Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The beer market size attained a value of USD 669.12 Billion in 2025. The market is expected to grow at a CAGR of 3.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 899.24 Billion.

Consumers are increasingly prioritizing health, leading to a surge in demand for low-calorie beers. This shift is especially strong among millennials and Gen Z. Breweries are responding by reformulating beers and introducing innovative variants that mimic traditional taste profiles. Functional beers infused with vitamins, adaptogens, or electrolytes are also emerging. In August 2025, Prime Time launched Prime Time ZERO, the United Kingdom’s first functional alcohol-free beer infused with Magnesium and Vitamin B12.

Packaging plays a crucial role in consumer perception and convenience, adding to the beer market expansion. Modern beer packaging emphasizes sustainability, portability, and shelf appeal. Smart packaging with QR codes or AR experiences is on the rise. In June 2023, Molson Coors’ beer brand Madrí Excepcional launched ‘Conectada,’ an interactive platform accessed via on-pack QR codes, enhancing beer consumer engagement. As competition grows, innovative packaging is likely to influence both first-time purchases and brand loyalty.

Base Year

Historical Period

Forecast Period

As per industry reports, China is the largest consumer of beer, with a total volume of 34,979 thousand tonnes in 2021.

In Europe, Czech Republic has the highest per capita consumption of beer, with 140.12 litres consumed per person in 2021.

Collectively, mall and independent brewers produced 23.4 million barrels of beer in 2023.

Compound Annual Growth Rate

3%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Beer Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 669.12 |

| Market Size 2035 | USD Billion | 899.24 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 3.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 3.5% |

| CAGR 2026-2035 - Market by Country | India | 4.0% |

| CAGR 2026-2035 - Market by Country | China | 3.3% |

| CAGR 2026-2035 - Market by Alcohol Content | High | 3.2% |

| CAGR 2026-2035 - Market by Distribution Channel | Supermarkets and Hypermarkets | 4.2% |

| Market Share by Country 2025 | Japan | 4.1% |

Sustainability is a major driver in the beer industry influencing both production and consumer choice. Breweries are increasingly adopting eco-friendly practices, such as water conservation, renewable energy use, packaging innovations and sustainable sourcing of ingredients. In June 2022, Corona India launched 100% compostable packaging made from barley straw, promoting sustainability and reducing environmental impact in beer packaging. Breweries also publish carbon footprints and sustainability reports to demonstrate transparency.

Craft beer continues to be a dominant trend, driven by consumer demand for unique flavors, artisanal quality, and local authenticity. Smaller breweries focus on innovation, producing limited batches with distinct ingredients, which appeal to younger, adventurous drinkers. In February 2025, BeeYoung expanded its craft beer portfolio with BeeYoung Beyond for offering innovative, flavorful brews to attract diverse beer enthusiasts. Breweries often experiment with hops, fruits, and barrel-aging techniques, leading to a wide flavor range.

The beer industry value is rising with breweries embracing technology to improve efficiency, consistency, and innovation. Automation, AI, and IoT are streamlining production, reducing waste, and enhancing quality control. In June 2025, Telenor IoT and PLAATO collaborated to AI-enable production data, enhancing efficiency and precision in brewing and fermentation industries. Blockchain is also being tested for ingredient traceability and transparency. These technological innovations reduce costs, ensure product safety, and accelerate time-to-market.

Consumers are showing strong support for local breweries, driven by community pride and trust in local sourcing. Hyperlocal brands offer freshness, transparency, and regional identity that large corporations often lack. Local beers often reflect the culture, ingredients, and traditions of a particular area, creating emotional connections. Governments and tourism bodies also promote local craft beer as part of cultural experiences. This localization helps smaller players thrive and adds rich diversity to the broader beer landscape.

Government policies significantly impact the beer market dynamics in terms of production, distribution, and pricing. Regulatory changes, such as easing of alcohol laws, licensing norms, and advertising restrictions, can open markets or create hurdles. Taxation on beer varies widely by region and influences affordability and accessibility. In April 2025, the Trump administration imposed 25% tariffs on imported beer cans and aluminum, impacting the United States beer packaging costs and supply chains. Labeling laws, health warnings, and recycling regulations are also evolving.

