Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aerosol paints market, valued at approximately USD 252.37 Billion in 2025, is poised for significant growth. The market size is expected to expand at a CAGR of 5.60% from 2026-2035, reaching an estimated USD 435.19 Billion by 2035.

This growth is driven by rising demand across industries such as automotive and construction, where aerosol paints are increasingly popular for their ease of use and versatility. Technological innovations in spray paint technology have further boosted this growth, offering improved efficiency and durability. The development of advanced spray paint options has revolutionised the way surfaces are coated, ensuring better results and faster application. As the aerosol paints market continues to evolve, it will grow further, with spray paint becoming an essential tool for various applications, including automotive refinishing and construction projects.

Base Year

Historical Period

Forecast Period

The New European Bauhaus initiative, launched in 2021, promotes sustainable architecture and design by integrating aesthetics with sustainability. This initiative encourages innovative building practices, further increasing demand for sustainable aerosol paint products. The emphasis on low-VOC (volatile organic compounds) and water-based formulations in aerosol paints also contribute to healthier indoor environments and lower emissions, resonating with the NEB's commitment to sustainability.

In India, the government has significantly increased its capital outlay for infrastructure development by 33% in the 2023-24 Union Budget, raising it to approximately INR 10 lakh crore. This substantial investment opens lucrative opportunities for paints and coatings, including aerosol paints, as the construction sector seeks high-quality, efficient solutions for new projects and renovations. The demand for durable and aesthetically pleasing finishes in residential and commercial buildings is expected to drive growth in the aerosol paints market.

Additionally, Germany's Energy Saving Ordinance mandates strict energy efficiency standards for both new and existing buildings. This regulation necessitates significant renovations aimed at improving insulation and overall energy performance. As part of these renovations, there is an increasing demand for low-VOC and water-based aerosol paints that comply with environmental regulations.

Compound Annual Growth Rate

5.6%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Growing demand for eco-friendly aerosol paints, innovations in aerosol paint technology, and rising interest in do-it-yourself (DIY) projects are the key trends propelling the market growth.

There is a growing demand for eco-friendly aerosol paints, particularly water-based formulations that have lower volatile organic compound (VOC) emissions. This trend of aerosol paints market is partly a response to stringent environmental regulations aimed at reducing harmful emissions from traditional solvent-based paint. For instance, the European Union VOC Solvents Emissions Directive (SED) sets strict emission limits for VOCs in industrial activities, including the paint and coating sector. It mandates the use of low-VOC or zero-VOC solvents where feasible, aiming to significantly reduce VOC emissions from manufacturing processes and improve air quality across member states. Manufacturers are increasingly focusing on developing sustainable products to meet consumer preferences for environmentally friendly options. For example, Rust-Oleum has introduced various eco-friendly products, including low-VOC and water-based aerosol paints. Their commitment to sustainability is reflected in their product lines that minimise environmental impact while maintaining high performance.

Innovations in aerosol paint technology are enhancing product performance and application ease. As per the aerosol paints industry analysis, new formulations are being developed that allow for better finishes and quicker drying times, making them more appealing for both professional and DIY users. In April 2022, Akzo Nobel launched the Dulux Simply Refresh spray paint collection, which features low splatter and low drip technology. This product is designed for DIY enthusiasts, allowing for a cleaner painting process with reduced waste, thus improving user experience while maintaining high-quality results. Additionally, In June 2022, BEHR introduced its BEHR PREMIUM Spray Paint, which combines primer and paint capabilities in a single can. This innovation simplifies the painting process for users by providing a durable and high-quality finish for both indoor and outdoor applications, streamlining the workflow for home improvement projects.

There is a rising interest in do-it-yourself (DIY) projects, leading more individuals to use aerosol paints for home improvements and crafts due to their convenience and ease of use. Aerosol paints are being widely used for various DIY applications, including modernising furniture, painting gates and fences, and creating murals, which increases aerosol paints market opportunities. Their ability to provide a smooth, even finish without the need for brushes makes them particularly appealing for home improvement projects. Consumers can easily apply aerosol paints to revitalise worn-out surfaces or create artistic expressions on walls. Moreover, retailers such as Home Depot reported significant growth in paint sales during the pandemic period, reflecting the rising popularity of DIY activities, which offered lucrative opportunities for market growth.

The automotive sector's demand for aerosol paints is significantly influencing the market, driven by a surge in vehicle sales and the upcoming 6th Indian Aerosols Expo 2025. In 2023, passenger vehicle sales in China reached approximately 26 million units, marking a more than 10% increase from the previous year. This growth is expected to boost the demand for aerosol coatings used for touch-ups and customisation by automotive companies. The 6th Indian Aerosols Expo, scheduled for February 28 to March 1, 2025, in Mumbai, will showcase innovations in the aerosol industry, including automotive applications. Organized by the Aerosols Promotion Council (APC), this trade show aims to promote sustainability and growth within the sector. It will feature a wide range of products, technologies, and machinery related to aerosol paints and coatings. The expo is anticipated to attract numerous exhibitors and buyers from various industries, highlighting the increasing focus on eco-friendly practices and advancements in aerosol technology.

