Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

The global automotive clutch market size reached around USD 12.44 Billion in 2024. The market is projected to grow at a CAGR of 6.30% between 2025 and 2034 to reach nearly USD 22.92 Billion by 2034. The demand for automotive clutches is driven by both passenger vehicles and commercial vehicles, influenced by stricter emissions regulations and the growing emphasis on fuel economy. This trend is evident worldwide as manufacturers focus on meeting environmental standards and improving vehicle performance in both segments of the market.

Base Year

Historical Year

Forecast Year

Value in USD Billion

2025-2034

Automotive Clutch Market Outlook

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Major Market Drivers

The global automotive clutch market is witnessing significant growth, driven by the increasing demand for manual transmissions in both commercial and personal vehicles. As more consumers opt for automobiles with manual transmissions, the market for automotive clutches continues to expand. Growth-inducing factors include rising demand for fuel efficiency and enhanced driving performance in commercial and personal vehicles, further fueling the automotive clutch market’s progress.

Key Market Trends

The global automotive clutch market is driven by advancements in technologies that enhance efficiency, performance, and durability. The demand for automated manual transmissions is increasing, further boosting the market. As vehicle manufacturers focus on improving clutch technologies, the market continues to grow, meeting the needs of both commercial and personal vehicles for better performance and reliability.

Competitive Landscape

Key companies in the global market include Aisin Seiki Co., Ltd., Magneti Marelli S.p.A., Schaeffler Group AG & Co., ZF Friedrichshafen AG, BorgWarner Inc., Valeo, Eaton Corporation Inc., WABCO Holdings Inc., EXEDY Corporation, F.C.C. Co. Ltd., NSK Ltd., AMS Automotive LLC, APLS Automotive Industries Pvt. Ltd., JATCO Ltd., Allison Transmission Inc., and FTE automotive GmbH, alongside several others.

Geographical Trends

The global automotive clutch market is growing steadily, with Asia Pacific expected to dominate due to its expanding automotive industry. The demand for vehicles with manual transmissions is driving market growth, as manufacturers focus on improving the performance of automotive clutches. This trend is contributing to the overall development of the market.

Challenges and Opportunities

The automotive clutch market is experiencing increasing demand, driven by the need for durable clutches that enhance vehicle performance. As consumers seek better clutch longevity, manufacturers are focusing on improving the durability and efficiency of their products. This shift towards high-performance clutches is expected to strengthen the market, ensuring long-lasting solutions for various vehicle types.

Advancements in Clutch Mechanisms

The automotive clutch market is experiencing significant growth, driven by innovations in clutch technologies and a growing demand for enhanced performance and durability. Automotive clutch systems, such as dual-clutch transmissions and automated manual transmissions, are evolving to meet the increasing performance expectations of modern vehicles. These advancements offer improved efficiency, drivability, and torque control, while also ensuring better fuel economy and lower emissions. Sustainable manufacturing practices are becoming a focus, with regulations pushing for environmentally friendly solutions. Durable clutches are becoming increasingly important to meet the demands of both passenger and commercial vehicles, as they enhance longevity and reduce maintenance needs. As the automotive market continues to evolve, manufacturers are focusing on the development of high-performance, sustainable clutch solutions that meet the needs of consumers while adhering to stricter emissions standards. With the rise of electric vehicles, the demand for clutch systems is expected to adapt to new transmission requirements, pushing further innovation in the market. By integrating advanced technologies, companies are aiming to provide more efficient, durable, and sustainable automotive clutch plates that ensure improved performance and enhanced driving experiences across various vehicle types.

Rising Demand for Electric Vehicles

The automotive clutch market is experiencing significant growth, driven by the increasing demand for electric vehicles (EVs) and innovative advancements in transmission technologies. Electric vehicles, including hybrids, require advanced clutches designed to support their unique powertrains, driving the demand for high-performance, durable clutch systems. The automotive industry is focusing on developing advanced clutch solutions to enhance the performance and efficiency of these EVs. As electric vehicles become more mainstream, the market for automotive clutches is expected to expand, particularly as manufacturers seek to optimise the transmission systems in these vehicles. These growth-inducing factors are prompting the development of more advanced and efficient clutch technologies, with a particular emphasis on durability and performance. The rising interest in electric vehicles is also leading to the introduction of innovative clutch designs that cater to the specific needs of EVs and hybrid vehicles. With the shift toward more sustainable and eco-friendly transportation options, the automotive clutch market is set to grow as manufacturers adapt to the evolving requirements of the EV market. These changes are expected to foster further advancements in clutch technology and drive the market's overall growth.

