Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

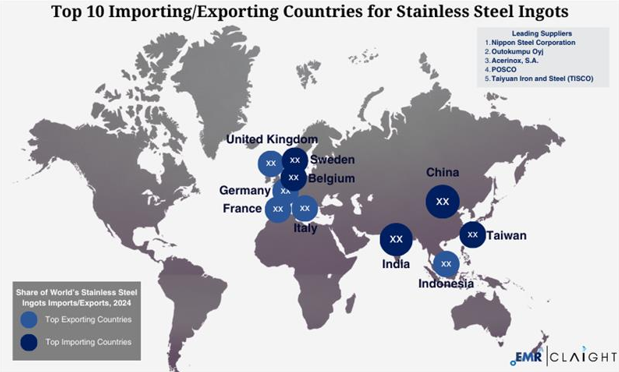

The EMR pricing report on Stainless Steel provides insights into the top 10 leading trading countries and regions.

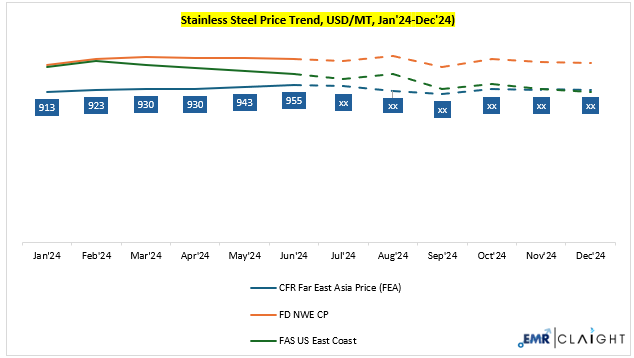

Stainless steel price trends have observed many fluctuations throughout 2024. Various factors, such as prices of raw materials like nickel, chromium, and iron, trade policies, geopolitical tensions, and economic factors, contributed to these changes. Different price trends were observed in major markets – North America, Asia-Pacific, and Europe, which reflected different cost structures and trade environments. European steelmakers reported stronger-than-expected first-quarter earnings in 2025 but remain cautious about the future due to lingering global trade tensions, weak European pricing, and ongoing market volatility.

| Stainless Steel Price (USD/TON) YoY Change, Ex-Works USA | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 2438 USD/TON | 1990 USD/TON | - 18% | Prices may fall due to oversupply and weak industrial demand. |

| November | 2269 USD/TON | 2107 USD/TON | - 7% | |

| December | 2189 USD/TON | 1968 USD/TON | - 10% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

In India, the prices of stainless steel have shown a consistent upward trend in the last quarter of 2024 compared to the same period in 2023. Global steel production capacity reached 2,452.7 million tones (MT) in 2022, with Asia holding the largest share at 60%, and China being the leading country in steelmaking capacity.

Stainless steels are an important component in the construction industry, owing to their versatility and sustainability. Broader macroeconomic factors affecting stainless steel price forecast include rapid urbanization and infrastructure development. As cities grow and infrastructure projects expand, there is a significant need for new buildings, roads, and utilities, where stainless steel plays an essential role in providing structural reinforcement. Their strength, adaptability, and cost-effectiveness make them an integral part of constructing durable, long-lasting structures.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| Indonesia | China | Outokumpu (Finland) |

| United Kingdom | India | Acerinox (Spain) |

| Germany | Sweden | POSCO (South Korea) |

| Italy | Belgium | Nippon Steel Corporation (Japan) |

| France | Spain | Metalmark (USA) |

| Netherland | Canada | Taiyuan Iron and Steel (TISCO) (China) |

| Japan | Poland | Tata Steel (India) |

| France | Korea | Arcelor Mittal (Luxembourg) |

Geopolitical events have had a profound impact on the global stainless-steel market outlook, with the Russia-Ukraine war being a key disruptor. One of the most significant developments was the implementation of EU sanctions on Russian-origin steel, which came into force on September 30, 2023. These sanctions banned the direct and indirect import of steel and stainless-steel products from Russia, including those routed through third countries. To ensure compliance, European importers were required to present documentation proving that imported products contained no Russian-origin steel. This policy not only disrupted established supply chains but also introduced administrative complexities and increased the cost of importing stainless steel into Europe. Consequently, the market experienced a tightening supply, especially in segments where Russian suppliers had previously played a dominant role, which pushed prices upward in the immediate aftermath.

The long-term implications have reverberated across global trade routes and procurement strategies. European manufacturers began diversifying their sources, turning to Asia, Latin America, and domestic production to bridge the supply gap, albeit at higher costs. The sanctions also caused ripple effects beyond Europe, as global buyers scrambled for alternative suppliers, leading to increased demand in already tight markets such as Indonesia, India, and South Korea. The overall uncertainty surrounding the war and the potential for further sanctions has made traders more risk-averse, adding volatility to prices and contract negotiations. Additionally, compliance and due diligence requirements have raised operational costs for companies involved in international trade, affecting profit margins and slowing down delivery timelines. As the conflict persists, the stainless-steel industry remains highly sensitive to geopolitical developments, with long-term strategies increasingly focused on supply chain resilience and regional sourcing.

The pricing analysis of stainless steel is highly influenced by the price changes in key feedstocks like iron ore, nickel, ferrochrome, and ferro molybdenum. While in March 2025, iron ore prices saw volatility when futures on the Dalian Commodity Exchange closed at USD 107.43 per metric ton but dipped 3.12% weekly due to steel production cuts that were expected, nickel's price, which is crucial because of its corrosion resistance, saw the price on the London Metal Exchange for September 2023 at USD 19,915 per ton, attributing this further to a market-wide correction. The trend in raw materials has led to a direct influence on the price forecast of stainless steel, with Indian 304-grade hot-rolled coil (HRC) prices in October 2023 hovering between USD 2,452 and USD 2,476, riding on subdued demand and fluctuating input costs. The depressed risk-return outlook for iron ore, nickel, and a plethora of alloying elements highlights their contributory roles to a higher cost of production and market stability. Given that supply-demand imbalances exist, along with geopolitical influences and trade policies, scrutiny of the direction of feedstocks is critical to forecasting stainless steel price movements.

The future of stainless steel looks promising, driven by the continued global demand for infrastructure investment. As the world moves toward an estimated USD 94 trillion in infrastructure spending by 2040, stainless steel will play a crucial role in shaping the construction landscape. Econometric market analysis also suggests that with growing urbanization, rapid development, and significant government investments in infrastructure projects, stainless steel is expected to remain a key material for structural reinforcement, framing, and support in buildings, bridges, roads, and utilities.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | Stainless Steel |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with EMR's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

Our market research reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share