Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global citric acid consumption is witnessing robust growth, driven by its extensive use across industries such as food and beverages, pharmaceuticals, and cosmetics. Citric acid, a naturally occurring organic acid, is widely utilized as a flavoring agent, preservative, and pH regulator in food products, beverages, and personal care formulations.

Base Year

Historical Period

Forecast Period

Key factors supporting the citric acid procurement report include the increasing preference for natural and organic food additives, the rising consumption of ready-to-drink beverages, and the expanding use of citric acid in pharmaceuticals for effervescent tablets and dietary supplements. Regionally, Western Europe is the largest consumer of citric acid, with major markets including Germany, France, and the United Kingdom. However, demand in the region, particularly in the carbonated beverages sector, has reached relative saturation. The United States follows Western Europe in consumption, with other key markets including China, the Middle East and Africa, Central and Eastern Europe, Brazil, and India. European countries hold the largest share of citric acid production globally, followed by the United States and China. The Asia-Pacific region in citric acid procurement report also plays a critical role in driving growth due to its expanding food processing industry and export activities.

On the supply side, innovations in fermentation technologies and the establishment of new production facilities are enhancing output to meet rising demand. However, challenges such as fluctuating raw material prices, stringent regulatory requirements, and environmental concerns related to industrial production may impact market dynamics.

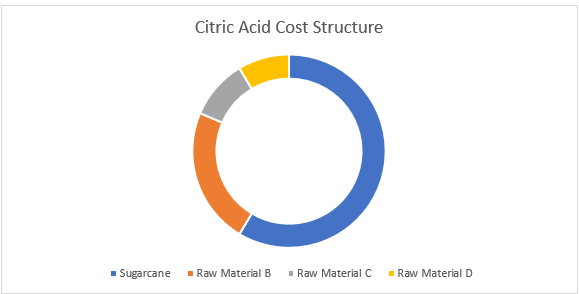

Citric acid production primarily depends on raw materials like glucose or sucrose, which are fermented by microorganisms in a controlled environment. The price of these sugars, as well as the cost of nutrients and microbial strains used in fermentation, are key contributors to raw material costs. Fluctuations in agricultural supply, global demand for sugar, and transportation costs of these raw materials impact the final price of citric acid in the citric acid procurement report.

Energy costs are another significant consideration in citric acid procurement report, as the fermentation process used in citric acid production requires precise temperature control, aeration, and downstream separation processes such as filtration and crystallization. Facilities in regions with lower energy costs benefit from competitive advantages.

The fermentation process for citric acid is energy-intensive, with costs primarily driven by electricity and water usage, along with the operation of bioreactors. Additionally, specialized equipment for fermentation, filtration, and crystallization adds to manufacturing expenses. The optimization of fermentation yields and minimizing by-product waste are important cost-reduction strategies.

According to the citric acid procurement report, citric acid is typically transported in liquid, crystalline, or anhydrous forms, each requiring specific storage and shipping conditions. Packaging costs, such as food-grade bags or plastic drums, impact distribution expenses. Transportation logistics must also account for temperature-sensitive handling, and international shipping incurs tariffs, which can influence pricing strategies across different markets.

Compliance with environmental and safety regulations, particularly in regions with stringent wastewater and emissions controls, further impacts cost modeling. The handling of by-products like calcium sulfate (from lime-based processes) or other fermentation residues also incurs additional disposal or valorization expenses.

Emerging methods, such as genetically engineered microorganisms or renewable feedstocks, could alter the cost structure by improving yields and reducing reliance on traditional raw materials. These interconnected factors determine the pricing and competitiveness of citric acid in global markets.

Citric acid pricing models are influenced by various factors, including raw material costs, energy prices, and market demand. Corn or sugar, the primary feedstocks for citric acid production, significantly impact pricing, with fluctuations in agricultural markets playing a critical role. Recent pricing trends in the citric acid procurement report indicate rising prices due to increased demand from the food and beverage, pharmaceutical, and personal care sectors, particularly in regions like Asia-Pacific and North America

Supply chain disruptions, rising energy costs, and stricter regulatory standards have escalated price pressures on citric acid, particularly due to fluctuations in raw material costs like glucose and sucrose. However, innovations in microbial fermentation processes, optimization of microbial strains, and advancements in bioreactor efficiency are expected to enhance yield and reduce production costs. Additionally, the expansion of downstream crystallization and drying capacities is anticipated to improve economies of scale, providing greater price stability in the coming years.