Regulatory Assistance

The global automotive clutch market has experienced significant growth due to advancements in clutch manufacturing and performance. Cam clutches and clutch systems are integral to automotive powertrains, enhancing overall efficiency and durability. As demand for ultrahigh-efficiency motors increases, particularly in light-duty vehicles, manufacturers are focusing on sustainable solutions. The market's expansion is driven by the need for improved emissions reduction and the continuous innovation of clutch technologies. Efficiency is a key factor in the development of automotive solutions, as both performance and durability are essential for long-term viability. Automotive companies are integrating advanced lighting technologies to support the growing demand for energy-efficient vehicles. Regulatory pressures and environmental concerns are prompting manufacturers to adopt green technologies to meet emissions targets. As a result, the automotive sector is transitioning towards sustainable practices that align with global regulations, thereby strengthening the market's growth trajectory. This commitment to efficiency and sustainability is likely to influence the evolution of the automotive clutch market, driving both product innovation and market growth in the coming years.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The global automotive clutch industry is segmented based on various factors, including type, vehicle application, and region. This segmentation allows for a detailed analysis of market trends, demand, and growth potential in specific sectors. Understanding these segments helps identify key opportunities and challenges, guiding manufacturers and stakeholders in developing targeted strategies to meet consumer needs and industry demands effectively.

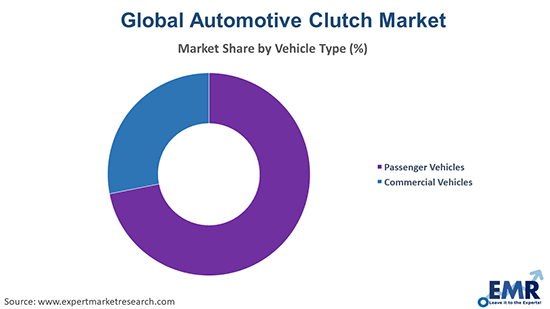

Passenger vehicles currently lead the market with a clear dominance

Passenger vehicles are a key segment in the global automotive clutch market due to their high demand for smooth driving experiences and fuel efficiency. The clutch system in these vehicles ensures seamless gear shifts, enhancing driving comfort and vehicle performance. With advancements in clutch technologies, such as dual-clutch and automated manual transmissions, passenger vehicles benefit from improved fuel economy, reduced emissions, and better drivability. As the demand for electric vehicles (EVs) increases, clutches in these vehicles are becoming more innovative, further driving growth in the automotive clutch market.

Commercial vehicles, including trucks and buses, require durable and high-performance clutch systems due to their heavy-duty operation. These vehicles benefit from clutch systems that offer enhanced torque transfer, ensuring better load handling and efficiency. The growing demand for commercial vehicles, particularly for logistics and transportation, is driving the automotive clutch market. Clutches in commercial vehicles are designed to withstand high-stress conditions and offer longevity, reducing maintenance costs. As these vehicles often operate in demanding environments, the durability and performance of clutch systems are critical for the efficient operation of commercial fleets worldwide.

Manual transmission commands the largest share of the automotive clutch market

Manual transmission offers enhanced control, allowing drivers to optimise performance by shifting gears according to their preference. It typically provides better fuel efficiency compared to an automatic transmission, as the driver can adjust the engine’s power usage more precisely. Additionally, manual transmissions are often more durable and cost-effective, as they have fewer components, leading to reduced maintenance costs. They are particularly popular among driving enthusiasts for the increased engagement and driving experience they offer.

Automatic transmission provides a smoother and more convenient driving experience, especially in heavy traffic, as it eliminates the need for manual gear shifting. It enhances comfort and reduces driver fatigue, making it ideal for long-distance driving or urban environments. Modern automatic transmissions offer improved fuel efficiency, with advances like CVT (continuously variable transmission) and dual-clutch systems. Additionally, automatic transmissions typically provide better performance in terms of acceleration and adaptability, as they adjust gear ratios automatically for optimal engine performance.

Friction clutch dominates the market with the largest share

Friction clutches are widely used in the automotive industry due to their high reliability and efficient performance. They offer smooth engagement and disengagement of power from the engine to the transmission. The design allows for consistent torque transmission while providing ease of operation, especially in manual transmission vehicles. With the ability to absorb shocks and vibrations, friction clutches enhance driving comfort. Their durability ensures long service life and reduced maintenance costs, making them a popular choice for various types of vehicles. Additionally, they are cost-effective, contributing to the overall affordability of vehicle systems.

Dog clutches are crucial in automotive applications that require high-performance shifting, typically in racing or heavy-duty vehicles. Unlike friction clutches, they offer a more direct and efficient engagement by using interlocking 'dogs' or teeth. This design results in minimal power loss during shifting, providing faster and more precise gear changes. Dog clutches are highly durable and can withstand high torque, making them ideal for applications where quick, smooth shifting is essential. While they require more skill to operate, they are beneficial for those prioritising performance and durability in demanding environments.

