Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The aluminium market size attained a value of USD 165.90 Billion in 2025. The market is expected to grow at a CAGR of 5.65% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 287.44 Billion.

Construction and urbanization are influencing the aluminum market dynamics as rapid infrastructure development is demanding lightweight, durable, and corrosion-resistant materials. With global urban population, large-scale projects in emerging economies are increasing aluminium consumption. According to industry reports, 68% of the global population is estimated to reside in urban areas by 2050. Innovations in aluminium alloys are further enhancing performance, making it a preferred choice for smart cities and energy-efficient buildings, adding to market growth.

Regulatory frameworks are favoring the aluminium industry by enforcing emissions reductions, promoting transparency, and incentivizing sustainable practices. Mechanisms, such as the European Union’s Emissions Trading System and China's national ETS are compelling aluminium producers to account for their carbon emissions whilst increasing financial pressure on high-emission producers. Certifications such as the Aluminium Stewardship Initiative (ASI) and TÜV Rheinland’s CertAl are providing frameworks for producers to demonstrate compliance with environmental and social standards for enhancing market access and competitiveness.

Recycled aluminium is a major driver of the aluminium market due to its significant energy savings and environmental benefits. As per industry reports, the recycling rate of aluminium packaging globally touched 68.2% in 2024, drastically reducing carbon emissions and costs. As sustainability has become a priority globally, the automotive, packaging, and construction industries are increasingly relying on recycled aluminium to meet green standards and circular economy goals.

Base Year

Historical Period

Forecast Period

With increased global emphasis on sustainability, B2B companies are increasingly looking for more recycled aluminum as part of the environmentally friendly practice and to minimize carbon footprints in the manufacturing process.

Higher consumption of aluminum in construction, transportation, and energy sectors due to rapid urbanization and infrastructure projects, especially in emerging markets, provides B2B opportunities in material supply and innovation, thus pushing the growth of the aluminium market.

Aluminum processing innovations and lightweight solutions for automotive or aerospace sectors create demand for specialized B2B products with high quality, efficient, and cost-effective material solutions for companies.

Compound Annual Growth Rate

5.65%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Aluminium Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 165.90 |

| Market Size 2035 | USD Billion | 287.44 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.65% |

| CAGR 2026-2035 - Market by Region | North America | 4.7% |

| CAGR 2026-2035 - Market by Country | India | 6.9% |

| CAGR 2026-2035 - Market by Country | UK | 6.3% |

| CAGR 2026-2035 - Market by Type | Secondary | 6.2% |

| CAGR 2026-2035 - Market by End Use | Packaging and Foil | 6.4% |

| Market Share by Country | Australia | 2.9% |

The strong automotive demand and the growing focus of manufacturers on vehicle lightweighting and electric vehicle efficiency are offering multiple aluminium market opportunities. As per industry reports, the number of electric vehicles globally sold touched 1.7 million in March 2025. Automakers are increasingly turning to aluminium for its lightweight and durable properties to enhance vehicle performance, fuel economy, and emissions compliance. With global regulations tightening around emissions and efficiency, the shift towards lighter vehicles is expected to further accelerate aluminium usage in the automotive sector.

The clean-energy transition is boosting the aluminium market trends with rising usage in solar panels, wind turbines, and transmission lines. Governments worldwide are investing heavily in renewable energy projects to meet climate targets. As a result, solar and wind installations are requiring significant aluminium inputs to offer strength and corrosion resistance. In March 2025, Hydro established a new wire rod cast house at its Karmøy smelter to supply aluminium for Europe’s critical energy infrastructure. The corrosion resistance and conductivity of aluminium also make it ideal for structural and electrical components.

To curb emissions, producers are adopting green smelting methods, adding to the aluminium market expansion. Inert-anode technology is helping to eliminate carbon emissions during electrolysis, while powering smelters with hydro, wind, or solar energy cuts reliance on fossil fuels. Companies are pioneering low-emission solutions, further enabling the production of green aluminium. In February 2022, Vedanta Aluminium introduced Restora, India's first low-carbon aluminium, produced using renewable energy. This shift is helping to meet stringent environmental regulations and appeal to eco-conscious customers and investors.

