Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

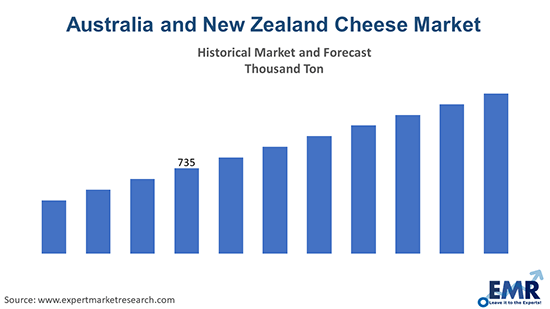

The Australia and New Zealand cheese market size reached around 404.10 KMT in 2024. The market is projected to grow at a CAGR of 2.70% between 2025 and 2034 to reach nearly 527.46 KMT by 2034.

Base Year

Historical Period

Forecast Period

The annual Mould Cheese Festival of Australia provides a platform for cheese producers to showcase their homegrown cheeses.

As average household disposable incomes are relatively high in Australia, customers buy more premium products.

In 2021-22, the gross disposable income per household increased by 3.7% than 2020-21 in Australia.

Value in KMT

2025-2034

Australia and New Zealand Cheese Market Outlook

*this image is indicative*

The cheese market in Australia and New Zealand is mainly driven by the increased consumption of cheese in restaurants and the foodservice industry. The growth is higher in the developing regions owing to rising disposable incomes and expanding fast-food joints or quick-service restaurants (QSR). In 2022, the dairy sector of Australia accounted for 7.8% of the GDP.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Some of the factors driving the Australia and New Zealand cheese market growth are the growing popularity of clean-labelled products and the availability of various categories of cheeses such as parmesan, cheddar, and blue cheese. Retailers in Australia and New Zealand support their local brands, and sometimes cheese brands invest in these retailers to maintain a strong distribution channel.

Growth in disposable income; availability of premium quality artisanal cheeses; the expansion of quick service restaurants; and wide availability of speciality cheese are the major factors aiding the Australia and New Zealand cheese market growth

| Date | Company | Details |

| January 2024 | CEC Entertainment, LLC | In partnership with Royale Hospitality Group, the globally recognised family entertainment restaurant brand Chuck E. Cheese, entered into the Australian cheese market. |

| December 2023 | Fonterra Co-operative Group Limited | Partnered with Nestle S.A. to support farmers with their sustainability actions and foster low-carbon milk production. |

| Trends | Impact |

| Growing demand for probiotic cheeses | The consumption of probiotic cheese is significantly increasing as it helps to improve immune health. |

| Increasing demand for clean-label cheese | The rising concerns regarding consumer health are giving rise to greater demand for clean-label cheese that is free from added/artificial flavourings, colourings, and preservatives. |

| Expansion of domestic cheese producers | The expansion of domestic cheese producers is aided by consumers' support for regional cheeses and artisanal cheesemakers as they become more aware of the provenance of cheese. |

| Wide availability of speciality cheeses | The wide availability of speciality cheeses, such as hand-made goat cheeses, cheddars, soft cheeses, and blue cheese, made from locally sourced ingredients, aids the market. |

| Expanding fast-food joints or quick service restaurants (QSR). | The high demand for pizza in Australia due to its various toppings and incorporation of different kinds of cheese fosters cheese demand among foodservice providers. |

| Growth in disposable income | The high disposable incomes in the region lead to consumers spending relatively freely on private-label brands that offer affordable and acceptable quality cheeses. |

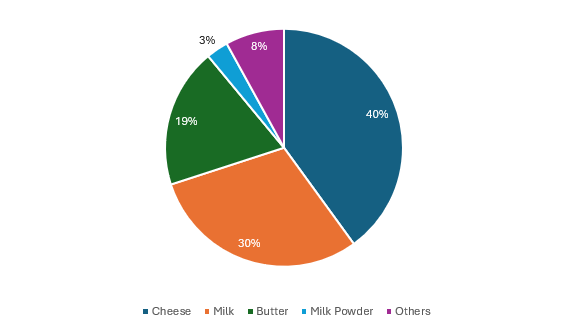

The sale and consumption of unpackaged hard cheese in the region is supported by speciality retailers who recommend local cheeses to customers. Manufacturers also provide tasting stocks to these retailers. As a result, consumers can purchase a variety of cheeses by tasting them at a store, which aids their satisfaction. In Australia and New Zealand, 40% of milk was utilised for cheese production in 2022.

