Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Expert Market Research report, titled “N-Methyl Aniline Manufacturing Plant Project Report 2026 Edition: Industry Trends, Capital Investment, Price Trends, Manufacturing Process, Raw Materials Requirement, Plant Setup, Operating Cost, and Revenue Statistics” includes various aspects that are critical for establishing a n-methyl aniline plant. These include infrastructure requirements, transportation requirements, utility specifications, and financial and economic analysis, among others.

The demand for n-methyl aniline (NMA) is significantly influenced by its critical role in the textile industry, particularly in the production of dyes and pigments, including azo dyes. In 2024, the global textile and apparel market is estimated to grow due to the significant scale of clothing production and consumption worldwide. The apparel sector accounts for approximately 1.63% of the global GDP. In terms of retail clothing sales in the United States alone, figures indicate an average monthly expenditure of about USD 25.63 billion, with sales reaching approximately USD 25.84 billion in April 2024. This creates a substantial opportunity for increased demand for dye products like NMA as fashion trends evolve. Furthermore, global fiber production reached an all-time high of 124 million tonnes in 2023, with expectations to rise to 160 million tonnes by 2030. As the textile and apparel industries expand, the consumption of dyes derived from NMA is anticipated to increase.

Other elements to consider while establishing a n-methyl aniline plant include raw material sourcing, workforce planning, and packaging. The primary raw material is aniline, which serves as the starting compound in the methylation process to produce NMA. Aniline is widely used in the manufacture of dyes, pharmaceuticals, and agrochemicals. Another important raw material is methylamine, which can be derived from natural gas. Additionally, chlorobenzene is used in some methods for producing NMA, where it reacts with methylamine in the presence of a catalyst such as copper chloride. The choice of these raw materials not only affects the yield and purity of NMA but also influences the overall cost-effectiveness of its production.

Moreover, to help stakeholders determine the economics of a n-methyl aniline plant, project funding, capital investments, and operating expenses are analyzed. Projections for income and expenditure, along with a detailed breakdown of fixed and variable costs, direct and indirect expenses, and profit and loss analysis, enable stakeholders to comprehend the financial health and sustainability of a business. These projections serve as a strategic tool for evaluating future profitability, assessing cash flow needs, and identifying potential financial risks.

However, challenges such as supply chain disruptions, particularly in Asia due to environmental regulations and trade tensions, may threaten supply stability for n-methyl aniline (NMA) manufacturers. Recent restrictions on chemical production in China have led to reduced output of key raw materials like aniline and methylamine, impacting the availability of NMA. These disruptions have been exacerbated by logistics challenges, reduced production rates in exporting countries, and increased shipping costs, which collectively impact the timely availability of raw materials and finished products.

To combat this, manufacturers could source aniline from suppliers in both Europe and North America to reduce reliance on a single region. Additionally, investing in advanced inventory management systems can help manufacturers better anticipate demand fluctuations and maintain adequate stock levels. Companies like BASF have implemented sophisticated supply chain analytics to ensure consistent production flows.

N-methyl aniline (NMA) is an organic compound with the formula C7H9N. It appears as a colourless, viscous liquid that can turn brown upon exposure to air. NMA is primarily used as an intermediate in the production of dyes and agrochemicals, and as a latent solvent. It is toxic and can harm the central nervous system, liver, and kidneys upon exposure. Additionally, it serves as an antiknock agent in gasoline, although it is toxic and can cause damage to the central nervous system, liver, and kidneys. Historically, N-methyl aniline was first produced in the early 19th century. Its industrial significance grew with the development of dye manufacturing processes. By the mid-20th century, it became crucial in the production of various chemical products and fuel additives. Moreover, regulatory measures have been implemented regarding NMA; it is banned in China and is not listed on the U.S. EPA's List of Registered Gasoline Additives. In the United States, its use is regulated under the Clean Air Act, which mandates the registration of fuel additives for compliance with environment.

N-methyl aniline (C7H9N) is a colourless to yellowish viscous liquid with a faint ammonia-like odour. It has a melting point of -57.3 °C and a boiling point of approximately 196 °C. The density is about 0.989 g/mL at 25 °C, and its refractive index is 1.570. N-methyl aniline has a flash point of 85 °C and a vapor pressure of 0.7 mmHg at 25 °C, indicating limited volatility. It is practically insoluble in water (0.1 g/L at 25 °C) but soluble in organic solvents like ethanol and ether. Chemically, it is a weak base with a pKa of around 9.4 and can undergo typical reactions of amines, such as alkylation and acylation.