Read more about this report - REQUEST FREE SAMPLE

The EMR’s report titled “Beer Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

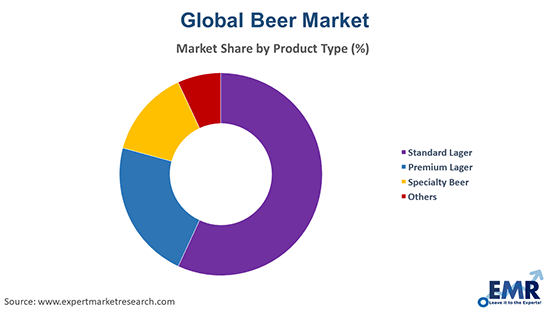

Market Breakup by Product Type

Key Insight: Standard lager is gaining popularity due to its mass appeal, affordability, and light, crisp flavor. Several brands exemplify this category, offering consistent quality and wide availability. In November 2024, Douglas Lager broadened its reach by introducing convenient 16oz cans, enhancing portability and appeal to on-the-go beer consumers. The vast distribution networks and competitive pricing further enhance its dominance, especially in emerging markets with growing beer consumption.

Market Breakup by Packaging

Key Insight: Glass packaging remains the most dominant format in the beer market due to its premium image, excellent preservation of flavor, and recyclability. Glass bottles are widely preferred by both mainstream and craft brewers, as they convey quality and tradition. In July 2024, Ardagh Glass Packaging-North America introduced a new series of 12oz glass bottles for craft beverages. Iconic brands also rely heavily on glass bottles for their flagship products.

Market Breakup by Production

Key Insight: Macro-breweries are recording popularity for producing large volumes of standard and premium beers distributed worldwide. These companies, such as Anheuser-Busch InBev, Heineken, and Carlsberg, benefit from extensive distribution networks, economies of scale, and strong brand recognition. They mainly produce lagers and mainstream beer styles appealing to mass-market consumers. Macro-breweries also focus on consistent quality and affordability, which ensures their dominance in both developed and emerging markets.

Market Breakup by Alcohol Content

Key Insight: The high alcohol content beer industry forms a niche segment favored by consumers seeking stronger flavor and higher potency. These beers command premium pricing and appeal to enthusiasts and connoisseurs. High-alcohol beers are popular in craft beer markets like the United States and parts of Europe and Asia, where experimental brewing is embraced. In May 2025, Japan’s Repubrew and Hansharo launched limited-edition ultra-high-alcohol craft beers with 24.5% and 19.5% ABV using special yeast.

Market Breakup by Flavour

Key Insight: Unflavoured beers lead the market, appealing to the broadest consumer base with classic taste profiles like lagers, pilsners, and ales. This segment includes most mass-produced beers from global brands, such as Budweiser, Heineken, and Corona, which emphasize traditional brewing techniques and familiar flavors. The widespread preference for unflavoured beer is driven by its versatility, food pairing ability, and general acceptability across demographics and regions.

Market Breakup by Distribution Channel

Key Insight: Supermarkets and hypermarkets remain the largest distribution channels in the beer market, accounting for most off-trade sales globally. These retail formats offer convenience, competitive pricing, and wide product selections, attracting everyday consumers purchasing for home consumption. In May 2025, Real American Beer launched in Walmart across 8 American states. Promotions, bulk buying options, and brand visibility in these stores are also making them critical for the market growth.

Market Breakup by Region

Key Insight: North America holds a dominant position, driven by a mature craft beer culture and strong consumer demand for premium and specialty beers. In July 2025, The Wrexham Lager Beer Co launched its signature lager in Canada, expanding its international presence and craft beer offerings. The United States leads with innovative craft breweries, fueling growth through unique flavors and limited-edition launches. The region’s emphasis on health-conscious products and sustainability further shapes market trends, maintaining its leadership globally.

Premium & Specialty Beer to Record Huge Popularity

Premium lager is a large segment of the beer market, targeting consumers who seek higher quality, richer taste, and brand prestige. The segment is witnessing innovations due to increasing disposable incomes and evolving consumer preferences toward more upscale drinking experiences. In September 2024, DeVANS entered the premium lager segment, expanding its portfolio with new Brute and Pilsner variants across six key markets.

