Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global data center rack market attained a value of USD 3.96 Billion in 2025 and is projected to expand at a CAGR of 10.10% through 2035. The market is further expected to achieve USD 10.36 Billion by 2035. Buyers demand racks that arrive pre-assembled with containment kits, monitoring gateways and liquid cooling loops ready to connect. This model drives recurring revenue for manufacturers since customers increasingly standardize trusted rack ecosystems when scaling data centers across regions.

Rising global deployments of AI-ready and high-density data centers are pushing rack architecture from basic steel enclosures to fully engineered thermal and power ecosystems. In June 2025, evolving its EcoStruxure Data Center Solutions portfolio, Schneider Electric introduced a Prefabricated Modular EcoStruxure Pod Data Center solution that consolidates infrastructure for liquid cooling, high-power busway and high-density NetShelter Racks. This has captured attention of cloud and colocation providers in North America and Asia because it confirms a shift away from standard rack architecture toward thermally intelligent racks that can survive the heat generated by AI accelerators, LLM inference nodes and GPU clusters running 24/7, accelerating the data center rack market growth.

The industry trajectory also revolves around density, energy efficiency, and deployment speed. Hyperscalers want racks that fit modular data center builds and align with sustainability targets. Manufacturers are responding to this trend by integrating cable management channels, hot and cold aisle zoning inside the chassis and native support for power distribution units with higher redundancy. In March 2024, Eaton launched SmartRack modular data centers that combine IT rack, cooling, and service enclosures to create a performance-optimized data center solution, reshaping the data center rack market trends.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

10.1%

Value in USD Billion

2026-2035

*this image is indicative*

AI workload concentration is changing procurement discussions throughout the global industry. Hyperscalers running GPU clusters beyond 50 kW per rack do not want old airflow chassis anymore because they throttle performance and waste energy. That is why companies like Schneider Electric, Vertiv and Rittal are rolling out liquid-ready racks with built-in distribution manifolds, thermal zoning and side-mounted cable routes that avoid heat stress. For example, in October 2025, Qualcomm launched AI200 and AI250 solutions deliver rack-scale performance and superior memory capacity for fast data center AI inference, impacting the overall data center rack market dynamics. Operators like these solutions because they can scale compute density without rewriting power and cooling layouts from scratch.

Open Compute Project (OCP) racks are growing popular as operators want standardization, faster deployment and easier interoperability. 21-inch Open Rack V3 designs allow more server real estate and smoother power distribution than conventional 19-inch enclosures. In December 2025, HPE announced it is speeding up deployment of at-scale artificial intelligence (AI) training and inferencing for cloud service providers (CSPs), including neoclouds, by offering the first AMD “Helios” AI rack-scale architecture with integrated scale-up Ethernet networking, exemplifying new data center rack market opportunities. Colocation providers appreciate this predictability because open racks simplify multi-tenant onboarding.

Energy regulations are compelling operators to redesign infrastructure and show measurable efficiency improvements. Racks now play a role in compliance because they shape airflow, containment, and liquid-cooling integration. European and Asian authorities are linking permits and incentives with heat reuse, temperature targets and renewable-power sourcing, which rewards data centers that support warmer inlet air and liquid loops. In September 2025, Flex expanded data center cooling portfolio with Launch of Modular Rack-Level Coolant Distribution Unit. Rack vendors who sell high-efficiency power distribution, built-in containment and predictive monitoring reduce the burden on operators chasing sustainability KPIs, broadening the data center rack market scope.

Colocation and edge operators now prefer fully pre-assembled racks because they no longer want to waste weeks installing cabling, PDUs, access control systems, and monitoring gateways every time a new hall goes live. Rack vendors are responding to this trend with pre-integrated builds that include cable trays, high-density PDUs, and sensors. In November 2025, NetBox launched an AI data center acceleration program to scale hyperscale infrastructure faster and turn complex networks into advantages. Colocation companies prefer this because it reduces human error and speeds up tenant onboarding, accelerating growth in the data center rack market. Edge sites, especially telecom and industrial campuses, need ruggedized short racks with fast serviceability.

