Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

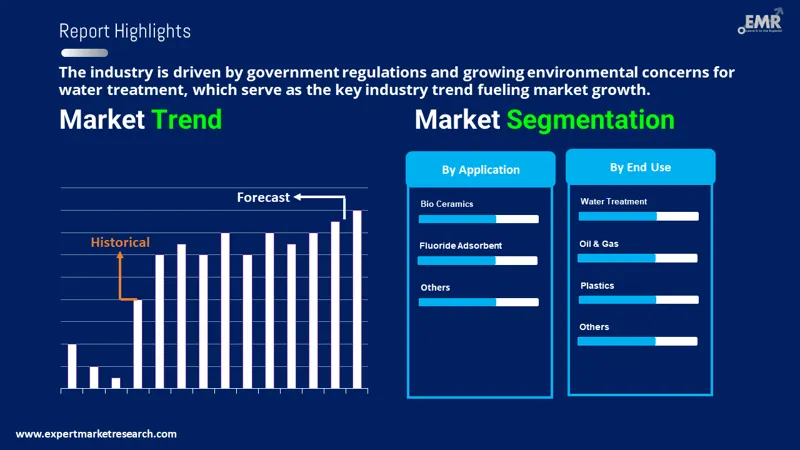

The global activated alumina market was valued at USD 1311.46 Million in 2025. The industry is expected to grow at a CAGR of 6.00% during the forecast period of 2026-2035. Activated alumina is an excellent adsorbing material in drinking and industrial effluents treatments for removing contaminates such as fluoride, arsenic, and heavy metals. Increasing water scarcity and pollution concerns have led to the government's and industry's investment in advanced filtration technologies and hence boosted the market demand of activated alumina for municipal and industrial water treatment applications across the globe. In turn, all these factors have resulted in the market attaining a valuation of USD 2348.63 Million by 2035.

Base Year

Historical Period

Forecast Period

In 2022, the United States led global crude oil production with 17.0%, followed by Saudi Arabia at 13.5% and Russia at 12.2%, which can contribute to industry revenue. Activated alumina market companies to build partnership models and supply tailor-made solutions to these high-output zones.

Canada produced 6.4% of crude oil, Iraq 5.0%, and China 4.6%, the United Arab Emirates contributed 4.5%, while Iran and Brazil accounted for 3.6% each in 2022, which drove significant demand for activated alumina. These oil-producing countries place activation alumina at the position of desiccant and catalyst support material for refining and processing of natural gas, which implies a growing demand for the material itself.

According to the International Energy Agency, biofuel demand is set to expand 38 billion litres in India. So as renewable energy technologies like biofuel production grow, activated alumina companies can explore new markets by providing adsorption solutions for purification and moisture control in green fuels processing applications.

Compound Annual Growth Rate

6%

Value in USD Million

2026-2035

*this image is indicative*

| Global Activated Alumina Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 1311.46 |

| Market Size 2035 | USD Million | 2348.63 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 6.6% |

| CAGR 2026-2035 - Market by Country | India | 7.2% |

| CAGR 2026-2035 - Market by Country | Saudi Arabia | 6.5% |

| CAGR 2026-2035 - Market by Application | Desiccant | 6.7% |

| CAGR 2026-2035 - Market by End Use | Water Treatment | 6.9% |

| Market Share by Country 2025 | UK | 3.6% |

The growth of activated alumina market is mainly supported by the oil and gas industries. The material is used as a drying agent and a catalyst support used in the energy production and distribution activities by making the refining processes, natural gas drying, and impurity removal more effective. Further, in the oil and gas industry, activated alumina is applied for desiccation and purification processes. Effective removal of contaminants like fluoride and arsenic drives its use in clean water initiatives.

The increasing use of 5G technology and the greater demand for petrochemicals further fuel greater demand in the activated alumina market. The pharmaceutical sector also contributes significantly to market expansion as the activated type is used in the communication process between drugs for making a better-mixed drug with its purification process. The increasing attention towards sustainability is opening up new opportunities in the applications of activated alumina in renewable energy technology, such as biofuel production.