Aluminium cans are dominating the packaging market while significantly driving the aluminium demand due to their sustainability, convenience, and versatility. As consumer preference shifts towards eco-friendly options, aluminium cans have become the packaging of choice for beverages, including soft drinks, beer, and energy drinks. In June 2025, Ball Brazil partnered with Açaí Motion to launch Brazil’s first ASI-certified aluminium cans for ensuring sustainable practices from mining to recycling. Additionally, advancements in can design and manufacturing are improving product preservation and consumer experience, bolstering market growth.

Innovation in 3D printing, alloy development, and AI-driven recycling are transforming production in the aluminium industry. In July 2024, Bright Laser Technologies introduced BLT-AlAM500, a high-strength aluminium alloy designed for 3D printing applications in aerospace. These innovations are enhancing material performance, manufacturing efficiency, and sustainability, positioning aluminium as a key material in the transition towards a more sustainable and technologically advanced future. Startups are also exploring aluminium additive manufacturing for aerospace, while AI scrap sorting is improving recycling efficiency.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Aluminium Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

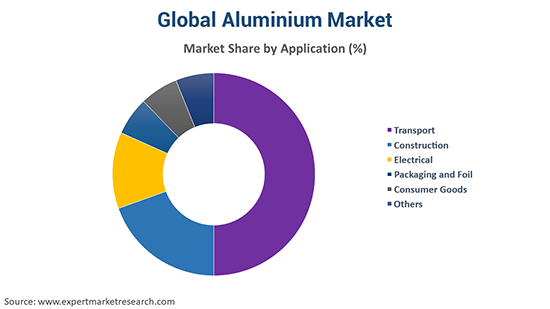

Market Breakup by End Use

Key Insight: The transport segment is largely impacting the aluminium market outlook, driven by demand for lightweight, durable materials to enhance fuel efficiency and reduce emissions. Automakers are increasingly replacing steel with aluminium for vehicle bodies and engine components. In March 2025, Novelis introduced automotive’s first aluminium coil made entirely from 100% recycled end-of-life vehicle scrap. The aerospace industry also relies on high-strength aluminium alloys for structural parts. With the global push for electric mobility and sustainable transportation, aluminium demand in this sector is growing significantly in developed and emerging markets.

Market Breakup by Region

Key Insight: Asia Pacific dominates the aluminium market, driven by robust industrial growth, high consumption, and a vast manufacturing base. China has emerged as the largest aluminium producer and consumer in the region due to its expansive infrastructure and automotive sectors. As per industry reports, China's total aluminium production totalled to 11.2 million tonnes in Q4 of 2024. India is rapidly emerging as a key player, with major investments from several companies and collaborations for low-carbon aluminium projects. Japan and South Korea are also contributing significantly via technological innovations and demand for lightweight materials in transportation and electronics.

| CAGR 2026-2035 - Market by | Region |

| North America | 4.7% |

| Europe | 4.3% |

| Asia Pacific | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

Construction & Electrical to Witness Huge Aluminium Adoption

The construction segment is contributing to the aluminium industry revenue, due to its strength, corrosion resistance, and design flexibility. In rapidly urbanizing regions, such as Asia and the Middle East, aluminium is playing a key role in modern infrastructure and smart buildings. Major urban projects in China and the United Arab Emirates are heavily incorporating aluminium for both structural and aesthetic applications. Moreover, green building standards are encouraging the use of recyclable materials, further boosting the demand for sustainable aluminium products in residential, commercial, and industrial construction.

The aluminium demand growth in the electrical sector can be attributed to its excellent conductivity, lightweight nature, and cost-effectiveness compared to copper. India and Brazil are expanding their power grids using aluminium-based solutions to meet rising energy demands affordably. With growing global investments in electrification and renewable energy, the electrical segment continues to expand as a vital aluminium-consuming sector. In April 2025, India’s aluminium sector revealed a ₹42,500 crore investment to add 18–20 GW of solar and wind power capacity by 2030, adding to the regional market growth.

Thriving Aluminium Production in North America & Europe

North America records a strong position in the aluminium market, supported by mature aerospace and automotive sectors that demand high-quality, lightweight aluminium alloys. The United States is witnessing renewed investments in domestic production. In March 2024, Century Aluminum received up to USD 500 million in funding to build a new green primary aluminium smelter. Meanwhile, Canada is leveraging its access to clean hydroelectric power for sustainable aluminium smelting. With increasing focus on supply chain security, low-carbon materials, and advanced manufacturing, North America is strengthening its role as a major producer and consumer in the market.

