Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Expert Market Research report, titled “Anodic Aluminium Labels Manufacturing Plant Project Report 2026 Edition: Industry Trends, Capital Investment, Price Trends, Manufacturing Process, Raw Materials Requirement, Plant Setup, Operating Cost, and Revenue Statistics” includes various aspects that are critical for establishing an anodic aluminium labels plant. These include infrastructure requirements, transportation requirements, utility specifications, and financial and economic analysis, among others.

| Anodic Aluminium Labels Product Details: | |

| Product Name | Anodic Aluminium Labels |

| Chemical Formula | Al |

| Molar Mass | 26.98 g/mol (Aluminium base) |

| Appearance and Color | Metallic surface, Silver/Matte Silver or Custom Colors |

| CAS No. | 7429-90-5 (for Aluminium) |

| Melting Point | 660.3°C (Aluminium) |

| Common Names | Aluminium Tags, Aluminum ID Labels, Anodized Nameplates |

| Top Exporting Countries | China, USA, Japan, Germany, Italy |

The increasing demand for anodic aluminium labels can be attributed to their unique properties and applications across various industries. Anodic aluminium labels are renowned for their durability. The anodization process enhances the aluminium's natural resistance to abrasion, heat, and chemicals, making these labels ideal for harsh environments. Industries such as automotive, aerospace, and manufacturing often require labels that can withstand extreme conditions, including exposure to chemicals and temperature fluctuations. This quality makes them suitable for applications like asset tags, machine labels, and outdoor signage where longevity is needed.

The anodizing process not only improves durability but also allows for a variety of aesthetic finishes. The ink is embedded within the anodic oxide layer, ensuring that graphics remain vibrant and fade-resistant over time. This feature has led to increased usage in sectors such as consumer electronics, e-commerce packaging, and high-end appliances. The advancement in printing technologies has further enabled production of high-resolution and multi-colour labels that appeal to businesses seeking attractive branding solutions.

Other elements to consider while establishing an anodic aluminium labels plant include raw material sourcing, workforce planning, and packaging. The production of anodic aluminium labels primarily relies on aluminium, which is sourced from bauxite ore. Bauxite is refined to produce alumina, and through an electrolytic reduction process, alumina is transformed into aluminium. This aluminium undergoes anodizing, an electrochemical process that creates a durable oxide layer, enhancing its resistance to corrosion and abrasion. In addition to aluminium, the production process involves dyes for colouring and sealants that improve the durability of the anodized surface. These raw materials are needed to ensure the production of high quality anodic aluminium labels.

Moreover, to help stakeholders determine the economics of an anodic aluminium labels plant, project funding, capital investments, and operating expenses are analyzed. Projections for income and expenditure, along with a detailed breakdown of fixed and variable costs, direct and indirect expenses, and profit and loss analysis, enable stakeholders to comprehend the financial health and sustainability of a business. These projections serve as a strategic tool for evaluating future profitability, assessing cash flow needs, and identifying potential financial risks.

However, challenges such as supply chain disruptions and fluctuating raw material prices may threaten supply stability for anodic aluminium labels. Factors like geopolitical tensions, environmental regulations, and the increasing demand for aluminium in electric vehicle production can lead to uncertainties in sourcing materials. To combat this, manufacturers of anodic aluminium labels can diversify their supply sources and invest in local production capabilities. Additionally, adopting just-in-time inventory practices can mitigate risks associated with delays and shortages. These strategies not only help manufacturers maintain a steady flow of materials but also enable them to respond swiftly to market changes.

Read more about this report - Request a Free Sample

Anodic aluminium labels are created through the anodisation process, which involves electrochemically oxidising aluminium to form a durable, corrosion-resistant oxide layer. This layer can be coloured and is often used for identification and branding purposes due to its resistance to wear and fading. Anodic aluminium labels are widely used in various industries, including manufacturing, automotive, and aerospace, for their durability and aesthetic appeal. Anodising was first industrially implemented in 1923 to protect aluminium parts from corrosion. The discovery of porous anodic alumina films occurred in the 1930s, leading to further advancements in the 1950s-1970s. Also, the highly ordered nanoporous structures were first demonstrated in 1995, which marked a significant milestone in anodic aluminium research.

Anodic aluminium labels are lightweight, typically weigh around 2.7 g/cm³, and thus, is advantageous for applications requiring minimal weight. They exhibit high tensile strength, often exceeding 200 MPa, making them robust enough to withstand mechanical stress. Additionally, anodic aluminium labels demonstrate exceptional abrasion resistance, with a hardness rating of 60-70 on the Shore D scale, ensuring longevity even in high-wear environments. Their good thermal conductivity, approximately 205 W/m·K, allows for efficient heat dissipation in electronic applications.

