xx% |

The direct selling market share in North America is driven by the growing health and wellness trend among Americans. According to the Direct Selling Association (DSA), the USA had over 6.7 million direct sellers in 2022, over 75% of which were female. The country has over 6.2 million individuals working as part-time direct sellers and 0.5 million working as full-time direct sellers.

| CAGR 2025-2034 - Market by | Country |

| UK | 5.6% |

| India | 3.5% |

| USA | 2.1% |

| China | 0.4% |

| Mexico | 0.2% |

| Canada | xx% |

| Germany | xx% |

| France | xx% |

| Italy | xx% |

| Japan | xx% |

| Australia | xx% |

| South Africa | xx% |

| Brazil | xx% |

Key market players are making investments in a mix of innovation, strategic partnerships, aggressive marketing, and comprehensive training programs to strengthen their position and enhance their market share in the highly competitive global direct selling market.

Amway, established in 1959 and headquartered in the United States, being a market leader for this industry, it would concern itself with a wide variety of high-quality products that are backed by a formidable global distribution network. Great effort and resources are put into innovation and product development to answer the many needs of consumers. Its competitive strategy engages in rigorous training of distributors, strategic cooperation, and constant market expansion to boost its geographical presence worldwide.

Avon Products, established in 1886 and headquartered in the United Kingdom, leverages the great brand equity and vast beauty and personal care product range. The company emphasises its direct-to-consumer selling model through thousands of independent representatives. Competitive strategies pursued by Avon Products include incessant product innovation, using digital platforms for selling and marketing operations, and strategic alliances to penetrate untapped markets.

Herbalife Nutrition, established in 1980 and headquartered in the United States, is oriented to nutrition, with weight management and health enhancement products. The competitive strategy of the company features scientifically-supported products, extensive training for the distributor network, and a community that creates a support system. Herbalife puts great emphasis on personal wellness coaching and personalised customer service to drive sales and loyalty.

Mary Kay, established in 1963 and headquartered in Texas, lays an emphasis on training and the development of these consultants, and the use of digital tools to optimise customer engagement and therefore optimal sales represent part of the competitive strategy of the company. Skincare and cosmetic products in which the company deals are directly sold through an individual sales force of independent beauty consultants.

Tupperware, established in 1946 and headquartered in Massachusetts, fuels its sales on in-home parties to give personalised service. Its competitive strategies are based on the continuation of product innovation, environmental sustainability, and the enhancement of its sales force through education and support.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the direct selling market report include Forever Living Products, Vorwerk, and Young Living., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The direct selling market reached a value of nearly USD 175.19 Billion in 2024.

The market is projected to grow at a CAGR of 1.70% between 2025 and 2034.

The market is estimated to witness a healthy growth in the forecast period of 2025-2034 to reach USD 207.36 Billion by 2034.

The major drivers include rising incomes, a heightened awareness of health and beauty concerns, and the expanding middle-class population.

The key trends include the surging demand for customised purchasing experience, rising awareness of health and well-being, and rising internet penetration.

The different types of direct selling include single-level marketing and multi-level marketing.

Major applications of direct selling include wellness, cosmetics, and household goods, among others.

The major players in the market include Amway Corp., Herbalife Nutrition Ltd, Natura & Co, Vorwerk SE & Co. KG, Tupperware Brands Corporation, Oriflame Holding AG, and Mary Kay Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share