Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

As per the oleochemical procurement report, growth in the automobile and construction industry is also positively contributing to higher demand for oleochemical derivatives, which finds its application as lubricants, coatings, and plastics. Innovations in the adoption of green chemistry technologies with bio-based polymers are on the rise further.

Base Year

Historical Period

Forecast Period

Worldwide oleochemical consumption faces immense growth pressure because of an increase in the demand for the personal care, detergents, plastics, and automotive sectors toward sustainable, bio-based products. Oleochemicals comprise bio-based chemicals and derivatives obtained from renewable sources of plants and animals, covering fatty acids, glycerin, and esters in the applications of the consumer and the industrial sector. The oleochemical procurement report points to the most vital market trends as well as strategies of sourcing required by businesses who wish to leverage their supply chain.

The key drivers for demand for such products are on the one hand increasing requirements for environmentally friendly and biodegradable products, which include the personal care and household cleaning segments. The demand for fatty acids and glycerin as basic constituents in soap, shampoo, lotion, and cleaning agent productions is highly penetrating in the Asia-Pacific region. The oleochemical procurement report states that it is a region of Indonesia and Malaysia, whose oleochemical production and consumption rely on the availability of ample reserves of palm oil and other renewable feedstocks. The market for oleochemical procurement will remain relatively steady and continue to increase because of heightened environmental regulations.

Another force behind investment into the production of bio-based oleochemicals is the contemporary push for more sustainable sourcing and production. It goes a step further, having less of a negative footprint and satisfying consumers with green-friendly goods. Oleochemical procurement is also facing its new strategies to align it in terms of both sustainability goals and cost efficiency by category management strategies.

According to the oleochemical procurement report, the efficiency and sustainability of oleochemical production are enhanced through the application of extraction and processing technologies like enzymatic catalysis and green refining methods on the supply side. Fluctuations in feedstock prices (for example, palm oil), geopolitical factors that influence production in key regions, and regulatory pressures on sustainability and traceability will pose challenges that can affect stability and pricing. Businesses leveraging pricing strategies in oleochemical procurement can mitigate risks associated with these fluctuations.

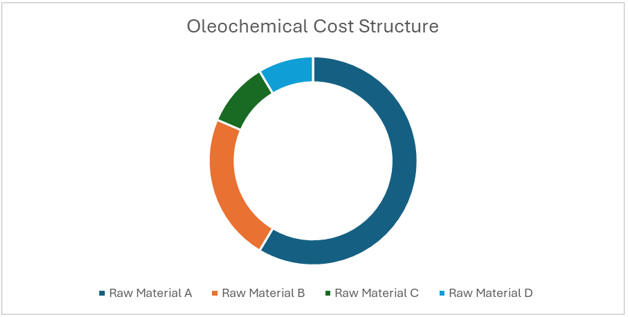

The cost structure of oleochemical production is affected by several key factors, including raw materials, energy, catalysts, operational expenses, and regulatory compliance. According to the oleochemical procurement report, raw materials are the largest cost component. The primary feedstocks for oleochemical production are vegetable oils (such as palm oil, soybean oil, and rapeseed oil) and animal fats. Fluctuating factors in crop yields, agricultural policies, weather conditions, and global commodity sectors affect the price of feedstocks. Such volatility has a paramount effect on the total cost of oleochemical derivatives, which include fatty acids, glycerin, and biodiesel. The oleochemical procurement report provides valuable insights into cost modeling approaches to manage these price variations effectively.

Energy costs are significant in oleochemicals, as all manufacturing processes such as hydrogenation, transesterification, and distillation consume energy. In regions where the prices of electricity or fuel are substantially high, energy cost does affect the cost of production naturally. Cost competition for oleochemical production arises more in a region where the energy price is low or has a cheap and efficient supply of energy sources. Another key driver includes more general macroeconomic factors including the variability in crude oil prices and the general state of health of the global energy industry. Oleochemical best practices procurement encourages strategic sourcing of energy-intensive production technologies.

Labor cost, plant operations, and maintenance and overheads are some very important operational aspects. According to the oleochemical procurement report, labor costs vary significantly from one location of production facilities to another, and plant maintenance and overheads are influenced by the complexity of the production process and the size of the facility. Efficient plant management and automation help reduce these costs. Transportation and distribution cost also accounts for the cost structure; proximity to sources of raw materials and end-use sectors helps reduce logistics expense. Thus, in the oleochemical market, customers are focusing on strategic purchasing to manage the costs for the operations.

Another cost-associated factor in oleochemicals production is compliance with environmental issues. The oleochemical procurement report indicates that the cost of compliance with strict standards in the environmental field, such as emissions or waste management, escalates the production cost of the oleochemical product. This cost factor can be approached from sustainability directives such as certification for sustainable palm oil and its protection, where companies have to absorb costs either by purchasing certified products or by changing their modes of sourcing products or materials based on sustainability principles. Market research for procurement professionals in the oleochemicals industry helps in navigating these regulatory landscapes.

The main trends that drive oil prices include swings in raw materials, energy-related prices, dynamics of supply vs. demand conditions, and legal issues. Prices of key feedstocks, which include vegetable oils such as palm oil, soybean oil, and rapeseed oil, and animal fats, are central to the cost structure of oleochemical production. Feedstock prices can experience significant volatility due to weather conditions, crop yields, agricultural policies, and global commodity sectors. Oleochemical procurement is therefore analyzed in terms of pricing trends.

