Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global AC drives market value reached around USD 15.39 Billion in 2025 due to infrastructure development and a shift towards electrification, which makes AC drives necessary for enhancing motor control and energy efficiency. Additionally, advancements in technology and the growing emphasis on energy efficiency are driving adoption across sectors such as manufacturing, oil and gas, and HVAC. As a result, the industry is expected to grow at a CAGR of 4.90% during the forecast period of 2026-2035 to attain a value of USD 24.83 Billion by 2035.

Base Year

Historical Period

Forecast Period

The demand for AC drives in India is significantly influenced by the manufacturing sector, which accounted for approximately 17% of the total GDP in 2022. This substantial contribution underscores the critical role of AC drives in enhancing the efficiency and performance of rotating equipment used in manufacturing processes. As industries increasingly adopt automation to improve operations, AC drives become essential for controlling motor speed and improving energy efficiency, thereby driving growth in AC drives market.

India's crude oil production saw a 1% increase in 2023, creating new opportunities for AC drives in drilling applications. The oil and gas sector is a major end-user of AC drives due to their ability to provide precise control over machinery, leading to enhanced operational efficiency and significant energy savings.

Furthermore, the European Union's EUR 7 billion investment in transport infrastructure projects through the Connecting Europe Facility (CEF) is expected to boost the demand for AC drives in various applications, including trains, elevators, and escalators. This investment aligns with the growing emphasis on energy-efficient technologies across Europe, further propelling the adoption of AC drives as industries seek to comply with stringent energy regulations and improve sustainability.

Compound Annual Growth Rate

4.9%

Value in USD Billion

2026-2035

*this image is indicative*

The rising demand for energy-efficient solutions is driving the market growth. The low energy consumption of AC drives and its low production cost are resulting in its increased adoption in various end-use sectors. The growth can also be attributed to rapid technological developments and favourable government initiatives. Factors like less maintenance, increasing demand for motor applications, and ease of use are also boosting the growth of the AC drives market across the globe.

Furthermore, increased infrastructure investments and rapid urbanisation and industrialisation are also helping to escalate AC drive sales worldwide, as infrastructure development across sectors such as water and wastewater treatment, power generation, transportation, and building automation demands advanced motor control solutions.

Integration of IoT and smart technologies, increasing adoption in HVAC systems, expansion of renewable energy projects are the key trends propelling the market growth.

AC drives greatly improve energy efficiency in various industrial settings, cutting down operational costs and environmental footprint, thus appealing to industries aiming for energy optimisation. The U.S. allocates USD 17.9 billion to clean energy, USD 16.4 billion to resilience projects, and USD 12.4 billion to safety improvements, promoting sustainability, infrastructure fortification, and public health. This reflects a comprehensive strategy for balanced development and resilience across sectors enhancing the growth of the AC drives industry. Moreover, according to the International Trade Administration, the municipal wastewater treatment market in China is nearing saturation, with 98.1% of municipal wastewater being treated as of 2021. Rural areas lag significantly, with only 28% of wastewater receiving treatment. To address this disparity and improve overall infrastructure, China has committed to constructing or renovating 80,000 kilometres of sewage collection pipeline networks in the coming years. This is boosting the demand for AC drives that allow the pumps and blowers in the sewage network to work at variable speeds and save energy costs.

AC drives market dynamics and trends are driven by ongoing innovations in AC drive technology, including IoT integration and advanced control algorithms, boost performance, reliability, and user-friendliness. The rise in industrial automation and smart manufacturing presents significant growth opportunities for the market as end-use sectors aim to enhance efficiency and productivity. As per the industry reports, around 16.7 billion devices, including IoT-enabled AC drives, across the world were IoT-based in 2023, which is expected to increase to 25.44 billion by 2030. The IoT-enabled AC drives can offer real-time data on motor performance, temperature and vibration, among other parameters. These devices can also send real-time alerts to the operators if they detect any failure and downtime, which may affect productivity. For instance, HVAC operators can use this information from IoT-enabled drives and adjust the motor speed based on the building occupancy to reduce risk of failure due to overload.