Rack-scale offerings combine GPUs, switches, storage enclosures and management software into one engineered block, eliminating the old approach of assembling components on-site. Cloud operators like this design because it reduces integration time and makes capacity planning predictable. In December 2025, Marvell Technology, Inc. announced it has entered into a definitive agreement to acquire Celestial AI, a pioneer of a disruptive Photonic Fabric technology platform, catering to the surging demand in the data center rack market. Storage vendors also use rack-scale layouts to deliver petabyte-level flash with embedded orchestration.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Data Center Rack Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Server racks dominate the current data center rack market dynamics because compute density continues to be the revenue engine for cloud and colocation operators. Networking racks, however, are gaining momentum as switching fabrics become central to AI cluster efficiency and low-latency performance. Storage-optimized racks appear where petabyte-class data lakes and flash systems matter, especially in analytics and streaming platforms.

Market Breakup by Rack Units

Key Insight: Across all the rack-unit sizes considered in the data center rack market report, 42U remains the universal template because it offers compatibility and safe density for traditional hardware. 48U grows fast in terms of popularity where operators want more vertical space for GPUs, networking uplinks or flash storage without expanding buildings. 45U, 47U and 51U appear in specialized environments tuned for HPC or telecom infrastructure with maximized floor economics. 36U fits well at the edge when shorter racks reduce installation time and structural stress.

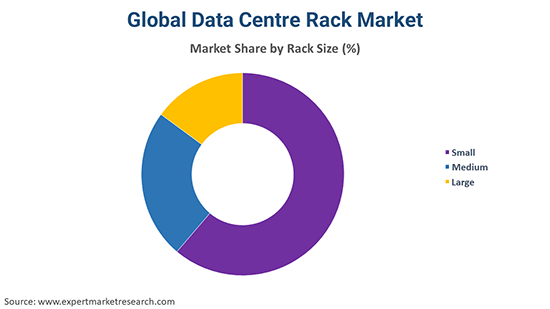

Market Breakup by Rack Size

Key Insight: Large racks dominate where hyperscale and cloud operators drive purchasing cycles, and they remain at the core of AI and high-density computing. Medium racks observe growth in hybrid IT and edge deployments where space, cost, and scalability drive purchasing decisions. Small racks persist in telecom rooms, micro-edge locations, and industrial plants that need compact footprints and simple servicing.

Market Breakup by Frame Size

Key Insight: The 19-inch format continuously dominates the market because most OEMs support it, and operators value smooth deployment across multiple facility designs. Wider racks are gaining traction where power density and airflow matter more than mechanical uniformity, especially in AI and HPC environments. Narrow or compact frames appear in telecom and rugged edge deployments where installation constraints win over capacity, propelling the data center rack market value.

Market Breakup by Frame Design

Key Insight: Enclosed racks lead the data center rack market because they combine safety, cooling discipline and compliance for most enterprise and hyperscale deployments. Open-frame systems stay relevant for labs, staging areas and test environments where fast access matters more than security. Customized frames grow at the fastest pace because operators want infrastructure that fits thermal, power and cabling strategy rather than compelling workarounds at installation time.

Market Breakup by Service

Key Insight: Installation and support dominate the overall data center rack market growth because operators prioritize deployment speed, risk mitigation and SLA protection. Consulting expands its share as buyers include thermal and capacity planning before installation. Professional services remain important where operators want long-term optimization or co-managed rack infrastructure instead of handling everything internally.

Market Breakup by Application

Key Insight: Large enterprises account for the largest share of the data center rack market because hyperscale and colocation expansion governs global rack procurement. Small and mid-market firms grow rapidly as cloud adoption and modernization unlock new demand growth opportunities. While large firms prioritize fleet consistency and density economics, smaller firms need easy deployment and reduced operational complexity.