Specialty beer, including craft beers, flavored brews, and imported varieties, is a fast-growing segment driven by adventurous consumers looking for unique flavors and artisanal production. This category thrives in markets like the United States, Germany, and Australia, where craft brewing culture is strong. Brands such as Sierra Nevada and BrewDog offer innovative flavors and styles, attracting millennials and beer enthusiasts.

Higher Beer Consumption via PET Bottles & Metal Cans

PET bottles hold a significant beer industry share, especially in emerging markets where cost-efficiency and portability are critical. These lightweight, shatterproof bottles offer convenience for transportation and reduce breakage losses, making them popular in regions like Latin America, Africa, and parts of Asia. Brands, such as Kingfisher and Brahma have adopted PET packaging to expand reach in rural and semi-urban areas.

Metal cans are rapidly gaining traction due to their portability, quick cooling properties, and environmental benefits. The rise in craft beers packaged in cans also fuels growth in this segment. In May 2023, Ambev launched Brahma draft beer in 350ml aluminum cans at Rio’s Web Summit, enhancing portability and freshness for consumers. Brands like Coors Light and Pabst Blue Ribbon have successfully boosted canned beer sales by marketing convenience and sustainability.

Increased Beer Production through Micro-Brewery

The micro-brewery segment of the beer market represents a rapidly growing segment due to the focus on unique, small-batch beers emphasizing innovation, quality, and local ingredients. Micro-breweries attract consumers seeking variety, artisanal craftsmanship, and authenticity, making way for innovations. In April 2023, The Brew Estate, India's largest microbrewery, expanded into Canada, marking its first international venture.

Surging Intake of Low Alcohol & Alcohol-Free Beers

Low-alcohol beers are gaining popularity as consumers seek moderate drinking options for health or lifestyle reasons. Brands like Beck’s Blue and Budweiser Prohibition Target this segment, offering balanced flavours with reduced intoxication risk. This category appeals to casual drinkers and markets with strict alcohol regulations. Growth is supported by increasing health consciousness globally.

The alcohol-free segment is contributing to the beer industry revenue due to rising health awareness and changing social norms. In January 2022, AB InBev’s Corona launched a non-alcoholic beer with added vitamin D, targeting health-conscious consumers seeking functional beverage alternatives. This segment is further expanding quickly in developed markets, supported by improved brewing techniques that maintain beer flavours without alcohol.

Flavoured Beers to Attain Traction

Flavoured beers, including fruit-infused, spiced, and craft variants, represent a growing niche driven by consumers seeking novelty and variety. In January 2025, Kingfisher introduced two new beer flavors, including 'Lemon Masala' and 'Mango Berry Twist', targeting young, experimental, and flavor-seeking consumers. This segment appeals particularly to younger demographics and craft beer enthusiasts exploring unique taste experiences. Brands are offering innovative flavoured products that cater to evolving palates.

On-Trade Channels & Specialty Stores to Drive Beer Sales

On-trade channels of the beer industry, including bars, restaurants, pubs, and hotels, are playing a vital role in consumption, especially for premium and craft segments. Popular in developed markets like the United States, the United Kingdom, and Germany, on-trade sales contribute significantly to brand awareness and consumer trial of new products. On-trade channels also command higher margins and cater to social drinking occasions, making them essential for premiumization and market differentiation strategies.

Specialty stores, such as liquor shops and craft beer boutiques, cater to niche consumers seeking premium, rare, or imported beers. These stores offer expert advice and curated selections, appealing to enthusiasts and collectors. In April 2024, Side Launch Brewing Company announced the opening of a new beer store in London, Ontario, expanding its retail footprint. Markets with strong craft beer cultures, like Belgium and the United Sates, see higher specialty store penetration.

Thriving Beer Prominence in Europe & Asia Pacific

Europe is a prominent beer market with rich brewing heritage and varied consumer tastes. Germany, Belgium, and the United Kingdom are famous for their distinctive beer styles, such as pilsners, ales, and lambics. Growing sales of flavored and non-alcoholic beers indicate changing consumer trends. Europe's well-developed retail infrastructure, consisting of specialist shops and on-trade outlets, sustains wide beer drinking, and it is an important, though slightly reduced, market relative to North America.

| CAGR 2026-2035 - Market by | Country |

| India | 4.0% |

| China | 3.3% |

| UK | 2.7% |

| USA | 2.6% |

| Australia | 2.4% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Italy | 2.1% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Asia Pacific market is driven by growing urbanization, higher disposable incomes, and middle-class expansion in China, India, and Southeast Asia. According to the Asian Development Bank, over 55% of Asia's population will be urban by 2030. The market is dominated by big macro-breweries like Tsingtao and Kirin that specialize in mass-market lagers. Changes in regulations and shifting consumption habits promote diversification, including higher distribution in supermarkets and online platforms.

