Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global dehydrated vegetables market attained a value of USD 85.98 Billion in 2025 and is projected to expand at a CAGR of 6.30% through 2035. The market is further expected to achieve USD 158.39 Billion by 2035. Rising demand for shelf-stable, precision-cut vegetable formats in meal kits, plant-based foods, and ready-to-cook mixes is compelling manufacturers to scale high-efficiency dehydration systems with tight microbial and color control.

The market witnesses a fresh wave of modernization as processing companies shift toward cleaner, faster, and more nutrient-retentive drying technologies. For example, in October 2021, Olam Food Ingredients expanded its proprietary Agri-Neo's pasteurization technology for onions and bell peppers, enabling processors to reduce moisture variability, boosting the dehydrated vegetables market value. This matters, because inconsistent moisture content has historically been a major challenge across ready-meal and seasoning manufacturing.

At the same time, momentum in the market is accelerating as food processors, quick-service restaurant chains, and packaged-meal companies evaluate long-term cost efficiencies. Many companies are dealing with unpredictable fresh vegetable supply, labor shortages, and rapidly changing food-safety norms. As these pressures intensify, dehydrated ingredients are letting manufacturers stabilize recipes, shrink cold-chain dependence, and lock in flavor consistency across geographies, driving demand in the dehydrated vegetables market. In February 2024, Nestle introduced a new product line of organic and plant-based dehydrated meals under its Garden Gourmet line. New entrants are also focusing on heat-stable, color-protected formats that hold better during retort, extrusion, and frying, which are especially critical for instant noodles, sauces, and snack coatings.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.3%

Value in USD Billion

2026-2035

*this image is indicative*

Processors and brands are treating dehydrated vegetables as a key inventory for smooth seasonal supply cycles. Contract farming tied to centralized dehydration hubs is enabling predictable lotting and consistent particle size, which industrial buyers prize for automated dosing. As per reports published in November 2025, a new production facility for dehydrated vegetables, including onions and garlic, is set to be established in the Turkestan Region by the Chinese company Qingdao Wanlin Food Co. Governments and trade bodies in producing nations are funding dehydration pilots and cold-chain alternatives, lowering capex barriers for SMEs, accelerating the overall dehydrated vegetables market growth.

Hybrid technologies such as vacuum-microwave drying, low-temperature drum drying with controlled atmospheres, and optimized infrared pre-drying are reducing nutrient and color losses versus conventional hot-air systems. These process gains translate to better rehydration profiles and reduced need for flavor masks or color stabilizers, appealing to clean-label formulators, reshaping dehydrated vegetables market trends. For example, Mumbai-based Khetar is an agritech startup that uses solar dehydration to preserve agricultural produce and increase their shelf life. Energy-efficient equipment and process controls also lower operational cost per kg, making high-value formats including fine powders, instant flakes commercially viable even at scale.

Retail and foodservice innovation in plant-based proteins, instant soups, savory snacks and meal kits is creating steady demand for standardized dehydrated inputs. Dehydrated onion, tomato powder, and vegetable blends enable consistent seasoning profiles and reduce inbound mass/volume costs. For example, Bowlful offers freeze-dried ready-to-eat products that have become a popular choice for busy individuals who want a nutritious meal on the go. Institutional buyers such as foodservice chains, military, humanitarian agencies are procuring dehydrated formats for logistics efficiency and extended shelf life. This predictable demand in the dehydrated vegetables market is encouraging processors to invest in product diversification from diced/re-hydrating vegetables to ultra-fine powders for extrusion lines.

Large manufacturers and exporters are demanding machine-readable certificates, moisture analytics, and third-party microbial data at batch level. Suppliers offering QR-linked provenance, COA automation, and embedded shelf-life models are winning preferred-supplier slots and premium pricing. In October 2025, INC initiated the first sustainability certification developed specifically for the global dried food industry. Export promotion bodies and co-ops are supporting certification and lab access, enabling small processors to meet phytosanitary and residue norms, accelerating the overall dehydrated vegetables market expansion.

