Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global barite market was valued at USD 1616.46 Million in 2025. The industry is expected to grow at a CAGR of 5.30% during the forecast period of 2026-2035 to reach a value of USD 2709.25 Million by 2035. The market growth is largely a result of the growing trend of oil and gas drilling globally.

The ongoing development of well-construction technologies that need high-performance drilling fluids is contributing to the market growth. As barite is a major weighting agent, it is at the center of keeping the wellbore stable and dealing with the high-pressure drilling situations. As energy producers drill deeper and more complicated wells, the demand for top-quality barite grades has risen significantly.

At ADIPEC 2023 Exhibition, in Abu Dhabi, Halliburton unveiled a range of drilling and well-construction technologies, including advanced managed-pressure drilling systems that enhance mud performance and fluid density, two parameters that are directly related to barite usage. These innovations are also creating notable barite market opportunities. The Middle East and North America regions are filled with an increasing number of upstream projects that are attracting investments, which is why there is now a high demand for high-grade barite to be able to carry out complex drilling operations. All these innovations have the effect of continuing to make barite a very important material that guarantees safety and efficiency in oil production.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5.3%

Value in USD Million

2026-2035

*this image is indicative*

The growth of the market is largely influenced by the heavily localizing supply of drilling fluids and mud logistics of the major oil-service firms, which, in turn, is boosting the consumption of barite. An instance of this is Baker Hughes, in November 2024, opening a new liquid-mud plant and multi-modal drilling-fluids facility in Walvis Bay, Namibia, to meet the offshore drilling infrastructure needs of the region. This sort of upstream infrastructure expansion is driving the demand in the barite market for drilling-fluid weighting as well as for completions support.

The market expansion is attributed to chemical manufacturers engaging in integration by going upstream into mining or beneficiation to ensure the supply of high-grade barite and upgrading to specialty derivatives. For example, in August 2023, Vishnu Chemicals inaugurated its industrial precipitated-barium-sulphate plant (that is, for paints, batteries, and other industrial applications) and made it baryte-beneficiation linked. Moves of this sort open the door for the transformation of raw barite into products of higher value and create the pull effect for barite in the different end-use sectors.

Industrial trends in the global barite market, which has surged the production of coatings and plastics together with the demand for high-density fillers, have led to the increased use of barite/barium sulfate in non-oil markets. For instance, in July 2023, Vishnu Chemicals started commercial production of precipitated barium sulfate with ultra-low impurities mainly for paints, batteries, and specialty markets. As the production of durable consumer goods and the coating of infrastructure speed up on a global scale, the demand for fillers made from barite is really growing.

The barite market development is attributed to the innovations made in the healthcare industry and the product innovations in medical-grade barium sulfate which led to additional demand besides the traditional industrial uses. A good example would be the case when, on 8 July 2024, Bracco Diagnostics Inc. announced the change in its barium-product portfolio updating packaging and launching new products for its barium-sulfate contrast agents. The departure of barite derivatives into diagnostic imaging helps support a niche that is small but growing rapidly.

The expansion of the market is a result of exploration companies widening their pipeline of barite supply through the discovery of new deposits which, in turn, improves the availability of raw materials and acts as a foundation for subsequent capacity increases. A good example would be when, in April 2024, InZinc Mining Ltd. announced that they had encountered high-grade barite and over 700 m barite trend stretch at their Indy project in British Columbia. Such exploration triumphs are an indication of supply depth and investment interest in the barite mining sector for the longer term.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Barite Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Grade

Key Insights: The global barite market is segmented into Up to Grade 3.9, Grade 4.0, Grade 4.1, Grade 4.2, Grade 4.3 and above, and others, each driven by specific demand patterns. Lower-density grades (up to 3.9) are used as cost-effective fillers and construction additives. Grades 4.0–4.1 support conventional drilling fluids and industrial fillers. Grades 4.2–4.3 address deepwater, HP/HT drilling and specialty industrial applications. Ultra-high-density grades serve niche sectors like radiation shielding, while “Others” fulfil custom, regional, and specialty application requirements.

Market Breakup by Deposit Type

Key Insights: The market is segmented into Bedding, Residual, Vein, Cavity Filling, and Others, each driven by unique trends and industrial demand. Bedding deposits dominate due to large, continuous layers, prompting companies to invest in beneficiation plants and supply-chain infrastructure. Residual deposits provide high-purity near-surface ore, with firms adopting advanced sorting and mining technologies. Vein and cavity-filling deposits cater to premium drilling and specialty industrial uses, while the “Others” segment covers mixed or unconventional deposits, encouraging producers to deploy flexible extraction and processing systems to meet regional and custom-grade requirements.