Furthermore, the manufacturing of dairy commodity products for export is mainly concentrated in South-Eastern Australia and includes cheddar, mozzarella cheese and other specialised cheese types. In 2021/22, Australia's per capita annual cheese consumption was approximately 15.1 kilograms. There are more non-cheddar cheese options available in Australia, though cheddar variations are still the most popular kind of consumed cheese.

Figure: Utilisation of Produced Milk in Australia, 2021-22

Australia and New Zealand Cheese Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type:

Market Breakup by Product:

Market Breakup by End Use:

Natural cheese is expected to hold significant share of the Australia and New Zealand cheese market as it is inherently gluten-free.

Natural cheese is perceived as a healthier alternative to processed cheese due to its minimal processing and lack of artificial additives. Natural cheese comprises natural ingredients, including natural salts, colours, enzymes, and high-quality milk. Natural cheese is increasingly being incorporated into quick-service restaurants and fast-food chains.

Processed cheese has a longer shelf life and is more cost-effective than natural cheese. As a result, it is ideal for the fast-food sector. The expanding pizzerias and quick-service restaurants are increasingly incorporating such cheese. Pizzeria Amore Mio, D.O.C Pizza & Mozzarella Bar, Frankie's Pizza and Via Napoli.

Sales of cheese from supermarkets and hypermarkets are likely to increase in the forecast period

Supermarkets and hypermarkets are anticipated to dominate the Australia and New Zealand cheese market share in the coming years. Supermarkets boast diverse cheese options, like blocks, grated cheese, slices, and snaking products, to meet consumers' needs for cooking and snacking. 32% of Australians eat cheese each day, but the average intake is less than a third of the Australian Dietary Guidelines.

Cheese with the ‘Australian Made/Product of Australia’ logo is available at local farmer’s markets. Speciality retailers distribute premium and unpackaged cheese brands to customers and play a crucial role in recommending local cheeses to buyers.

The preference for online channels is driven by the availability of a variety of cheeses, such as parmesan, cheddar, and blue cheese, among others, delivered right to the doorstep.

Major players in the Australia and New Zealand cheese market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

| Company Name | Year Founded | Headquarters | Products/Services |

| Bega Cheese Limited | 1899 | Australia | Offers different kinds of natural, processed cheese and specific cheese for kid’s snacking. |

| Saputo Dairy Australia Pty Ltd | 2013 | Australia | Offers cheddar cheese under brands including CHEER and Cracker Barrel. |

| Fonterra Co-operative Group Limited | 2001 | New Zealand | Offers speciality cheese under the brand Kapiti, Mainland and other dairy products |

| Lactalis Australia Ltd. | 1933 | Australia | Offers premium and flavour cheeses under brands, including Lemnos, President, Galbani. |

Other key players in the Australia and New Zealand cheese market include Kraft Foods Limited and Arla Foods Mayer Australia Pty Ltd., among others.

Australians are fond of cheeseboards for hospitality purposes. These cheeseboards often contain different types and textures of cheese such as hard cheese, semi-hard cheese, cheesy dips, and others. The foodservice sector is also a significant consumer of cheese as Australians' demand for products, such as pizzas and burgers, continues to rise.

Meanwhile, dairy farming plays a significant role in New Zealand’s economy. The favourable climatic conditions, soil, and abundant water availability in New Zealand create an ideal environment for dairy farming. This provides the ease of procuring milk to produce cheese for manufacturers.

Furthermore, consumers in New Zealand are becoming more discerning about the brands and products they consume. Adding to this, the idea of the “Buy NZ Made” ethos is driving consumers to purchase locally-produced cheese.

Australia and New Zealand Cheese Market Size

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2024, the market volume was approximately 404.10 KMT.

The market is projected to grow at a CAGR of 2.7% between 2025 and 2034.

The market is estimated to witness a healthy growth in the forecast period of 2025-2034 to reach around 510.73 KMT by 2034.

The major drivers include increasing preference for premium quality cheese, wide availability of speciality cheeses, and the expanding fast-food joints or quick service restaurants (QSR).

The key trends include growing demand for probiotic cheese and increasing demand for clean-labelled cheese.

The different types of cheese include natural cheese and processed cheese.

The major distribution channels for cheese include supermarkets and hypermarkets, convenience stores, speciality retailers, and online, among others.

The major players in the market include Bega Cheese Limited, Saputo Dairy Australia Pty Ltd, Fonterra Co-operative Group Limited, Lactalis Australia Ltd., Kraft Foods Limited, and Arla Foods Mayer Australia Pty Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2024 |

| Historical Period | 2018-2024 |

| Forecast Period | 2025-2034 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Product |

|

| Breakup by End Use |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share