Brands and institutional buyers are increasingly screening suppliers for carbon intensity and water reuse. Solar-assisted drying, waste-heat recovery, and closed-loop condensate reuse are gaining traction, driven by energy price volatility and green procurement policies. In August 2025, UpFood developed a novel fruit and vegetable dryer that is solar powered and therefore more sustainable and with a very low production cost, widening the dehydrated vegetables market scope. The standard model has the capacity to dry 1Mt per day of fresh fruits and vegetables. Governments in several regions are coupling tax credits and grants with energy-efficiency targets for food processing, making low-energy dehydration investments more attractive.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Dehydrated Vegetables Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

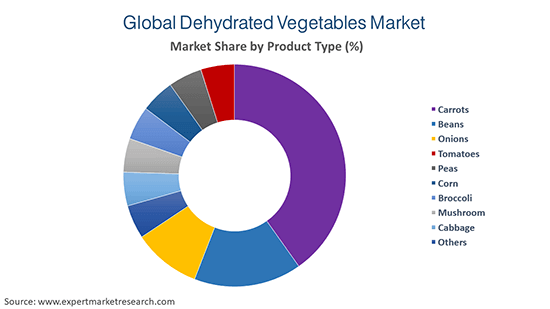

Market Breakup by Product Type

Key Insight: Onions lead the market due to versatile flavor contribution, predictable rehydration, and integration across sauces, snacks, and seasonings. Tomatoes are rapidly gaining share in the dehydrated vegetables market as concentrated powders reduce freight intensity and provide natural color and umami flavor for sauces, snacks and extruded foods. Carrots and peas maintain steady demand for health-positioned ingredients, while mushrooms and broccoli support premium savory blends. Market decisions are also being driven by particle size control, soluble solids, and baked-and-extruded performance.

Market Breakup by Form

Key Insight: Form choices reflect logistics, dosing precision and end-use. Powder and granule account for the dominant share of the market because of low freight, metering accuracy, and broad usage across seasonings and dry mixes. Minced and sliced variants are gaining popularity among meal-kit and ready-meal manufacturers who require visible texture and fast rehydration, driving the dehydrated vegetables market revenue. Slices and cubes serve foodservice and industrial stew applications where body and appearance matter. Chopped/flake forms are favored for snack and extruded product lines for texture control.

Market Breakup by Technology

Key Insight: As per the dehydrated vegetables market report, air drying remains dominant due its output and improved energy efficiency. Vacuum and drum drying serve specific formulations needing rapid drying or paste conversion, while freeze drying is growing its shares for premium, high-value items because of superior reconstitution and nutrient retention. Emerging hybrid systems combine mild heat with vacuum to reduce thermal damage. Processors are choosing technologies based on SKU margins, shelf-life needs and buyer specifications, prompting OEMs to offer modular, retrofitable lines with digital controls, supplier-backed performance guarantees and third-party lab validation.

Market Breakup by Distribution Channel

Key Insight: Supermarkets and hypermarkets control volume sales and private-label requirements, pushing suppliers toward cost optimization and standardized formats. Online channels are growing at a rapid pace by enabling micro-SKUs, premium direct listings and subscription models that suit meal-kit and food service clients.

Market Breakup by End Use

Key Insight: While the retail end use dominates volume sales with private-label and CPG formats demanding standardized specs, traceability and retail-ready packaging, the food service category expands its shares in the dehydrated vegetables market dynamics as operators value shelf-stable, quick-rehydrate ingredients that reduce prep time and waste. Others including pet food and industrial ingredients require tailored grades and bulk logistics.

Market Breakup by Region

Key Insight: Regional dehydrated vegetables market trends shape production and procurement strategies. Asia Pacific leads the market owing to integrated cropping systems, low labor costs and consolidated drying hubs that supply global private-label needs. Europe demands higher specification and sustainability reporting, pushing processors to invest in energy recovery and certifications. North America is expanding its share at the fastest pace as brands invest in onshore sourcing, automation and premium formats. Latin America and Middle East and Africa have become niche suppliers for certain crops and seasonality.

By product type, onions dominate the market due to heavy ingredient demand with broad culinary and processing applications

Onions are one of the main ingredients for savory processing, dominating dehydrated vegetable volumes because they deliver concentrated flavor, natural browning precursors, and functional sugar content that improve mouthfeel in sauces and ready-to-make meals. Industrial buyers demand standardized particle size that integrates easily into mixers and seasoning lines. In May 2023, China's Wanlin Group Limited announced that the company is set to build a plant for producing dehydrated onions in the Zhambyl Region in three phases within five years. Global snacks and seasoning formulators prefer dehydrated onions to reduce inbound mass and avoid cold-chain costs.

Tomato powders and flakes are rapidly contributing to the dehydrated vegetables market growth as manufacturers shift from shipments of canned tomato to lighter dehydrated formats for cost, weight and sustainability reasons. Advanced drying preserves lycopene and soluble solids, delivering concentrated umami flavors and natural colors that appeal to clean-label ketchup, sauce and seasoning producers.