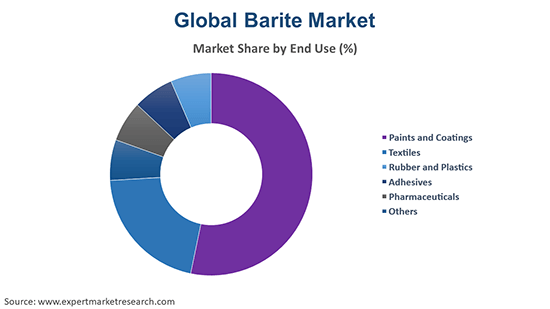

Market Breakup by End Use

Key Insights: Paints and coatings end-use category hold substantial barite market share owing to the increasing adoption of higher-purity and ultrafine barite to enhance opacity and durability, with companies investing in milling upgrades and supply-chain optimization. Textiles use barite for weighted fabrics, prompting firms to produce custom particle sizes. Rubber and Plastics leverage barite for high-density fillers, with producers collaborating with OEMs for tailored polymer blends. Adhesives and Pharmaceuticals benefit from barite’s rheology and purity, while Others cover niche industrial uses, driving innovation and expanding market applications globally.

Market Breakup by Region

Key Insights: The global barite market sees active engagement from companies across all regions to strengthen supply chains and meet rising demand. In North America, firms are investing in processing facilities and supply-chain optimization for high-spec drilling fluids. European players focus on speciality grades for coatings and industrial fillers, enhancing product quality and compliance. In Asia Pacific, producers are expanding beneficiation and logistics capacities to ensure consistent supply for both local and export markets. These initiatives collectively support market growth, efficiency, and reliability across the regions.

By grade, grade 4.0 is picking up momentum

The demand for Grade 4.0 barite is driven by its dual role in conventional drilling fluids and industrial fillers used in paints, plastics, and coatings. Companies like Pavan Minerals and Intercontinental Mining focus on delivering consistent mid-density barite, balancing purity, performance, and cost. Even when specific launches are limited, suppliers highlight adjacent product lines to assure manufacturers of reliability, reflecting a market that values both adaptability and steady supply in moderate-density applications.

Ultra-high-density barite (SG 4.3+) powers deepwater drilling, high-pressure wells, and specialty industrial applications such as radiation-shielding concrete. Firms like The Kish Company, Inc. and Steinbock Minerals Ltd are upgrading processing plants and investing in high-purity mining operations to meet these exacting requirements. Where explicit product launches are rare, companies often reference regional high-grade expansions or near-term projects, demonstrating the barite industry’s readiness and innovative approach to serving niche and challenging sectors.

By deposit type, bedding deposit category records notable growth

Bedding type barite deposits, typically vast sediment-layered beds, drive growth through their scale and lower mining costs, making them ideal for supplying large volumes for drilling and filler uses. Mining companies are ramping up capacity to exploit these extensive deposits. For instance, in April 2023, IBC Limited highlighted its extraction from the major Mangampet grey barite bed in Andhra Pradesh, India, featuring a specific gravity around 4.20 g/cm³. Suppliers leverage these bedded resources to meet bulk demand in oilfield fluids and industrial fillers.

Veintype barite deposits, formed in fractures and hydrothermal zones, offer high purity, often premium-grade ore that caters to specialty applications and premium drilling grades. Exploration firms target these because the ore often requires minimal processing. For example, in March 2024, InZinc Mining Ltd. announced abundant barite intersections at its Indy project in British Columbia from vein-hosted mineralisation. Such vein systems are increasingly important owing to the rising demand in higher-grade barite market for advanced downstream uses.

By end-use, paints and coatings category generate substantial revenue

In the paints and coatings segment, demand is rising for ultrafine, high-whiteness barite powders that enhance opacity, gloss retention, and weather resistance in premium finishes. Companies such as The Kish Company, Inc., with a portfolio including chemical-grade, pigment-grade, and precipitated barium sulfate, calcium carbonate, treated talc, and specialty additives, and Steinbock Minerals Ltd, supplying drilling, chemical, and paint-grade barite alongside anthracite and ilmenite, are investing in advanced milling and surface-treatment technologies. These tailored barite fillers enable manufacturers to deliver high-performance, durable coatings and expand barite’s industrial applications.

Growth in automotive components, housing materials, and sound-dampening polymer parts is driving demand for high-density fillers in rubber and plastics. Firms like The Kish Company, Inc. and International Earth Products LLC, whose portfolio includes high-quality barium sulfate grades such as Barpro IEP 4.20, Bar4one 4.10, and Barme 4.00, are partnering with polymer compounders to supply low-oil-absorption barite and custom particle-size distributions. These collaborations help formulators achieve superior mechanical and acoustic performance, widening barite’s role in specialty polymer systems.

