Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The base metal mining market size USD 395.41 Billion as of 2025 and is anticipated to grow at a CAGR of 4.00% during the forecast period of 2026 to 2035. One of the major drivers of the base metal mining industry is increasing infrastructure development across the world, especially in developing economies. Increasing demand for copper, zinc, and aluminum for use in construction, transportation, and electronics drives mining activity and investment in exploration and production technology. The market is thus expected to reach a value of nearly USD 585.30 Billion by 2035.

Base Year

Historical Period

Forecast Period

Increasingly booming electric vehicle (EV) sector is majorly driving the demand for base metals such as copper and nickel. EVs consume up to 80 kg of copper per vehicle, thus promoting increased mining to address the growing global movement toward sustainable mobility.

Asia-Pacific accounts for the highest percentage of the base metal mining market, spurred by industrialization in China and India. China's robust manufacturing sector and investments in infrastructure continue to fuel high base metal consumption, making the region a key target for mining growth, and hence increasing the growth of the base metal mining market.

Technologies like autonomous drilling, remote monitoring, and AI-based analytics are increasing extraction efficiency and safety. They minimize operational expenses and environmental footprints, leading to more sustainable mining operations with greater output from formerly less accessible or lower-grade base metal deposits.

Compound Annual Growth Rate

4%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Base Metal Mining Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 395.41 |

| Market Size 2035 | USD Billion | 585.30 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.2% |

| CAGR 2026-2035 - Market by Country | India | 5.9% |

| CAGR 2026-2035 - Market by Country | China | 5.0% |

| CAGR 2026-2035 - Market by Product | Aluminium | 4.6% |

| CAGR 2026-2035 - Market by Application | Construction | 4.5% |

| Market Share by Country 2025 | China | 33.4% |

The market for base metal mining is witnessing significant growth, driven mainly by fast-paced urbanization, industrialization, and infrastructure growth in developing economies. Industries like construction, automotive, and electronics are increasing the utilization of major base metals such as copper, aluminum, nickel, and zinc. Governments globally are investing huge budgets in developing infrastructure, thereby directly driving demand for these metals in wiring, piping, and structural requirements. Factors such as these are boosting the growth of the base metal mining market.

Technological progress is also helping to drive market growth. Automation, artificial intelligence, and remote sensing are rationalizing mining activities, lowering operational costs, and allowing access to uneconomical ore bodies that were previously unattainable. Sustainability is increasingly becoming key, and mining companies are spending money on cleaner and more efficient production methods. Firms are also concentrating on ensuring long-term supply through merger and acquisition activities.

A good example is Rio Tinto, a top global mining company. It keeps increasing its copper output to satisfy the booming demand from renewable energy and electric vehicle markets. Rio Tinto's investments in projects such as the Oyu Tolgoi mine in Mongolia are indicative of its plan to diversify its base metal portfolio in the face of increasing global demand.

Base metal mining is driven by electrification, sustainability, tech advancements, and rising resource nationalism reshaping global supply dynamics. Such factors are thus shaping the base metal mining market dynamics and trends.

The transition to electric vehicles and renewable energy is heavily driving demand for base metals such as copper and nickel. These are critical for batteries, charging networks, and grid systems, which is driving mining firms to ramp up production and invest in new exploration to fulfill global energy transition objectives, thus pushing the growth of the base metal mining market.

Environmental, social, and governance (ESG) standards are propelling the move towards sustainable mining. Businesses are embracing green extraction practices, lowering carbon footprints, and enhancing waste management. Such practices not only satisfy regulatory requirements but also attract green investors and responsible resource development-demanding stakeholders.

Automation, artificial intelligence, and data analytics are revolutionizing base metal mining operations. These technologies improve ore discovery, increase operational efficiency, and enhance worker safety. Intelligent mining practices, such as remote monitoring and predictive maintenance, are becoming the norm, allowing cost-efficient production and yield from complex and lower-grade deposits, thereby helping to create new trends in the base metal mining market.

Nations are prioritizing the control of local mineral resources, imposing tighter regulations and local processing preferences. The strategic value of base metals to national development and supply security is the driving force behind this trend. It is restructuring global supply chains and generating new geopolitical dynamics in mineral-rich countries.

Mining firms are more and more embracing circular economy concepts to reduce waste and recover valuable materials. Boston Metal, for example, has used molten oxide electrolysis technology to mine high-value metals from mining waste without producing CO₂ emissions. Not only does this save the environment, but it also accesses previously untapped resources, in line with global sustainability efforts, thus shaping new trends in the base metal mining market.

Artificial intelligence is transforming mineral exploration and mining activities. Firms such as Rio Tinto are using AI and 3D mapping technologies to improve mineral discovery processes. Moreover, AI-based predictive maintenance and autonomous equipment are enhancing safety, minimizing downtime, and maximizing resource extraction, thus boosting overall productivity in mining operations.