The demand for efficient HVAC (Heating, Ventilation, and Air Conditioning) systems is escalating due to heightened awareness of energy conservation in building management. AC drives are increasingly used in HVAC applications to control fan speeds and improve heating and cooling processes. For instance, Schneider Electric has developed advanced solutions that integrate AC drives into HVAC systems to improve energy efficiency by up to 40% while maintaining comfort levels. In 2024, it was reported that India's energy demand is expected to double by 2030, with the HVAC sector projected to account for approximately 30% of total electricity consumption. Furthermore, a study by the U.S. Department of Energy found that implementing variable speed drives in HVAC systems can lead to energy savings of about 20-50%. As manufacturers focus on energy-efficient technologies to reduce operational costs and comply with regulations, the adoption of AC drives in HVAC systems is set to rise significantly, contributing to substantial energy savings and enhancing overall AC drives market expansion.

The integration of renewable energy sources, such as wind and solar power, continues to drive AC drives demand. These systems are crucial for controlling turbine speeds and optimizing energy output, making them essential for renewable energy applications. For example, in March 2024, Delta Electronics and Inovance introduced AC drives with multi-axis capabilities that save around 50% cabinet space while enhancing efficiency by up to 30% compared to traditional systems. Additionally, a report from the International Renewable Energy Agency (IRENA) indicated that global renewable energy capacity reached 3,400 GW in 2023, with wind and solar accounting for a combined 80% of this growth. As countries ramp up investments in renewable infrastructure (projected to exceed USD 2 trillion globally by 2025), the reliance on AC drives is expected to grow.

There is a rising demand for built-in safety features in AC drives. For instance, the Safe Torque Off feature allows the AC drive to stop the motor without shutting off the entire power supply, which is the safest response to emergency situations. This feature is specifically useful in the manufacturing and processing sectors which require constant power supply and can boost the demand of AC drives market.

Safe Brake Control (SBC) is another crucial feature which can safely stop motors during system faults. This feature is gaining prominence in conveyors and cranes which may require rapid deceleration during case of emergency. Between 2011 and 2017, the Census of Fatal Occupational Injuries (CFOI) reported 297 crane-related deaths, which may have been prevented with a safety feature on the crane. Moreover, companies like Allen-Bradley and GE are readily investing in AC drives with enhanced operational safety and resilience features that can be crucial in the manufacturing and packaging sectors.

The growing adoption of renewable energy sources such as wind and solar power requires efficient energy conversion and management, boosting the demand for advanced AC drives. As per the International Energy Agency, wind power generated more than 2,100 TWh in 2022, making it the leading non-hydro renewable energy source across the world, out of which China was responsible for around half of the generated energy, enhancing the AC drives market revenue.

In 2022, solar PV generated around 270 TWh of power, which was a 26% increase compared to 2021. Solar power also accounted for around 4.5% of the world’s electricity generation in 2022 and is on track with the 2030 milestones under the Net Zero Scenario. This has boosted the demand for specialised AC drives that control the rotation speed of the blades in wind turbines as well as solar water pumping systems, which can optimise energy usage.

The high initial costs for acquiring and installing AC drives can deter adoption, particularly among small and medium-sized businesses. Integrating AC drives with existing systems can be complicated and time-consuming, needing skilled personnel and potentially increasing the operational expenses of the companies. Regular maintenance and technical support are essential for AC drives to perform optimally, which can further raise operational costs and lead to downtime if not managed well, affecting the AC drives market value.

Moreover, global economic instability and shifts in industrial production can impact investments in new technologies, potentially slowing AC-drive adoption. This is further affected by intense competition among many players and can lead to price wars and reduced profit margins, affecting financial stability. Stringent and evolving regulations on energy efficiency and environmental impact can further pose challenges for manufacturers, requiring ongoing compliance and potentially raising costs.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global AC Drives Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Voltage

Market Breakup by Power Rating

Market Breakup by Application

Market Breakup by End Use

Market Breakup by Region

Market Analysis by Voltage

Based on voltage, the low voltage segment drives the AC drives demand and is anticipated to maintain its dominance in the forecast period as well. This can be attributed to the inexpensive nature of low-voltage AC drives and their ability to operate in low and high-power applications. Governments and international bodies have been tightening regulations around energy consumption and efficiency and low-voltage AC drives help businesses comply with these regulations by reducing energy usage and carbon emissions, making them a go-to solution for companies aiming to meet environmental standards.