By Region, North America experiences a notable growth rate

North America demonstrates notable growth in the barite industry influenced by the escalating concentration on pharmaceutical-grade material and establishing secure domestic supply chains. In August 2025, Voyageur Pharmaceuticals Ltd. commissioned VAST Resource Solutions to upgrade the Frances Creek Barite Mine, thus providing locally produced high-purity barium sulfate for contrast media and lessening dependence on imports and synthetic substitutes. This move towards vertical integration, along with the formation of strategic partnerships and strict adherence to regulations, not only elevates the quality and availability of medical-grade barite but also facilitates market growth and satisfies the increasing demand in the region for specialized high-value end uses.

The Asia Pacific barite market growth is largely attributed to increased demand for oilfield drilling, construction, and industrial applications, along with the development of regional supply chains. In September 2025, Fast markets-initiated Vietnam-based FOB assessments for SG 4.10 and SG 4.20 drilling-grade barite, thus improving price transparency and supporting the growing role of Southeast Asia in global trade. Regional players are ramping up production and upgrading quality to provide a more consistent supply of the material both locally and for export, thereby consolidating the Asia Pacific region's position as a significant contributor to global barite consumption and market expansion.

Major barite market players are aligning their operations with strategic outreach, eco-friendly mining, and vertical integration to consolidate their supply chains. For example, Intercontinental Mining and Steinbock Minerals Ltd are channeling their money into resource efficiency and clean extraction to be able to meet the growing demand of the industry. The players are also upgrading export potentials and laying out sophisticated beneficiation plants to certify the consistent and high-quality barite supply for oilfield and industrial applications.

On the other hand, prominent barite companies like The Kish Company, Inc. and International Earth Products LLC are prioritizing product innovation and diversification to meet the needs of end-use sectors such as paints, plastics, and pharmaceuticals. They are introducing high-purity and micronized barite grades with improved whiteness, density, and dispersion properties. These innovations not only enhance the performance of coatings and polymer formulations but also facilitate the use of barite in new markets that require advanced material solutions.

Besides the founding year, 1996, and its head office being in Atyrau, Kazakhstan, Intercontinental Mining is the main producer of high-grade barite and other kinds of industrial minerals. The company is committed to environmentally friendly mining operations and mainly sells barite to the oil and gas industry, which is the most significant customer, in Central Asia, North America, and Europe.

The Kish Company, Inc. was founded in 1957 and is headquartered in Mentor, Ohio, USA. It is a well-known supplier of minerals and chemicals for the production of coatings, plastics, and rubber. By providing customized mineral solutions, including the best barite grades, the company has created many long-term partnerships with worldwide manufacturers, further expanding the global barite market scope.

Located in Zurich, Switzerland, and established in 1989, Steinbock Minerals Ltd is a company that specializes in the sourcing, processing, and distribution of industrial minerals like barite, talc, and mica. Through a vast global supply network, the company provides the mentioned industries from paints, plastics to oilfield services with the required materials.

The year 2002 marks the establishment of International Earth Products LLC which is located in New York, USA. The company is engaged in the production and distribution of minerals and raw materials for different industrial applications. Their broad range of products includes barite, calcium carbonate, and talc that come from the construction, coatings, and energy sectors.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Desku Group Inc., and several other local companies.

Explore the latest trends shaping the Global Barite Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on GLOBAL BARITE Market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 5.30% between 2026 and 2035.

Key strategies driving the market include product innovation with high-purity and specialty barite grades, backward integration and beneficiation by chemical and mining companies, expansion of regional supply chains, strategic partnerships for distribution, and adoption of eco-friendly and efficient mining practices.

The key trend guiding the growth of the market includes the technological advancements.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading grades of barite in the market are up to grade 3.9, grade 4.0, grade 4.1, grade 4.2, grade 4.3, and grade above 4.3, among others.

The significant deposit types of barite in the industry are bedding, residual, vein, and cavity filling, among others.

The major end use sectors in the market are paints and coatings, textiles, rubber and plastics, adhesives, and pharmaceuticals, among others.

The key players in the market include Intercontinental Mining, The Kish Company, Inc., Steinbock Minerals Ltd, International Earth Products LLC, Desku Group Inc., and others.

In 2025, the global barite market reached an approximate value of USD 1616.46 Million.

North America holds the largest share of the global barite market, driven by growing oil and gas drilling activities, increasing demand for pharmaceutical-grade barite, and investments in domestic supply chain security.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Grade |

|

| Breakup by Deposit Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share