Regionally, the activated alumina market revenue is augmented by most influential countries are North America, Asia-Pacific, and the Middle East, as they have robust industrial and energy sectors. In fact, with new innovations in material development and tightened environmental regulations, the future of activated alumina appears bright with respect to its growth and diversification.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The growing need for clean and safe water has further influenced demand for activated alumina in water treatment applications. The material’s remarkable adhesion characteristics make activated alumina effective for fluoride, arsenic, and heavy metals removal from all types of drinking waters and effluents, including industrial waste. Governments and industries worldwide are also supporting research development and investment in the advanced filtration technologies needed to combat water scarcity and pollution problems. This is especially true for the developing economies, where potable water availability matters, thereby opening up new possibilities for activated alumina suppliers, boosting market growth.

Environmental concerns and stricter regulation have made industries adopt greener practices, resulting in more activated alumina demand in renewable energy and green processes. For example, the increased use of activated alumina in biofuel purification and emission control systems has boosted the market growth. Several industries are considering options on how activated alumina can be made more recyclable and effective, thus aligning with worldwide sustainability goals. This drives not only the activated alumina market growth but also encourages innovation in terms of market strategy that can provide a competitive edge to companies investing in their provision of eco-friendly solutions.

Major trends influencing the activated alumina market are the increased deployment of activated alumina in oil and gas sector, advancements in the activated alumina, increased demand for alumina in aluminum manufacturing, and growing demand in water treatment applications.

The rising usage of activated alumina in the oil and gas sector for the adsorption of water from natural gas streams is a crucial trend of activated alumina market. With the growing establishment of new refinery projects, the demand for activated alumina is also expected to increase. The significant production in North America and the Middle East Africa drove demand for activated alumina in gas purification processes, particularly for removing moisture and contaminants. High production regions like CIS countries and Asia Pacific also required substantial activated alumina for efficient gas treatment. As per the Enerdata, in 2022, North America led global natural gas production with 28.7%, followed by Middle East Africa at 23.9%, and CIS countries at 21.4%, which boosts the growth of the activated alumina industry.

Improved porosity and surface area increase the effectiveness in removing contaminants like fluoride, arsenic, and phosphates, making it ideal for water treatment and boosting activated alumina market value. Thermal regeneration extends the lifespan and cost-effectiveness of activated alumina, beneficial for repeated use in water and air purification systems. By regenerating the activated alumina through thermal treatment, its useful life can be significantly extended. This reduces the frequency of replacement and makes the material more cost-effective in the long run. The material’s durability at high temperatures makes it valuable as a catalyst in petrochemical processes and as a desiccant in high-temperature gas and liquid streams.

One of the major trends currently influencing the activated alumina market is the increased demand for alumina in aluminum manufacture, which is evidently fueled by increased adoption in the industries including automotive, aerospace, and construction. Alumina demand has also increased while countries are directing infrastructure development to adopt electric vehicles, which will put pressure on material cost and supply for making lighter and durable materials like aluminum. Programs to promote more sustainable manufacturing processes and recycling of aluminum increase the demand for alumina as a key product for contemporary industry.

Another important trend that is gaining quite importance is the increase in alumina for usage in water treatment applications. Such concern for quantity and quality of water makes it a huge scene for using alumina materials for purification and filtration processes. Increased demand for clean drinking water leads to advanced filtration technologies for removal of specific contaminants such as fluoride, arsenic, and other impurities using alumina. This activated alumina market trend pushes innovations, as companies try to come up with the newest, more efficient methods in purifying water for both developing and developed regions.

According to World Health Organization, in 2022, Northern America led in safely treated domestic wastewater at 96.1%. Oceania and Europe followed with 79.2% and 74.3%, respectively, indicating significant use of advanced water treatment technologies. As per the activated alumina industry analysis, Eastern and South-Eastern Asia reported 62.6%, while Northern Africa had 67.5%, both showing moderate adoption rates of advanced treatment technologies. Asia's treatment rate stood at 50.1%, suggesting a growing market for activated alumina. Latin America and the Caribbean managed 45.9%, highlighting the need for improved water treatment infrastructure.