Market Analysis by Power Rating

The low power drives (<40 kW) account for a significant AC drives market share due to their growing applications across various end-use sectors such as food processing, and medical, among others. These drives can be implemented in metal processing machines, food processing machines, fans, pumps, and healthcare instruments, among others. Major companies such as Siemens and Fuji Electric, among others, are offering low power drives which can enhance the segment growth.

Market Analysis by Application

The pump segment is expected to gain prominence in the market due to the growing use of AC drives in pumps in end-use sectors such as chemical, energy, mining and oil and gas, among others. AC drives can reduce energy consumption by 20 to 50%, which can be crucial in industries which aim to achieve sustainability goals and boost AC drives demand growth. AC drives also offer smooth control of processes in several manufacturing applications, which is further boosting the demand for pumps.

Market Analysis by End Use

The power sector holds a major share in the market due to its extensive requirements for efficient, reliable, and precise control of electric motors used throughout various power generation, transmission, and distribution processes. AC drives play a crucial role in enhancing energy efficiency within power plants and throughout the distribution network. By allowing the precise control of motor speed and torque, AC drives reduce the energy consumption of pumps, fans, compressors, and other motor-driven equipment, leading to significant energy savings and reduced operational costs, boosting the market growth.

North America AC Drives Market Dynamics

The U.S. Department of Treasury in 2023 indicates that the largest allocation in the BIL Announced Projects is for roads, bridges, and major projects, receiving USD 174.7 billion, emphasising the priority on improving critical infrastructure. Broadband follows with a substantial USD 46.5 billion investment, reflecting the importance of expanding internet access. As per the AC drives industry analysis, public transportation projects receive USD 34.1 billion, underscoring efforts to enhance urban mobility. Water infrastructure is allocated USD 22.8 billion, indicating a focus on addressing water quality and supply issues.

Asia Pacific AC Drives Market Growth

AC drives have a wide range of uses across end-use sectors such as manufacturing, HVAC, water treatment, and transportation, ensuring consistent and rising AC drives market revenue. Rapid industrialisation and urbanisation in emerging markets offer substantial market opportunities, with increasing investments in infrastructure and industrial projects. For instance, the Rural Industrial Technology (Spark) Project in China aims to improve the technology standards in rural areas of the country. It also includes the modernisation of enterprises in rural industries as well as offering high-end equipment and technologies, including advanced AC drives that find growing applications in various industries.

Europe AC Drives Market Trends

The stringent energy efficiency regulations and the European Union's ambitious objectives to lower carbon emissions are two of the major factors boosting AC drives market opportunities in the region. Under the European Green Deal, the EU aims to achieve carbon neutrality by 2050 through its various policies and measures. For instance, it is allocating funds such as the Just Transition Mechanism and the European Green Deal Investment Plan to shift towards a low-carbon economy, which can support the equipment and technologies, including advanced AC drives for energy efficiency, that are crucial for a green economy.

Latin America AC Drives Market Outlook

In Latin America, the adoption of AC drives is on the rise, driven by the growth of the industrial and manufacturing sectors in countries such as Brazil and Mexico. Companies are increasingly seeking energy-efficient solutions to reduce operating costs and aid AC drives market expansion. This regional expansion is further bolstered by a rise in foreign investments focused on modernising infrastructure, which necessitates the deployment of advanced automation technologies such as AC drives. Moreover, Latin American countries are allocating resources towards water and wastewater management systems, which often incorporate AC drives for effective pump control.

Middle East and Africa AC Drives Market Drivers

The market growth in the region is driven by the increased adoption of AC drives in the oil and gas sector. Around 95% of the energy generated in the Middle East region comes from oil and gas reserves, which is increasing the opportunities for the use of AC drives in the oil and gas sector.