Chemically, anodic aluminium labels have a corrosion rate of less than 0.1 mm/year in neutral salt spray tests. This property makes them suitable for use in marine and industrial environments where exposure to moisture and corrosive substances is common. The anodised surface also provides excellent resistance to oxidation, preventing degradation over time. Furthermore, these labels are resistant to a wide range of chemicals, including acids and alkalis. They maintain stability across a pH range of 4 to 9, allowing for use in diverse environments without compromising integrity.

Moreover, anodic aluminium labels feature an effective electrical insulation capability. With a dielectric strength of about 15-20 kV/mm, they are ideal for electronic devices and components that require minimal electrical interference. Additionally, their high surface resistivity (greater than 10^12 ohm) ensures that they do not interfere with sensitive electronic equipment.

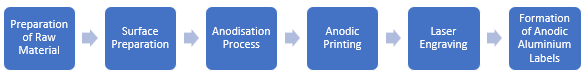

The production process of anodic aluminium labels begins with raw material preparation, where high-quality aluminium sheets, either natural or pre-coloured, are selected. Next, the surface preparation phase involves cleaning and degreasing the aluminium sheets to remove any contaminants.Following this, the anodisaion process takes place. The cleaned aluminium sheets are immersed in an acid bath, where an electric current is applied to create a thick layer of aluminium oxide on the surface. The next step is the printing process, which can be executed through two primary methods: anodic printing and laser engraving. In anodic printing, ink is printed into the open pores created during anodisation and then sealed in a hot water bath to ensure longevity. Alternatively, laser engraving uses a laser to remove part of the oxide layer, which exposes the underlying metal colour. After printing, each label undergoes final finishing, where a thorough inspection is conducted to ensure that it meets quality standards regarding durability and appearance. Finally, the finished labels are carefully packaged to prevent damage during transportation before being shipped to customers or distributors.

Read more about this report - Request a Free Sample

Below is the process for making anodic aluminium labels:

Step 1: Cleaning and Pre-Treatment of Aluminium

Aluminium sheets are first cleaned and degreased using alkaline or acidic solutions to remove any surface contaminants. This step ensures proper adhesion of the anodic layer.

Typical chemical reaction involved in alkaline cleaning:

Al + NaOH + H2O → Na[Al(OH)4] + H2

Step 2: Anodisation

The cleaned aluminium is then anodised by placing it in an electrolytic bath containing sulfuric acid (H2SO4). A direct current is applied, causing the aluminium to act as the anode, forming a thick oxide layer (Al2O3) on its surface.

The chemical reaction involved is:

2 Al + 3 H2O → Al2O3 + 6 H+ + 6 e- (at the anode)

Step 3: Sealing

After anodisation, the porous aluminium oxide layer is sealed to increase its durability. The sealing process often involves hydrothermal sealing in boiling water or using chemicals like nickel acetate.

The chemical reaction for hydrothermal sealing:

Al2O3 + H2O → AlO(OH)

Step 4: Printing or Dyeing

Once the anodised layer is sealed, the labels can be printed or dyed using various methods. The pores of the anodised aluminium allow dyes or inks to adhere to the surface, which are then sealed to make the markings permanent. In this process, aluminium sheets are cleaned, anodised in an acidic bath to form a protective oxide layer, sealed for durability, and finally printed or dyed to create durable labels.

The anodic aluminium labels market is significantly influenced by the expansion of aerospace and automotive industries. As per industry reports, the global aircraft production is projected to increase, with Boeing forecasting a demand for 43,000 new airplanes over the next 20 years, driven by the need for more fuel-efficient models and increased air travel. This demand translates into a heightened requirement for durable materials such as anodised aluminium.

Moreover, the Society of Indian Automobile Manufacturers (SIAM) reported that total vehicle production in India reached approximately 7.55 million units in the first quarter of 2024 alone, with passenger vehicle sales hitting over 1 million units for the first time in Q1. Overall, the total production of passenger vehicles from April 2023 to March 2024 was around 42.2 million units, reflecting an 8.4% growth compared to the previous year. Additionally, light vehicle production is increasing as regions like Greater China anticipate an increase of 227,000 units in 2024, driven by supportive policies. This consistent growth in both sectors highlights the critical role of anodic aluminium labels as manufacturers seek reliable labeling solutions to meet regulatory standards.