Central and Southern Asia, and Sub-Saharan Africa, with 23.9% and 20.1% respectively, indicated substantial opportunities for enhancing water treatment with advanced solutions. Globally, 57.8% of domestic wastewater was safely treated, emphasising the significant potential for advanced treatment solutions like activated alumina. Major oil producers like the United States and Saudi Arabia required substantial quantities of activated alumina for efficient refining.

Stricter pollution control standards boost adoption for air and water purification and enhance activated alumina demand growth. Technological improvements enhance product quality and performance, increasing its appeal across applications. The market is highly competitive, with key players focusing on enhancing adsorption efficiency, and high-temperature stability. Companies are rapidly investing in research and development to improve porosity and surface area, making products more effective for water and air purification.

Activated alumina is widely being adopted in the pharmaceutical industry for drug formulation, purification, and drying. This is chiefly because of its large surface area and chemical stability that enables it to trap impurities and consequently ensure quality control. The increasing population growth and improvement in health care are leading to increasingly high demands for pharmaceutical products; therefore, activated alumina is becoming more relevant in manufacturing processes, hence boosting its global activated aluminum market growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Activated Alumina Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Application

Market Breakup by End-Use

Market Breakup by Region

Market Insights by Application

The use of activated alumina in desiccant is anticipated to grow at a CAGR of 6.7% between 2026 and 2035 and boost activated alumina market share. Activated alumina is widely used as a desiccant, a substance that absorbs moisture, to keep products dry and prevent damage. Industries such as oil and gas, chemicals, and pharmaceuticals use activated alumina desiccants to keep their products and processes dry. Activated alumina continues to find application as a catalyst support material in petroleum refining and petrochemical industries, owing to a growing concern in having much efficient chemical processes and energy production systems. Increased concern regarding pollution of drinking water and the need for safe drinking sources is currently increasing the use of activated alumina as a fluoride adsorbent in water purification systems across the globe. Moreover, the growing healthcare sector and present need for advanced medical devices and implants propel activated alumina used in bio ceramics, which will be applied for orthopaedic and dental uses.

Analysis by End Use

The usage of activated alumina in the water treatment sector is expected to grow at a CAGR of 6.9% in the forecast period, boosting the activated alumina demand. More people are becoming aware of the importance of clean water, leading to increased use of activated alumina in water treatment facilities. The increasing demand for natural gas processing, refining, and moisture removal in the oil and gas industry is driving the adoption of activated alumina for moisture removal and absorption. Moreover, the increased demand for high-performance polymers and sustainable materials as plastics drive the use of activated alumina for moisture control and drying applications. The rising number of end-use applications such as general healthcare filtration systems, drug purification, and manufacturing of medical devices has propelled the activated alumina market.

North America Activated Alumina Market Trends

The United States is investing in water purification to address contamination issues, increasing the demand for activated alumina, which is effective in removing impurities like fluoride and arsenic. The region's robust oil and gas sector utilises activated alumina for refining processes and gas dehydration, contributing to growth of the North America activated alumina market. Additionally, increased exploration activities in the region are leading to higher consumption of activated alumina in refining and gas processing. The chemical sector in the country utilises activated alumina for various applications, including as a desiccant and catalyst. The expansion of chemical manufacturing in the region supports the market's growth.

| CAGR 2026-2035 - Market by | Country |

| India | 7.2% |

| Saudi Arabia | 6.5% |

| China | 6.5% |

| Mexico | 6.3% |

| UK | 5.8% |

| USA | XX% |

| Canada | XX% |

| Germany | 5.2% |

| France | XX% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Brazil | XX% |

Asia Pacific Activated Alumina Market Drivers

The market in the Asia Pacific region is expected to grow at a CAGR of 6.6% in the forecast period. The markets in India and China are anticipated to witness growth rates of 7.2% and 6.5% during the forecast period, which can influence Asia Pacific activated alumina market dynamics and trends. The industry is expected to witness high growth rates in the Asia Pacific owing to rapid urbanisation and increased population in the region. Government initiatives, such as the launch of multiple water supply and water treatment projects, are likely to boost consumer demand over the forecast period. Further, the product is gaining popularity for its use in the lithium purification process.