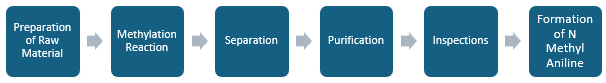

The production of N-methyl aniline typically begins with the preparation of raw materials, including aniline and methylating agents like methyl alcohol. The methylation reaction occurs in a reactor, where aniline is heated to elevated temperatures (around 200-300 °C) and reacted with methyl alcohol in the presence of a catalyst such as hydrochloric acid or copper chloride. After the reaction, the mixture is cooled, and N-methyl aniline is separated from by-products, often through distillation. The crude product undergoes purification to remove impurities and unreacted materials, followed by quality control testing to ensure it meets industry standards. Finally, the purified N-methyl aniline is packaged for distribution.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Below is the process for making N-methyl aniline:

1. Ingredients and Formulation

The primary reactants used in the production of N-methyl aniline are:

2. Methylation of Aniline

N-methyl aniline is produced through the methylation of aniline using a methylating agent. The most common method involves using methyl iodide (CH3I) or methyl alcohol (CH3OH) in the presence of a base. The reaction can be described as follows:

C6H5NH2 + CH3I → C6H5NHCH3 + HI

Alternatively, methyl alcohol can also be used in the presence of a catalyst like zinc chloride (ZnCl2):

C6H5NH2 + CH3OH → C6H5NHCH3 + H2O

In both cases, N-methyl aniline (C6H5NHCH3) is produced, along with either hydroiodic acid (HI) or water (H2O) as by-products.

3. Purification of N-methyl aniline

After the reaction, the mixture contains N-methyl aniline, unreacted aniline, and by-products such as hydroiodic acid (HI) or water. The reaction mixture is neutralised using a base such as sodium hydroxide (NaOH) to remove acidic by-products:

HI + NaOH → NaI + H2O

The resulting mixture is then purified by distillation to separate N-methyl aniline from other components.

4. Final Product and Applications

The final product, N-methyl aniline, is a colourless to light yellow liquid that is used as an intermediate in the production of dyes, agrochemicals, and other chemical products.

N-methyl aniline (NMA) primarily serves as an intermediate in the production of dyes, pharmaceuticals, and agrochemicals. Its role in dye manufacturing, particularly in the synthesis of azo dyes, drives significant demand in the textile industry. Additionally, NMA is used in the production of rubber chemicals and serves as a solvent for oils, resins, and waxes, enhancing its application in cosmetics and personal care products. Market drivers include the growing demand for dyes and pigments, the increasing need for agrochemicals, and the expansion of the pharmaceutical sector, all of which contribute to market growth.

A detailed overview of production cost analysis that evaluates the manufacturing process of n-methyl aniline is crucial for stakeholders considering entry into this sector. Furthermore, stakeholders can make informed decisions based on the latest economic data, technological innovations, production process, requirements of raw materials, utility and operating costs, capital investments by major players, pricing strategies, and profit margins. For instance, in 2024, global investment in agricultural research and development (R&D) reached approximately USD 20 billion. India's budget allocation for agricultural R&D witnessed a marginal increase to about INR 99.4 billion (around USD 1.2 billion). In Australia, total agricultural R&D funding was reported at USD 2.98 billion, where the private sector contributed around USD 1.52 billion. As NMA is a crucial intermediate in the production of various agrochemicals, including pesticides and herbicides, this heightened investment will likely lead to increased demand for innovative agrochemical formulations. Moreover, the rising emphasis on sustainable farming practices and the need for effective crop protection solutions will drive further research into new applications of NMA in agrochemical formulations. This trend can enhance the market position of NMA manufacturers.

Below are the sections that further detail the comprehensive scope of the prefeasibility report for a n-methyl aniline production plant:

Market Dynamics and Trends: Factors such as its vital role as an intermediate in producing various active pharmaceutical ingredients (APIs) are significantly affecting market conditions in the n-methyl aniline sector. Its use in pharmaceuticals is expanding due to the increasing focus on healthcare and the development of new drugs. In 2024, global investment in healthcare infrastructure reached approximately USD 10.6 trillion as countries like India and China invested heavily in expanding their healthcare systems. Also, India is planning to increase its healthcare spending to about 2.5% of GDP by 2025. This surge in investment is driven by the need for improved healthcare access worldwide.

Additionally, spending on drug development is expected to exceed USD 200 billion in 2024. Major pharmaceutical companies, such as Pfizer and Novartis, are significantly increasing their R&D budgets, with Pfizer allocating over USD 13 billion for drug development in 2024 alone. This increase in funding supports the development of new therapies and treatments, particularly in areas like oncology and rare diseases, where NMA is an important component. Understanding these factors helps businesses align their production plans with demands and trends in the n-methyl aniline market.

Profiling of Key Industry Players: Leading manufacturers like Aarti Industries Limited, Jiangsu King Road New Materials Co. Ltd., and Ganesh Polychem Limited are included in the n-methyl aniline report. Recently, Ganesh Polychem Limited accounted for the maximum share of NMA shipments globally, with 315 shipments reported from March 2023 to February 2024. Following closely, Sigma Aldrich Chemicals Pvt Ltd contributed 250 shipments, while Aarti Industries ranked third with 166 shipments.

In addition, BASF SE and Huntsman Corporation are also significant players in the NMA market. Moreover, Jiangsu Huachang Chemical Co., Ltd. has recently expanded its production capacity to meet the rising global demand for NMA, investing in advanced manufacturing technologies to enhance efficiency and reduce environmental impact. This competitive landscape reflects the growing importance of NMA in industries such as pharmaceuticals, agrochemicals, and specialty chemicals.