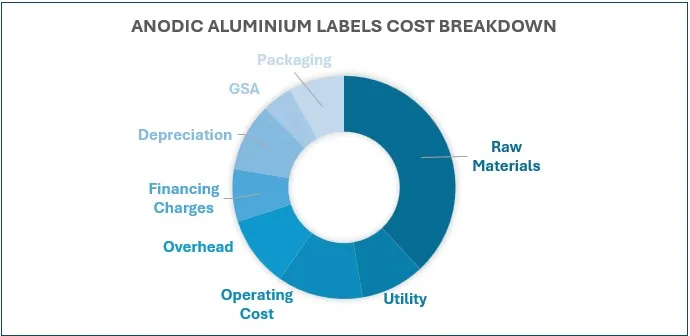

A detailed overview of production cost analysis that evaluates the manufacturing process of anodic aluminium labels is crucial for stakeholders considering entry into this sector. Furthermore, stakeholders can make informed decisions based on the latest economic data, technological innovations, production process, requirements of raw materials, utility and operating costs, capital investments by major players, pricing strategies, and profit margins. For instance, Vedanta has reported a 3% year-on-year increase in aluminium production for Q3 FY25, reaching 614,000 tonnes, up from 599,000 tonnes in Q3 FY24. The company's mined metal output also rose 3% sequentially to 265,000 tonnes, driven by improved production at the Agucha and Zawar mines. Additionally, alumina production at the Lanjigarh refinery saw a 7% year-over-year increase, totaling 505,000 tonnes. For the first nine months of FY25, total aluminium production amounted to 1.89 million tonnes. This increase in aluminium production ensures a more stable supply of raw materials for anodic aluminium label manufacturers, potentially lowering costs and enhancing production capacity.

Below are the sections that further detail the comprehensive scope of the prefeasibility report for an anodic aluminium labels production plant:

Market Dynamics and Trends: Factors such as expansion of automotive industries are significantly affecting market conditions in the anodic aluminium labels sector. The automotive sector relies on anodic aluminium labels for vehicle identification and component labelling. As vehicle production increases all over the world, the market outlook seems favourable. As of 2025, global sales of battery electric vehicles (BEVs) are projected to reach approximately 15.1 million units, reflecting a 30% increase from 2024 levels and accounting for about 16.7% of total light vehicle sales. China is expected to witness around 49 million EVs on the road by 2025, while Europe and North America are also anticipated to see significant growth in EV adoption. This surge in EV production translates to increasing number of new models and variants, thereby necessitating the need for clear and durable labelling. Understanding these demands and trends helps businesses align their production plans in the anodic aluminium labels market.

Profiling of Key Industry Players: Leading manufacturers included in the anodic aluminium labels report are Bonnell Aluminium, Dajcor Aluminium Ltd, Monocrystal, CoorsTek Inc., Superior Metal Technologies, LLC, and Lorin Industries, Inc. Recently, these companies have been focusing on expanding their production capabilities and enhancing product offerings to meet the growing demand for high-quality anodized aluminium labels across various industries. Additionally, players are focusing on improving their market presence by investing in technologies as the integration of advanced printing technologies allows for more intricate designs, which can cater to niche markets such as medical devices.

Economic Analysis: Capital expenditure (CAPEX) analysis provides stakeholders the knowledge about required investments in advanced technologies, efficient machinery, and necessary infrastructure. Investing in high-capacity mixing equipment, such as a continuous mixer or high-shear mixer, can improve production efficiency by 20-30%. Investing in energy-efficient systems, such as combined heat and power (CHP) systems could reduce energy consumption by up to 30%, as these systems use waste heat from production processes to generate electricity and provide heating.

Fluctuations in the prices of anodic aluminium labels are significantly influenced by various key factors, particularly the costs of essential raw materials like aluminium. As of January 2025, the aluminium market is indicating a potential transition from surplus to deficit conditions. Goldman Sachs has revised its average aluminium price forecast for 2025 to USD 2,700 per ton.

Recent data shows that global primary aluminium production reached 48.2 million tons from January to August 2024, reflecting a 3.2% year-on-year increase. However, Rusal anticipates a surplus of approximately 500,000 metric tons in 2024 and between 200,000-300,000 tons in 2025. Factors such as lower borrowing costs and stimulus measures from China are expected to enhance demand, with aluminium consumption projected to rise by 2.5–2.7% in 2024 and 3.5% in 2025.

Additionally, record-high alumina prices are squeezing smelter profitability, complicating supply dynamics further. The increasing demand for durable and visually appealing labeling solutions across industries like automotive and consumer goods is also contributing to price variations. Overall, despite ongoing geopolitical tensions and economic recovery efforts, the market appears poised for resilience.

Establishing an anodic aluminium labels manufacturing facility requires a comprehensive financial investment that encompasses various elements critical to the project's success. The following sections detail these components:

Projected profit margins and effective product pricing strategies improve overall profitability. Manufacturers might target a profit margin of around 20-30%, achieved through strategic pricing based on raw material costs and prevailing market demand. Effective pricing strategies should consider fluctuations in raw material prices and competitive positioning within the market.