Europe Activated Alumina Market Opportunities

The UK market accounted for around 3.6% of the global market share in 2025. The market in Germany is expected to grow at a CAGR of 5.2% in the forecast period. Stringent EU environmental policies are driving industries to adopt activated alumina for pollution control and water treatment applications, which can further boost Europe activated alumina market revenue over the next few years. Activated alumina is used in various industrial sectors including chemical manufacturing and pharmaceuticals, supporting market expansion.

Latin America Activated Alumina Market Growth

The Mexican market is anticipated to grow at a CAGR of 6.3% between 2026 and 2035. Countries are implementing water treatment projects to combat scarcity, utilising activated alumina for effective purification. Expanding industries are also adopting activated alumina for various applications, including catalysis and adsorption that can increase the Latin America activated alumina market opportunities. Moreover, government bodies in Latin America are implementing stricter environmental regulations, prompting industries to adopt activated alumina for pollution control and compliance with environmental standards.

Middle East and Africa Activated Alumina Market Dynamics

The market in Saudi Arabia is expected to grow at a CAGR of 6.5% in the forecast period. The region's significant oil and gas industry relies on activated alumina for refining and gas dehydration processes. Efforts to provide clean drinking water are increasing the use of activated alumina in water treatment facilities, further boosting the Middle East and Africa activated alumina market. With increasing concerns over water scarcity and quality, countries in the MEA region are investing in water treatment infrastructure. Activated alumina is effective in removing contaminants like fluoride and arsenic, making it valuable for providing safe drinking water.

Key activated alumina market players are looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions. Activated alumina companies are focusing on enhancing product performance, expanding applications, and improving sustainability. BASF SE, for instance, has introduced advanced activated alumina products aimed at water treatment and air purification, emphasizing sustainability and performance.

BASF SE is a leading German chemical company headquartered in Ludwigshafen, Germany. Established in 1865, it is the world's largest chemical producer, offering a diverse range of products, including chemicals, plastics, performance products, agricultural solutions, and oil and gas.

Porocel Corporation was founded in 1937, specialises in catalyst services and is a leading producer of activated alumina and specialty adsorbents. The company offers technologies for the rejuvenation of desulphurisation catalysts, which are in increasing demand for producing low-sulphur fuel.

Honeywell International Inc. is an American multinational company headquartered in Charlotte, North Carolina. Established in 1906, Honeywell operates in various sectors, including aerospace, building technologies, performance materials, and safety and productivity solutions.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major players in the market are Dynamic Adsorbents, Inc., among others.

Startups in the activated alumina market are focusing on innovative applications and sustainable solutions. For example, some startups are developing a high-purity alumina refinery which aims to produce ultra-pure aluminum materials for sectors such as semiconductors, lithium-ion batteries, and LED lighting, leveraging proprietary low-cost technology and existing aluminum infrastructure.

RWT India Private Limited

RWT India Private Limited is a startup company in activated alumina ventures that is interested in bringing good adsorbents, which find their use in water treatment, air purification, and chemical processes. RWT develops advanced technologies into sustainable efforts in providing efficient cost-effective solutions to driving growth and innovations in both environmental- and industry-related businesses.

Clicant

Cilicant, founded in 2011, is an emerging startup that engages in research and development of high-performance adsorbents, with possible applications in water treatment, gas filtration, and other industrial applications. The company designs sustainable manufacturing practices integrated with cutting-edge technologies, producing effective green solutions. Thus, it sets itself up vigorously for pioneering the growing activated alumina industry by appropriately addressing the demand for advanced filtration and purification materials.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 1311.46 Million.

The activated alumina market is assessed to grow at a CAGR of 6.00% between 2026 and 2035.

The major drivers of the market include water treatment sector, rapid urbanisation, and increased population.

Government regulatives and growing environment concerns for water treatment is the key industry trend propelling the growth of the market.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The application segments are catalyst, desiccant, fluoride adsorbent, and bio ceramics, among others.

The water treatment industry is the dominant end user for activated alumina.

The major players in the industry are BASF SE, Porocel Corporation, Honeywell International Inc. (NYSE: HON), and Dynamic Adsorbents, Inc. among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 2348.63 Million by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share