Economic Analysis: Capital expenditure (CAPEX) analysis provides stakeholders the knowledge about required investments in advanced technologies, efficient machinery, and necessary infrastructure. Investing in high-capacity mixing equipment, such as a continuous mixer or high-shear mixer, can improve production efficiency by 20-30%. Investing in energy-efficient systems, such as combined heat and power (CHP) systems could reduce energy consumption by up to 30%, as these systems use waste heat from production processes to generate electricity and provide heating.

Fluctuations in n-methyl aniline prices are influenced by the costs of essential raw materials such as aniline and methanol. Aniline, being the primary feedstock for producing NMA, directly impacts pricing; any increase in its production costs due to supply chain disruptions or regulatory changes can lead to higher NMA prices. In 2023, the price of aniline increased by approximately 15% due to rising input costs and high inflation in major exporting nations, which contributed to price variations in NMA across Europe and Asia.

Additionally, methanol prices, which are also subject to market volatility, play a significant role in determining the overall production cost of NMA. In early 2024, methanol prices were reported to be around USD 320 per tonne, reflecting a 10% increase from the previous year. The demand from downstream industries, particularly textiles and agrochemicals, further exacerbates these fluctuations. In September 2023, for example, NMA prices showed mixed sentiments due to prolonged dullness in the textile market and increased demand from the agrochemical sector during the harvesting season. This situation resulted in NMA prices fluctuating between USD 1,800 and USD 2,100 per tonne during that period. Manufacturers must closely monitor these raw material costs and market dynamics to manage pricing strategies effectively.

Establishing a n-methyl aniline manufacturing facility requires a comprehensive financial investment that encompasses various elements critical to the project's success. The following sections detail these components:

Projected profit margins and effective product pricing strategies improve overall profitability. Manufacturers might target a profit margin of around 20-30%, achieved through strategic pricing based on raw material costs and prevailing market demand. Effective pricing strategies should consider fluctuations in raw material prices and competitive positioning within the market.

The establishment of a n-methyl aniline manufacturing facility must comply with various regulatory frameworks that govern production standards. Key regulations include environmental protection laws that dictate emissions and waste management practices. In the United States, the Environmental Protection Agency (EPA) requires compliance with the Clean Air Act and the Clean Water Act, which set limits on air pollutants and wastewater discharges associated with chemical manufacturing.

Additionally, manufacturers must adhere to safety regulations outlined by organizations such as the Occupational Safety and Health Administration (OSHA), which mandates safe working conditions to protect employees from hazardous substances. In Europe, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations require manufacturers to register NMA and provide detailed safety data on its use and potential impacts. Specific countries have imposed additional restrictions; for instance, China has banned the use of n-methyl aniline as a gasoline additive due to health concerns. Compliance with these regulatory frameworks is essential for manufacturers to operate legally while ensuring the safety of their products.

This prefeasibility report aims to equip potential investors and existing manufacturers with crucial insights to make informed decisions in the n-methyl aniline industry.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Basic Plan

USD 5,699

USD 4,844

Get Startedtax inclusive*

Raw Material and Product Specification, Raw material consumption, Process flow diagram

Machinery Cost, Working Capital

Utilities consumption, Operating cost, Overheads, Financing Charges, GSA , Packaging

Premium Plan

USD 6,799

USD 5,779

Get Startedtax inclusive*

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis

Raw material consumption and prices, Utilities consumption breakdown, By-Product Credit, Labour Charges Breakdown

Land and Site Cost, Equipment Cost, Auxiliary Equipment Cost, Contingency, Engineering and Consulting Charges

Enterprise Plan

USD 8,899

USD 7,564

Get Startedtax inclusive*

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis, Variable Cost Breakdown, Investing Cost Breakdown,

Breakdown of machinery cost by equipment, Auxiliary Equipment Cost, Piping, Electrical, Instrumentation

Cost of Construction, Plant Building, Site Development Charges

Land Cost, Development Charges

Dynamic Spreadsheet (Unlocked)

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Basic Plan

USD 5,699

USD 4,844

Key Processing Information

Raw Material and Product Specification, Raw Material Consumption, Process Flow Diagram

Capital Investment Analysis

Machinery Cost, Working Capital

Conversion Cost Analysis

Utilities Consumption, Operating Cost, Overheads, Financing Charges, GSA , Packaging

Premium Plan

USD 6,799

USD 5,779

All Contents of Basic Report

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis

Variable Cost Breakdown

Raw Material Consumption and Prices, Utilities Consumption, Breakdown By-Product Credit, Labour Charges Breakdown

Investing Cost Breakdown

Land and Site Cost, Equipment Cost, Auxiliary Equipment Cost, Contingency, Engineering and Consulting Charges

Enterprise Plan

USD 8,899

USD 7,564

Includes all Report Content

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis, Variable Cost Breakdown, Investing Cost Breakdown,

Equipment Cost Breakdown

Breakdown of Machinery Cost By Equipment, Auxiliary Equipment Cost, Piping, Electrical, Instrumentation

Land and Construction Cost Details

Land Cost, Development Charges, Cost of Construction, Plant Building, Site Development Charges

Dynamic Excel Cost Model

Dynamic Spreadsheet (Unlocked)

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share