Additionally, the growing focus on renewable energy projects in the AC drives market in this region, especially solar energy, has boosted the demand for AC drives that support grid integration and energy storage systems. The advancement of infrastructure initiatives across Africa, aimed at addressing urbanisation challenges, further promotes market growth.

Startups are investing in AC drive technology which allows accurate control of motor speeds that can lead to reduced energy usage in end-use sectors such as manufacturing, water treatment, and HVAC, among others. These firms are relying on high-end power electronics to develop drives that use less energy than conventional systems, in line with regulatory requirements for energy efficiency and reduced carbon emissions.

Invertek Drives

This UK-based startup in the AC drives industry specialises in manufacturing energy-efficient variable frequency drives (VFDs) for controlling AC motors in various industrial applications. Invertek's products are known for their compact design and ease of integration. The company has also been readily investing in IoT compatibility, allowing for remote monitoring and control.

Shenzhen V&T Technologies Co., Ltd.

Shenzhen V&T Technologies, based in China, offers innovative AC drive solutions that include high-end features for remote diagnostics and predictive maintenance. The company offers compact drives with multi-axis capabilities, serving end-use sectors such as automotive manufacturing, textile production, and logistics, among others. The company stands out for its integration of data analytics in its drives, which enables real-time performance monitoring to enhance efficiency and reduce downtime.

The companies are readily emphasising innovation, digitalisation, AI-driven analytics, and energy efficiency. They drive market growth through research and development investments, strategic expansions, and eco-friendly practices, shaping industrial automation's future. Several companies leverage high-performance AC drives for critical industrial processes and are readily offering localised production and service hubs. Some major AC drives industry players are also investing in robotics, power, automation, and electrification to excel in technological innovation, sustainability, and improving energy efficiency across multiple industries.

The company focuses on innovation, enhancing AC drive efficiency and reliability, and further emphasises digitalisation with advanced control and monitoring systems. Sustainability is also a priority in the company as it offers eco-friendly drive solutions.

Siemens is offering AC drive technology for industrial applications and is also investing heavily in research and development for energy-efficient drive solutions to increase market opportunities. The company integrates IoT and AI for predictive maintenance and optimisation.

Rockwell Automation specialises in integrated AC drive systems for automation and is also innovating in scalable solutions tailored to diverse industrial needs. The company further focuses on cybersecurity in drive systems to ensure data protection.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other major players in the AC drives market are Hitachi, Ltd., and Fuji Electric Co. Ltd, among others.

India AC Drives Market

DC Drives Market

Slewing Drives Market

Electric Drives Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 15.39 Billion.

The AC drives market is assessed to grow at a CAGR of 4.90% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 24.83 Billion by 2035.

The major market drivers are rising demand for energy efficient solution, low energy consumption of AC drives, and its low production cost.

The growing infrastructure investments and the rapid urbanisation and industrialisation are the key trends guiding the market growth.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The market is categorised according to voltage, which includes medium voltage and high voltage.

The various segments based on power ratings considered in the market report are low power drives (<40 kW), medium power drives (41 kW - 200 kW), and high-power drives (>200 kW).

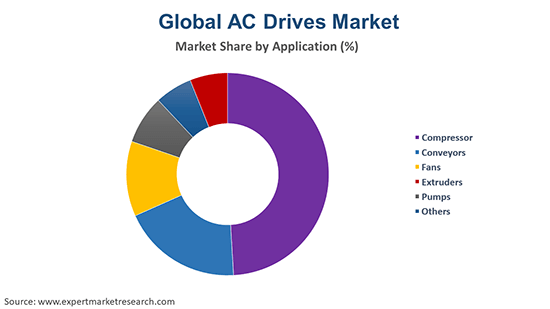

Based on the application, the market is divided into compressor, conveyors, fans, extruders, pumps and others.

The different end uses of AC drives are water and wastewater, oil and gas, power, chemical, metal processing, and HVAC, among others.

The market key players are ABB Ltd, Siemens AG, Rockwell Automation, Inc., Hitachi, Ltd., and Fuji Electric Co. Ltd, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Voltage |

|

| Breakup by Power Rating |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share