Read more about this report - REQUEST FREE SAMPLE COPY

The EMR’s report titled “Base Metal Mining Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Products

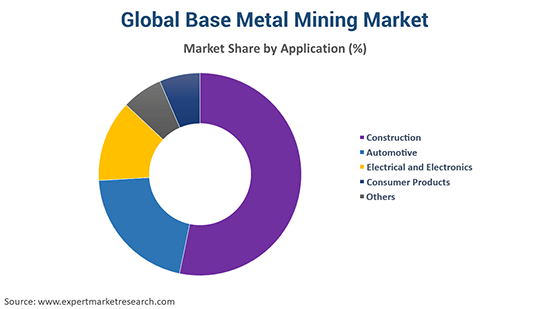

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Product |

| Aluminium | 4.6% |

| Copper | 4.3% |

| Lead | XX% |

| Nickel | XX% |

| Zinc | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Application |

| Construction | 4.5% |

| Electrical and Electronics | 4.3% |

| Automotive | XX% |

| Consumer Products | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 5.2% |

| Latin America | 4.4% |

| North America | XX% |

| Europe | XX% |

| Middle East and Africa | XX% |

The market for various base metals is increasing as they play critical roles in contemporary infrastructure, technology, and clean energy. As per base metal mining market analysis, copper is seeing robust growth led by its excellent conductivity, and it is crucial in electric vehicles (EVs), power networks, and renewable energy systems. Aluminium demand is increasing in transport and building sectors as it is light and corrosion-resistant. The metal finds extensive use in packaging and electrical uses, fueling consumption even further. Zinc is mainly utilized for galvanizing steel for corrosion protection, with demand growing from the automotive and construction industries.

| Market Share by | Country |

| China | 33% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

Nickel, on the other hand, is highly sought after for use in lithium-ion batteries, particularly in EVs and energy storage systems. According to the base metal mining industry analysis, as battery technologies develop, nickel-intensive chemistries are preferred for higher energy density. Lead remains crucial to conventional batteries, particularly in backup power systems and vehicles, although its growth is sluggish owing to environmental issues. The others segment, comprising tin and cobalt, is also experiencing growing demand from energy and electronics industries. As world economies turn their attention to green transitions and smart technologies, the strategic value of these base metals is growing, driving exploration, recycling, and innovation in extraction and processing techniques.

| CAGR 2026-2035 - Market by | Country |

| India | 5.9% |

| Brazil | 5.0% |

| China | 5.0% |

| Mexico | 4.3% |

| Australia | 3.5% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 3.1% |

| Saudi Arabia | XX% |

Leading base metal mining market players are major multinational mining companies and regional players with large operations in copper, aluminum, nickel, and zinc mining. These players dominate global supply through large-scale mining, high technology, and sustainability programs. They aim to increase exploration, enhance resource efficiency, and incorporate renewable energy in mining activities to address increasing demand. Their activities also comprise strategic acquisitions and alliances with a view to consolidating their position in the market and securing consistent supplies of fundamental base metals worldwide.

Freeport-McMoRan was founded in 1988 and is based in the United States. The organization mainly deals with copper, gold, and molybdenum mining. It owns some of the world's biggest copper and gold mines, such as the Grasberg mine in Indonesia. Freeport-McMoRan is a significant producer of copper for use in different industries.

Established in 1888, Antofagasta has its headquarters in Chile. It is a top copper producer and has a number of mining projects in Chile, which is one of the richest places in the world for copper deposits. Antofagasta specializes in exploration, extraction, and copper concentrate production.

Established in 1993, Zijin Mining is based in China. The main products of the company are gold, copper, and other base metals mining. It has several mining projects all over the world, including large copper and gold mines in China and overseas, and it concentrates on resource development and production.

Nornickel, founded in 1993 and based in Russia, is one of the world's largest producers of nickel and palladium. Nornickel is a specialist in the mining and refining of nickel, copper, platinum group metals, and other base metals, with major operations in Siberia and the Arctic.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players profiled in the base metal mining market include Glencore plc, BHP Group Limited, Rio Tinto Group, Vale, Southern Copper Corporation, and Anglo American plc, among others.

Refining And Metallurgy In Base Metal Mining

Sustainability Advances In Base Metal Mining

Beneficiation And Processing Technology Trends

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the base metal mining market reached an approximate value of USD 395.41 Billion.

The market is assessed to grow at a CAGR of 4.00% between 2026 and 2035.

The major drivers of the market include the expansion of various end user verticals, surge in industrialisation, rising urbanisation, infrastructural development, increasing demand for copper, rising focus of the government on pro-mining policies and an increase in disposable income.

Key trends aiding the market expansion include the growing technological improvements including the use of robotic and remote technologies, and the growing focus on recycling and sustainable mining practices.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the significant markets for base metal mining.

The products include copper, silver, zinc, lead, nickel, and aluminium, tin, among others.

Key players in the market are Freeport-McMoRan, Inc., Antofagasta plc, Zijin Mining Group Co., Ltd., Nornickel, Glencore plc, BHP Group Limited, Rio Tinto Group, Vale, Southern Copper Corporation, Anglo American plc, Others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 585.30 Billion by 2035.

The strict government policies related to mining, including its negative environmental impact, and high-risk nature of mining operations are the key challenges in the industry.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share