Citric acid procurement involves sourcing from specialized manufacturers with robust fermentation capabilities, particularly those using optimized strains of Aspergillus niger for high-yield production. Buyers focus on securing consistent supply from vendors who meet food-grade, pharmaceutical, or industrial-grade specifications, depending on end-use. Contract terms often involve bulk purchases or long-term agreements to mitigate raw material price volatility, especially for glucose or sucrose. Logistics considerations include temperature-controlled storage and transportation due to the sensitivity of liquid or anhydrous forms. Regulatory compliance for food safety, such as adherence to FDA and EFSA guidelines, is critical in selecting reliable suppliers.

ADM is a global leader in agricultural processing and food ingredient production and was founded in 1902 and is headquartered in Chicago, Illinois. As per the citric acid procurement report, the company plays a significant role in the citric acid market, leveraging its extensive supply chain and innovative fermentation technologies.

The company was established in 1865 and is headquartered in Minneapolis, Minnesota, United States. Cargill is a leading global provider of food, agriculture, and industrial products. The company offers high-quality citric acid and related products, supported by its robust global operations and sustainability initiatives.

It was founded in 1859 and is based in London, United Kingdom, Tate & Lyle is a global supplier of food and beverage ingredients. The company provides citric acid solutions with a focus on quality, innovation, and customer-centric services across various industries.

Jungbunzlauer is a key player in the citric acid procurement report and was established in 1867 and is headquartered in Basel, Switzerland. The company is known for its eco-friendly production processes, the company supplies high-purity citric acid to the food, beverage, pharmaceutical, and industrial sectors worldwide.

Founded in 1949 and based in Beijing, China, COFCO is one of China's largest agribusiness and food processing companies. Its citric acid offerings benefit from vertically integrated operations, ensuring reliable supply and competitive pricing models.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global citric acid consumption stood at a volume of 2.93 Million Tons in 2025.

The industry is projected to grow at a CAGR of 4.10% between 2026 and 2031.

The citric acid procurement report is projected to grow to 3.73 Million Tons by 2031.

The citric acid production is concentrated in Europe and United States.

The global citric acid procurement market is growing due to its use in food, beverages, pharmaceuticals, and cosmetics. The demand for natural preservatives and plant-based products is driving this expansion.

By form, the citric acid procurement market report is divided into anhydrous and liquid.

The primary raw materials used in the production of citric acid are sugar or molasses (as carbohydrate sources) and aspergillus niger (a fungal strain used in fermentation processes).

Procurement in the citric acid sector involves sourcing high-purity anhydrous or monohydrate citric acid, ensuring compliance with food and pharmaceutical-grade standards, managing supply from fermentation processes, and securing stable contracts with suppliers.

The competitive landscape of the citric acid procurement report consists of Archer Daniels Midland Company, Cargill, Incorporated, Tate & Lyle PLC, Jungbunzlauer Holding AG, COFCO Group, Shandong Ensign Industrial Co., Ltd., RZBC Group Co., Ltd., Gadot Biochemical Industries Ltd., Pfizer Inc, and Huangshi Xinghua Biochemical Co., Ltd., among others.

The market is broken down into North America, Latin America, EMEA, and APAC.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2031 |

| Growth Rate | CAGR of 4.10 from 2026 to 2031 |

| Regional Cost Structure | Key Cost Indicators, Cost Breakdown by Component |

| Raw Material Market Outlook | Raw Material Market Analysis, Mapping of Key Raw Material Suppliers, Availability of Raw Material by Region, Pricing Outlook of Key Raw Materials |

| Key Sourcing Strategies | Vendor/Supplier Selection, Price and Contract Model Structure, Sourcing Model, Negotiation Strategy |

| Supplier Analysis | Supplier Selection, Key Global Players, Key Regional Players, Supplier Profiles and SWOT Analysis, Innovation and Sustainability |

| Companies Covered | Archer Daniels Midland Company, Cargill, Incorporated, Tate & Lyle PLC, Jungbunzlauer Holding AG, COFCO Group, Shandong Ensign Industrial Co., Ltd., RZBC Group Co., Ltd., Gadot Biochemical Industries Ltd., Pfizer Inc, and Huangshi Xinghua Biochemical Co., Ltd., among others. |

Datasheet

One User

USD 2,999

USD 2,699

tax inclusive*

Single User License

One User

USD 4,399

USD 3,959

tax inclusive*

Five User License

Five User

USD 5,599

USD 4,759

tax inclusive*

Corporate License

Unlimited Users

USD 6,659

USD 5,660

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share