Major players in the beer market are employing varying strategies to remain competitive and stimulate growth. Product diversification is being propelled by new varieties of craft beers, non-alcoholic beers, and flavored options in response to changing consumer preferences. Brand positioning and marketing strategies are key factors also, with the use of social media, sponsorships, and storytelling in marketing to build strong emotional connections with customers. Also, digital transformation including e-commerce, data-driven marketing, and personalized, customer engagement helps companies that streamline supply chains.

Geographic expansion is also a strategy as major breweries are entering emerging markets where beer consumption is increasing. Mergers and acquisitions help coordinate to consolidate market share and distribution channels, allowing larger players to absorb regional and niche brands. Sustainability initiatives are becoming also increasingly vital, with investment in eco-friendly packaging, water conservation, and carbon reduction in response to consumer standards and regulatory expectations. Finally, players are focused on premiumization and innovation of packaging to bolster higher-end products with better profit margins.

Asahi, founded in 1889 and headquartered in Tokyo, Japan, is one of the largest beverage companies. Asahi Super Dry introduced the 'dry' beer category and is very involved in sustainability initiatives. The firm is making a strong commitment through acquisitions across Europe with recent success with Peroni and Grolsch.

Founded in 2008, Anheuser-Busch InBev is headquartered in Leuven, Belgium and is, by far, the world's largest brewer. Brands like Budweiser, Modelo, and Stella make it a key player given their advanced logistics management systems, vast global reach and unique smart drinking campaigns that seek to reduce harmful drinking for smarter consumption.

Founded since 1847, Copenhagen Denmark-based Carlsberg Group is a respected name in brewing and known for superior quality in brewing, breaking scientific ground while identifying pure yeast and strong in Europe and Asia. Carlsberg has earned accolades for its sustainability program "Together Towards ZERO" seeking zero carbon emissions and zero water waste.

Heineken, founded in 1864 and based in Amsterdam, Netherlands, is the world’s second-largest brewer, with a strong global footprint in over 190 countries. Known for innovation in brewing and marketing, Heineken emphasizes sustainable brewing and digital transformation, and its flagship lager remains one of the most recognized beer brands globally.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the beer market are Sierra Nevada Brewing Co., and United Breweries Ltd, among others.

Unlock valuable insights into the evolving global beer industry. Download your free sample report today to explore key beer market trends 2026, regional performance, and future forecasts. Stay ahead of the competition with data-backed strategies, expert forecasts, and actionable intelligence. Get your copy now and make informed business decisions with confidence.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 669.12 Billion.

The market is projected to grow at a CAGR of 3.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to USD 899.24 Billion by 2035.

The key strategies driving the market include product diversification with flavoured and low-alcohol variants, expansion into emerging markets, strong branding and digital marketing, sustainable packaging innovations, and premiumization of offerings. Breweries are also investing in local sourcing, e-commerce channels, and collaborations to attract health-conscious and younger consumer demographics.

Key trends aiding market expansion include the premiumisation of beer, introduction of low calorie and alcohol-free variants, and popularity of new flavours like blueberry, strawberry, peach, chocolate, and lemon are the major trends of the market.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The leading product types in the market are standard lager, premium lager, and speciality beer, among others.

The alcohol content of beer in the market includes high, low, and alcohol-free.

Supermarkets and hypermarkets, on-trades, speciality stores, and convenience stores, among others, are the leading distribution channels of beer in the market.

The key players in the market report include Asahi Group Holdings Ltd., Anheuser-Busch InBev, Carlsberg Group, Heineken N.V., Sierra Nevada Brewing Co., and United Breweries Ltd, among others.

North America holds a dominant position, driven by a mature craft beer culture and strong consumer demand for premium and specialty beers.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Packaging |

|

| Breakup by Production |

|

| Breakup by Alcohol Content |

|

| Breakup by Flavour |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Price Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share