Market Breakup by End User

Key Insight: IT and telecom lead the demand growth because cloud and network infrastructure set the global pace for rack deployments. BFSI follows closely with fast procurement cycles driven by regulated workloads and security-centric on-prem compute. Healthcare values patient data protection and predictable uptime in medical systems. The public sector relies on hardened designs for smart-city and defense infrastructure. Retail, manufacturing and media entertainment scale in line with omnichannel growth, automation and streaming demand.

Market Breakup by Region

Key Insight: North America dominates the market, powered by hyperscale AI clusters and cloud campuses that dictate global standards for rack density and deployment discipline. Asia Pacific grows at the fastest pace due to parallel expansion of cloud, telecom edge and AI infrastructure. The European data center rack market focuses on energy-efficient and compliance-aligned rack systems because sustainability rules shape the purchasing decisions. Latin America expands through new colocation builds and enterprise modernization projects, often prioritizing modular racks for predictable scaling. Middle East and Africa concentrate on liquid-ready and rugged rack designs for high-temperature environments and rapid government-led digital programs.

By type, server rack account for a significant share of the market due to high AI workload integration

Server racks dominate the market because AI and cloud workloads now dictate data-center planning, and most GPU and CPU compute nodes are deployed inside server-specific enclosures. Operators depend on server racks that allow dense power distribution, cleaner airflow zoning, and easier serviceability, especially inside multi-tenant colocation halls. In October 2025, European cloud and data center firm OVHcloud announced a new cooling architecture for its data centers. Manufacturers respond by designing reinforced frames, deeper chassis and cable pathways that support GPU trays, blade servers, and high-performance nodes without thermal penalties, boosting the data center rack market revenue.

Network racks are also expanding their shares in the market because modern data-center blueprints emphasize massive east-west traffic, software-defined networks and ultra-low-latency switching for AI clusters. Operators need network-dedicated enclosures with dense patching, reversible airflow and cable segregation to handle high-bandwidth fabrics. Rack vendors are adding side-channel cable containment, modular PDU positioning and integrated labeling systems to simplify operations in multi-region deployments.

By rack units, the 42U category registers the largest share of the market as data centers standardized capacity scalability

42U racks account for the dominant share of the market, powered by their density, weight distribution and easy servicing. Many hyperscale and colocation facilities standardize 42U footprints for predictable power planning, spare parts management, and aisle spacing. Cooling technology vendor Air2O, in August 2025, launched a modular, stackable design for data center racks, which is claimed to improve cooling efficiency.

The 48U category observes accelerated growth in the data center rack market as operators increasingly focus on vertical expansion. AI clusters, private cloud deployments and storage expansion all benefit from a taller rack when floor space is expensive, or power density per aisle is fixed. Vendors are strengthening 48U frames, improving anti-tip structures, and adding front-to-rear cable routing to reduce service risks at height.

Large rack size leads the demand growth in the market due to hyperscale deployment requirements

Large rack sizes dominate the market because hyperscale and colocation data centers anchor the bulk of global deployments, and they need full-height enclosures to support GPU compute and high-capacity flash arrays. These racks improve power density and reduce aisle count, which matters when real estate and megawatts are both expensive. In March 2025, Vertiv unveiled new systems to solve speed of deployment, management, and rack power and cooling challenges for AI applications.

As per the data center rack market report, medium rack sizes are gaining traction because enterprises, SaaS players and regional colocation sites want scalable racks that do not feel oversized in smaller rooms. These footprints support mixed loads such as computing, switching and storage without dominating space or requiring aggressive power rewiring.

By frame size, 19-inch frame sustains its dominance in the market because OEM ecosystems depend on compatibility

The 19-inch frame size dominates the data center rack market dynamics because the entire OEM ecosystem from servers to switches to PDUs is designed for it. It offers the broadest interoperability and lowest integration risk, so operators do not waste time figuring out mechanical fit or airflow patterns. Most reference architectures for cloud, AI clusters and private data-center designs still converge on 19-inch because serviceability, spare stock and lifecycle cost are straightforward. In April 2023, IBM launched z16's new rack-optimized footprint that is designed for use with client-owned, standard 19-inch racks and power distribution units.