The aerosol paint market is experiencing significant growth across regions, with North America, the U.S., Asia Pacific, and Europe driving key demand. Manufacturers in these regions are responding to the increasing product demand, particularly in construction sectors where aerosol paints are crucial for infrastructure development. As the market expands, innovation and efficiency in spray paint technology continue to meet the evolving needs of consumers. This growth is supported by strong regional demand and the ongoing development of infrastructure in these regions.

The aerosol paint market is witnessing growing demand for both water-based and solvent-based products. Water-based techniques are gaining popularity due to their eco-friendly nature, with water-based products offering a safer alternative to traditional solvent-based options. This shift is driven by the increasing demand for sustainable solutions in industries such as green building, where environmental norms are pushing for lower emissions. Water-based paints are preferred over solvent-based ones as they contain fewer hazardous chemicals, aligning with consumer demand for safer, more environmentally responsible options. In December 2024, Shalimar Paints launched the ‘Smart Bharat 2-in-1 Paint’ and ‘Mela Series’ in Phuket, offering affordable, durable paints for homes, especially in rural India. The company also expanded its portfolio to include masking tapes, sandpaper, spray paints, and wood adhesives.

The global market is witnessing a surge in demand, driven by sustainable product development and increased disposable income, particularly in emerging economies. In the construction sector, aerosol paints are becoming a preferred choice due to their convenience and eco-friendly options. As the construction industry expands, both in developed and emerging economies, the need for high-quality aerosol paints grows. This demand is fostering innovation, leading to more sustainable products that meet the evolving needs of consumers in the construction and other sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The DIY sector in the global aerosol paints market offers convenience and accessibility, enabling consumers to easily apply paint without professional help. Aerosol paints are easy to use, fast-drying, and provide smooth finishes. They are ideal for smaller projects, offering flexibility in design and colour. DIY enthusiasts benefit from cost-effectiveness and the ability to personalise home décor, furniture, and outdoor items. In April 2022, AkzoNobel India launched the 'Dulux Simply Refresh' range in the DIY paints category. It offers multi-surface paints, spray paints, repair solutions, and painting kits, designed for easy, one-coat application, catering to consumers seeking hassle-free DIY home transformations.

In construction, aerosol paints provide durability, ease of application, and precise coverage. They are ideal for both small-scale and large-scale projects, ensuring quick and efficient painting of surfaces. The aerosol format offers smooth finishes, even coverage, and is highly versatile, catering to various materials such as wood, metal, and concrete. This helps save time and labour, making aerosol paints a popular choice in the global construction sector. In April 2023, Rust-Oleum launched its Custom Spray 5-in-1, an innovation in spray paint technology. This product allows users to change spray patterns with a dial, offering five options for different surfaces. It features the advanced Stops Rust formula, providing enhanced corrosion resistance and colour retention.

Water-based aerosol paints are increasingly popular due to their eco-friendly nature and low levels of volatile organic compounds (VOCs). They offer quick drying times, reduced odour, and are safer to use, making them ideal for indoor applications. These paints are easy to clean up with water and can be applied on a variety of surfaces, including wood, metal, and plastic. Their environmental benefits, coupled with improved durability and colour retention, make them a top choice for both consumers and industries.

Solvent-based aerosol paints are known for their superior durability and resistance to harsh weather conditions. They provide a smoother finish and are ideal for outdoor applications, especially on surfaces exposed to moisture or extreme temperatures. These paints are more effective on metal and other hard-to-paint surfaces, offering long-lasting protection. While they contain higher levels of VOCs, advances in formulation have made them more user-friendly, providing high-quality finishes that meet professional standards in various sectors.

Acrylic aerosol paints offer fast drying times, excellent colour retention, and a smooth, durable finish. They are versatile, suitable for both indoor and outdoor use, and provide a wide range of vibrant, long-lasting colours with easy application. In March 2025, Martha Stewart and Plaid Enterprises launched a new line of multi-surface acrylic paints and accessories after a five-year hiatus. The collection, developed for crafters of all levels, includes paints, stencils, and unfinished wood surfaces for creating home décor and artistic projects.

Epoxy aerosol paints are highly valued in the global market for their exceptional adhesion, durability, and resistance to chemicals, moisture, and physical wear. These paints form a hard, protective coating that is ideal for industrial, automotive, and other heavy-duty applications. Their superior resistance to corrosion and ability to withstand harsh environments make them perfect for metal surfaces exposed to high stress. Epoxy paints are often used in environments like factories, warehouses, and marine settings, offering long-lasting protection and performance even in challenging conditions.