The aluminium market in Europe is rapidly growing on account of the increasing demand for lightweight, sustainable materials in construction, packaging, and renewable energy. The strong push towards decarbonization and circular economy practices is boosting the demand for recycled and low-carbon aluminium. Key players are investing in greener production methods. Additionally, the influx of stricter environmental regulations is encouraging innovation and capacity expansions. The stronger commitment to sustainability is further fueling Europe's long-term market growth.

Key players operating in the aluminium market are deploying vertical integration by controlling the entire supply chain in bauxite mining, alumina refining and aluminium smelting. This strategy is helping to reduce costs while securing a steady supply of raw materials and improving the overall profit margins. By managing multiple production stages, companies are effectively navigating market fluctuations and enhancing operational efficiency. Aluminium producers are also introducing specialized alloys and downstream products tailored for the automotive, aerospace, packaging, and construction sectors.

Companies are investing in energy-efficient smelting technologies along with advanced recycling processes. These innovations are mitigating the production costs and environmental impacts, which is largely important due to the rising energy prices and stricter sustainability regulations. Many players are also focusing on expanding into emerging markets such as China, India, and Southeast Asia. These regions are experiencing rapid industrialization and infrastructure growth, creating strong demand for aluminium. By increasing production capacity and sales efforts, companies are tapping into new growth opportunities and diversifying their market presence.

RusAl, formed in 2000 and headquartered in Moscow, Russia, is a leading aluminium producer providing a vast range of products including primary aluminium, alumina, and aluminium alloys. The company is serving the automotive, packaging, and construction sectors globally.

Chalco Aluminum Co. Ltd., founded in 2001 and headquartered in Beijing, China, is a major aluminium producer with a portfolio including primary aluminium, alumina, and fabricated aluminium products. Chalco serves various sectors, such as transportation, aerospace, and electronics whilst focusing on mining and smelting operations.

Rio Tinto plc, launched in 1873 and is headquartered in London, United Kingdom, is a diversified mining major with aluminium as one of its key businesses. Rio Tinto supplies alumina, bauxite, and primary aluminium across the globe for catering to the automotive, packaging, and construction industries.

China Hongqiao Group Co., Ltd., founded in 1994 and headquartered in Shandong, China, specializes in producing primary aluminium and alumina. The firm is known as one of the biggest aluminium producers as it is focusing on energy-efficient production as well as supplying multiple industrial sectors.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the aluminium market include Alcoa Corporation, Norsk Hydro ASA, Alux do Brasil, and Companhia Brasileira de Alumínio (CBA), among others.

Download your free sample of the aluminium market report today to explore the latest aluminium market trends 2026. Gain valuable insights on market growth, competitive strategies, and industry forecasts to make informed business decisions. Stay ahead with expert analysis and data-driven projections tailored to your needs.

Saudi Arabia Aluminium Market

South Korea Aluminium Market

Philippines Aluminium Market

Australia Aluminium Market

Vietnam Aluminium Market

Canada Aluminium Market

Mexico Aluminium Market

Brazil Aluminium Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 165.90 Billion.

The market is projected to grow at a CAGR of 5.65% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 287.44 Billion by 2035.

The key strategies driving the market include technological innovation, sustainable production practices, and increased use of recycled aluminium. Companies are expanding capacity, forming strategic partnerships, and entering new markets to meet demand from automotive, construction, and aerospace sectors. Customization, lightweight solutions, and digital manufacturing are also critical growth enablers.

The key trends propelling the aluminium market growth includes the growing transportation industry and increasing downstream industries.

The major regions in the aluminium market are North America, Latin America, Europe, Middle East and Africa, and Asia Pacific.

The various end uses of aluminium in the market are transport, construction, electrical, machinery and equipment, packaging and foil, and consumer goods, among others.

The key players in the market report include W RusAL, Chalco Aluminum Co. Ltd, Rio Tinto plc, China Hongqiao Group Co., Ltd., Alcoa Corporation, Norsk Hydro ASA, Alux do Brasil, and Companhia Brasileira de Alumínio (CBA), among others.

Asia Pacific dominates the market, driven by robust industrial growth, high consumption, and a vast manufacturing base.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| Report Features | Details |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share