Read more about this report - Request a Free Sample

| Report Features | Coverage - Detailed Report |

| Product Name | Anodic Aluminium Labels |

| Report Coverage | Manufacturing Process & Unit Operations: In-depth analysis of each step involved in the production from raw materials, including technical tests, mass balance, and key unit operations. |

| Plant Infrastructure & Development: Comprehensive review of land selection, site development, environmental impacts, construction costs, and project phasing. | |

| Plant Layout & Design: Factors influencing the plant layout, including space planning, machinery placement, and operational efficiency. | |

| Machinery & Equipment Requirements: Analysis of machinery needs for production, including costs, suppliers, and technological advancements. | |

| Raw Material Procurement & Costs: Detailed breakdown of raw material requirements, procurement strategies, supplier options, and cost structures. | |

| Packaging & Distribution: Insight into packaging requirements, material selection, procurement channels, and associated costs. | |

| Operational Costs & Resources: Examination of utility needs (water, electricity), transportation logistics, human resources, and other operational costs. | |

| Financial & Economic Analysis: Project investment costs, financial projections, income/expenditure forecasts, and cost-benefit analysis. | |

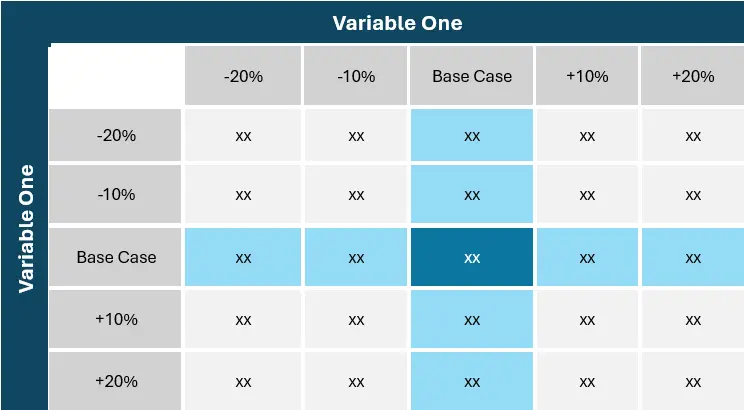

| Profitability & Risk Analysis: Financial performance metrics, including profitability margins, payback period, and sensitivity to market risks. | |

| Market & Competitive Landscape: Competitive positioning, market trends, regional breakdown, and strategic recommendations for market growth. | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | 10-12 weeks of post-sale analyst support available. |

| Data Access | Lifetime Access |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

This prefeasibility report aims to equip potential investors and existing manufacturers with crucial insights to make informed decisions in the anodic aluminium labels industry.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Basic Plan

USD 5,699

USD 4,844

Get Startedtax inclusive*

Raw Material and Product Specification, Raw material consumption, Process flow diagram

Machinery Cost, Working Capital

Utilities consumption, Operating cost, Overheads, Financing Charges, GSA , Packaging

Premium Plan

USD 6,799

USD 5,779

Get Startedtax inclusive*

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis

Raw material consumption and prices, Utilities consumption breakdown, By-Product Credit, Labour Charges Breakdown

Land and Site Cost, Equipment Cost, Auxiliary Equipment Cost, Contingency, Engineering and Consulting Charges

Enterprise Plan

USD 8,899

USD 7,564

Get Startedtax inclusive*

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis, Variable Cost Breakdown, Investing Cost Breakdown,

Breakdown of machinery cost by equipment, Auxiliary Equipment Cost, Piping, Electrical, Instrumentation

Cost of Construction, Plant Building, Site Development Charges

Land Cost, Development Charges

Dynamic Spreadsheet (Unlocked)

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Basic Plan

USD 5,699

USD 4,844

Key Processing Information

Raw Material and Product Specification, Raw Material Consumption, Process Flow Diagram

Capital Investment Analysis

Machinery Cost, Working Capital

Conversion Cost Analysis

Utilities Consumption, Operating Cost, Overheads, Financing Charges, GSA , Packaging

Premium Plan

USD 6,799

USD 5,779

All Contents of Basic Report

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis

Variable Cost Breakdown

Raw Material Consumption and Prices, Utilities Consumption, Breakdown By-Product Credit, Labour Charges Breakdown

Investing Cost Breakdown

Land and Site Cost, Equipment Cost, Auxiliary Equipment Cost, Contingency, Engineering and Consulting Charges

Enterprise Plan

USD 8,899

USD 7,564

Includes all Report Content

Key Processing Information, Capital Investment Analysis, Conversion Cost Analysis, Variable Cost Breakdown, Investing Cost Breakdown,

Equipment Cost Breakdown

Breakdown of Machinery Cost By Equipment, Auxiliary Equipment Cost, Piping, Electrical, Instrumentation

Land and Construction Cost Details

Land Cost, Development Charges, Cost of Construction, Plant Building, Site Development Charges

Dynamic Excel Cost Model

Dynamic Spreadsheet (Unlocked)

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share