Recent trends have further increased upward pressure on oleochemical prices, while the demand in personal care, household cleaning, and automotive sectors continuously increases for bio-based products. The oleochemical procurement report adds that owing to a greater preference for "eco-friendly" products and sustainable renewable ingredients, the supply has become somewhat tighter, further increasing the price. Strategic purchasing of raw materials gives business owners an opportunity to enter into favorable pricing models.

Another factor that majorly influences price trends in the oleochemicals industry is energy price dynamics. Oleochemicals are highly energy-intensive to produce. Countries with significantly higher energy expenses consequently increase costs on production fronts and subsequently bring forth higher levels of product costs. Procurement research is important for companies that are looking to adopt negotiation strategies that improve cost efficiency.

As per the oleochemical procurement report, supply chain disruptions, especially in the major regions of Southeast Asia, which are the primary palm oil producers, have also had an impact on oleochemical prices. Challenges such as logistics, export bans, and fluctuations in raw material supply have led to price increases. Strategic sourcing of oleochemical raw materials is crucial to mitigating supply chain risks and ensuring stable pricing models.

Procurement practices in the oleochemical industry focus on ensuring a stable supply of raw materials, managing costs, and meeting sustainability standards. The oleochemical procurement report highlights that long-term agreements with suppliers of vegetable oils, including palm oil, soybean oil, and rapeseed oil, as well as animal fats, are among the key strategies used to minimize exposure to price volatility driven by commodity sector fluctuations. Negotiation strategies play a crucial role in securing favorable contract terms.

Diversifying supplier sources is another critical strategy. Sourcing from multiple regions, such as Southeast Asia, South America, and Africa, helps minimize risks associated with supply disruptions caused by geopolitical factors, export restrictions, or crop yield variability. Category management approaches in oleochemicals procurement emphasize supplier diversification for risk mitigation.

Efficient logistics and inventory management play a crucial role in oleochemical procurement as these products need to be transported in bulk form through specialized tankers or containers. Optimized transportation routes and lead times must be minimized and proper storage conditions maintained to reduce costs and retain product quality. The oleochemical procurement report highlights best practices for logistics optimization.

Advanced procurement tools, including intelligence platforms and digital supply chain management solutions, also support the forecasting of price trends, improvement in collaboration with suppliers, and enhancement of overall procurement efficiency. These tools provide real-time data on industry conditions, allowing for better decision-making in sourcing raw materials and managing costs.

BASF is one of the largest chemical businesses in the world. The company offers its product portfolio for different segments including chemicals, materials, industrial solutions, surface technologies, nutrition and care, and agricultural solutions.

Founded in 1991, Wilmar International Limited headquartered in Singapore, is Asia’s leading agribusiness group. As per the oleochemical procurement report, the Group's business activities include oil palm cultivation, oilseed crushing, edible oils refining, flour and rice milling, sugar milling and refining, manufacturing of consumer products, ready-to-eat meals, central kitchen products, specialty fats, oleochemicals, biodiesel and fertilisers as well as food park operations.

Headquartered in Malaysia, Kuala Lumpur Kepong Berhad is primarily engaged in the development of oil palm and rubber. KLK has about 300,000 hectares of planted area (97% oil palm). The company’s landbank is spread across Malaysia (Peninsular and Sabah), Indonesia (Belitung Island, Sumatra, as well as Kalimantan), and Liberia.

IOI Corporation Berhad (IOI) is a leading global integrated and sustainable palm oil company. The company is listed on the Main Market of Bursa Malaysia Berhad and trading as MYX: 1961. According to the oleochemical procurement report, the company’s palm oil business consists of upstream plantations in both Malaysia and Indonesia; and downstream resource-based manufacturing business.

Founded in 1887, Kao Corporation is a leading manufacturer in the fields of hygiene, beauty and health and chemicals. The company’s renowned brands include Jergens, Curél, Bioré, Guhl, and John Frieda.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The oleochemical market is estimated to be valued at USD 29.44 Billion.

The industry is projected to grow at a CAGR of 5.80% between 2026 and 2031.

The oleochemical demand is projected to grow to USD 41.29 Billion by 2031.

The demand is being driven by expansion of end use industries such as personal care, paper, rubber, soap and detergent, etc.

Fatty acid, fatty alcohol, glycerine, and ester, among others, are the different types of oleochemicals.

Oleochemicals are produced from oils and fats, whether of plant or animal, including fish, origin.

The major players include BASF SE, Wilmar International Ltd, Kuala Lumpur Kepong Berhad, IOI Corporation Berhad, Kao Corporation, and Ecogreen Oleochemicals Pte. Ltd, among others.

The best procurement practices in the oleochemical industry include prioritizing the use of renewable feedstocks, fostering innovation in product development with suppliers, and ensuring compliance with global sustainability and environmental certifications.

The industry is broken down into North America, Europe, Middle East and Africa, Asia Pacific, and Latin America.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2031 |

| Growth Rate | CAGR of 5.80 from 2026 to 2031 |

| Regional Cost Structure | Key Cost Indicators, Cost Breakdown by Component |

| Raw Material Market Outlook | Raw Material Market Analysis, Mapping of Key Raw Material Suppliers, Availability of Raw Material by Region, Pricing Outlook of Key Raw Materials |

| Key Sourcing Strategies | Vendor/Supplier Selection, Price and Contract Model Structure, Sourcing Model, Negotiation Strategy |

| Supplier Analysis | Supplier Selection, Key Global Players, Key Regional Players, Supplier Profiles and SWOT Analysis, Innovation and Sustainability |

| Companies Covered | BASF SE, Wilmar International Ltd, Kuala Lumpur Kepong Berhad, IOI Corporation Berhad, Kao Corporation, and Ecogreen Oleochemicals Pte. Ltd, among others. |

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share