The 21-inch open rack format is the fastest-growing frame size because hyperscalers and AI data center architects want wider chassis that can host more GPUs, storage sleds and top-of-rack switching without choking airflow. Wider frames free up lateral cable pathways and leave space for liquid-cooling distribution lines, something 19-inch racks struggle with at extreme densities.

By frame design, enclosed racks largely boost the overall demand in the market due to superior security and thermal control

Enclosed racks account for a significant market share because colocation and hyperscale operators cannot risk open exposure of high-density compute and switching gear. Doors, lock systems, and internal airflow direction give them better control of heat and cable discipline. The design also supports containment systems, PDUs and liquid-cooling feeds without leaving equipment vulnerable to accidental contact or thermal recirculation.

Customized racks are growing at an accelerated pace in the data center rack market shares because large operators are tired of adapting their layouts to fixed rack designs. GPU clusters, petabyte-class storage and low-latency fabrics each demand different airflow, cable paths and power profiles, and custom racks solve this without constant field hacks.

Installation and support services lead the market due to faster deployment expectations across regions

Installation and support services dominate the market because operators want projects delivered fast, error-free and repeatable across multiple sites. High-density racks are no longer simple metal frames, they require cable architecture, airflow zoning and PDU coordination during setup. Buyers rely on vendors for rack commissioning because mistakes downstream cause downtime and SLA penalties.

Consulting services are gaining significant momentum in the data center rack market. This is because operators now require planning before installation. AI workloads, hybrid cloud migrations and space-power constraints demand architectural guidance upfront. Vendors that offer thermal modeling, airflow simulations, cable strategy, and refresh-cycle mapping become strategic partners rather than transactional suppliers. Enterprises entering high-density computing rely heavily on consulting to avoid oversizing or under-engineering rack floors.

By application, large size organizations clock in substantial share of the market revenue as hyperscale footprints drive majority of rack spending

Large organizations dominate overall data center rack demand because hyperscalers, telecom cloud divisions and colocation giants run multi-megawatt campuses that consume racks to a great extent. Their buying logic revolves around density, operational consistency and future-proof power design. They choose rack platforms that scale AI compute, storage and switching across multiple halls rather than short-term lifecycle gains. Procurement teams also drive volume through standardization, as once a rack design is validated in one region, it becomes the global template.

Small and medium organizations largely contribute to the data center rack market revenue because they are modernizing aging server rooms and adopting colocation and private cloud models. These companies want enterprise-grade rack reliability without the complexity of hyperscale infrastructure. Vendors therefore offer preconfigured racks with PDUs, airflow accessories and simplified cable kits that reduce operational guesswork for smaller IT teams.

By end user, IT and telecom dominate the market due to AI workloads and cloud network expansion

IT and telecom register the largest share of the market as public cloud, edge networks and AI fabrics depend on racks that can carry compute, storage and switching density under strict uptime conditions. Telcos upgrading 5G cores and content delivery networks also refresh racks to support low-latency designs.

BFSI also contributes to the data center rack market value because banks and fintechs are tightening latency, compliance, and cybersecurity requirements, which pushes modular server room upgrades rather than total cloud dependency. Highly regulated workloads and fraud-risk analytics must stay on secured on-prem or colocation racks. BFSI deployments also prioritize high-performance architecture for AI-driven risk scoring, trading platforms, and compliance monitoring.

North America holds the leading market position due to large colocation expansion and hyperscale buildings

North America dominates the data center rack market because hyperscalers, AI cloud operators and colocation majors keep expanding large multi-building campuses. Rack procurement in this region is no longer a hardware decision, it is now tied to power strategy, liquid-cooling readiness and lifecycle efficiency. Operators standardize rack platforms that support higher compute density, faster deployment and integrated containment because every square foot of white space has revenue consequences.