At present, the automotive clutch market outlook is dominated by sizes below 9 inches

Clutches below 9 inches are widely used in compact vehicles, offering key benefits such as efficient space utilisation and lower weight. These clutches provide excellent torque control in smaller engines, ensuring smooth operation in light-duty vehicles. Their compact design contributes to enhanced fuel efficiency, making them ideal for urban driving and reducing emissions. The smaller size also allows for easier integration in tight engine compartments, which is increasingly important as the automotive industry moves towards more efficient and eco-friendly solutions. Additionally, they offer lower production costs, making them a cost-effective choice for manufacturers while maintaining durability and performance.

Clutches ranging from 9 inches to 10 inches are commonly found in mid-sized and larger passenger vehicles, providing optimal power and durability. These clutches are well-suited for moderate to high-torque applications, offering improved performance and drivability. Their slightly larger size ensures better heat dissipation and greater longevity, particularly in vehicles with more powerful engines or those requiring frequent gear changes. The 9 to 10-inch clutches also strike a balance between weight and efficiency, making them a preferred choice for automakers aiming to meet both performance and environmental regulations. Their robust construction ensures longer-lasting performance, reducing maintenance costs.

OEM holds the largest market share

The aftermarket segment offers a wide range of replacement and performance-oriented automotive clutches. It provides consumers with cost-effective options for maintaining or upgrading their vehicles. Aftermarket clutches are available in various designs and materials, catering to specific performance needs, such as enhanced durability, improved torque, or better performance for modified vehicles. With a growing number of vehicle owners opting for replacements over OEM products, the aftermarket continues to see increasing demand in the automotive clutch market.

Original Equipment Manufacturer (OEM) clutches are produced by the vehicle manufacturers themselves, ensuring a perfect fit and compatibility with the vehicle’s design. OEM clutches offer superior performance, reliability, and durability as they are specifically tailored to meet the original vehicle standards. These clutches are ideal for customers seeking replacement parts that maintain the vehicle’s factory specifications. The OEM segment holds a significant share of the automotive clutch market due to its high demand for new vehicles and long-term performance.

Ceramic holds the largest share of the market

Ceramic clutches are known for their high performance and durability, making them ideal for high-performance and heavy-duty vehicles. They offer excellent heat resistance and can withstand extreme conditions, providing consistent performance under stress. Due to their toughness, ceramic clutches are commonly used in sports cars and racing vehicles. Their ability to handle higher torque and prolonged use without slipping or wearing out contributes to their popularity in the automotive market.

Organic clutches are widely preferred for their smooth engagement and quieter operation compared to other types. Made from materials such as paper, rubber, and resin, they offer good comfort for everyday driving. Organic clutches are more affordable and have a relatively lower wear rate, making them suitable for standard passenger vehicles. Their eco-friendly nature, combined with reasonable durability and cost-effectiveness, makes them a popular choice in the global automotive clutch market, particularly for light-duty vehicles.

Asia Pacific

The Asia Pacific region offers substantial growth opportunities in the global automotive clutch market due to the rapid expansion of automotive production in countries such as China, Japan, South Korea, and India. This region benefits from a large manufacturing base, a growing demand for both passenger and commercial vehicles, and increased vehicle ownership. The demand for advanced automotive clutches, including dual-clutch and automated manual transmission systems, is rising, driven by improved vehicle performance, efficiency, and fuel economy. Additionally, the adoption of electric vehicles (EVs) and hybrid powertrains further boosts the demand for efficient clutch systems in this region.

Europe

Europe plays a key role in the global automotive clutch market, driven by high automotive standards, innovation, and technological advancements. The region’s strong automotive manufacturing base, including leading companies like Volkswagen and BMW, ensures continued demand for durable and high-performance clutches. Additionally, Europe’s focus on sustainability and environmental regulations encourages the adoption of energy-efficient clutch systems that help reduce emissions and improve fuel economy. The growing popularity of electric and hybrid vehicles also creates new opportunities for the automotive clutch market, as hybrid powertrains continue to demand advanced clutch technologies.

North America

North America, particularly the United States, remains a significant market for automotive clutches, driven by the presence of major automotive manufacturers such as General Motors, Ford, and Chrysler. The region’s strong demand for both passenger and commercial vehicles, along with a growing interest in performance and luxury vehicles, has contributed to the increased adoption of advanced clutch systems. The rise of electric vehicles (EVs) and hybrid powertrains in the region is creating new growth opportunities for clutches that can handle higher torque demands. Technological advancements, such as dual-clutch systems, are also gaining traction.