By form, powder and granules command the bigger share of the market owing to logistics and functional versatility

Powders and granules dominate the market because they minimize shipping weight, improve dosing accuracy, and integrate seamlessly into automated seasoning systems and dry mixes. Manufacturers prefer powders for their long shelf life and the ability to micro-blend for consistent flavor release across batches. According to the dehydrated vegetables market analysis, dehydrated potato granules and pellets exports surged to USD 63 million in FY2025, with Malaysia, the Philippines, and Indonesia leading the way. Powdered vegetables are also being encapsulated to protect sensitive compounds such as lycopene, carotenoids and tuned for solubility in hot-fill and cold-mix processes.

Minced formats are also gaining rapid popularity due to their convenience for ready meals, soups, and meal kits, where rapid rehydration and visible texture are important for consumer perception. Minced dehydrated vegetables enable chefs and co-packers to deliver consistent mouthfeel without handling fresh produce waste. Advances in pre-treatment and blanching, combined with hybrid drying methods, are preserving color and reducing rehydration times, making minced products near-equivalent to frozen in sensory trials.

By technology, air drying continues to be dominant in the market due to low cost and high output

Air drying has long been the pillar of dehydrated vegetable production because it offers reliable output and familiar process controls for industrial operators. Modern tunnel and belt dryers are integrating heat-recovery modules, variable airflow management and in-line moisture scanning to cut energy intensity to a considerable extent. B2B buyers favor air-dried powders and flakes for cost-sensitive ingredients in soups, seasonings and pet food where functionality outweighs aesthetics.

Freeze drying, traditionally premium, is emerging as fastest-growing technology in dehydrated vegetables market scope due to superior rehydration quality, nutrient retention and flavour preservation that premium food manufacturers demand. Recent capex declines and modular pilot units are enabling mid-sized processors to trial lyophilization economically. Suppliers are pairing freeze dryers with cold-chain logistics and MAP packaging to guarantee shelf stability and functionality. In January 2024, Ovāvo, a startup based in New Zealand, introduced freeze-dried fruits and vegetables powder, leveraging its unique vacuum technology. Regulatory-compliant documentation and validated water-activity profiles are simplifying specification acceptance by food service buyers.

Supermarkets secure the larger market revenue share due to scale advantages, retail procurement and visibility

Supermarket and hypermarket chains are the dominant distribution channel for dehydrated vegetables since they aggregate consumer demand and support large-volume private-label sourcing. Category managers are favoring suppliers who can guarantee consistent particle size, colour metrics and supply cadence across 52-week promotions. This is driving processors to standardize formulations and invest in SKU rationalization, co-manufacturing agreements and EDI-linked traceability. Retail buyers are also requesting sustainability credentials and reduced packaging weight, prompting producers to implement compressed flake packaging and recyclable sachets.

Online distribution observes fast-paced growth in the dehydrated vegetables market as e-grocery and B2B marketplaces boost demand for ingredient consolidation and micro-SKU flexibility. E-commerce buyers prioritize shelf-stable, lightweight formats and detailed ingredient matrices. They also demand rapid sample fulfilment and small-batch agility. Dehydrated vegetable producers are adapting by offering shrink-wrapped trial pouches, flexible case sizes and serialized lot tracking to enable direct-to-kitchen replenishment for food service and meal-kit operators.

Retail end use continues to hold dominance in the market owing to private-label demand, visibility and standardized product specifications

Retail accounts for the largest end-use category in the dehydrated vegetables market because consumer packaged goods are the primary outlet for dehydrated vegetables across multiple formats from powders to chips. Retail buyers are demanding clean-label claims, consistent colour and particle-size specifications, and optimized pack formats that reduce shelf-space while maximizing visibility. In March 2024, BranchOut Food and True Essence Foods introduced new dehydration technologies aimed at enhancing flavor and nutrient retention for consumers. This is prompting producers to invest in blended seasoning-ready SKUs, co-branded promotions and retail-ready case configurations.

Food service represents the fastest-growing end-use category as operators seek cost-stable, shelf-stable ingredients to simplify back-of-house processes and reduce prep times. Chain restaurants, institutional kitchens and meal-kit providers are sourcing dehydrated vegetables for consistent portioning, reduced waste and predictable flavour, creating new dehydrated vegetables market opportunities. Suppliers are developing par-cooked, quick-rehydrate formats and customized grade specifications to meet yield and cook-time constraints.

By region, Asia Pacific clocks in significant market share due to production scale and processing infrastructure

Asia Pacific is the dominant regional market for dehydrated vegetables because it combines raw-material supply, low-cost processing and proximity to major seasoning and instant-food manufacturers. Countries in Southeast and South Asia provide year-round harvesting windows and vertically integrated supply chains that support steady output. Export-oriented processors are investing in energy-efficient drying lines, ISO certifications and consolidated packing hubs to serve global private-label buyers. Many mid-market players are leveraging contract farming and farmer aggregation apps to secure quality inputs and reduce price volatility.