The North American aerosol paint market benefits from advanced technological innovations, high consumer demand, and a well-established infrastructure. The region's focus on eco-friendly solutions, such as water-based paints, aligns with growing environmental awareness. Additionally, the strong presence of major manufacturers and a high level of disposable income support the market's growth. The automotive and construction sectors drive the demand for aerosol paints, especially in industrial and DIY applications. In May 2022, PPG launched the Dulux PRO app in Canada, providing professional painters with a digital tool to order paint, access job details, and review past orders. The app also offers features like colour matching, job delivery, and technical product data to improve efficiency.

Europe's aerosol paint market benefits from stringent environmental regulations, which promote the development of low-VOC and sustainable products. The region's well-established DIY culture boosts demand for aerosol paints, particularly in home improvement and furniture restoration. Strong market growth is supported by technological advancements, as well as the increasing popularity of decorative and functional coatings in the automotive and construction sectors. Consumer preference for eco-friendly solutions also drives innovation in Europe. ColorMatic offers professional-grade aerosol and repair systems, delivering high-quality spray paint results like a spray gun. With innovative nozzle technology, solvent or water-based refillable cans, and reliable 2K technology, it ensures consistent spray power and professional finishes for car repairs.

The global aerosol paints market has been experiencing significant growth, driven by increasing demand across regions like North America, Asia Pacific, and Europe. Key manufacturers in the industry, such as AkzoNobel and PPG Industries, have expanded their global footprint to meet the rising demand. These manufacturers are witnessing strong revenue and a growing market share as consumers in emerging economies benefit from increased disposable income and purchasing power. The construction industry plays a crucial role in this growth, with aerosol paints used for both commercial and residential applications. As the market grows, manufacturers continue to innovate, developing new products tailored to the evolving needs of consumers. With the rise in DIY projects and the increasing use of aerosol paints in various sectors, the market is expected to maintain its upward trajectory in the coming years.

Nippon Paint Holdings Group is a leading paint and coatings manufacturer based in Japan. Established in 1881, it has grown to become one of the largest paint companies in Asia and operates globally.

Aeroaids Corporation is a private company based in India, established in 1990. It specialises in manufacturing and exporting a variety of chemical products, particularly aerosol spray paints, glass cleaners, dashboard shiners, UV protectors, and liquid car polish.

Krylon Products Group is a well-known American brand under the Sherwin-Williams Company that specialises in spray paints and coatings. Founded in 1947, Krylon is recognised for its innovative products that cater to both DIY consumers and professional painters.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

The aerosol paints market has experienced notable revenue growth, influenced by industry trends at global, regional, and country levels. This growth is supported by the expansion of subsegments, with key companies diversifying their product offerings. Segmentation across product, application, and region highlights varying consumer demands, driving innovation. As the market adapts to these evolving trends, it provides a wide range of aerosol paints tailored to specific regional needs and applications, fueling further expansion.

Product Outlook (Revenue, Billion, 2026-2035)

Resin Outlook (Revenue, Billion, 2026-2035)

Application Outlook (Revenue, Billion, 2026-2035)

Region Outlook (Revenue, Billion, 2026-2035)

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is assessed to grow at a CAGR of 5.60% between 2026 and 2035.

Key factors driving the aerosol paints market growth include an increase in automobile refinishing activities and growing demand from the end-use industry.

The rowing R&D investment for sustainable paints is expected to be a key trend guiding the growth of the industry.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market, with the Asia Pacific accounting for the largest market share.

The water-based and solvent-based aerosol paints are available in the market.

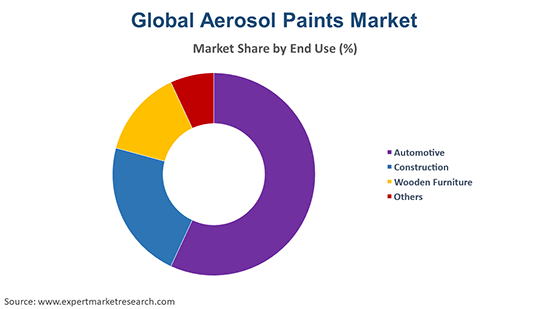

Construction industry is the leading end-user for aerosol paints.

The key players in the market are Nippon Paint Holdings Group, Aeroaids Corporation, Krylon Products Group, RPM International Inc., PPG Industries, Inc., Masco Corp., Dupli-Color Products Company, LA-CO Industries, Inc., Montana Colors S.L., Southfield Paints Ltd., Kobra Paint, and Rust-Oleum, among others.

In 2025, the market reached an approximate value of USD 252.37 Billion.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 435.19 Billion by 2035.

The aerosol paints market in the Asia Pacific region has been the leading force, driven by growing demand across various industries and a notable increase in per capita disposable income, particularly in the developing economies of the region.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Resin |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share