Middle East and Africa

The Middle East and Africa (MEA) region is experiencing steady growth in the automotive clutch market due to the increasing demand for passenger vehicles and light commercial vehicles. The region’s automotive market benefits from the growing economies of countries like Saudi Arabia and the UAE, as well as a rising demand for luxury vehicles and high-performance cars, which require advanced clutch systems. Moreover, the growing transportation infrastructure and the demand for durable and reliable clutches in commercial vehicles, such as trucks and buses, are also contributing to the market’s growth in this region.

Latin America

Latin America is seeing steady growth in the automotive clutch market, with increased demand for passenger vehicles and light commercial vehicles. The automotive industry in countries such as Brazil and Mexico is expanding, and a rising middle class has contributed to growing vehicle ownership. Manual transmission vehicles are still popular in many Latin American countries, but the shift towards automatic transmissions and dual-clutch systems is gaining momentum. Hybrid and electric vehicle adoption, though at an early stage, is also providing growth opportunities for advanced clutch systems tailored to hybrid powertrains in the region.

The global automotive clutch market is experiencing significant growth, driven by the increasing demand for advanced clutch technologies in both passenger and commercial vehicles. Innovations like dual-clutch transmission (DCT) are enhancing vehicle performance, fuel efficiency, and overall driving experience. Hybrid and electric vehicle adoption is also spurring demand for specialised clutches designed to handle higher torque and improve efficiency. Friction materials are being refined for better durability and performance, with reduced weight contributing to improved fuel efficiency. R&D investments are leading to the development of next-generation clutches, boosting performance and meeting evolving automotive standards. The shift towards more sustainable and efficient powertrains is encouraging the integration of cutting-edge clutch technologies that improve overall vehicle performance, efficiency, and longevity in the competitive automotive market.

The market research report has offered an in-depth analysis of the competitive landscape, including detailed profiles of all leading companies in the automotive clutch market. Key players in the market include:

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2024, the market attained a value of nearly USD 12.44 Billion.

In the forecast period of 2025-2034, the market is projected to grow at a CAGR of 6.30%.

The market is estimated to witness a healthy growth in the forecast period of 2025-2034 to reach about USD 22.92 Billion by 2034.

The global automotive clutch market growth is primarily driven by the changing consumer preferences from manual to semi-automatic or fully automatic transmission systems in vehicles, alongside the introduction of Dual Clutch Transmission (DCT) technology, which helps deliver smoother performance, quicker acceleration, improved fuel efficiency, and other benefits.

The growing adoption of electric vehicles (EVs) and rising popularity of semi-automatic or fully automatic transmission systems in automobiles are major trends guiding the growth of the market.

On a regional level, the market has been classified into Asia Pacific, Europe, North America, the Middle East and Africa, and Latin America, where Asia Pacific currently dominates the global market.

Based on the clutch type, the global automotive clutch market has been bifurcated into friction clutch, dog clutch, hydraulic clutch, and others. Among these, the friction clutch currently exhibits a clear dominance in the market.

Based on the vehicle type, the global automotive clutch market has been divided into passenger vehicles and commercial vehicles, where passenger vehicles hold most of the total market share.

Based on the clutch disk/plate size, the global automotive clutch market can be categorized into below 9 inches, 9 inches to 10 inches, 10 inches to 11 inches, and 11 inches and above. Currently, below 9 inches account for most of the global market share.

Based on the material type, the global automotive clutch market can be bifurcated into ceramic, organic, and others. Currently, ceramic holds the largest market share.

Based on the transmission type, the global automotive clutch market can be segmented into manual transmission, automatic transmission, Automated Manual Transmission (AMT), and others. Currently, manual transmission accounts for the largest market share.

Based on the distribution channel, the global automotive clutch market has been segregated into aftermarket and OEM, where OEM currently exhibits a clear dominance in the market.

The major players in the global automotive clutch market are Magneti Marelli S.p.A., Schaeffler Group AG & Co., ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., BorgWarner Inc., Valeo, Eaton Corporation Inc., WABCO Holdings Inc., EXEDY Corporation, F.C.C. Co. Ltd., NSK Ltd, AMS Automotive LLC, APLS Automotive Industries Pvt. Ltd., JATCO Ltd., Allison Transmission Inc., and FTE automotive GmbH, among others.

The unexpected emergence of the COVID-19 pandemic led to the enforcement of strict lockdown measures in various countries, causing the temporary shutdown of many vehicle manufacturing facilities and, consequently, having an adverse effect on the global automotive clutch market.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Vehicle Type |

|

| Breakup by Transmission Type |

|

| Breakup by Clutch Type |

|

| Breakup by Clutch Disk/Plate Size |

|

| Breakup by Distribution Channel |

|

| Breakup by Material Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share