Growth of the dehydrated vegetables market in North America is driven by increasing demand for clean-label ingredients, onshoring of supply chains, and investments in automation. United States and Canadian food processors are prioritizing supplier traceability, faster sample cycles and validated functional performance to meet private-label and premium brand specifications. Incentives for energy efficiency plus availability of retrofit capital are enabling renewal of drying assets and pilot freeze-drying lines. E-commerce and meal-kit growth in urban centers is amplifying demand for shelf-stable, premium dehydrated inclusions.

The market is becoming more innovation-led as processors shift from commodity drying to value-engineered ingredients tailored for foodservice, meal kits, seasonings, and premium packaged foods. Dehydrated vegetable companies are investing in advanced drying systems, digital moisture profiling, clean-label processing, and backward-integrated sourcing to stabilize quality. Partnerships with QSR chains and ready-meal manufacturers are opening new opportunities for SKU customization, while AI-driven sorting, automated grading, and nitrogen-flush packaging are helping players deliver high consistency with lower wastage.

Sustainability is also emerging as a real differentiator, pushing dehydrated vegetables market players to adopt energy-efficient dryers, solar-assisted preheating, and farm-level traceability dashboards. As global brands tighten specification thresholds, suppliers that can validate rehydration curves, color retention, and microbiological safety are securing multi-year co-manufacturing contracts. The market now rewards companies who are able to merge technical capability with rapid sample turnaround, predictable delivery cycles, and flexible order quantities.

Founded in 1980 and headquartered in California, United States, Mercer Foods is a leader in freeze-dried vegetables and fruits, supplying premium ingredients to CPG brands, foodservice chains, and meal-kit companies. The firm focuses on advanced lyophilization, clean-label production, and tight color and nutrient retention standards. It leverages automated sorting and in-house application labs to create custom blends and functional inclusions for snacks and ready meals.

Established in 1972 and headquartered in Tralee, Ireland, Kerry Group serves the dehydrated vegetables market through its taste and nutrition division, delivering functional vegetable powders, culinary blends, and clean-label dehydrated ingredients. The company uses advanced drying, controlled thermal processes, and flavor-protection systems to meet strict formulation needs across global CPG and foodservice clients.

Founded in the year 1979 and headquartered in North Carolina, United States, Harmony House Foods specializes in premium dehydrated and freeze-dried vegetables, targeting natural retailers, e-commerce buyers, and emergency-preparedness suppliers. The company maintains strict processing controls, small-batch agility, and clean-label commitments with no additives or preservatives.

Established in 2015 with its base location in India, Krusha Premium Industries offers dehydrated vegetable flakes, granules, and powders for export and domestic markets. The company focuses on low-thermal-stress drying technologies that preserve aroma and nutrient density. Krusha has built strong procurement relationships with regional farmers, enabling consistent raw-material quality and price stability.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Seawind Foods, among others.

Unlock the latest insights with our dehydrated vegetables market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 6.30% between 2026 and 2035.

Key strategies driving the market include expanding contract farming, upgrading hybrid dryers, co-developing application prototypes with clients, integrating digital QC dashboards, and pursuing sustainability certifications to win long-term supply agreements in competitive B2B ingredient portfolios.

The hectic lifestyle and the increasing consumption of packed and ready-to-eat foods are the key industry trends propelling the market's growth.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various product types in the market are carrots, beans, onions, tomatoes, peas, corn, broccoli, mushroom, and cabbage, among others.

The forms include powder and granules, minced, slices and cubes, chopped and flakes, among others.

The various technologies involved in the market are vacuum drying, air drying, freeze drying, and drum drying, among others.

On the basis of distribution channel, the industry can be categorised into supermarket and hypermarket, convenience stores, and online, among others.

The end-uses are retail and food service, among others.

The key players in the market include Mercer Foods, LLC, Kerry Group plc, Harmony House Foods, Inc., Krusha Premium Industries Pvt Ltd, and Seawind Foods, among others.

In 2025, the market reached an approximate value of USD 85.98 Billion.

Companies struggle with raw-material volatility, rising energy costs, and strict microbiological limits, while maintaining color consistency, rehydration performance, and traceability across fragmented agricultural supply chains with unpredictable climate-driven disruptions.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Form |

|

| Breakup by Technology |

|

| Breakup by Distribution Channel |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share