The data center rack market in Asia Pacific is growing at the fastest speed because cloud subscriptions, AI buildouts, and 5G-edge deployments are happening simultaneously. Data-center developers across India, Japan, Singapore and Australia want rack systems that fit high-density pods while keeping energy consumption predictable under constrained power availability.

The industry is highly competitive but not purely cost-based anymore. Most of the data center rack market players are competing to win standard positions inside hyperscale, colocation, and edge blueprints, because once a rack platform is locked in, it tends to follow every new hall. The focus has shifted toward density, thermal readiness, and deployment speed. Players are investing in liquid-ready frames, integrated cable channels, and pre-configured power distribution, so operators can roll out AI and cloud capacity faster with fewer design debates.

There is also growing opportunity in consulting, installation, and lifecycle services around racks, where data center rack companies help customers model heat, space, and refresh cycles. Vendors that supply racks bundled with monitoring gateways, containment kits, and reference designs for GPU pods or high-density storage blocks are gaining more traction directly with data-center architects, creating space for premium platforms that can still justify long-term cost advantages.

Eaton Corporation plc, founded in 1911 and headquartered in Dublin, Ireland, approaches the data center rack market through its broader power management portfolio. It delivers racks tightly integrated with busways, PDUs, and intelligent breakers, so operators treat electrical and mechanical design as one package, not separate projects.

Samsung Electronics Co., Ltd., founded in 1969 and headquartered in Suwon, South Korea, influences the rack market from the server and component side rather than as a traditional rack supplier. Its high-density memory, SSDs, and AI accelerators push power and cooling limits, setting up the performance benchmarks that rack manufacturers must design around.

Vertiv Group Corporation, established in 2016 and headquartered in Ohio, United States, focuses directly on racks as part of integrated power and thermal solutions. It offers enclosed and open rack systems bundled with PDUs, busway, and advanced cooling options for cloud, telecom, and edge sites.

Black Box Corporation, founded in 1976 and headquartered in Pennsylvania, United States, approaches racks from the connectivity and integration angle. The company designs and delivers rack solutions bundled with structured cabling, KVM systems, and network management hardware for enterprise, government, and edge facilities.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Schneider Electric, among others.

Unlock the latest insights with our data center rack market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 3.96 Billion.

The market is projected to grow at a CAGR of 10.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 10.36 Billion by 2035.

Stakeholders are standardizing AI-ready rack platforms, expanding liquid-cooling partnerships, co-designing layouts with hyperscalers, bundling services with hardware, investing in sustainability credentials to boost the overall data center rack market growth.

The key trends guiding the growth of the market include the introduction of new-generation frames and rapid advancements in technology.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The server rack and network rack are the leading data center rack types in the market.

The 36U, 42U, 45U,47U,48U, and 51U are the leading data center rack units in the market.

The small, medium, and large rack sizes lead the overall data center rack market.

The 19 inch frame size among others are the various frame size of data center rack in the market.

The open, enclosed, and customised are the leading frame designs in the market.

The installation and support services, consulting services, and professional services are the key services in the market.

The large sized organisations and medium and small sized organisations are the leading applications in the market.

IT and telecom, BFSI, public sector, healthcare, retail, manufacturing, and media entertainment, among others are the leading end uses of data center racks in the market.

The key players in the market include Eaton Corporation Plc, Samsung Electronics Co., Ltd., Vertiv Group Corporation, Black Box Corporation, and Schneider Electric, among others.

Vendors face rising density requirements, fragmented regional standards, qualification cycles, price pressure from large buyers, and the need to prove liquid-cooling readiness without overcomplicating deployment, serviceability, or long-term operating costs.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Rack Units |

|

| Breakup by Rack Size |

|

| Breakup by Frame Size |

|

| Breakup by Frame Design |

|

| Breakup by Service |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share